iSPIRT, India’s software products think tank, SignalHill, technology focused M&A advisory boutique firm and Microsoft Ventures, accelerator program for high potential technology startups released the much-awaited 2015 India Technology Product M&A Industry Report. The report highlights key trends in the Indian technology M&A and funding landscape so far as well as predictions for M&A activity in the following year.

To access the report, visit: PMI Report

To watch the Think Next Roundtable: ThinkNext Video

M&A

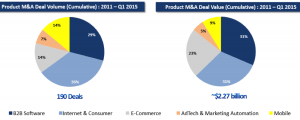

According to the report, technology majors as well as large Indian ‘Unicorns’ are predicted to continue acquiring Indian technology product startups to fill technology gaps as well as talent requirements. Since 2011, there have been 190 M&A transactions involving Indian technology product companies, with a total estimated transaction value of $2.27B. That makes the average deal size in India stand at $11.3mn, far lower than that of mature startup ecosystems such as Israel ($113mn) and the US ($57mn). Furthermore, there’s a substantial difference in value between inbound and domestic transactions. Inbound M&A transactions (M&A by global acquirers) average $21.1M versus domestic deals that average $8.4M. Therefore domestic transactions may account for the lion share (72%) of M&A activity by volume (largely driven by the Indian ‘Unicorns’ including Flipkart, Snapdeal, OlaCabs) but a much smaller share (51%) by value.

From a sector perspective, there seems to be a clear trend emerging where the majority of M&A transactions and transaction values of B2B software companies is cross-border in nature, while domestic transactions account for the bulk of transaction value and volume for Internet & Consumer and E-Commerce deals.

INVESTMENTS:

From a funding perspective, VC/PE investments in India have hit an all-time high in 2014. Funding in the E-commerce and Consumer Internet markets have grown 38x from 2010-2014. $4.2B was invested in this space 2014 alone, with the two main companies (Flipkart & Snapdeal) accounting for > 50% of the Indian internet investment dollars. Investments in B2B software are also showing an upward trend.

With a fear of missing out, hedge funds & private equity funds are investing in ‘new’ Series B ($10-25mn) and Series C & D ($20-250m) onwards, fueling a frenzy in valuations. Prior to 2014, it would take startups at least 1-2 years to raise series B and C funds. In the last 12 months, this has dropped by half with companies reaching this mark in less than a year.

OTHER HIGHLIGHTS

The report indicates that a generation of entrepreneurs is coming up in India, looking to build deep-tech companies in the country. Where B2B software companies are aiming at serving the global market, the Internet & E-commerce businesses are focusing on India. These are vision-driven and are focused on creating a market differentiator rather than “selling-out” early. These entrepreneurs are also likely to be angel investors and help other startups succeed, in parallel to running their own firms.

The report also highlights two key challenges that Indian entrepreneurs and startups face: Discovery & Readiness. Most startups are not on the radar of the large global tech companies either for business engagements or investment, which in turn reduces their chances of going through an acquisition. iSPIRT’s M&A Connect Program is solving this problem via targeted connects between US and Indian tech companies with specific technology gaps, and exciting India startups who can fill these gaps.

[Any startups with ongoing M&A discussions, please reach out to [email protected] for advisory support.]

PREDICTIONS

Finally, the report makes some interesting predictions for M&A and investments in India in 2015.

M&A activity will continue to accelerate. Domestic transactions will dominate E-Commerce and Consumer Internet, with large Indian “Unicorns” will aggressively make strategic acquisitions to enhance market dominance and strengthen strategic growth areas such as: mobile, data & analytics and payments etc. Cross-border M&A will dominate B2B / Enterprise Software transactions.

Acqui-Hires will continue to be a critical focus for US and India acquirers. Areas of interest include iOS &Android engineers and Machine Learning/Data Science experts, whose demand is rapidly growing.

Finally, from an investment perspective, E-Commerce and Consumer Internet sectors will continue to be hot into 2015. Internet of Things [IOT] will also receive significant interest from VCs.

Seems like the market is hot and there’s a lot of activity predicted for 2015. Exciting times ahead… Stay tuned!