We had the chance to conduct a discussion on the National Health Stack during the LetsIgnite event organized by the LetsVenture team on 15th June at the Leela Palace. The audience comprised of early stage healthcare startups along with angel investors and venture capitalists having keen interest in healthcare investments. Some notable attendees included Dr. Ramesh (senior cardiologist, MD Endiya Partners) and Mr. Mohan Kumar (Partners, Norwest Venture Partners).

Sharad Sharma (co-founder, iSPIRT), Dr. Santanu Chatterjee (Founder, Nationwide Primary Care), Dr. Ajay Bakshi (Founder Buddhimed Technologies, ex-India CEO Parkway Pantai) and Arun Prabhu (Partner, Cyril Amarchand Mangaldas) had been invited to lead the session, which was moderated by Anukriti Chaudhari and Priya Karnik, both core volunteers at iSPIRT championing the health stack initiative.

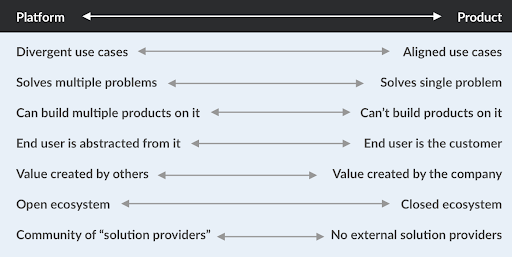

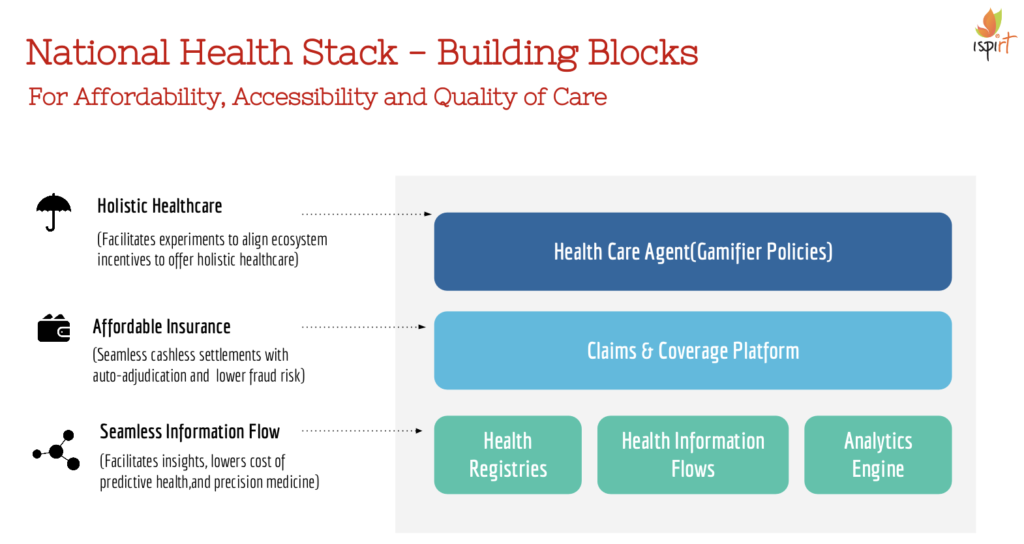

The context was set by an interactive talk by Sharad who began by giving a glimpse of the underlying philosophy of the iSPIRT Foundation – the idea of building public goods as digital technology stacks which can be leveraged by private players to serve Bharat. . Sharad described societal change in India being a Jugalbandi between digital public infrastructure, market participants and policy makers to achieve the same. He mentioned how the India Stack was changing the face of fintech in India and that the Health Stack could do the same for healthcare. The audience was more than startled to hear that a day prior to the session, the number of UPI transaction in India were already one-sixth of what MasterCard had done worldwide. ( UPI has only been around for 33 months! ). Sharad then went on to explain the different layers of the Health Stack comprising National Registries, standardised health information flows, an insurance claims management software built upon a standard Policy Markup Language and a gamifier policy engine. He didn’t miss reminding the audience that the Health Stack was being built to solve for the healthcare needs of ‘Bharat’and not the privileged 30 million Indian families already being well-served by the healthcare conglomerates in urban areas.

With the context in place, Anukriti took over to give a background of the healthcare landscape in India. India struggles with a 1:1600 doctor to patient ratio with more than 60% of doctors and hospitals concentrated in urban regions. To add to that, the public expenditure for healthcare is just 3.9% of our annual GDP (compared to 18% in the US) and it’s not surprising that most deaths in public healthcare facilities happen because of poor quality of care. Health insurance penetration barely touches 20% with OOP expenditure dominating the healthcare spending in India. With a huge underserved population, the need of the hour is to leap-frog to scalable solutions that can reach the masses instead of incremental linear growth solutions to address the Indian healthcare challenges. The different layers of Health Stack make it much easier for innovators (both public and private) to develop radical solutions.. While funding in healthcare startups has increased over the last 5 years, it still significantly lags behind areas like fintech, e-commerce, ed-tech, etc. Moreover, the bulk of healthtech investments have been focused on the consumer tech sector. Anukriti ended her views with a futuristic optimism regarding the innovations that Health Stack could open, to make healthcare truly affordable, accessible and high quality.

We were fortunate to have Dr. Santanu and Dr. Bakshi give insights about the Health Stack with their on-ground experiences in healthcare spanning over decades. Dr. Santanu mentioned that for primary care, the national registry of care providers was very fundamental to ascertain ‘which stakeholder provides what’ given that almost every provider is somewhere involved in primary care. On top of that, he stressed about the need for Artificial Intelligence backed clinical support systems that seamlessly integrate with the doctor’s workflow. This is of particular relevance for rural healthcare settings wherein, despite various efforts, there aren’t enough doctors to setup shops in villages . A standardized health information layer, along with data transfer mechanisms, could be the driving force for this. He was, however, wary of how well standard insurance schemes would work for primary care as the insurance business model falls apart given that almost everyone needs access to primary care at some point or the other. Priya resonated with his views and further suggested that for ‘Bharat’, micro insurance policies could be the key mechanism to drive insurance adoption at the consumer level. Such a system could potentially be facilitated by a claims engine platform build upon a standard policy markup language to ‘almost-automate’ (auto-adjudicate) the claims addressal process.

Dr. Bakshi contended that for a stable society, healthcare and education are a must, as the former secures our ‘today’ while the latter secures our ‘tomorrow’. Having worked as the CEO of three major hospital chains in India, he accepted (without an iota of political correctness) that as a nation, we have failed miserably in providing either. Healthcare is a social good and nowhere in the world has it been solved by private players alone (given the way private incentives are aligned). The public sector in India hasn’t stepped up which is the reason that private players dominate the quality healthcare delivery which could lead us (or is perhaps already leading) to following the footsteps of the US. This is an alarming trend because in the short and medium term, India cannot afford to outsource the entire healthcare delivery to private players. Dr. Bakshi remarked that to set things on the correct track, the Health Stack is a very important initiative and congratulated the iSPIRT team for working ardently to make it happen. He however suggested all stakeholders to be privy of the fact that while fintech transactions are linear (involving the payer and the recipient), a healthcare ‘transaction’ involves multiple aspects like the doctor’s opinion, investigation, drugs, nurses, ward boys and many other layers. This underlying multidimensionality would make it difficult to replicate an India Stack kind of model for the healthcare setting. At the core of the healthcare transaction lies the ‘doctor-patient’ interaction and it is imperative to come but with some common accepted standards to translate the healthcare lingo into ‘ones and zeroes’. He lauded the health information flows of the Health Stack for being a step in the right direction and mentioned that in his individual capacity, he is also trying to solve for the same via his newly launched startup Buddhimed Technologies.

With two stalwarts of healthcare sitting beside her, Anukriti grabbed the opportunity to put forth the controversial concept of ‘doctors being averse to technology’ which could possibly be a hindrance for Health Stack to take off. Dr. Santanu and Dr. Bakshi were quick to correct her with the simple example of doctors using highly technical machines in providing treatments. They coherently stated that doctors hated Information Technology as it was forced upon them and suggested that IT professionals could do a better job by understanding the workflows and practical issues of doctors and then develop technologies accordingly. This is an important takeaway – as various technologies are conceptualized and built, doctors should be made active participants in the co-creation process.

The idea of a common public infrastructure for healthcare definitely caught the attention of both investors and startup founders. But amidst the euphoria emerged expected murmurs over privacy issues. That was when Arun Prabhu, the lawyer-in-chief for the session, took the lead. He reiterated Dr. Bakshi’s point of the doctor-patient relationship being at the core of the healthcare transactions. Such a relationship is built upon an element of trust, with personal health data being a very sensitive information for an individual. Thus, whatever framework is built for collating and sharing health information, it needs to be breach proof. Arun cited the Justice Srikrishna report to invoke the idea of consent and fiduciaries – a system wherein individuals exercise their right to autonomy with respect to their personal data not by means of ownership (which in itself is an ambiguous term), nor by regimes of negligence or liability but by the concept of a coherent consent mechanism spread across different stakeholders of the healthcare value chain. Moreover, the consent system should be straight-forward and not expressed via lengthy fifty page documents which would make it meaningless, especially for the India 2 and India 3 population. Lastly, he mentioned that just like physical and tangible assets have certain boundaries, even data privacy can have certain realistic limitations. If an information point cannot be specifically identified or associated with a particular individual but can have various societal benefits, it should be made accessible to relevant and responsible stakeholders. Thus, while it is imperative to protect individual health data privacy, there should be a mechanism to access aggregated anonymized health data. There is tremendous value in aggregating large volumes of such data which can be used for purposes like regional analysis of disease outbreaks, development of artificial intelligence based algorithms or for clinical research. Priya added that such a system was inherent in the Health Stack via the Population Health Analytics Engine and the framework for democratisation of aggregate data.

Overall, the session amalgamated various schools of thought by bringing together practitioners, CEOs, CIOs, lawyers, startups and investors on one common discussion platform. This was perhaps an example of the much-needed Jugalbandi that Sharad had mentioned about. A public good is conceptually ‘by the stakeholders, for the stakeholders and of the stakeholders’. This necessitates its active co-creation instead of isolated development. Needless to say, multi-way dialogue is the DNA of such a process. Staying true to that philosophy, we look forward to conducting many such interactive sessions in the future.

Ravish Ratnam is part of the LetsVenture Team – a platform for angel investing and startup fundraising.

He can be reached on [email protected]