Being a consultant and a coach for companies both large and small gives me the opportunity to learn of challenges first hand at several places, situations and from talking to colleagues. I also have been dedicating a part of my time in mentoring startups in India. I have participated in several mentoring sessions organized by Google Launchpad, TiE Boot Camp, TLabs here in Bangalore over the past few years. Many of the startups have tremendous opportunity ahead. However, due to various reasons including their background or skill set or lack of exposure to business, they tend to carry baggage that slow down the speed of growth. After working with several startups and discussing with fellow practitioners, there seems to be a common set of problems that keep coming up from time to time. Here are the top 10 mistakes early stage startups can easily avoid. These are common mistakes that one can easily watch out for and may even serve as a ready made checklist for early stage startups to determine their course and take corrective measures.

Here they are:

1. Not enough understanding of the business model

Several startups have found their original idea is not big enough or not exciting enough anymore or will not scale or will not work for various reasons and now they are looking for direction literally on what to do with their startup and where to go next. It’s a big predicament because their current product is not bad but either they are operating in a mature market or the technology has become a commodity diluting their original value proposition. They had the grit and guts to set sail from the land but now they are adrift in the open sea with not a sea gull in sight. Now what? There are only 3 options – to double down on your current business model, pivot or close down. But the bigger question, how can we avoid getting to this space? It’s a really tough one as you will find convincing cases of success on either sides of the debate.

I will share my perspective of evaluating market opportunity more from user demand initially. What most marketers forget to consider is something that I call “user fatigue”. User fatigue is what users go through while fulfilling their goals with the currently available solutions. For e.g. job search, house search, school search etc. If your solution is not 10x better than currently available methods, then you are not moving the needle on user fatigue. Hence even if it’s marginally better with a different UI or UX but still saddled with the incumbencies of marketplace dynamics, you will soon face saturation. I found this situation commonly in markets where they were mature with lot of players already entrenched in the market or the value proposition was not strong enough.

A good starting point would be to flush out the business model using Alex Osterwalder’s original business model canvas or Ash Maurya’s Lean Canvas. If you need a link to any of the above or a copy of my adapted canvas, let me know.

2. Doing everything your first big client says

This is a major issue with several startups that struggle to get their first big break and still find their two feet to stand. Startups need to get smart at how to handle their first big client. Even though the startup may be dealing with a large brand, you have to look at the visibility of your offering in your prospect’s organization. The key thing to watch out for and push back is the tendency of investing too much into a proof of concept. If the conversation is not yielding good results with a quick show down of your value proposition, understand why and make future bets. Opening up your technology platform to changing scope in the hope of getting a contract without explicitly having a pricing agreement is very risky.

This is also one of a mindset issue where we confuse requirements from a prospect with willingness to buy. As a product vendor, remember it’s still your prerogative of what to build, for whom, why and when. There are two aspects to this situation; first, the eagerness to close the deal and generate revenues and second, understanding whether your value proposition is resonating with your first prospect. The pressure to generate revenues is so high that we tend to entertain splitting the current business model into services and products, in an instant. As a result, when the prospect says “what you have is nice, but can you do this, this and this?” we jump on it and agree to everything. Is this really necessary? Building custom solution is like playing devil in the product’s world. Yes, you are thinking, sometimes a known devil is better than no revenues (read salaries and food on the table). It’s a tough call to make. Whether you consciously build custom solutions or not, if you want to build a product what you need to do is to understand why your prospect is interested and estimate the size of the market or aggregate need for each request coming in. Then take a call to build it or defer it or trash it.

3. Going for the big launch without any real customer input

There are several startups that are going for the big launch without any customer input. “The product is not ready for customers yet” is an oft-heard phrase. What we need to shoot for is a good enough product that builds on the core value proposition as layers. And, with so many online services for creating landing pages (e.g. instapage.com) and A/B experimentation (e.g. wingify), it would be very risky and expensive to launch before seeking real customer input. There is also an aspect of maturity in how we handle rejections from customers. Just being open to their feedback and working on it will result in wonders than trying to assume our limited understanding of any customer. It’s a natural tendency to make up requirements sitting in our offices, assuming we know our customers. I love the quote “Answers don’t lie in the building”. Doesn’t matter if we are a consumer or an enterprise shop, talking to customers and getting their inputs with an open mind should be a top priority for any organization.

4. That is one helluva MVP!

Minimum Viable Product or MVP has become a buzzword and also a highly misinterpreted and abused term. Everyone has their own definition on what is a MVP. MVP comes from Lean Methodology where it actually began to describe the first version of the product that tests the most important assumption of the idea with minimal effort for maximum validation. Other variations based on MVP I have heard are Minimum Compelling Product, Minimum Desirable Product, Minimum Sellable Product. I guess there is a lot of confusion around first what we mean by VIABLE. As a result there are several features added to the first few versions but still gets referred to as MVP. Doesn’t matter what you call your product version. There are two simple things you need to consider. First, validate your problem statement; Second, validate your solution to the problem so you can achieve problem/solution fit. To validate the problem statement, you don’t need to write a single line of code. To validate the solution, you need to demonstrate how the product could work and hence need to build something minimal so you can get maximum and quick validation. Once you achieved problem/solution fit, go out and build the rest of the product.

5. That is one helluva MVP – Reloaded

A common situation is to know when to stop calling the product MVP. The reason is we are not sure what to call the product beyond MVP. For some reason, we like to use the term MVP even if our product versions are at 3.0 or 4.0. If you look at the stages of a startup, they go from problem/solution fit to product/market fit and then start scaling. What lies between problem/solution fit and product/market fit? I’d like to combine frameworks at this point to bridge the missing piece. Geoffrey Moore’s framework of Core product and Whole Product is very interesting.

The Core Product demonstrates core value proposition. The Whole Product makes the product available for customers. A very simple example is the automobile. Nobody buys an automobile without warranty and most don’t buy without financing. In software, often the core value proposition is the algorithm. The whole product consists of user interface, user experience, delivery channels, API for partners, communities, ecosystems etc. After the MVP, it’s time to think about and build the whole product towards achieving product/market fit.

6. Designed for yourselves

Design has taken center stage. It’s suicidal to compromise on user experience design even in the first version of the product. Especially in mobile if the user finds your app confusing to use for some reason he/she is not going to come back. Most startups when feeling the crunch for good designers tend to design themselves. Similar to making up requirements, designing without the user in mind is disastrous. We need to unbox our minds and step in to the user’s shoes. Coming up with personas and understanding user behaviour through ethnographic studies can be very useful here.

7. Going after too many things

When you are a startup, you are open to a lot of opportunities and many of them are right around your original vision. It is very enticing and sometimes tiring to entertain these various possibilities because at the end of the day, you have limited resources and time. So, instead of going after too many things that may spread the focus too thin, the top management needs to develop a continuous process of evaluating business ideas and arriving at quick decisions whether to pursue, defer or trash. Using the business model canvas is a good way of doing due diligence for every opportunity. Trying to open up multiple lines of the already cash starved business in the hopes of hedging can be counter-productive if you are a startup. It may work for large companies since they may need to diversify to grow. Even then, remember what Steve Jobs said on what he is proud of. He is proud of the 95 things out of 100 that he had to say no to than the 5 things he said yes to.

8. Not having a real vision

I ask a lot of startups what is their vision and most of them give me a roadmap. Very few get what a vision is. A very simple way to describe your product vision is to imagine how the world would look like after everybody on this planet who could use your product is using your product. What would that world look like? It takes time to develop a strong and real vision, sometimes going beyond your original target segment. For example, my design consultancy’s vision is to “Live in a Thoughtful World”. And how are we going to achieve that vision? By helping our clients with designing thoughtful experiences!

9. Not having a clear monetization strategy

While it is true that if you are a consumer startup you will spend a lot of time, money and energy on building the user base before monetizing on them, it does not and should not preclude one from having a good idea about how you will monetize and from when. If your value proposition is so compelling that the customers would be willing to pay, you should go ahead and charge them from day one. If you are an enterprise startup, it is imperative to begin with a revenue model and a few well tested pricing plans before reaching out to your customer segment. A recent survey indicated that the more your web site visitors spent time on your pricing plan page, the more they are likely to convert.

10. Not measuring product usage

It’s disappointing to see several startups not tracking product usage; especially when there are free and powerful services like Google Analytics. The old adage “that which you cannot measure, you cannot manage” applies to every business. Knowing how your customers are using the product is critical. The other part that startups need to strongly consider is get serious on measuring customer satisfaction routinely. Customer satisfaction scores should be part of the executive dashboard that the top management should look at every day. The success metrics of a product should be defined and measurable goals set before launch of the product. This reinforces the belief in the product. If the success metrics and goals are transparent and exciting for the whole product team, it makes a lot of difference!

Hope this helps build powerful and thoughtful products!

Season’s greetings and wishing success in the years to come!

Good luck.

Building an IT product business can be quite challenging if you don’t have certain foundational elements well understood and institutionalized. This applies to not just startups but large organizations too. The goals in any sized company are similar. For example, getting a new idea out to market, entering new markets, trying to achieve scale, reducing cycle time between idea to market, reaching the right set of customers etc. Large organizations will need to maintain their leadership positions by continuously innovating, whereas startups agile nevertheless, have a lot less room for errors due to scarce resources. Some of the symptomatic situations of a shaky foundation are; building a new product with several features without involving potential customers; depending heavily on sales to gather customer requirements; misaligning outsourced development outcomes; mixing custom solutions and products while positioning etc.

Building an IT product business can be quite challenging if you don’t have certain foundational elements well understood and institutionalized. This applies to not just startups but large organizations too. The goals in any sized company are similar. For example, getting a new idea out to market, entering new markets, trying to achieve scale, reducing cycle time between idea to market, reaching the right set of customers etc. Large organizations will need to maintain their leadership positions by continuously innovating, whereas startups agile nevertheless, have a lot less room for errors due to scarce resources. Some of the symptomatic situations of a shaky foundation are; building a new product with several features without involving potential customers; depending heavily on sales to gather customer requirements; misaligning outsourced development outcomes; mixing custom solutions and products while positioning etc.

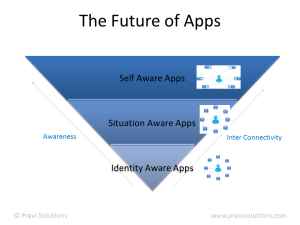

Consider an inverted pyramid as shown in the image above, with two dimensions growing simultaneously. The first being awareness and the second inter-connectivity. Awareness can also be perceived as manual vs automatic interactions with little input from user. Inter-connectivity is communication between apps or devices. When considered with the number of apps available in the market today, it is a straight pyramid with the bottom of the pyramid containing a lot more ID aware apps than the top with very few self-aware apps. When considered with the dimensions awareness and inter-connectivity, it is an inverted pyramid.

Consider an inverted pyramid as shown in the image above, with two dimensions growing simultaneously. The first being awareness and the second inter-connectivity. Awareness can also be perceived as manual vs automatic interactions with little input from user. Inter-connectivity is communication between apps or devices. When considered with the number of apps available in the market today, it is a straight pyramid with the bottom of the pyramid containing a lot more ID aware apps than the top with very few self-aware apps. When considered with the dimensions awareness and inter-connectivity, it is an inverted pyramid.