Matrix India recently hosted two firebrands of the financial services world, Mr Sanjay Agarwal, founder AU Small Finance Bank and Mr Sharad Sharma, founder iSPIRT Foundation, Volunteer at India Stack, for a no holds barred discussion at the Matrix Rooftop in Bangalore. Here is an excerpt from the evening and some of our learnings for fin-tech entrepreneurs.

Part 1 of the two-part series features the untold story of AU Bank, in the words of Sanjay Agarwal himself, as below:

Sanjay Agarwal – on his background and early days before starting AU:

“In my early Chartered Accountancy days, I started out by doing audit work, taxation, and managing clients. I had studied hard and was naïve and enthusiastic at that time hoping, to solve the world’s problems. This pushed me to work harder and I had a desire to do something more.

I believe that we are the choices we make. While evaluating various choices, I eliminated all the options that I didn’t want to pursue e.g. to work for a fee or commission and then I started digging deeper on what really interests me – that was when the concept of AU Financiers was formed.

In 1996, as 26 years old, I began approaching HNIs to raise capital, as back then, there were no VCs. I was fortunate to raise INR 10 cr at a 12% hurdle rate and I had to secure the funding with a personal guarantee. But what is the guarantee of the guarantor? No one questioned this at that time. So, I technically became one of the first P2P lenders, and structured a product that didn’t exist– short term, secured and at a 30% rate of interest. That was the start of the AU journey.”

The Early Days of AU:

“I started off AU as a one-man army. I was everything from the treasurer to the collector. Slowly we built our team and rotated the 10 cr of capital to disburse 100 cr of loans – not a single rupee was lost. There were several challenges at that time for e.g., there was no CIBIL score, financial discipline was lacking, people were still learning how to take a loan and repay it and customer ids didn’t even have a photograph. But somehow, we managed.

The period from 1996 to 2002 taught me everything I needed to learn – how to lend, how to collect, how to manage people, read people’s body language, and most importantly how to manage yourself in different situations. I follow all of that until today, and my team also benefits or suffers from those learnings of mine even today. In those 7 years, we would have dealt with 2000 customers out of which 500 defaulted. That was the ratio of defaulters – 25%. But we managed and there were actually no NPL’s.”

Partnering with HDFC Bank

“In 2002, retail credit was beginning to take off, but our HNIs started pulling their money out, as they wanted a higher return. However, at that time, the most premium bank in the country, HDFC Bank, appointed us as their channel partner. The model we followed was very simple – AU was responsible for sourcing the customer, KYC processing and doing on the ground diligence while loans were booked on HDFC’s balance sheet. HDFC is perceived to be a conservative bank, and it is – however, they gave me Rs 400 cr, on a net worth of only Rs 5 cr! They made an exception in our case due to our strong track record, through execution, sound knowledge of the market, and most importantly our integrity.

By 2008, our net worth had increased to Rs 10 crore through internal accruals. At that time, HDFC told us that we can’t give you any more capital, as we were overleveraged, and that we now needed to bring in equity capital if we wanted to grow.”

Growing the balance sheet and partnering right

“I had two choices at that point, I could continue in Jaipur, keep my ambition under control and live comfortably or figure out what else is possible. I chose the latter and this marked the beginning of my partnership with Motilal Oswal. Its easier to raise equity now, back in the day shareholder agreements used to look like loan agreements with min IRR requirements, etc. As luck would have it, a few months after we raised equity, the Lehman Brothers crisis broke out and most banks stopped funding. We were supported once again by HDFC – they were our saviour and I will cherish my relationship with them always. Once the market settled down, having survived this negative environment, there was no looking back.

Our next major investor was IFC. For the entrepreneurs here, I want to say that you have to be selective about your investors, who will help with not just capital – there should be added value they bring to the table apart from money. IFC was giving me 20% lower valuation, but I knew that I didn’t have any lineage to fall back on. As a first-generation entrepreneur, I had to raise money on the strength of my balance sheet and not basis my family name. I knew that partnering with IFC would shift the perception of AU within the industry, especially for PSU banks. After their investment, we grew from one bank relationship with HDFC to 40 bank partnerships. One thing led to another and Warburg Pincus, ChrysCapital, and Kedaara Capital all came on board after that.”

Consistent performance

“From 2008 onwards, we started diversifying from vehicle lending and got into other forms of secured lending like a loan against property, home loans etc. We never tried unsecured lending and never ventured into microfinance or gold finance. Those were very popular products at that time but focusing on what we were good at resulted in a consistently strong performance. We never had a bad year. In the world of finance, the margin of error is very less. If you have a bad year you can almost never come back. Good companies survive regardless of the market condition, you can never blame the market for your company’s poor performance. In 2015-16, we were a successful NBFC, our RoA was close to 3% with an asset base of close to 8,000 crores, with a RoE of 27-28% and everyone was chasing us – the question at that time before us was, what next?”

How we became a bank

“As an NBFC, it is very hard to manage a book of Rs 50,000 cr with the same efficiency and effectiveness as it’s a people dependent business, there are limits to the kind of products you can do and you can’t keep raising capital. Hence, we became a bank because we wanted to be there for the next 100 years and that perpetual platform can only be created through a bank. That is the biggest platform and it is not available at a price. It’s available through your integrity, business plan and execution. Today, we receive Rs 100 cr of money every single day. This is the same person who was struggling to raise Rs 10 cr in 1996, and is now getting money at the speed of Rs 100 cr every day – it feels amazing but there is a lot of responsibility!”

Part 2 of the two-part series features insights from Sharad Sharma:

Recognizing the Athletic Gavaskar moment in Indian Financial Services

“Indian financial services industry is going through its equivalent of the Athletic Gavaskar project of Indian cricket. The motive behind this project was to instil the importance of being athletic to successfully compete in the modern game. A new team was created with the rule that if you are not athletic, you cannot be a part of the team, regardless of other skills that you bring to the table. Virat Kohli eventually became the captain of this team and the results are for everyone to see. Similar yet contrasting stories played out in hockey and wrestling. In hockey, we lost for 20 years because we refused to adapt to the introduction of astroturf. However, in wrestling, the Akhadas in Haryana embraced the move from mud to mat with rigour, and Indian wrestling is already punching above its weight class and hopefully will do even better over time. The idea of sharing this is that similar to sports, sometimes an industry goes through a radical shift. Take the telecom space, for example, if Graham Bell came alive in 1995, he would recognize the telephone system, 20 years later he wouldn’t recognize it at all. The banking industry is going to go through a hockey/wrestling or communications type disruption and a lot of us are working hard to make it happen.”

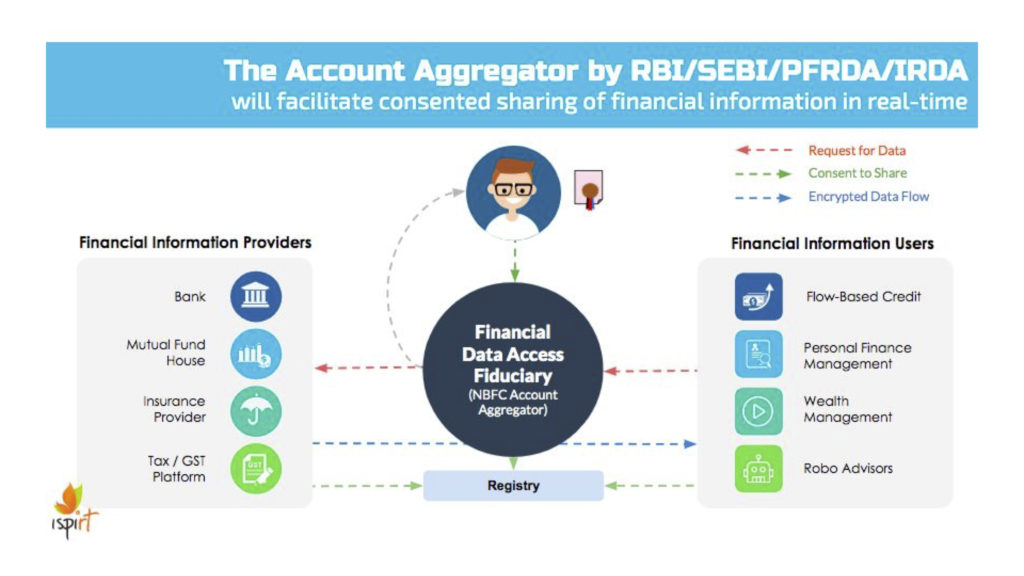

Infrastructure changes lead to New Playgrounds

“All the banks and NBFCs put together are not serving the real India today. We have 10 million+ businesses that have GST id’s, out of which 8 million+ are big enough to pay GST on a monthly basis, but only 1.2 million have access to NBFC or bank finance. This is a gap that needs to be addressed and it cannot be solved through incremental innovations.

Entrepreneurs and incumbents should learn from what happened in the TV industry when new infrastructure became available. When India went from state-run TV towers in 34 cities to cable and satellite TV in pretty much every town, there was a massive new market that was unlocked that did not want to watch the same Ramayan or Hum Log TV serials. What transpired was an explosion of entertainment products because of the high demand stemming from the new markets and the TV channel players that reinvented their content is thriving today while others that did not, are barely surviving or have shut down.

So where does this leave the bankers? I think it is the biggest opportunity for the right banker who understands this problem, wants to serve this section of the market and is willing to reinvent the way they do their business and take advantage of the new infrastructure that will be available.”

Dual-immersed entrepreneurs have the biggest advantage

“Entrepreneurs who are immersed in the messiness of both the new infrastructure and the old problem are “dual immersed entrepreneurs”. They are the ones that succeed when a market shift is underway. Today this is not happening. Some of our city-bred entrepreneurs are more comfortable with California rather than Bharat. And some of our sales-oriented entrepreneurs are intimidated by the messiness of the new technology infrastructure.”

New Playgrounds need new Gameplay

“In a world where eKYC exists, and we can transfer money through UPI from a phone, and sign documents digitally – we are ready to deliver financial products on the phone and this is the disruption that is required. Access to credit drives the economy and with this new infrastructure, it is now possible to lend to the real India. However, it’s easy to give money, but the ability to get it back and keeping defaults at a minimum is the real trick. Even there we are moving towards seeing a radical improvement. Debt providers now have powers they never had and defaulters are being brought to book. Customers are now incentivized to build their own credit history to get better and lower interest rates over time. A new Public Credit Registry is coming to enable this at scale. But the biggest innovation is related to the dramatic shortening of the tenor. One can structure a one-year loan into 12 monthly loans or 52 weekly loans. This rewards positive customer behaviour and brings about the behaviour change that is needed.

There is no secret sauce here, it requires gumption – like that shown by Reed Hastings, founder of Netflix. He disrupted the TV and home video industry by first having the wisdom to go from ground to cloud and then again when they started developing original content. In both cases, he had little support from the board or investors. If you can reinvent yourself before it becomes necessary, you’re a winner but this is harder to do for a successful company. The legacy of success provides resisters with the clout to block change. The real beneficiary of Aadhaar based eKYC in the telecom world was not the incumbents but Jio – eKYC allowed Jio to acquire customers at an unprecedented scale and they saved INR 5000 crores on KYC costs as well.”

About iSPIRT

iSPIRT is a non-profit think tank that builds public goods for Indian product startup to thrive and grow. iSPIRT aims to do for Indian startups what DARPA or Stanford did in Silicon Valley. iSPIRT builds four types of public goods – technology building blocks (aka India stack), startup-friendly policies, market access programs like M&A Connect and Playbooks that codify scarce tacit knowledge for product entrepreneurs of India.

About AU Small Finance Bank:

AU Small Finance Bank Limited (AU Bank) started in 1996 as a vehicle financing NBFC, AU Financiers and scaled to touch over a million underbanked and unbanked customers across 11 states of North, West and Central India, prior to becoming a bank in April 2017. During this time, AU attracted equity investments from marquee investors such as IFC, Warburg Pincus, Chrys Capital, Kedaara Capital and recently went public when its IPO was oversubscribed ~54 times. Over the years, AU Bank, led by its founder Sanjay Agarwal, has created significant shareholder value with its equity value growing from ~$120 million in 2012 to current market capitalization of ~$3 billion.

Please Note: The blog was first published and authored by Matrix India Team and you can read the original post here: matrixpartners.in/blog

In the initial days of your SaaS startup, when you are doing

In the initial days of your SaaS startup, when you are doing