India has made rapid progress in digitisation of the economy in the last decade becoming a world leader in identity systems, digital payments and tax, and a new data sharing and empowerment framework. However, many deep-rooted issues still exist, such as extending true financial inclusion; formalisation and creating a higher trust economy, that is essential for growth of mostly small businesses.

In this blog post, we look at innovations in blockchain, distributed ledger and other technologies such as zero-knowledge proofs as potential solutions to build a stronger fabric for the economy for decades ahead. The unique opportunity India has is to boost commerce by enhancing trust, thereby culminating the transformation already underway through existing building blocks of digital identity, payments and data sharing to boost commerce. Unlike many other countries, faster and interoperable payments or reducing the dominance of private money are solved problems for India; the missing piece is to digitise commercial contract enforcement, which on the other hand is a solved problem for developed countries. Lack of adequate contract enforcement caused by contracting parties having different versions of the truth; due to data systems that don’t interoperate reduces trust and creates friction for economic growth. Solution requires connecting the goods and services ledger to the money ledger, so that contracts of any kind become binding promises that can be executed programmatically. Using technology to solve this trust problem is a unique opportunity for India.

BADAL (also happens to be a word for Cloud in local language), a techno-legal solution in the form of “Distributed Ledger for Privacy-preserving Trustful Commerce; is proposed as an interoperable fabric underlying a future programmable economy across large and small businesses to create high trust economy.

We also look at the emergence of Central Bank Digital Currency (CBDC) which is one of the core money applications of this framework and global backdrop in Annexure. There are many other use cases being proposed from land records to decentralised clinical trials for blockchain and allied technologies in different areas of government and business1https://www.meity.gov.in/content/national-strategy-on-blockchain likewise, that can be implemented in BADAL.

First of all, why is trust important?

Trust is the basic glue that connects strangers and promotes economic activity. Money is the basic economic institution in a society building that trust2 https://press.princeton.edu/books/paperback/9780691146461/the-company-of-strangers. However, trust builds slowly due to a combination of various factors such as the nature of institutions (political and legal) and the level of formalisation. While formalisation of even small businesses is increasingly addressed by the successful rollout of GST for India, formalisation of trust still remains elusive. At a core fundamental level, trust is a public good that creates friction-free commerce and is a recipe for rapid economic growth.

There is a high correlation between the level of trust in society and GDP per capita3https://ourworldindata.org/trust-and-gdp. A study conducted by World Value Survey attempted to measure the level of trust in a country by recording the positive responses received to the question ‘most people can be trusted’. It found that countries with high GDP per capita such as Sweden, Norway and Netherlands recorded high levels of trust exceeding 60% determined in this manner as the graphic below shows.

Douglass C. North, Nobel laureate in economics4https://www.nobelprize.org/prizes/economic-sciences/1993/north/lecture/, found that ‘the inability of societies to develop effective, low-cost enforcement of contracts is the most important source of both historical stagnation and contemporary underdevelopment.’ The Union Minister of Finance and Corporate Affairs has rightly acknowledged the role of the “Hand of Trust”5https://pib.gov.in/PressReleasePage.aspx?PRID=1601273 when presenting the Economic Survey of 2019-20.

In societies like India, with limited ability to efficiently enforce routine civil or property contracts, businesses tend to restrict working with those similar to them based on caste, religion etc. (called associational activity) where there is an implicit social and moral enforcement mechanism or with members who have clearly demonstrated reputation in the past (usually the large or the older players). In both these situations, the economic benefit that a new firm can bring with new ideas or new techniques will be muted as its absorption is slower. Similarly, a new player will find it very difficult to compete with incumbents even if such players are economically more efficient. Economist Olson6Olson, M. (1974). The logic of collective action. Harvard University Press showed that associational activity is often more detrimental than favourable for an emerging economy. So we need better ways to break this trust logjam. Trust in the money system in India is comparatively high, as promises tend to be kept with sufficient legal backing and can be digitised with e-mandates or automated payments/ collections; but the same is not the case for goods (or services) ledger, leaving room for delays cascading into a logjam resulting in low trust. This is often felt in day to day life by citizens not getting routine services despite advance payment or small businesses not getting paid despite having supplied goods. Delays, defaults and disputes can become the norm if parties have different versions of the truth.

Every economic activity is thus like a mini-contract with one side on the money ledger (payment from party A to B) and the other side, on the goods/services ledger (from B to A) between counterparties, and can be converted into an electronic contract that automatically executes on both ledgers subject to interoperability. To assure the performance of contracts, the money ledger and the goods/ services ledger need to be connected in a way that is scalable, privacy-enhancing, non-repudiable and programmable. This enables a contract agreed between parties becomes a commitment, and fulfilment is guaranteed by code through the electronic contract. Assuring performance of contracts is critical for a country that is seeking to grow through startup activity, not just in tech but other sectors too.

Currently, litigants lose nearly ₹ 50,000 crores annually in wages or business lost which comes to 0.5% of the country’s GDP, because of litigation, an indication of how expensive litigation can be. The majority of civil disputes in courts are related to recovery of money (30.2 per cent) and land-or property-related matters (29.3 per cent) As reported in the 2016 survey carried out by DAKSH. Common reasons for dispute are different versions of the truth of contracting parties, prior to contract (past) or during the performance of contract (future). Having the same truth and programmability inherent in electronic contracts is a boon in this regard.

In an earlier blog, we have explored the benefits of adapted blockchain technologies to solve the problem of SME financing in India with a related post by global experts7https://balajis.com/add-crypto-to-indiastack/. We build further on that and believe that India can harness recent advances associated with blockchain technology to enable trust between unrelated parties by combining the best of the scalable and centralized legacy world with a secure and private decentralized world. This can benefit the real economy vastly along with the financial world.

Innovations in distributed ledger technologies and BADAL

Distributed Ledger technology can help in two ways – first by being able to verify past performance before one party strikes a deal with another, and second, by being able to enforce a contract in most situations as performance unfolds in future. Thus, building trust about the past as well as the future.

We thus imagine a fabric based on the following basic principles to help create and grow a large number of applications to record economic activity even while reconciling with other activities and past data and help inject a level of trust by creating a reliable, immutable record of trusted data records and programmable contracts

- Single platform to allow standards bodies and organisations to publish their schemas, and reuse other schema elements in composing workflows

- Fully privacy-preserving capabilities to allow participants to publish relevant zero-knowledge proofs which do not require private data to be shared beyond the participating entities

- A programmatic contracts capability that can help automatically carry out the relevant tasks as agreed on without any further manual intervention

By connecting a new digital money ledger (such as Central Bank Digital Currency, or stablecoins) with the new goods & services ledger, we envisage a boost to trust across economy and commerce. As such, BADAL is the first such framework we are aware of globally, uniquely suited to India’s needs, opportunities and strengths.

We have discussed the early version of this in detail in an earlier open-source document8https://github.com/iSPIRT/ppl, called Public Private Ledger. BADAL is thus a privacy supporting, trust enhancing mechanism of coordinating economic activity, and information recording and sharing. Originally this group started out of a process to explore the domain around and figure out the appropriate model to support CBDC, support data sharing between participants, and coordination and automation of event-based standing instructions across events in the goods and services ecosystem and/or money flow.

We then reviewed exciting developments in related areas first to understand their relevance given India’s unique needs. Blockchain technologies generally are seen to enable unrelated parties to trust each other and transact without depending on a central institution or intermediary. These technology innovations are around three key areas:

- Maintaining immutability and integrity of data across the distributed ledgers of parties.

- Governance mechanisms, especially for decentralised networks

- The programmability of such transactions to allow automatic execution.

Public blockchain technologies like Bitcoin and Ethereum, on the other hand, are based on a philosophy of distrust of centralised institutions like Central Banks and are designed for unrestricted access and decentralised decision-making. But they have had to develop new approaches to contend with a few challenges, especially given the huge growth off late that see further wor:

- The enormous consumption of resources to establish ‘proof of work’ that limits efficiency and scalability, leading to newer approaches

- Exposing all transactions on these networks that generally do not allow sensitive data to be private on the key layer, is as critical for confidential business data as it is for personal data

- Rise of many networks that are not interoperable with each other or with the mainstream economy, though some bridges do exist

- May have ability to operate outside banking conduits and regulatory frameworks that challenges government’s sovereignty and financial stability through greater oversight has been coming recently

Research on amending throughput, reducing costs and enhancing privacy/auditability/KYC compliance has been ongoing at a rapid pace, especially over the last couple of years.

Despite these unresolved issues, Public blockchain-based tokens, so-called cryptocurrencies, NFTs etc have become an unregulated asset class, especially amongst the young rapidly given the ease of use, creating concerns on possible misuse as well as potential opportunities. We were also part of the recent consultation of the Parliamentary Committee on Finance on ‘Cryptoassets: Opportunities and Challenges’ and had shared with them some of our ideas above in our submission here9https://docs.google.com/document/d/e/2PACX-1vShkuTno_bSILFZPf-Cb_KNwwgM6A_6OgyRiASNS0tXB3ViriHztovrkL7sebiAC7O54y0uwQheTdin/pub.

Various solutions have been employed to address some of these challenges:

- Permissioned blockchains, such as Hyperledger Fabric and Corda, allow only trusted parties to participate. Corda uses Notaries for verifying transactions. Such solutions have been successfully used in finance, supply chain, property rights, healthcare, education and e-governance

- Zero-knowledge Proofs (ZKPs) allow proving/verification of specific aspects of data without actually making the data public

BADAL builds on the above primitives and is offered as an open and interoperable platform to enable money ledgers such as CBDC/stablecoin along with applications relevant for finance and commerce. This can be designed as a permissioned network relying upon a few regulated entities, and interoperable to ensure that its benefits are widespread and at much lower costs than permissionless systems. It consists of a private ledger that holds sensitive user data with access restricted to participating entities only, and a public ledger that contains notarised zero-knowledge proofs about transactions between users. It supports different schemas (configurations) that enable usage across different use-cases.

This programmability coupled with immutability akin to electronic contracts, allows applications in BADAL to be used to leapfrog the trust logjam, without diluting sovereign privileges of control of money given India’s stage of development. BADAL will thus establish provenance that helps establish credibility and reputation of transacting parties, proof of title/ownership of goods and assets, proof of the history of transactions including promises made and ambiguously defined and fulfilled; automatic execution of terms of contracts along with privacy as a fundamental right.

Historically, monetary accounting has solved for only one side of this metaphorical coin- the monetary value. All monetary systems denote a money value to any transfer of goods or services. BADAL, being a ledger that can record value in any domain, solves for the non-monetary aspect of the transaction. Integrated with electronic contracts for a variety of applications, BADAL will enable digital claims on non-monetary assets, including new age asset classes such as crypto assets, NFTs, where claims can be financialized and liquidated. An inherent promissory layer can be enabled into the current transaction mechanism. This extends to all data types, from land records to hospital quality service quality etc, rather than just transactions involving money and goods/ services.

The ability to connect any of the data types across domains can give rise to massive amount of efficiency gains with automated execution thanks to new data from machines like cars, consumer durables like refrigerators or health wearables coming from advances in IoT (Internet of Things), 5G, Imagine a use case of automated crop insurance with sensors that monitor weather from a satellite in space to moisture in soil etc. and deliver claim benefit to the farmer with zero friction in real-time.

One of the biggest problems BADAL could solve at bottom of the pyramid is financial inclusion in India. This is not only in the form of increased monetary transactions through it, but also the ability for MSME’s to gain cheaper credit. This is a possibility as MSME’s will find it easier to prove their liquidity and income to banks and other lenders due to the monetary traceability the system will provide. An increased ability to prove financial stability will lead to greater leverage for borrowers and more systemic trust for lenders. This increase in the systemic trust will not only lead to an increase in credit creation but catalyse an increase in money velocity in India as a whole.

In a subsequent blog post, we will detail the potential use cases; as well as preliminary design of a prototype of one sample use case that is being built currently.

BADAL fabric supporting India Stack could boost digital India

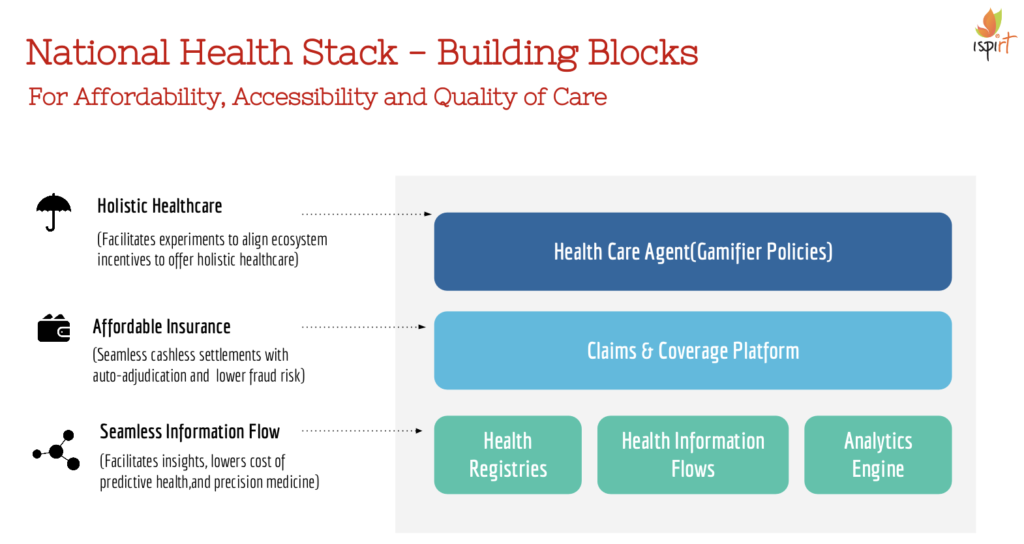

India has pioneered transformations in Identity, Payments, and Data empowerment (these building blocks are popularly called the India Stack) through a techno-legal approach. These address friction of doing business, information asymmetry, and distributed systems. Breakthroughs along the way were public platform (identity), public protocols and standards, and techno-legal approaches to solving big societal problems.

Some examples of this:

- Aadhaar enabled e-KYC has significantly reduced the onboarding cost for finance companies and utilities from ~Rs 1500 to as low as Rs10/10userhttps://documents1.worldbank.org/curated/en/219201522848336907/pdf/Private-Sector-Economic-Impacts-from-Identification-Systems.pdf. This lower KYC cost has helped in expanding the reach of government initiatives like PMJDY and similar massive private rollouts like Jio.

- Unified Payments Interface (UPI) has led to an explosion of digital wallets and payment technologies that reduce transaction friction. India has logged more real-time online transactions11https://www.financialexpress.com/industry/banking-finance/digital-payments-india-pips-china-us-others-in-2020-leads-global-tally-with-this-many-transactions/2226074/ than China and USA in 2020.

- The recent launch of the Account Aggregator (AA) model (based on Data Empowerment and Protection Architecture, DEPA) allows the controlled sharing of private financial data by citizens with various financial institutions to get the best deals. This is a global first and in some sense, an export of a truly global standard12https://twitter.com/Product_nation/status/1435997280692158464?s=20 from India.

- Open Credit Enablement Network (OCEN) is creating a way to democratise access to credit, to the level of making it accessible to a street vendor for small sums. These public goods prevent any large player from monopolising the data ecosystem and at the same time reduce the cost of providing service. For instance, microloans as small as Rs.300 can be availed on GeM-SAHAY leading to true inclusion at the bottom of the pyramid.

These techno-regulatory concepts are now being considered for adoption by several countries across the world. Overall, India is arguably ahead of most countries in adopting technology for promoting financial inclusion as well13https://www.bis.org/publ/bppdf/bispap106.pdf.

The next building block now is the trust layer through BADAL, ensuring every commitment is met and every contract is enforceable, boosting transparency and growth over the next decade. Trust permeates through all three ends of this triangle as identity is the ‘who’; and data and payment relate to ‘what’ of commerce. In BADAL, identity and data sharing can be achieved without diluting privacy to enable trusted payments (& commerce).

Annexure: CBDC Developments

While BADAL provides fabric to money or goods ledgers, we describe CBDC in detail here, given its importance. Money was traditionally issued by the sovereign (through a Central Banker) and circulated in the economy through layers of banking intermediaries. With the advent of permissionless public blockchains, some of which also seek to portray themselves as alternate currencies, the sovereigns have taken note and introduced their own variant as a public good to protect the financial stability of the nation-states. This sovereign/state-issued digital currency is popularly known as Central Bank Digital Currency (CBDC).

Central Banks have been increasingly researching and in some cases developing prototypes of CBDC since 2017 as per a survey14https://www.bis.org/publ/work114.pdf by the Bank for International Settlements (BIS). 86% of the world’s central banks15https://www.bis.org/publ/bppdf/bispap114.pdf are studying CBDCs actively. Sweden has finished its phase-1 pilot for CBDC called e-Krona in April 202116https://www.riksbank.se/en-gb/payments–cash/e-krona/. China published its plan for a CBDC retail pilot called e-CNY in July 2021 and has already put this in production apparently timed ahead of the Winter Olympics that will be hosted this year. This seems to already cover a fifth of the population 17https://techcrunch.com/2022/01/18/chinas-digital-yuan-wallet-now-has-260-million-individual-users/. The USA is evaluating its own CBDC18https://www.reuters.com/business/fed-release-paper-central-bank-digital-currency-soon-powell-says-2021-09-22; has been considering a regulatory framework for Stablecoins and has come out with a detailed report titled ‘Money and Payments: The U.S. Dollar in the Age of Digital Transformation in January 202219https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf’. In India, RBI is actively studying the benefits of CBDC20https://www.rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1106.

fig: Central bank’s work on CBDC advances further

While there are different types of CBDCs such as wholesale/ retail and account-based/ token-based, ultimately a payment using CBDC can be immediately settled. This is akin to using paper money and unlike a cheque or money transfer between bank accounts that require a process of clearing and settlement adding to inefficiency and costs. CBDC can potentially thus leapfrog depending upon the development of existing banking systems in different countries.

Advanced Economies (AEs) and Emerging Markets and Developing Economies (EMDEs) have different motivations for issuing CBDC to end-users (via Retail CBDC) and financial institutions (via Wholesale CBDC), illustrated in the diagram below.

fig: Motivations for issuing a retail CBDC

- In countries like China21https://www.cgap.org/research/publication/china-digital-payments-revolution and Sweden22https://www.riksbank.se/en-gb/payments–cash/e-krona/, a significant part of money moves digitally on private networks and central bankers are losing visibility and control of money flows. Both countries are moving quickly towards the launch of a retail CBDC.

- China is also possibly viewing its CBDC as a tool to emerge as a global reserve currency23https://www.reuters.com/business/china-cbank-says-it-will-steadily-push-forward-digital-yuan-pilots-2021-07-16/ like the USD. China was also home to some of the largest mining pools24https://www.statista.com/statistics/1200477/bitcoin-mining-by-country/ that spend enormous electricity on cryptocurrency. In this backdrop, China has recently banned crypto-mining and private cryptocurrencies.

- In the USA, payments are expensive due to its legacy system of banking. This has led to a burst of digital payment options, the latest being ‘stablecoin assets’ (digital currencies backed by real assets like US dollar, treasuries, etc) that also compete with their money-market funds. Stablecoin assets have crossed $100 billion25https://www.statista.com/statistics/1255835/stablecoin-market-capitalization/ in market value and are a popular choice to transact in Decentralised Finance (DeFI). DeFi is a parallel financial system evolving around crypto-assets. DeFI is not subject to transparency and compliance required in the conventional financial world at this point in time. As DeFi becomes big and interacts with the conventional financial world, there is a growing systemic risk arising from failure or fraud in DeFi. The US Government, therefore, wants to regulate some aspects of DeFI26https://www.federalreserve.gov/monetarypolicy/fomcminutes20210728.htm and may thereby bless some stablecoins and crypto-assets as explicitly permitted financial products. Earlier in 2015, Bitcoin was determined to be a commodity27https://www.cftc.gov/sites/default/files/2019-12/oceo_bitcoinbasics0218.pdf by some authorities there. The US Fed has also begun a consultation process towards design choices and feasibility of CBDC implementation.

Indian perspective

In India, the focus of policy has rightly been on promoting financial inclusion to formalise the economy and drive economic growth. One important factor which drives the usage of unregulated informal value transfer systems is the lack of banking facilities and corresponding amenities for managing money, which leaves rural communities without alternatives other than a person-to-person method of transferring monetary value. Even though India has seen a significant increase in the number of bank accounts created, Reserve bank data still highlights little improvement in account usage and institutional borrowings, which feeds into the broader issue of financial inclusivity.

Initiatives like Pradhan Mantri Jan-Dhan Yojana (PMJDY) opened doors to big change. UPI has been very successful as a payment mode but still needs underlying bank accounts to transact and thus depends on the banking system & its motivation to provide access to the poor. The PMJDY scheme announced in 2014 has increased the number of adults with bank accounts to 43.47cr 28Progress Report as on 22-Sep-21, PMJDY, MOF, GOI, https://pmjdy.gov.in/account (~46% of 93.55cr adults with an Aadhaar29https://uidai.gov.in/images/Saturation_Report_State-UT_Agewise_31-08-2021.pdf). Despite this headway, there is still a lot to be achieved. The Financial Inclusion Index (FI) recently launched by RBI shows that India is at 53.9 on March 21 (vs 43.4 in March 2017) – a little more than halfway towards complete financial inclusion (FI of 100)30https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52068. Presently, the banking system acts as the main gateway to financial inclusion as the banking system is the main distributor of cash. Hence, various government programmes (like PMJDY) rely upon banks for financial inclusion, despite those being not remunerative for banks. The accounts also have various restrictions on the number of debits/withdrawals to ensure low cost.

Even with the existence of such low-cost bank accounts, the poor do not have an incentive to use a bank account regularly as they do not save enough to use the bank account as a store of value. They use these accounts mainly to collect remittances and withdraw cash at ATMs as bulk of their transactions is in cash, not leaving a visible money trail that in turn makes financial inclusion difficult. Cash in circulation in India even now is Rs 29.38 trillion31https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52274 (~14.9% of estimated GDP for 2020-2132http://mospi.nic.in/sites/default/files/press_releases_statements/Statement_12_1st+September+2021.xls) despite the availability of these cheaper accounts, demonetisation in 2017 and the subsequent formalisation of the economy with GST, RERA, etc.

In addition, the cost of handling cash by the central bank and commercial banks (currency printing, operating currency chests, logistics of moving currency, ATM operations, etc.) has been estimated to be ~Rs 21,000 cr (Rama Bijapurkar) and ~1.7% of GDP ( (Visa Inc., 2016). High adoption of CBDC can help in reducing this cost while creating enormous amounts of data and enabling policymakers to diagnose and regulate better. At a later stage, CBDC can also be used for targeted monetary policy actions when its impact on the financial system is well understood. Experts are concerned that CBDC may result in the disintermediation of the financial system. This risk can be mitigated by following design principles set out by the Bank for International Settlements (BIS)33https://www.bis.org/press/p201009.htm (i) “do no harm” to monetary and financial stability; (ii) coexist with cash and other types of money in a flexible and innovative payment ecosystem; and (iii) promote broader innovation and efficiency.

CBDC inherently provides an alternative to cash to directly reach a customer and can complement the banking network to make adoption quicker. By providing a digital alternative to cash will enable building verifiable money trails that can lead to greater financial inclusion by private players providing customised health, insurance, investment & education products in compliance with privacy laws. In the financially excluded segments, CBDC, being a form of central bank currency, is likely to be well trusted and be adopted easily.

The blog post is co-authored by Sanjay Phadke, Dhananjay Nene, Sharad Sharma, Navin Kabra, R Barve, K Babel, V Agarwal, K Gokarn, Kalyan Narguru, Shashank B, Arun Maharajan, Karan Sirdesai, P Sahu, P Rao, A Kulkarni, Krishna Iyer, V Nene and A Lath.

If you have any queries or comments, please contact us at [email protected].

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25https://www.statista.com/statistics/1255835/stablecoin-market-capitalization/

- 26

- 27

- 28

- 29

- 30https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=52068

- 31

- 32http://mospi.nic.in/sites/default/files/press_releases_statements/Statement_12_1st+September+2021.xls

- 33

The other that perhaps will have equal transformational impact is its peer in the world of digital payments, the Unified Payment Interface (UPI). As soon as I had my first experience with UPI, I realized that its impact has barely been appreciated by most, including me.

The other that perhaps will have equal transformational impact is its peer in the world of digital payments, the Unified Payment Interface (UPI). As soon as I had my first experience with UPI, I realized that its impact has barely been appreciated by most, including me.