Note: This is a long form article. It will take time if you want to read it through the end. If you’re heady about entrepreneurship, you may be offended by a lot that’s in here. Also, if you’re looking for a listicle or an article to skim through, this isn’t it. So be warned before you start 🙂

Over the last few years, literature around entrepreneurship has increased manifold. Sadly, much of it is prosaic; some puerile.

I’m a demanding reader. Like most, I read a lot on the internet. I look for articles that engage my curiosity, amuse me, educate me or inspire me. I relish stories well told. I love articles that challenge my thinking and alter my world view. They make me realize that between the oft-cited ends of black and white positions lie not just drab shades of gray, but the entire vivid color spectrum. (Don’t trust me? Ask Photoshop!)

There have been articles and books on entrepreneurship that have done all of these. Books like ‘The Everything Store’ on Jeff Bezos offer a glimpse into how complicated setting up a new age business is. Others like ‘The Startup of You’ by Reid Hoffman and Ben Casanocha help pre-empt many mistakes first-time entrepreneurs make. Websites like www.avc.com offer sound reasoning on financing and share holdership. Many articles by the likes of Vivek Wadhwa explore what’s happening around the world and exciting new fields where people setup business. The common thread across the good articles is how grounded and truthful they are. Literature of this kind enriches your view of the world of entrepreneurship.

Then there is the other kind. This is the frothy tabloid variety: exultant about projected valuations for businesses that on close scrutiny appear exorbitant; breathless in dissecting every short term trend as if it will change the world; and forever in search of the next big thing.

Bad entrepreneurial literature largely follows one of three threads.

Funding frenzy

Firstly, there’s the variety that announces every funding statistic with ecstasy and tries outdoing others in spotting ‘trends’.

Every article here veers to the extreme — laudatory about the new startup on receiving funding, and eager to predict how success in the category will pan out. Witness the innumerable articles about Big Data, sharing economy, e-commerce and others today.

This narrative is invariably presented as a ‘Breaking News’ story — quick to predict trends, build heroes, present abstract reasoning on why this trend would make billions of dollars, and invariably in a few years, write obituaries dismissing their chances of success. Need examples? Read past literature on NFC or QR codes.

In the initial hype time, many more entrepreneurs and investors are drawn to explore the area. Driven by euphoria, money flows in as VCs and angels look to cash in to the trend, leading to more ‘Breaking news’ of new companies and investments. Other companies are accused as laggards, leading them to start their own initiatives in the area to tell their shareholders that they have a foot in the door.

Every company is highlighted as a potential Google or Facebook, every new founder eulogized.

Business models are given a miss in the coverage. Founders get away with talking scale, attempting growth-hacking, and if all fails, pivoting to something as ostensibly world-changing. Posturing is taken for substance; intent for achievement.

It’s one big party till the basics come undone.

The risk with this set of articles is they distort what entrepreneurs need to be prepared for when they start off in this new domain.

Entrepreneurs are led to believe that if they pick one of the new age ideas and get funded, they are well on their way to success. No one mentions that when the basics of business are not well understood, investors bet on various companies to spread their risk. They know it is a long shot and are willing to bet on few successes from many outlays. For the entrepreneur, it is not an option. It will consume his life and effort and often come to naught.

Don’t get me wrong. I’m not in any means undermining the courage it takes to start something anew. But I think we need to take a more balanced look at new ‘trends’ and explore longer-term merits before committing to it.

I wonder why so many people put themselves through needless struggle due to misinformation. In our rush to be successful and well-known, do we realize that we could avoid much of our future woes with some initial planning?

The fundamentals of business do not change. You need a market that values your product, sound planning to take things from a concept to a viable product, a good team to support you, and most importantly, a business model.

Throwing together an app and expecting people to discover it, love it, and click on ads does not make you a millionaire. Planning a business model, in contrast, could.

Packaging known wisdom

Secondly, there is the variety of entrepreneurial literature that potters around important issues but never gets specific.

Most articles tell you about why ‘wow’ user experience is a must, the importance of having a good co-founder, lessons entrepreneurs can learn from a variety of contexts in their lives and the like. Once you’ve read a few, you realize that these are the tabloid variety of articles. There’s never something that you can take away and work on, but there’s just enough to entice you to read. Be light on specifics is the mantra. After all, if you don’t give specifics, you can’t go wrong. You can always say that your opinions were shortchanged by shoddy implementation.

The offline version of these are panel discussions at startup events.

Go to a few and you realize that mostly everyone repeats the same advice and statistics. People use generic examples like Apple’s focus on design, how companies like Nokia missed the boat on this and other well-known illustrations. This makes the speaker or writer look smart without actually saying anything of importance.

All wisdom is distilled into simple homilies.

But do not make the mistake of asking questions about details. These articles or talks are never meant to be about them, as the speaker glosses over real world difficulties to spin an interesting tale.

As readers, we often realize that much of this is trite — witness the innumerable number of articles of how people have learned entrepreneurial lessons from watching babies, dogs, pets and what not. You would think people are in a heightened state of awareness, teasing insights from every interaction of the day.

Given the rise of ‘growth hacking’ strategies, this variety is unlikely to die and will make the signal to noise ratio for good insights tougher to find.soon, and will make the signal to noise ratio for good insights tougher to find.

The promised life

The third variety is like an advertisement without a disclaimer. This variety markets a life that’s lived on ‘one’s own terms’, a promise of a life of guts and glory. Whatever happens, do it your way!

Much of this paints the picture of heroic struggle. This kind is aimed at first-time entrepreneurs, or those looking to start off. Anyone who has started something off, irrespective of how successful it has been, is allowed to proffer advice. Every story is incomplete without a triumph, even if it is in the coming. People never fail, they ‘pivot’. In case things go wrong, they ‘exit’. Just don’t ask about terms of the exit.

In this world, ambition is the ultimate seductress; struggle the ultimate romance.

The trouble with this thread is that it is, like the first variety, misleading and dangerous. It goads people on without outlining the risks.

Literature of this kind should be more nuanced and truthful. It should ideally present different stories of those who tried and failed and analyze why so. I do not mean the well marketed ‘failure events’, where people celebrate failure and gloss it over as an achievement. I mean real stories that let people know what’s at stake. Every opportunity has a cost behind it; every success a sacrifice. Entrepreneurship is a considered choice, not taken on because it is cool to be in the ‘club’.

Don’t get me wrong. I am not suggesting that people do not become entrepreneurs.

I think entrepreneurship is definitely an idea everyone should examine at some point in their lives.

But I find it unsettling that many of the entrepreneurs whom I meet seem enveloped by the idea that success as a natural outcome.

They have risked it all on an idea. They rarely pause to examine if their idea or product has merit. Or understand the effort it would take to make it successful. They have taken a leap, and now the universe has to pay them back.

Not many evaluate what their key strengths are as individuals, what are real market opportunities and whether they have a shot at success. Many quit their jobs based on fads of the moment, just because the urge to be an entrepreneur is strong.

You have multiple folks trying to build software, games and utilities that have odds stacked against them. They don’t think through whether it is the right time in the market for an idea, what factors can determine success and how many of these they can control.games and utilities that have odds stacked against them.

Much of the available literature of this kind is about how successful people got to where they were, often presented with the fanboy worship of the writer. So you get a laundry list of instructions asking you to be paranoid about your business, choosing the right co-founder, running teams effectively, pitching yourself, etc. There are a bunch of tips from others’ lives as if urging us to apply them to our own lives for definite success — the ‘how I did it’ and ‘how I live my life’ tales.Sadly, they don’t highlight that the journey is uncharted, and there are no milestones to mark progress. What works for one does not work for another. You cannot borrow tips from someone’s life and apply them to your own to achieve success.

We find advice against the grain of logic — don’t worry about profitability, there’s a ton of money waiting for the right idea.

It could be your idea that VCs smack down on as the winner. One day, people will talk about the tremendous odds you faced to push their vision through and finally, in a moment of triumph at a product launch that drives the world into a tizzy (or a funding round that’s publicized), punch the air to show that you did it your way.

Armed with vision, tenacity and hubris, we are told, we will definitely succeed against all odds. Life will be tough, but why dither? Struggle makes you stronger.

This appeals to our inner emotional self rather than a rational calculative mind. It promises a chance to burnish your name amongst those-who-count in the world.

Literature of this kind indirectly rails against being a salaried employee. There are many presumptions about this role: one does not have control over one’s destiny, has to do work that’s mundane, is not able to reach one’s potential and will ultimately regret taking up the Hobbesian choice: give up a life of glory for a one for steady accumulation of wealth and comforts.

But take note of why people jump ship into entrepreneurship, and you’ll see many who have been seduced by the idea of being an entrepreneur rather than the idea of building a business or solving a market problem.

What we need are more articles that present a firmer picture. Articles that advice on how to assess market opportunity and see if it is viable, questions to ponder on whether you feel deep within that you should be the one to fix it and a more balanced view of what you will be giving up. We need articles that make you question beliefs that you strongly hold true, for that is when you will be open to the possibility of being wrong, and hence be willing to learn. We need articles that force people to think about worthwhile problems to solve on which they can build a business rather than just the fad of the month.

Till then, as Bertrand Russell says, “A wise man will enjoy the goods of which there is a plentiful supply, and of intellectual rubbish he will find an abundant diet, in our own age as in every other. “

Note: This is a revised version of an article I had written two years ago. I know that there may be many who’s views differ from mine. I’d love to hear what you think about this in the comments section.

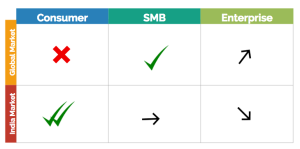

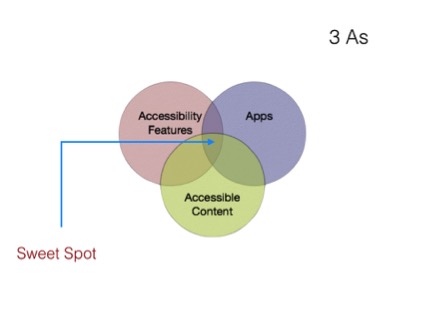

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –