There are many tactics mobile games and apps can borrow from retailers and e-commerce stores when it comes to selling In-App Purchases. Dynamic Pricing is one of the most powerful of them. This post is going to look at the low-hanging fruit with dynamic pricing that almost every mobile app or game can take advantage of, quickly and effectively.

WHAT is Dynamic Pricing?

Changing the effective price of an item based on the situation or context is dynamic pricing. Note that it is “effective” price. If the grocery store stocks half a gallon of milk for $2.00, and one gallon of milk at $3.00, the full gallon is actually cheaper even though the total dollars paid by the customer is more.

The simplest way to change the price is to offer a straight-up discount to the customer: a dollar off on a $2.99 item.

There are other ways to vary prices:

- Quietly sticking a new price on the tag.

- Creating a bundle of different items with a single price tag such that the individual prices cannot be determined.

- Creating a premium class of the item via additional value (organic milk?) or a limited supply.

- Etc.

For the low hanging fruit, we will just focus on discounts.

HOW can you give discounts on the In-App Purchase items?

Both Apple and Google require you to declare your In-App Products up front (in iTunes or the Play Store) and assign static prices. The workaround is to create multiple products for every item, but at different prices. The SKU or Product ID will be unique, but you can create a “disable ads for $0.99″, a “disable ads for $2.99″ and a “disable ads for $4.99″ item that all maps to the same item / functionality.

Here are instances of some of the popular apps doing this (showing examples from AppStore because PlayStore doesn’t show IAPs):

Go to the LinkedIn App in the App Store and scroll down to the In-App Purchases section. This is what you will see. Notice the same items at a different price?

Here are Hay Day, Candy Crush Saga and Spotify too:

Or, some games offer bonuses at existing price points like this:

WHEN should you give a discount?

This is the “dynamic” part of Dynamic Pricing. Big businesses, especially retailers, have teams of data scientists trying to determine the most optimum answer to this very question.

The low hanging fruit for mobile games and apps is in determining the basic rules or conditions under which a discount will get a user to make the purchase. Obviously, discounting the same item for everyone at the same time is a really bad idea – you should only do that when having a closing sale: “everything must go”.

Here are some instances of when you should offer a discount:

- An Abandoned Cart: A user clicked on an IAP but cancelled out at the confirmation dialog from iTunes or PlayStore. Track these events and offer a discount to that user for that item the next time they are in the app. Will this teach users to hit cancel and wait for the discount? It could. One way around it is to offer the discount only when the abandoned cart is by an infrequent buyer.

- Free Users: Users who have been using the free version of the app for a while and are not paying for the premium upgrade or game currency likely think the price is too high. Offer them a discount once they have used the app for enough time. Extra effectiveness if you offer the discount at a time when they will immediately be able to benefit from the upgrade (extra health just after running out of lives?).

- Potential Power Users: If there are users who are buying the small packages: the weekly subscription instead of the quarterly, the $1.99 coin pack instead of the $4.99, consider giving them a discount on the larger items to give them a nudge into becoming power users.

These are three “dynamic” discounts your app should have as soon as it goes out of the door. There are lots more, and if you want to pick our brains about them, drop us a line!

HOW MUCH discount?

The next question is obvious: how much should you discount? 10%? 20%? 50%?

The answer is not as obvious: do not pick a number based on your gut. You will invariably be wrong. The human psyche has a tendency to qualitatively evaluate numbers based on the nearest comparison. You might decide 20% is a lot of discount, based on what you see in the grocery store down the street. But the grocery store has a different cost structure and RoI than your app or game.

The right answer would be to test a few different discounts levels: 20% and 40% are good numbers to start with. Apple makes the price choices a little easier by letting you change the price only in $1 discrete amounts.

Also see what other similar games or apps do. If you see the Hay Day example above, they drop the price of their “Bag of Diamonds” from $4.99 to $0.99 – that a huge 80%! The level of discount can also depend on when you are offering the discount: if it is to a first-time buyer for their first purchase only, getting the conversion is more optimal, so the largest discount is the right strategy at that point.

Don’t you incur a loss by dynamic pricing?

Not if your product is 0s and 1s getting duplicated in computer memory. The cost of duplicating is 0. Any price you sell the item at is a profit. In fact, you incur a loss if you DON’T do dynamic pricing. For every user who does not buy your product because the price was too high for them , you incur a loss of the price they would have bought at. This is true of all products that have a zero marginal cost.

All you should focus on is the total revenue, which needs to be greater than your total cost of building, marketing and running the app. Price per unit is not important.

The Lattice system is built to automatically do dynamic pricing in your app. If you want to find out what it can do for your app, drop us a line!

We get into these FUDs(fears, uncertainties, doubts) because whenever you ask for money, there is friction, which cannot be removed, it can only be minimized. The best way to overcome these objections is to prevent them from happening. Well, I tried to study, how other people, were addressing the same problem, and tried to come up with one for my own product. Its taken more than 6 months, and hours of brainstorming with few of the amazing folks for me to reach here. I will try and summarize few of them.

We get into these FUDs(fears, uncertainties, doubts) because whenever you ask for money, there is friction, which cannot be removed, it can only be minimized. The best way to overcome these objections is to prevent them from happening. Well, I tried to study, how other people, were addressing the same problem, and tried to come up with one for my own product. Its taken more than 6 months, and hours of brainstorming with few of the amazing folks for me to reach here. I will try and summarize few of them.

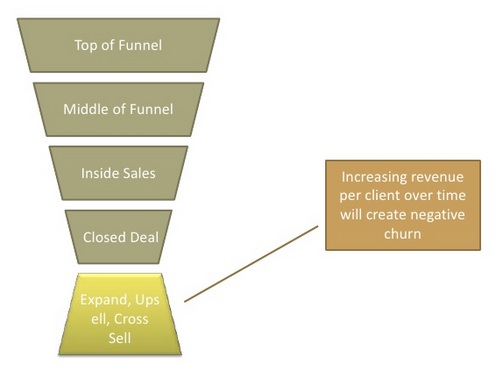

More users in freemium, but a small percentage of them drive astronomical amounts of revenue.

More users in freemium, but a small percentage of them drive astronomical amounts of revenue. Escalators are faster than stairs, even faster if you run up them.

Escalators are faster than stairs, even faster if you run up them.