Think about endgame, chess grandmasters do so to win.

Studies point out that chess grandmasters visualize the chess board state few steps away to a ‘winning game’ and make moves based on memory pattern that can lead to that board state and thus help them win the game.

Many startups however operate in a game where the rules are dynamic and change unexpectedly. An unanticipated flood of competition could sweep in, or the ground gets shaken underneath because of a regulation or policy change. Due to such unpredictability most of the founder’s move is extremely tactical, the focus is in on surviving and not getting killed as opposed to planning to grow like rabbits.

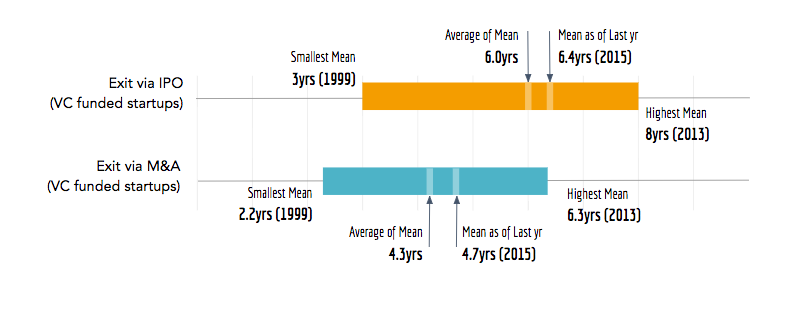

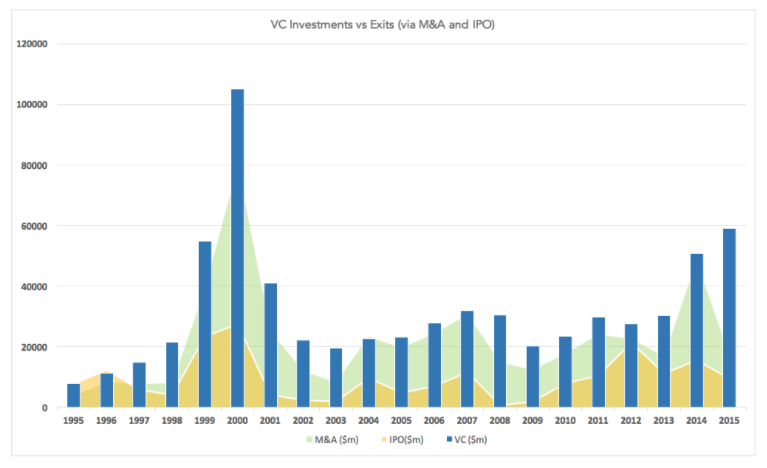

Data from 20 years of startups in US suggest mean time to exit is 4th and 6th year.

This is simply because If investors don’t do that then they can’t return the capital to their own investors (i.e limited partners) within the 10 year fund cycle.

Same data also reveals that after 1997 there has been more exit through M&A than IPO both in terms of count and value which means that it is more likely for a startup to have an exit via M&A rather than an IPO as the most likely route

In India with no IPO route, M&A is the most likely endgame

On decade long VC scale, Indian ecosystem is quite young and thus historical data is not available to compare however similar forces broady apply.

Also while scale can become large but technology market growth rates in India are not as fast the US. Add to this the fact there is no IPO market in India for the technology companies. Some efforts are underway to open it such as the new ITP platform by SEBI but nothing has kicked in practice. That makes M&A option all the more important to consider for an Indian startup founder.

From limited data that is available about the Indian ecosystem we can that $14.5 billion of VC money has been invested in last 4 years and $2.5b of exits have happened in the same period spread over 300 deals. This ratio are still very skewed when compared to other ecosystem.

All of this build the strong case for why an Indian startup founder should think about exits via M&A

A reason they don’t think about it is because they don’t know much about exits or the playbook involved in doing that. Second likely reason could be that advisors actively discourage founders from thinking about exits by labeling them opportunistic and not being a visionary founder.

Paradoxically the right time to think about exits is exactly when an exit is not needed.

Founders should think about exit before they are forced to think about it

PS: Exit has a broader significance, applies to open source and even countries. Here is a talk by Balaji Srinivasan that illustrates the importance of exit as key lever of an healthy ecosystem