If you are an entrepreneur, investor, or simply interested in the start-up sector, then you already know that Angel Tax is the buzzword right now.

Based on a law that was introduced in the 2012 budget by Mr Pranab Mukherjee, the rule aimed to target money laundering through high share premium. But unfortunately, the same provision is today attacking startups for their “high” share premiums and treating the difference between book value and DCF (Discounted Cash Flow) projections as income taxable at 30%. (For those interested in a more in-depth study of the provision and associated rulings can check out this article.

Thus, a law to penalize shell corporations and sham transactions are now being used against startups employing tens of people and generating value for the community. Valuations are usually based on a startup’s future potential for growth and revenue and using book value, a method that’s better suited to asset-heavy manufacturing industries, is like measuring time in light years – it sounds right but is blatantly inappropriate

Hence the problem. This section hasn’t kept pace with the other anti-laundering and anti-abuse measures instituted by law and has become a blanket provision with little opportunity for a Startup to distinguish itself from a fake business. It also specifically discriminates against domestic investments thereby discouraging both investors and startups from accepting investments from Indian residents.

Latest changes, notified just yesterday, provide some way out for certain startups. However, this is a partial solution to a much larger problem, the CBDT needs to solve for the basic reason behind the cause of Angel Tax to be able to give a complete long-term solution to Indian Startups.

While the share capital and share premium limit after the proposed issue of share is till 10 crores and helps startups for their initial fundraising, which is usually in the range of Rs 5-10 Cr. Around 80-85% of the money raised on LetsVenture, AngelList and other platforms by startups is within this range, but the government needs to solve for the remaining 15-20% as startups who are raising further rounds of capital, which is the sign of a growing business, are still exposed to this “angel tax”. Instead, the circular should be amended to state that section 56(2)(viib) will not apply to capital raises up to Rs 10 Cr every financial year provided that the startups submit the PAN of the investors.

The notification also introduces the concept of an “accredited investor” into the startup ecosystem, which is an acknowledgement of the role that domestic investors play. Globally, an accredited investor tag is given to sophisticated investors investing in risky asset classes to denote that they acknowledge the risks associated with such investments and that they have the financial ability to do so. But instead of fulfilling both criteria of income and net worth, they should follow the global model of fulfilling either criteria and lowering the threshold to 25 lakhs of income or a net worth of Rs 1 crore. Their investment into startups should be excluded from the scope of section 56(2)(viiib). As a process mechanism if the CBDT could put in place a simple once a year mechanism for the Investor to submit his returns and giving him a reference number valid for the financial year, this will enable him to invest in more startups in the year without the need to get permissions every time the investor invests his funds.

Most importantly, any startup who has received an assessment order under this section should also be able to for the prescribed remedies and submit this during their appeal. They should not be excluded from this circular since its stated scope is both past and future investments. The CBDT should also state that the tax officers should accept these submissions during the appeals process and take it into consideration during their deliberation.

So, to summarise:

- The angel tax should not apply to any investment below Rs 10 crore received by a startup per year, from Indian investors provided that the startup has the PAN of the investors

- The angel tax should not apply to investors who have registered themselves with DIPP as accredited investors, regardless of the quantum of investment

- The threshold stated should be either a minimum income of Rs 25 lakhs or a net worth of at least Rs 1 crore

- Any startup who has received an assessment order should be able to seek recourse under this circular during their appeal

Through this circular, DIPP has reaffirmed its commitment to promoting entrepreneurship and startups in India. With these suggestions, the spectre of the “angel tax” will end up as a footnote in the history of the Indian startup ecosystem. We look forward to these pending matters

Start up India, Stand up India.

The post is authored by our policy experts, Nakul Saxena and Siddarth Pai.

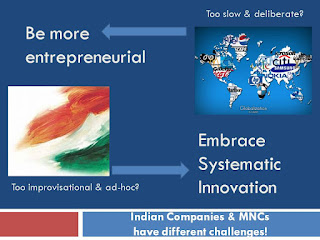

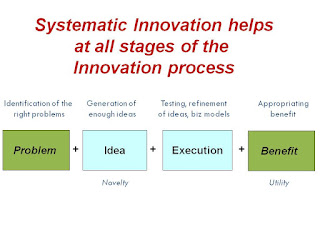

ian companies need to embrace systematic innovation so as to capitalize on their innate abilities of intuition and market sensing. Vinay Dabholkar and I hope that 2013 will be the year for systematic innovation in India. May systematic innovation go viral! Our own contribution towards this will be released soon – watch this space for more details!

ian companies need to embrace systematic innovation so as to capitalize on their innate abilities of intuition and market sensing. Vinay Dabholkar and I hope that 2013 will be the year for systematic innovation in India. May systematic innovation go viral! Our own contribution towards this will be released soon – watch this space for more details!