Strength of a industry is not just judged by how much it contributes to the economy. There are a number of factors to consider and surveys play a major role in painting a clear picture.

The India SaaS Survey is all about getting the pulse of the burgeoning SaaS ecosystem in our country. A survey of this kind is indispensable in drawing an insightful analysis and in getting credible benchmarking data about how the industry is shaping out. Though nascent, the SaaS industry has a lot of potential. The data from the survey is useful not only to help entrepreneurs and investors but also showcases the prospect of the industry to technically sound aspirants looking to step into the industry.

Signal Hill, India’s largest software investment banking advisory practice in partnership with iSPIRT, the Indian Software Product Industry Round Table decided to conduct the India SaaS Survey last year. In their commitment to refreshing results of the survey annually, the second edition took shape. The learnings of the first edition has made the second iteration a better fit to the cause.

iSPIRT puts the number of respondents who took the survey at 10% of the entire SaaS ecosystem in India!

This sizable sample size with variation ranging from bootstrapping startups to the biggest names in the industry is what sets it apart from the rest. As the SaaS ecosystem in India continues to grow, participation is bound to further increase and India SaaS survey would be the benchmark.

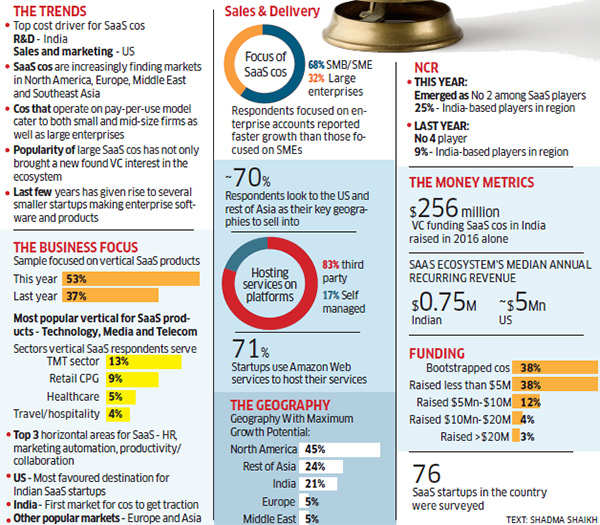

Image credits to The Economic times

Here are the 7 key takeaways of the India SaaS Survey 2016:

- NCR has moved up three places to the second position and established itself as the latest hotspot for SaaS companies

- Vertical focussed SaaS players occupy majority share of the scaled and funded respondent pie

- Enterprise focussed clients have reported higher median growth rates compared to SMB/SME focussed players

- Though inside sales is by far the most preferred and effective sales channel, post the $1Mn ARR mark respondents do report an increased usage of feet on street (which is still #2 after inside sales)

- ‘Try and Buy’ is the most preferred sales model (vs. sales channel)

- Horizontal and Vertical SaaS players report similar median growth rates, however companies that focus on the US as their primary market (as against India or Asia) reported distinctively higher median growth rates

- The median CAC payback period (for >$1Mn ARR) is 6-12 months

Do have a look at all the data we dissect with the survey:

We are open to your suggestions to make this survey better with time. Please do let us know what else you would love to see us cover next time. Write to us at indiasaassurvey(at)signalhill.in

On behalf of Signal Hill & iSPIRT Team

Nishant & Varun(SignalHill), Krish(ChargeBee) & Suresh(KiSSFlow)