For our most recent Startup Bridge Salon on May 9th, we had planned for sixty 1-1 strategic partnership meetings between 11 B2B startups and 35+ US corporates. In the weeks leading up to the event and the week post-event, we clocked 115 meetings. Read more to learn about the event & program, and how you can participate or get involved.

I got 10 meetings with decision makers through StartupBridge which is worth 1000 business cards at a trade show. (Raviteja, CEO @Moengage, May 2019)

I made 18 connects out of which 11 are of extremely high value. (Aditya, CEO @FirstHive, May 2019)

History of StartupBridge, M&A/PSP Connect

In 2013-14 the M&A Connect (and Business Exchange BEX) program was established as part of iSPIRT’s Market Catalyst pillar to help solve the problem of extremely low “exits” to “investment” ratio for startups in India. Strong “exits” are healthy markers of a mature startup ecosystem, closing the cycle of capital flows. The program consisted of developing a strong match between the global corporates interested in acquisitions (buy-side) and Indian startups (sell-side).

The initial problem was a discovery issue where Indian startups were not on the radar of these potential acquirers. The M&A connect program activated the India radar, by engaging the buy-side to collect deep virtual mandates, and use it to match and make warm connects with the sell-side, at times hand-holding the connect process to several favorable outcomes.

In this program, we found that our startups were not effective at pitching their story to a potential acquirer. This resulted in a few aborted connections. Additionally, it became clear that the path to an effective M&A lay in facilitating potential strategic partnerships (PSP), which if nurtured has the potential to blossom into investments or acquisitions. Strategic partnerships can surface in the form of technology or GTM/distribution level enfgagement between startups and larger corporates. It can open several doors instantly, making distribution easier, revenue growth faster and gives the startup multiple options.

The M&A Connect program morphed into PSP Connect (Dec 2016 onwards) and the program goals moved from pure M&A to building strategic partnerships. iSPIRT partnered with TiE leaders in Silicon Valley to create the Startup Bridge India initiative (SBI), where many buy-side companies were invited to meet and explore strategic level engagement with highly curated sell-side startups.

The Startup Bridge Approach

Over the last 3 years, the SB team, iSPIRT volunteers and TiE partners, have helped B2B SaaS/enterprise startups refine their air-game, and engage in partnership discussions with high conversion outcomes.

We have connected 45 startups to Fortune 1000 corporations and in the process catalyzed $200M+ of value in terms of PSP (potential strategic partnership), customers and M&A. (Manu Rekhi, Inventus Capital & Startup Bridge)

The key value proposition is to help startups scale revenue by 10x in 2 years through meaningful PSP connects with decision-makers at global Fortune 1000. In turn, these corporations leverage SB to engage with highly curated startups to get access to technology and product gaps.

We are effectively the bridge over the chasm that most startups struggle with, and the potential disruption that many corporates are worried about.

Startup Selection

Did you know that ~50% of Unicorn enterprise startups in the Silicon Valley have an Indian founder or co-founder and had origins or back-offices in India?

Our stringent startup selection process is essential for matching the “Who in India” with the “Who in USA”. Data from the program over the years have shown that the startups which stood to leverage the program effectively and benefited the most were in the ARR range of $500K to $5M. Hence SB’s high-level criteria for inducting B2B enterprise/SaaS startups into the program focus on a) having a global product-market fit, preferably in the US, with b) a strong footprint & revenue (~$1M ARR), and c) bringing deep technology, high revenue potential and/or a high growth momentum.

PSP Wishlist

On the buy-side, it is critical to engage corporates who can enable the 10x growth for these startups. Most startups see partnerships as tactical like with a reseller, system integrator (SI), channel/OEM partner… A strategic partner goes beyond tactical value. A startup can explore and collaborate with a PSP to accelerate its strategy in the emerging focus area. In return, the PSP provides a rocket boost to the startup’s customer acquisition, distribution, branding, and/or a holistic product strategy. Having such a partner can also significantly impact startup valuation.

As a startup, you need to think about a PSP early in the game at the ‘Flop’ and not at the ‘Turn’. You need time to develop a PSP and you need to start early. (Vijay Rayapati, Nutanix, Jul 2018)

If you think of the value chain of your customers, their vendors, integrators, solution & platform providers, a strategic partner may lie above you and your peers, and a level or two above your target customer. Often high growth customers can transform into strategic partners. We help the startups think through their PSP wishlist and make relevant recommendations.

Startup Air Game

Pitching to a PSP company is very different from the pitching to a customer or to an investor. A well-articulated pitch can make a difference between a yawn and a wow! A great startup pitch highlights their Mission, problem statement, their solution & approach, the product/platform overview, key metrics & traction, unit economics of growth & acquisition, testimonials, market size & drivers, and finally their ask.

I thought I knew my pitch and had the details at my fingertips. But then I started getting really valuable, thought-out feedback…I had to focus on pitching to partners, not customers. (Pallav Nadhani, FusionCharts, Dec 2016)

It takes 100 hours per startup to articulate their value proposition into a pitch deck of only 10 crisp slides. The initial hours creating & refining their pitch deck with assigned mentors. It is followed by a day-long boot camp before the event where they are grilled through their pitches by the SB team, startup & corporate mentors from the industry, and successful entrepreneurs.The multiple rounds of feedback not only cover their proposition, but also helps weave in the founders’ story, and develop their stage presence, and tonality. Post boot camp they work on the critical feedback with their individual mentors, sometimes even redefining their models & assumptions, and final dry runs with the SB team. The results at every SB event have been astounding 7-min founder pitches amazing every attending corporate and industry leader.

PSP Virtual Mandates & Exclusive Connects

We have found that startups require 2 points of support for effective partnership outcomes. First, crafting warm connects based on virtual mandates. Second, prime focus on shepherding the startup-partner conversations on a rolling basis. The unmet need is to have 1-1 connects with the right person on common ground.

I went from first discussion into pricing in one week with a Fortune 10 company. Getting in front of the decision maker is all the difference. As a founder/CEO I can close the sale without the long drawn out sales process. (Sanjoe Jose, CEO @Talview, May 2019)

Bringing PSP companies into our network, we connect with key profiles within the company on their build-buy-partner outlook. This helps in surfacing several latent areas of focus for partnerships, investments or acquisitions. Constructing the virtual mandate out of these relations is key to recommending a high-potential match between the startups and corporates.

All startup bridge sessions and introductions are curated and by invite-only.

Exclusivity made the quality of event and connections even more important. I attended because of an impressive amount of my peers from other Fortune 1000 companies. (Rahul Kamath, VP Oracle, May 2019)

Impact to Date

The stringent startup curation criteria ensure high potential innovation & growth partnerships for corporates. The intense boot camp and mentoring hours help startups develop highly effective positioning in the market. The latent virtual mandates enable effective match-making resulting in extremely relevant growth opportunities for the startups.

If I had to do this on my own each of these connections would have taken 8-12 weeks of effort.

Though these events get significant attention & traction, the goal of the SB program is to deliver these connections on a rolling basis. Here are some stats and anecdotes across the years:

- 19 out of the 45 startups in the SB cohorts have grown 10x in the past 2 years.

- 749 connections to decision-makers have been made to-date with >$200M of value creation in terms of partnerships, customer purchases, and M&A.

- 121 PSP connections from the May 9th event and beyond.

- 3 exits and 1 more on the way.

- Focus on quality and value creation has resulted in consistent high NPS 56-81. This focus on quality is the core principle of this community lead effort and the hallmark of success so far.

What can you do?

Shifting from its pro-bono, volunteer-run orbit, Startup Bridge is transforming into a mature, scalable global program. By broadening the corporate network reach beyond Silicon Valley, and expanding support to startups of Indian origin regardless of domicile, the program is poised to benefit startups and corporates at scale. Upcoming SBDays are being planned for New York, Bay Area, Japan. Startup Bridge continues to be mission-driven, helping fill a critical gap in strategic partnership building for Indian origin startups.

If you are a startup or would like to refer a startup to be part of the SB program please fill the partnership application form. Alternately you could email us at [email protected].

If you are a corporate exec and/or can help us with decision-makers (CXOs, EVP/SVP, GM), or key influencers (VP/Director of Partnerships, Corporate Development) please email us at [email protected].

[This post could not have been possible without inputs from the SB Team & iSPIRT volunteers, Dipty Desai, Jibin Jose, Manu Rekhi, Raju Reddy, Sharad Sharma, Sijo George, Rajan Thiyagarajan, Vrushali Malpekar, and volunteers from the previous Startup Bridge/PSP Connect program. Also, personal thanks to all the volunteers, mentors, and the participating startups for making the SB Salon on May 9th successful.]

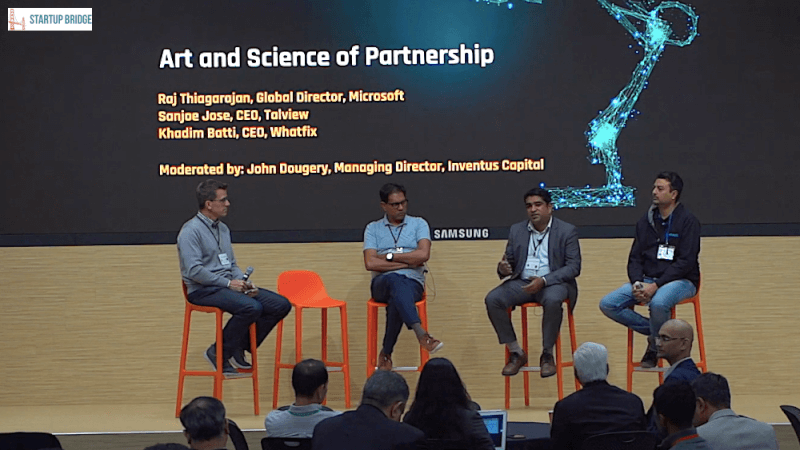

Some more photos from the salon

While the SaaS industry began over 2 decades ago, many say it is only now entering the teenage years. Similar to the surge of hormones which recently brought my teenage daughter face-to-face with her first pimple. And she is facing a completely new almost losing battle with creams and home remedies. In the same vein, convergence of

While the SaaS industry began over 2 decades ago, many say it is only now entering the teenage years. Similar to the surge of hormones which recently brought my teenage daughter face-to-face with her first pimple. And she is facing a completely new almost losing battle with creams and home remedies. In the same vein, convergence of

As market needs change, the product needs a transform. As new target segments get added different/new product assumptions come into play. In both these scenarios existing products begin to age rapidly and it becomes important for startups to re-invent their product offerings. To deal with such changes startups must experiment and iterate with agility. They require support from a base “internal” platform to allow them to transform from a single product success strategy to scaling with multiple products strategy.

As market needs change, the product needs a transform. As new target segments get added different/new product assumptions come into play. In both these scenarios existing products begin to age rapidly and it becomes important for startups to re-invent their product offerings. To deal with such changes startups must experiment and iterate with agility. They require support from a base “internal” platform to allow them to transform from a single product success strategy to scaling with multiple products strategy. A strategic partner offers 2 benefits for startups. First is the obvious ability to supercharge the startup’s GTM strategy with effective distribution & scale. How does one make a strategic partnership? Pitching to a strategic partner is very different from pitching to a customer or investor. PSPs look for something that is working and where they can insert themselves and make the unit economics even better.

A strategic partner offers 2 benefits for startups. First is the obvious ability to supercharge the startup’s GTM strategy with effective distribution & scale. How does one make a strategic partnership? Pitching to a strategic partner is very different from pitching to a customer or investor. PSPs look for something that is working and where they can insert themselves and make the unit economics even better.