Today we are giving a fond sendoff to Praveen Hari and Venky Hariharan as they transition out of full-time volunteering and onto new challenges! This is a bittersweet moment: as excited as we are about their future plans, we can’t help but feel a sense of loss. We will most certainly miss their selfless energy in our mission to democratize credit in India.

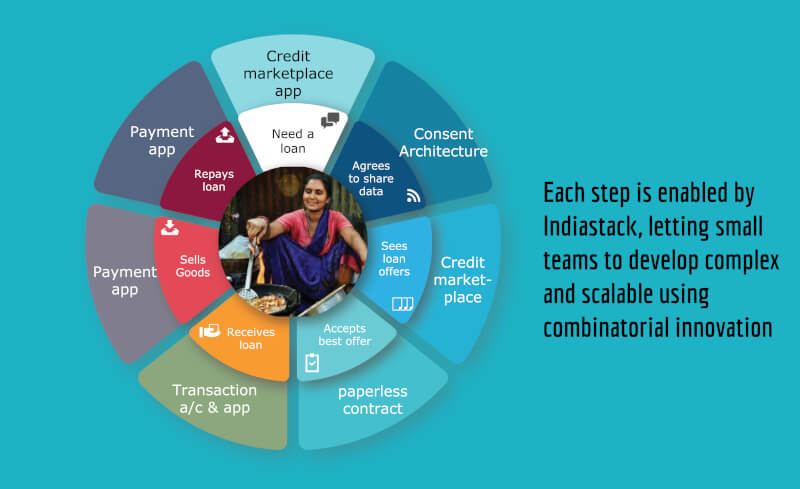

Democratizing credit is vital for India’s future. This particular breed of the societal problem needs a jugalbandi between public platforms like India Stack and market players like banks, NBFCs, and Fintechs – a kind of jugalbandi that is new to our ecosystem. To bring it about, it needed catalysts like Praveen and Venky.

Praveen has been iSPIRT’s ‘dynamo’ behind flow-based lending. He has done innumerable learning sessions, pulled together countless borrower pools, knocked partnerships together, and was instrumental in the design of “Type-4” loans. He has been the go-to person on all things around flow-based lending for lenders, loan service providers (LSPs), technology providers, sophisticated model builders, and VCs. His can-do spirit is legendary: he has been an inspiring blend of thought-leadership and hustle for all of us volunteers in iSPIRT. Because of this, his name will be forever etched into the history of flow-based lending in India.

Venky anchored our Fintech Leapfrog Council (FTLC) efforts from the very beginning and took on the challenging task of helping incumbent banks embrace non-linear change. Since its launch, FTLC has been instrumental in kicking off a number of market experiments and has helped banks think through their strategies around UPI, BBPS, cash flow based lending, and the technology and data governance changes they need to transition to a new era.

Venky’s soft-spoken approach masks a determination to get difficult things done. His charm is legendary, and he used it to help leaders of FTLC banks practice intentional unlearning. This collective effort has moved the industry forward, helped the banks prepare for a more dynamic future, and set the stage for partnership between banks and new age technology and Fintech players.

As quintessential iSPIRT volunteers, both Praveen and Venky have created enormous ecosystem value, and they did it for the mission. Many market players benefited from their work, and (as is iSPIRT custom) not one paisa flowed to either of them. This selfless volunteering is the iSPIRT way. After subsisting on a small Living Wage as full-time volunteers, it is time for Praveen and Venky to move on.

New Beginnings

Praveen is planning to become an entrepreneur again. After his two month cooling off period, he will launch his new startup. We, for one, are hoping that this startup will be in the flow-based lending space! We are rooting for him to be the Jonathan Rosenberg of flow-based lending: Jonathan was instrumental in bringing SIP Protocol to life as an IETF standard, and in helping to create Skype as a winning implementation of SIP Protocol as its Chief Technology Strategist. We hope Praveen’s path will have a similar trajectory, both in direction and impact! In parallel, he will continue to volunteer part-time for our PSP Connect (formerly M&A Connect) program where he has been active since the beginning. He will no longer be involved in our policy work.

Venky is moving to IDFC Institute to create a new Data Governance Network. We are at the cusp of a new data regime and data economy in India driven by Data Empowerment and Protection Architecture (DEPA), something that is very different from the paths taken by the US, Europe, and China. This Network will bring evidence-based inputs into the policy and practice of data governance; in this new world of data, it is key to secure empowerment and protection of each individual. Alongside this important new responsibility, Venky plans to keep volunteering part-time with iSPIRT on our software patents initiative where he has been active for many years.

When our full-time volunteers roll off to new challenges, they are a gift to the ecosystem. They carry with them an emboldened sense of what India can be, and an energized plan to make new things happen – in turn creating new capacity in the market.

Shifting Gears: Playground Orchestration

iSPIRT has been at work on the societal problem of democratizing credit for the last 4-5 years. We have made considerable progress, yet more needs to be done: Rajni is not yet being served as we would like it.

After some soul-searching, we realized that the next phase of ecosystem building for credit democratization needs a more deliberate orchestration of market and state actors. Meghana Reddyreddy, a power volunteer, will drive this phase; she will don the mantle of Playground Orchestrator for Democratizing Credit.

Volunteering with iSPIRT

Our central tenet is that societal problems are solved by market players. To come up with truly innovative solutions, these market players need various kinds of public goods – scaleable public platforms, supportive policy and procedural guidelines, transformational market catalysts, and world-class playbooks – to succeed. Our volunteers build these public goods in a selfless fashion. They are often the most talented and driven folks in the ecosystem. Some do this public goods building on weekends. Others, like Praveen and Venky, take a year or two off from their career to do this.

If you want to be one of these volunteers, read our Volunteer Handbook (https://pn.ispirt.in/presenting-the-ispirt-volunteer-handbook/) and feel free to reach out to us.

By Sharad Sharma, Pramod Varma, Siddharth Shetty for Volunteer Fellow Council and Pankaj Jaju for Donor Council.

I recently met with

I recently met with