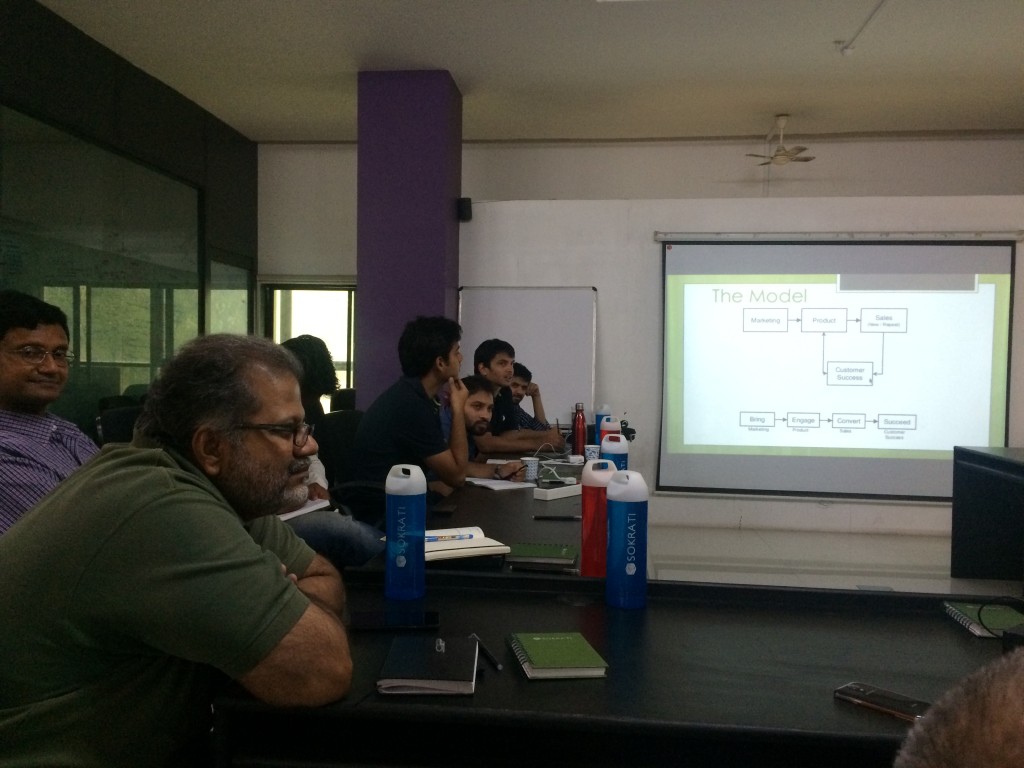

The 50th PlaybookRT session was held at Helion Ventures in Bengaluru to brainstorm and understand best practices for positioning and messaging of startup products. This roundtable was led by Shankar Maruwada, who by virtue of his illustrious past experiences as the brand builder for Aadhar and P&G, and being a successful entrepreneur at Marketics ably anchored the deliberations. Twelve product entrepreneurs spread across IoT, mobile, social, analytics and B2B sectors benefited from the insightful interactions.

Nice 🙂 @mtrajan: 50th #playbookRT pic.twitter.com/T9JBQtIqr7 Tks to #Mavens @mrgirish @sureshsambandam @avlesh @AneeshBReddy @amitsomani 1/2

— Avinash Raghava (@avinashraghava) June 27, 2015

This roundtable was special for iSPIRT family, since it marks a milestone of a journey that began with the same person – Shankar Maruwada in April 2013, at the same venue as well! To mark this special occasion, Sharad Sharma, co-founder of iSPIRT was present at the start of the session. He traced back the evolution of PlaybookRTs and explained that these roundtables came to action to fill the need for honest and open peer to peer knowledge sharing and gaining among product entrepreneurs. Shankar recollected his experiences of running the roundtable on the same topic at various locations across India and narrated the differences and common patterns he observed amongst the participants across these sessions. Rajan wrapped up the pre-event activities by describing the metrics iSPIRT uses to measure the effectiveness of such programs, and the way forward.

The roundtable began with Shankar asking all the participants to jot down three things about their prospective customer Bob:

- The problem that the customer faced/is facing

- Solution provided by the participants to alleviate the above problem

- The value/benefit that Bob, as a customer derives by using the above provided solution

Once completed, a review of the pitches that participants had written was done in the group. There was a lot of variety in the pitches. While one such pitch was crisp, succinct and focused on numbers/metrics to drive the value proposition of the solution for Bob, a customer in the B2B space, the other was a story that tried to explain the value provided by the participant’s IoT solution invoking a connect to the customer’s parents. This variety in the pitches generated a lot of discussion among the participants about the best/optimal way to pitch/position their corresponding products.

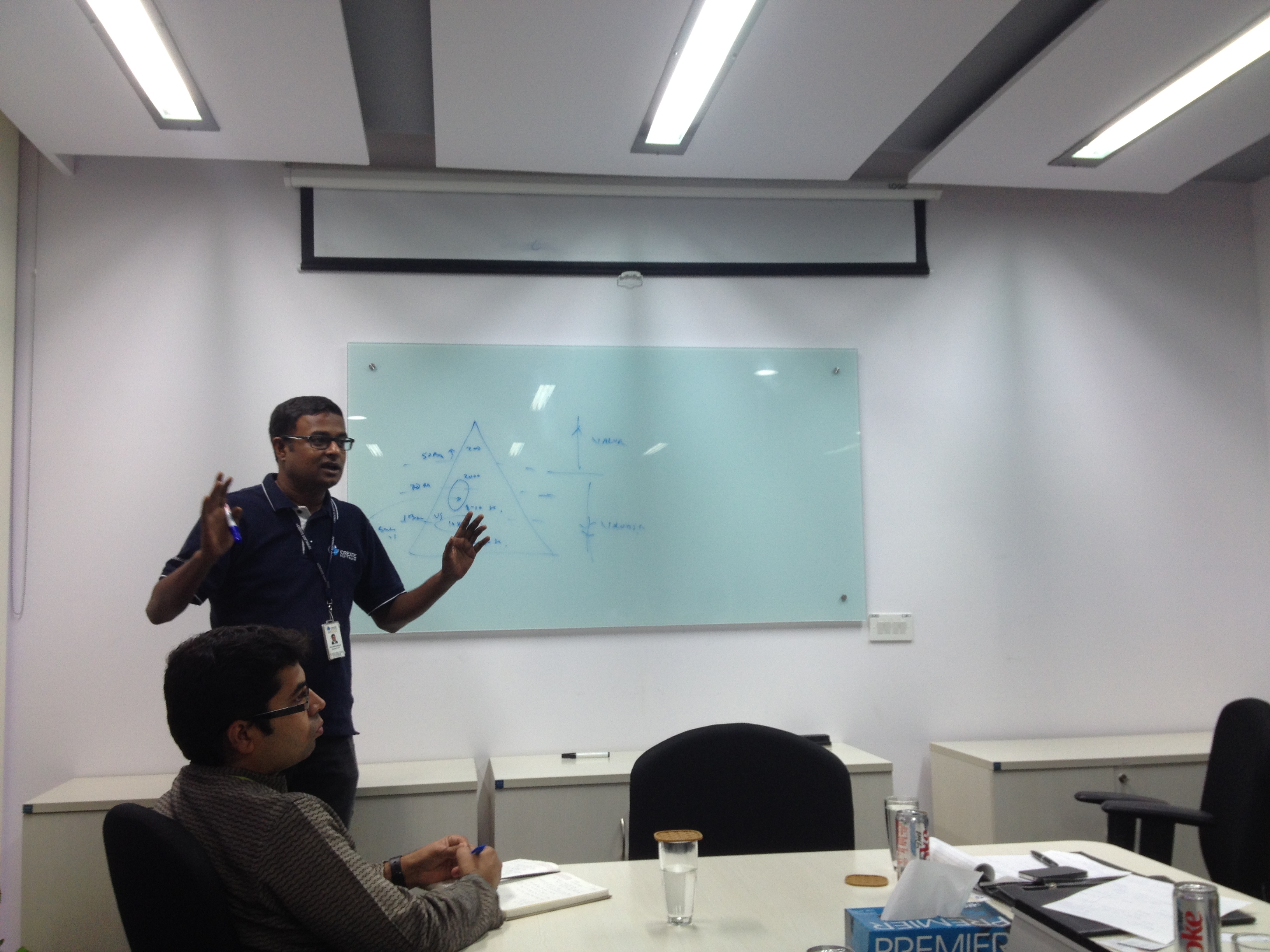

At this point, Shankar introduced the concepts of curse of knowledge*, and the Golden Circle* that helped the participants to understand the need to emotionally connect with their prospective customers, as well as, the need to keep in mind, the knowledge of the customer (not the know-how presenter of the pitch), while describing the key tenets of their products.

These concepts paved way for further brainstorming on the applicability of the inside – out or outside – in approach of the WHY – HOW – WHAT trilogy of the Golden Circle across different segments. For example, there were discussions on whether it is appropriate in the B2B context to start with an outside – in approach, and vice versa for a B2C context and so on. There was also an opinion that Marketing team in a startup would usually use the Why – How – What route, whereas the Sales team would go vice versa. A video of Steve Jobs addressing his internal marketing team about how they should reach out to their intended customers helped internalize these aspects.

One of the participants resonated with the ill effects of the curse of knowledge when he shared how he had assumed that all of his customer base would be aware of the familiar ‘Settings’ icon. Upon getting a support request from an aged customer, who cited inability to locate the ‘Settings’ option, he realized that he had not provided a text alongside the icon based on the assumption that what he knew would be also known to his customers.

As the group digested these concepts, Shankar nudged the participants to revisit the pitches that they had initially created, and explore if they could make any changes based on the learning they had on account of the above two concepts. This brought about a few revisions to the pitch each of the participants had made. At this juncture, the group listened to pitches from a few more participants and ideated on what aspects of the pitch resonated with them.

The group then moved on to understand in more detail, the art of explaining the core value of their products. This was done by reviewing the Dropbox advertisement* created by Lee Lefever and discussing about how the ad starts by establishing a common connect/chord with the audience (SETUP), and then, in common language (without jargons) explains the key benefits a user would get (SOLUTION) using analogies, and finally, reinforces it with factual details of its features (SUPPORT).

Some time was spent in explaining the importance of using analogies as a bridge to transition the customer attention from the initial few minutes to introducing the product/solution to the customer, while keeping his attention intact. The Dropbox video and another video from the thisamericanlife.org archives*, where a doctor explains the vulnerabilities of children who face daily abuse from drunken parents helped the participants to understand the power of using analogies to convey the right message.

These videos and a couple more on the book ‘Made to Stick’* by Heath brothers helped the participants to craft/revise their positioning and messaging pitches, which started with building a context to establish emotional connect, used analogies to describe the solution and finally strengthened the pitch with factual/logical and data driven narration to make a lasting impression on the prospective customer.

Towards the end of this roundtable, as a last aid, Shankar introduced the 6 tips of persuasion* which entrepreneurs could use to help build up customer connect. As the participants completed these deliberations, they had imbibed the knowledge that being able to connect both emotionally and functionally to the customer is key while positioning and messaging for their products to prospective customers. The participants spent more than four and half hours and not one of them moved till Shankar actually ended this session at about 9 PM.

The evening was very well spent, and the participants had an accelerated learning by virtue of this roundtable. Dinner, arranged by Rajan, courtesy iSPIRT and the friendly staff at Helion provided the perfect way to end a very eventful learning experience to all the participants as they ruminated about the things that they learnt and shared their thoughts about time well spent during the session.

* The following URLs provide additional information about the concepts and views expressed by fellow participants of the previous sessions on this topic. Skimming through these write-ups and watching the videos will provide additional context for those who want more insights:

- Simon Sinek’s ‘The Golden Circle’: https://www.youtube.com/watch?v=l5Tw0PGcyN0

- Dropbox Intro Video: https://www.youtube.com/watch?v=w4eTR7tci6A

- Lee LeFever on the Art of Explanation: https://www.youtube.com/watch?v=j6gyI7_j-1o

- Made to Stick–Review of the book (Part 1): https://www.youtube.com/watch?v=E7U74c0Hzbk

- Made to Stick – Review of the book (Part 2):

https://www.youtube.com/watch?v=FLt3H01XNto

- Science of Persuasion: https://www.youtube.com/watch?v=cFdCzN7RYbw

- Steve Jobs – Think Different Speech:

https://www.youtube.com/watch?v=keCwRdbwNQY

- Summary of the PlaybookRT session on positioning and messaging products, held at Bengaluru: https://pn.ispirt.in/some-takeways-from-the-first-ispirt-playbook-roundtable-on-positioning-messaging-in-bangalore/

- Summary of the PlaybookRT on this topic, held at Bengaluru: https://pn.ispirt.in/ispirt-playbook-roundtable-positioning-and-messaging-lot-of-it-is-common-sense/

- Summary of the PlaybookRT on this topic, held at Mumbai: https://pn.ispirt.in/8-powerful-things-i-learned-about-positioning-your-startup-at-the-ispirt-round-table/

- Summary of the PlaybookRT on this topic, held at Mumbai: https://pn.ispirt.in/why-no-other-product-like-yours-is-not-cause-for-celebration-playbookrt/

12. Summary of the PlaybookRT on this topic, held at Delhi: https://pn.ispirt.in/the-best-things-are-simple-is-your-messaging-there-yet-from-playbookrt/