National Policy on Software Product provides for creating a HS Code under Strategy item 1 for “Promoting Software Products Business Ecosystem”

| The tax regime will be demarcated for ‘Software Products’ from ‘Software Services’, by providing clearly defined HS Code for the “Software products (intangible goods)” delivered through any medium; physically or online using internet (to be published within three months of notification of this policy). A model HS code will be evolved that will be further sub categorized based on the type of software products, its inter-linkages with other economic sectors, including services and hardware manufacturing. Thus, software products defined by such identifiable HS code will be treated as goods manufactured in India and will be able to avail all incentives provided under Make in India Programme. |

Objective of this blog

There are number of challenges to get the HSN Code issue resolved and to get a right HSN code from the Govt. of India. This blog is an attempt to understand the regimes of HSN/SAC Code use and its application to promote a Software product industry in India to implement the above said item in the NPSP 2019.

It will be good to read the following reference documents (Click below to read)

Present status of HSN and SAC Code

After launch of GST, all transactions are to mention the relevant HSN code /SAC Codes are must to be mentioned in Invoices. HSN for Goods and SAC for services.

Under GST regime, all IT Software has been treated as “Service”. Yet, there exists HSN codes and SAC codes both. HSN codes traditionally meant for physical exports through ports still exist in GST regime as there still will be Physical exports through ports.

iSPIRT has time and again represented to Government of India that the provisioning for a “Digital Goods” regime will help India embark upon a Software product wave. However, the GST regime has assumed all Software as service.

Following HS Codes or SAC codes are in use by Indian Software product companies.

For a full view of the codes relevant file links at CBIC are given above.

| HS Code | Item Description |

| 4907 00 30 | Documents of title conveying the right to use Information Technology software |

| 4911 99 10 | Hard copy (printed) of computer software (PUK Card) |

| 8523 80 20 | Information technology software on Media (Packaged or Canned) |

| SAC code | Item Description |

|

9973 31 |

Under 9973 – Licensing services for the right to use intellectual property and similar products.

Licensing services for the right to use computer software and databases. |

|

9984 34 |

Under 9984 Online Content

Software downloads |

Most prevalent uses are of

- 8523 80 20 – for packaged products and downloads

- 9973 31 – SaaS Software

Following Codes are specifically for use of Software Services companies

Under Category 9983 – Management consulting and management services; information technology services.

| 9983 13 | Information technology (IT) consulting and support services |

| 9983 14 | Information technology (IT) design and development services |

| 9983 15 | Hosting and information technology (IT) infrastructure provisioning services |

| 9983 16 | IT infrastructure and network management services |

| 9983 19 | Other information technology services n. e. c |

The coding mechanism covers both international trade Domestic Tariff Area (DTA) under new GST regime for invoicing.

Present coding is bottleneck for Software product trade

The above coding scheme has emerged from a traditional regime which

- Classifies only physical ‘goods’ can only qualify for cross-border trade and hence under HSN and

- Software sales is a ‘license to use’ in stead of a product trade.

In addition, it induces a confusion in SAC 9984, where it also lists Software downloads along with other content.

- ‘Software’ has not been given recognition but how Software is delivered is given an importance.

- It also does not allow us to account for Software product in a clear manner, both Domestic and International Trade Statistics.

- It does not allow us to ‘account’ for emerging segments of Software products due to technological change.

- It is also confusing in sense packaged software downloads can be classified under 9984 also.

“Having right code system is Central to promotion Software Product Industry and related ecosystem.”

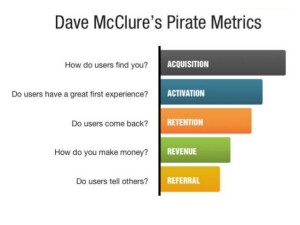

| A proper classification and coverage will help us promote Indian Software product industry and account for Software product trade verses Software services bother internationally and domestically.

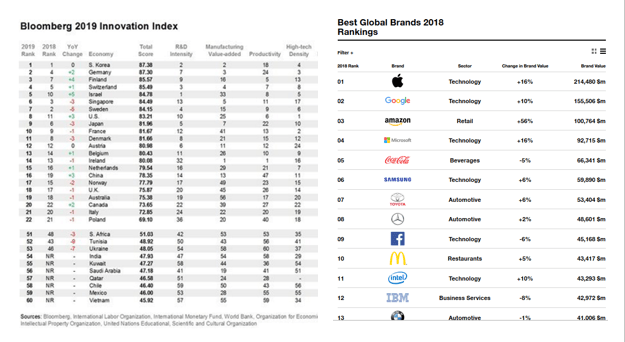

Adoption of Software product will be an important measure of maturity of digital economy. |

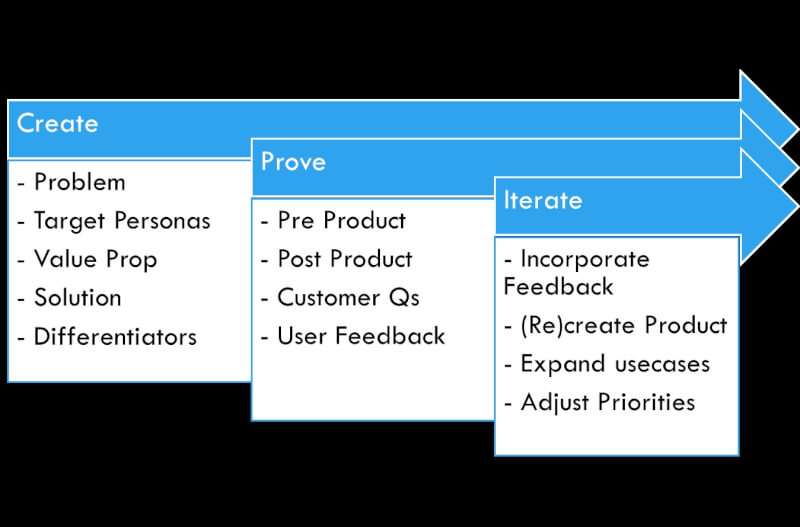

What is needed to boost SPI under NPSP

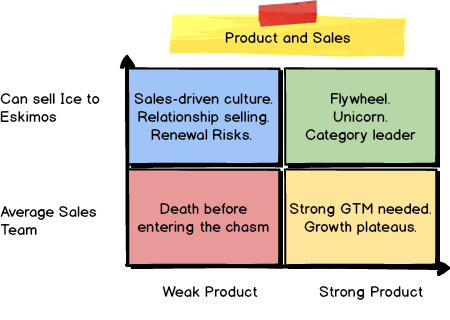

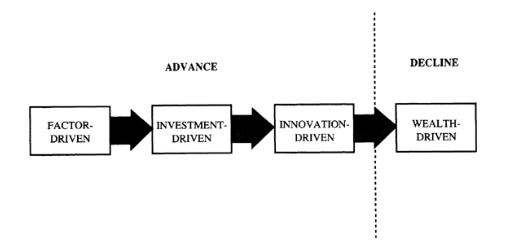

The very basis of NPSP launch by Government of India is the recognition of our Competitive advantage in “Software” and hence capability to create world class products.

We have earlier presented papers to Govt. where “digital goods” verses “services” debate is in advanced stage.

Despite being a Software power house, Indian today has a digital deficit.

Recognizing the “Software products” as a new reality will boost India’s strength in “digital deficit”.

Recognize Software product and Distinguish Products from Services

The goods/products exhibit the following properties (as per internationally accepted definition):

- Durability (perpetual or time bound)

- Countability – traded commodity can be counted as number of pieces, number of licenses used, number of users etc.

- Identifiability – identified as a standardised product

- Movability and storage. Can be delivered and stored and accounted as an inventory

- Ownership of the right to use

- Produced/Reproduced through a process

- Marketable/Tradable or can be marketed and sold using standard marked price (except when volume discounts, bid pricing and market promotion offers are applicable).

as distinguished from services that are consumed either instantly or within very short period of time or continually coinciding with the activity of provision of service.

Software product exhibit all the properties of a ‘good’ except that they are intangible. Hence, Software products is an ‘intangible’ good, with discrete symptoms.

Software product brings in high value for the Software manufacturer and is normally tied to “Intellectual Property” in its development. Traditionally all software products were installed and used on end-user computers.

However, with advent of cloud it is possible to ship same product as ‘on-premises’ product (to be installed and used by end-user on their premises) or be installed on computers/cloud resources owned by original manufacturer and used by end-user through internet.

The latter is category called “SaaS” based products.

Some Software take a expanded view and present themselves as ‘platform’ with multiple products integrated together capable of being used alone or as set of products and services and ability to serve at country or global scales.

‘Platforms’ are a reality in software world and to be a power in global game, countries having large “platforms’ will be winders. India has the capacity and capability, but has systemic bottlenecks to be removed.

Technological changed will bring in newer dimensions of trade. In 2019, India should provide direction to worls by setting new trends and nudge global community in that direction.

Software products trade can’t be delimited under ‘license’ to sale regime only.

Trade is central to success of an Industry. Treating Software as mere ‘license’ is limiting the trade under Indian tax regime as of now.

The IP and ‘Software product’ is central to original Software manufacturer (Software product company). Yet, it is a ‘product’ or intangible good.

Other ‘goods’ also have IP attached as patents and copy rights, but that never is the ‘license’ a barrier to sales.

Treating Software product as a license is creating a barrier, as then each sales of Software product is subjected to “withholding tax” regulations under direct taxes.

Treating Software product as intangible goods neither infringes the ownership of IP of Software OEM nor does it cause loss to tax. But, it lubricates the trade.

Break through from tradition leads to success

The traditional understanding of trade in tax regimes does not account for technological changes. Indian took a lead in past and has a reference point of adopting such changes to successfully create an Industry.

India created a success of IT Services industry by breaking tradition. In 1992, there was a similar problem that faced country after launch of Software Technology Park (STP) Scheme. As per customs, the exports of any goods could happen only through ports or at best from foreign post office.

To enable exports through data communication links, SOFTEX form was introduced, feeling the need of hour. This was a breakthrough from existing regulations that gave us glorious 25 years in IT.

Indian can have another glorious 25 years of being a Software power, by adopting a mechanism that can distinguish the Software products from services and recognises Software product as intangible goods.

Recommendations (for creating SW product ecosystem)

A HS code classification for following categories can be issued using the last 2 digits (first 6 Digits being defined under international system).

Following category of definition will solve the issues of raised above for creating favourable environment a Software product Industry.

- (i) 8523 80 20 – IT Software on media that is not Off-the-self i.e. not covered under Product

- (ii) 8523 80 21 – Software Product (Pre-packaged software downloaded or Canned Software)

- (iii) 8523 80 22 – Software Product hosted by OEMs on cloud (SaaS, PaaS Model of Software) and used by end-clients using internet.

Note: Problem with 85238020 is that it can be any Software. The only requirement is it is Information Technology Software and on media.

This will give cover for all Software products in following two categories and leave (i) above for Software other than product on media.

- S/W product Used – On premises (on computers/private cloud of end-user) – 8523 80 21

- S/w product On Cloud of OEM – 8523 80 22 (SaaS/PaaS)

The above recommendation is minimum basic and should not be a limitation to a more wide and granular classification e.g. a different code for SaaS and PaaS etc.

Can we use SAC code?

It is recommended to use HSN rather than SAC for “Software product” for following reason.

- (i) The Software ‘product’ attribution is difficult in Services codes and will always be confused with services. SAC is not right place either for a ‘product’ image or for a trade accounting of intangible ‘goods’.

- (ii) The SAC code classification is not targeted at distinguishing Software services and Software product. Also, the license to use a database can not be same as license to use a pre-packaged product.

- (iii) It is better Software product are defined in HSN to capture both national and International trade Statistics. Not having them at one place will create redundancy, with chances of lot of import happening under a code under existing HSN 85238020. (The idea is to get clear distinction between Software product from services)

- (iv) In a “Digital Economy” eventually Software products will have a international trade dimension. Hence, HSN code is a better place.

- (v) The whole idea of NPSP is to get Software product recognition with a vision aiming India as a “Software product nation”. Hence, we need to start accounting for intangible mercantile”. To make these changes will nudge the system in that direction.

| Note: Some countries have created a HS code under 98/99 for Downloaded Software e.g. China has a code under 980300 for Computer software, not including software hardware or integrated in products. Similarly, some countries are using 9916 as a code for pre-packaged software. |

Conclusions

Future of ‘digital economies’ will see trade wards on ‘digital goods’. A meaningful breakthrough from traditional trade regimes is must for a winner. India must be a winner and we should play our games in the area we have enough capability.

Software product Industry is some thing Indian needs badly both for domestic and international trade, specially when our IT Services industry growth is diminishing day by day.

Let us power up the “Software product’ with new coding and classification that recognises Software product with legitimacy to do provided by NPSP.

In 1992, MeitY (then DOE) took lead and created a breakthrough that led to 25+ years of Success of IT Industry. Once more MeitY leadership can take lead and create next 25 golden years by making Indian a Software product nation.