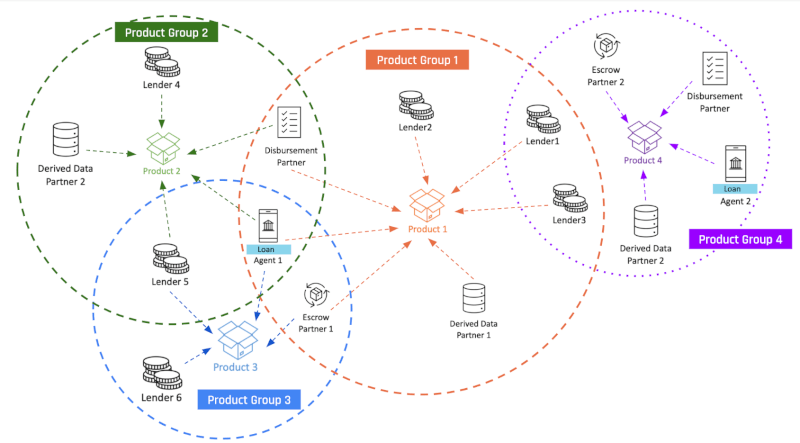

The Open Credit Enablement Network (OCEN) is steadily progressing from its early stages into a more robust growth phase. With its current ecosystem participants, OCEN has started facilitating smoother credit …

Continue reading “OCEN: Advancing Digital Public Infrastructure for MSME Credit Access”