“The best way to do something ‘lean’ is to gather a tight group of people, give them very little money, and very little time.” – Bob Klein, chief engineer of the Grumman F-14 program.

I first came upon this quote on Paul Graham’s website, and it always intrigued me, the small detail about the money – it could be little or a lot, but money is a factor, and a very important factor at that.

Bob Klein’s F-14 program is now legendary in aviation history; the Tomcat was one of the airplanes I was familiar with even in the Indian Air Force circles of the 90’s. Designed to fulfill duties both as a air superiority fighter as well as a naval interceptor, the F-14 Tomcat was easily one of the greatest airplanes ever built then, and Bob Klein did it, as he said, by keeping it fast and cheap.

Bootstrapping or Venture Capital

So is that the blueprint to build something amazing and meaningful? To just sit down, tighten your belt and do it, what we call bootstrapping, or is embracing the stability of venture capital a better way?

It’s an important question in the context of the product startup, and I believe there’s no right and wrong answer to it.

Last week, in a conversation with iSPIRT’s co-founder Sharad Sharma, this topic came up and proceeded to lay claim our entire discussion. When these days a bootstrapped startup is seen as something of an aberration, and scale is seen as validation, Sharad maintained that there’s no formula here; both these paths can lead to success, if followed with caution and perseverance.

Quoting Sharad –

“When you are building something that hinges on a market prediction, that so and so market will be worth so and so in 2025, and you want to be there to fill that gap, then VC funding for the idea and for you is probably the way to go. But if you have no such idea or bet on the future for what you are building; it’s much more experimental (which is ok, that’s how innovation happens), then bootstrapping might make better sense, even if just for the sake of flexibility and more control.”

I could find no reason to disagree.

The Zoho Example

The success of Zoho, the poster child for the bootstrapped product startup, is now quite well known. And all of it with not a penny in external funding. The company is growing, has always been growing, and has just announced a bold move to make one of its flagship products completely free. These are big decisions, made strategically and with a much larger gameplan. Zoho has always stood for something, and its clear, unmuddled decision making has been one of its strengths through the years.

Would Zoho have been able to make such decisions if a member of its board was an investor? Perhaps, but not very likely.

Which I think is significant. What ails the ecosystem these days is a ‘go big or go home’ attitude that typically results in an organization and a product that scales far ahead of its time, resulting in chaos and sometimes even graver problems. Zoho didn’t fall into that trap, it took its own time, and now stands tall as an organization.

Sometimes VC money, though a huge competitive advantage, can come with its own baggage, and the pressure of having to execute something extraordinary all the time can weigh down on doing what actually needs to be done.

But sometimes that baggage is exactly what you want.

The Zomato Story

When Deepinder Goyal started Zomato off, he certainly would not have known that the product he was building, a restaurant review and recommendations site that is today used in 40 cities across the world, would change the entire landscape of eating out. He would have had a vision, but of course he could never have knows what exact shape his business was taking. But he knew he had something; he raised funding. Venture capital stood him up as he expanded hard and fast and cool. It was great to watch.

Would Zomato have been able to scale the way it did without venture capital? The answer is an emphatic no. The awesomeness of the Zomato model rested on its ability to execute, and they did it magnificently well; waiting was something Zomato could not have afforded anyway.

In this case, the VC prerogative to execute fast and hard tied in perfectly with what Zomato itself wanted to do. What resulted is Zomato’s incredible success as a platform, a lovely example of using funding to take an idea big.

“There is no formula”

Again, though, Sharad put in a word of caution – it all depends. This may be a good rule of thumb but there is no formula. Product startups are all different from each other, and what works for one is not at all guaranteed to work for another.

And this is when it struck me that there’s a third category here as well, the perfect example of which is that darling of the younger generation, Instagram.

The Instagram Model

Instagram started out as Burbn, a location sharing app with the option of taking a photo thrown in, but then pivoted to the unbelievably successful photo sharing app we know. And they were funded from the beginning by Andreessen Horowitz and Baseline Ventures.

So here’s a venture funded company, which was trying to build something purely ‘social’ and ‘viral’ in parlance, and the VC’s let them experiment to an extent as to change the focus of the product itself. This is the third kind, the company which adds the no-commitments freedom of bootstrapping to the competitive advantage of venture capital, and becomes a sort of hybrid, absorbing the good in both approaches and ridding itself of the bad.

An important point here is that Instagram never really had a monetization plan in the first place (other companies like this include Tumblr, Twitter, Foursquare, and so on). Positioned for acquisition because of the exponential increase in their user base, they could tread this middle ground with the confidence of knife edged focus.

WhatsApp also did something similar. When Jan Koum and Brian Acton started working full time on WhatsApp, they already had $250000 in funding from friends, which meant that they had the freedom to innovate and at the same time had the stability of capital.

The Last Word

In 1986, Tony Scott’s Top Gun hit the silver screen, in which a young man called Tom Cruise flew a F-14 Tomcat to box office glory and superstardom. The immediate aftermath was that the US Armed Forces were overwhelmed with young people wanting to sign up for service, so much so that the US Navy opened recruitment desks outside cinema halls.

The Tomcat became the symbol of a generation, the high of the air and the allure of uniform combining to give an era its own narrative. And it was exhilarating.

It was a small team that built it. With the entire might of Grumman (later Northrop Grumman) behind them, Bob Klein could have done it in any way he wanted, but he and his team chose the best way for the specific thing they wanted to do, and executed.

And that’s exactly what we can learn from them – that there’s no ‘one size fits all’ answer to this question, and the ecosystem should encourage bootstrapping as as much of a viable pathway to growth as venture capital.

As for the startup, it should choose wisely.

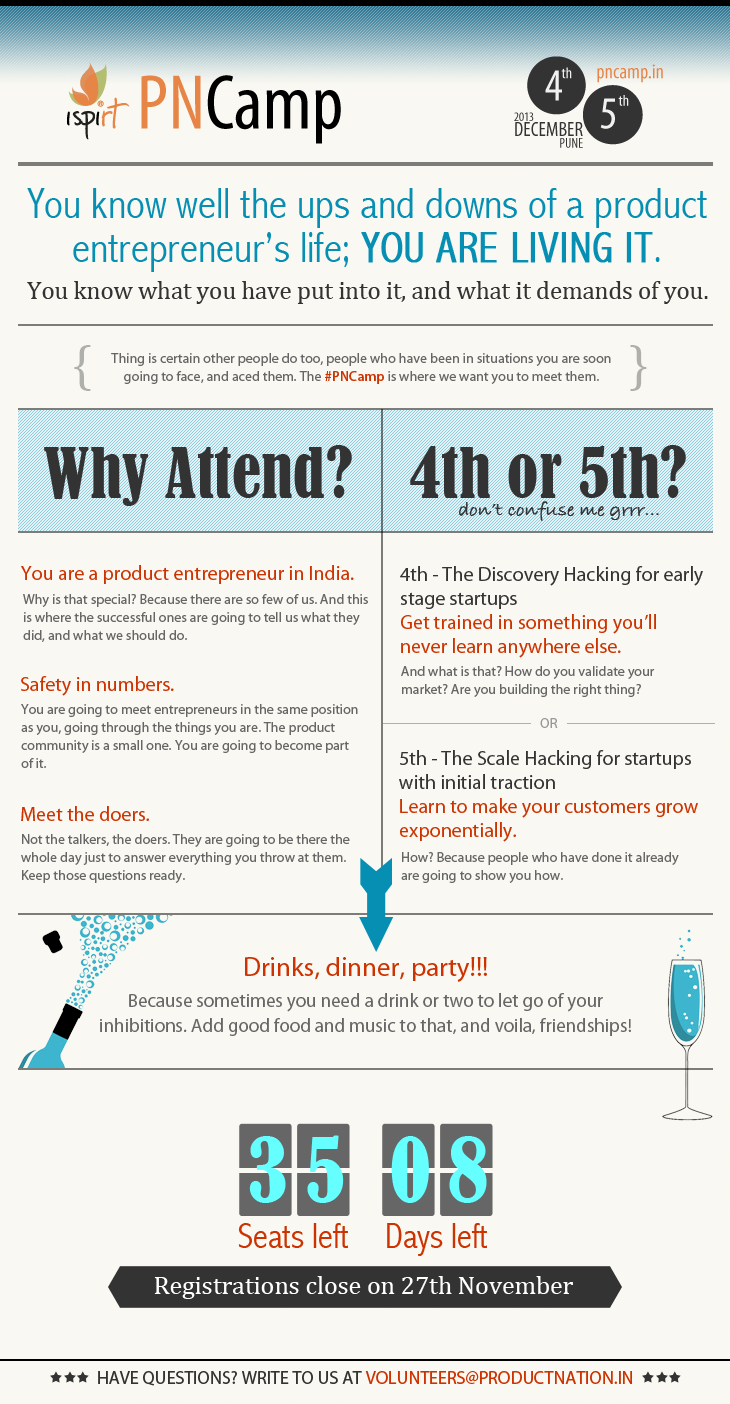

the problem we had on our hands was to simplify it. We wanted to bring together a group of product people who were ready to ask each other the tough questions. When they came out of the event we were putting together, we hoped they’d be changed, they they’d find answers, and in the process, new questions as well.

the problem we had on our hands was to simplify it. We wanted to bring together a group of product people who were ready to ask each other the tough questions. When they came out of the event we were putting together, we hoped they’d be changed, they they’d find answers, and in the process, new questions as well.

RippleHire helps you engage your workforce, leverage their network and benefit from automatic sourcing. You make great hires and distribute more wealth within the organisation. I first met Sudarshan and the company when they had a table next to

RippleHire helps you engage your workforce, leverage their network and benefit from automatic sourcing. You make great hires and distribute more wealth within the organisation. I first met Sudarshan and the company when they had a table next to

For early stage startups, cash-strapped and overworked, there are few things more valuable than PR. There is nothing more important at that stage than getting the word out there and getting users on board, for which PR is the only real shortcut available. And when there is an important feature release or a launch or a funding announcement and so on, all of which can be leveraged to get your startup up into the fickle spotlight, you need to be on your best game.

For early stage startups, cash-strapped and overworked, there are few things more valuable than PR. There is nothing more important at that stage than getting the word out there and getting users on board, for which PR is the only real shortcut available. And when there is an important feature release or a launch or a funding announcement and so on, all of which can be leveraged to get your startup up into the fickle spotlight, you need to be on your best game. She asked me for a few pointers, and I jotted down a five point list I’ve distilled from my time as a content marketer at Freshdesk. Her experience is as a sales professional, and this gives her a unique vantage point of the system, and I thought this would be a good lens to look at the process through.

She asked me for a few pointers, and I jotted down a five point list I’ve distilled from my time as a content marketer at Freshdesk. Her experience is as a sales professional, and this gives her a unique vantage point of the system, and I thought this would be a good lens to look at the process through.

But there is one gentleman (or a brand, however you choose to see him) who has consistently been so good at product marketing, that it would be a shame not to try to learn from him. Chetan Bhagat has been so good at selling books that several of our more established, critically acclaimed (and might I say, better) writers have had to go into therapy to treat their egos. He single handedly changed publishing in India, and though his methods may be suspect, they are nothing if not effective.

But there is one gentleman (or a brand, however you choose to see him) who has consistently been so good at product marketing, that it would be a shame not to try to learn from him. Chetan Bhagat has been so good at selling books that several of our more established, critically acclaimed (and might I say, better) writers have had to go into therapy to treat their egos. He single handedly changed publishing in India, and though his methods may be suspect, they are nothing if not effective.