iSPIRT Foundation, a technology think-and-do tank, believes India’s hard problems can be solved only by leveraging public technology for private innovation. iSPIRT, as a think-and-do-tank, pioneered the concept of Digital Public Infrastructure (DPI)

The Budget starts by acknowledging that India is facing “an external environment in which trade and multilateralism are imperilled and access to resources and supply chains are disrupted”. But the details aren’t in line with the idea. The Government also acknowledged AI and cutting-edge technologies as force multipliers for better governance.

AI has been spoken about a few times at different places. However, there is no material proposal on AI, except as a tool for “Bharat-VISTAAR”—a multilingual AI tool in agriculture.

FM announced Manufacturing support to seven strategic and frontier sectors, including Bio-Pharma, Chemicals, Semiconductors, and Electronic Components. This will help the ecosystem build up in these sectors and, in a way, support the cause of “Product Nation” from a building capacity and infrastructure point of view. However, it does not address “strategic autonomy” and technological sovereignty as a thought process.

The one that most closely links to “Aatmnirbhar Bharat” or strategic autonomy is the announcement on ISM 2.0, to produce equipment and materials, design full-stack Indian IP, and fortify supply chains, including skilling and training. Also, the mention of established dedicated Rare Earth Corridors is a welcome move to fill the gaps in the supply chain in these areas, given the geopolitical situations.

Any Government announcement takes about 2 years to roll out in the field. The AI Mission, National Quantum Mission, Anusandhan National Research Fund, and Research and Development and Innovation Fund have been mentioned by the FM in speech. RDI is rolling out now. The government missed the bus to announce a “market access” scheme or a fund for the products developed after taking all the steps in R&D and frontier technology advancements.

We have maintained that our Economic Policy will need to foreground Strategic Autonomy as a core pillar, which becomes all the more imperative in the current global geopolitical scenario. But Strategic Autonomy is not possible without technological sovereignty. While the government has taken steps to “reduce critical import dependencies,” at a time when “new technologies are transforming production systems”, incremental steps are not enough.

“A market access plan for Indian products designed and developed in India by resident Indian companies is the need of the hour for any fruitful outcome from R&D and product development. The Government must consider this with all seriousness in the future,” said Amit Agrahari, volunteer at iSPIRT Foundation.

Last year, Bharat Trade Net was announced as an integrated trading platform. This year’s announcement of “Customs Integrated System (CIS) as a single, integrated and scalable platform for all the customs processes and use of non-intrusive scanning with advanced imaging and AI technology for risk assessment, takes the thought to the next level. This is very much in line with our National Regulatory Compliance Grid (NRCG) approach and use of advanced technology for data-driven governance.

However, our proposal of building a NRCG for all regulatory systems is still waiting. “Unless we use a Grid approach for digital transformation and connect all regulators, it is going to be difficult to reduce the regulatory cholesterol”, said Sudhir Singh, an iSPIRT Volunteer looking after Ease of Doing Business, and Policy.

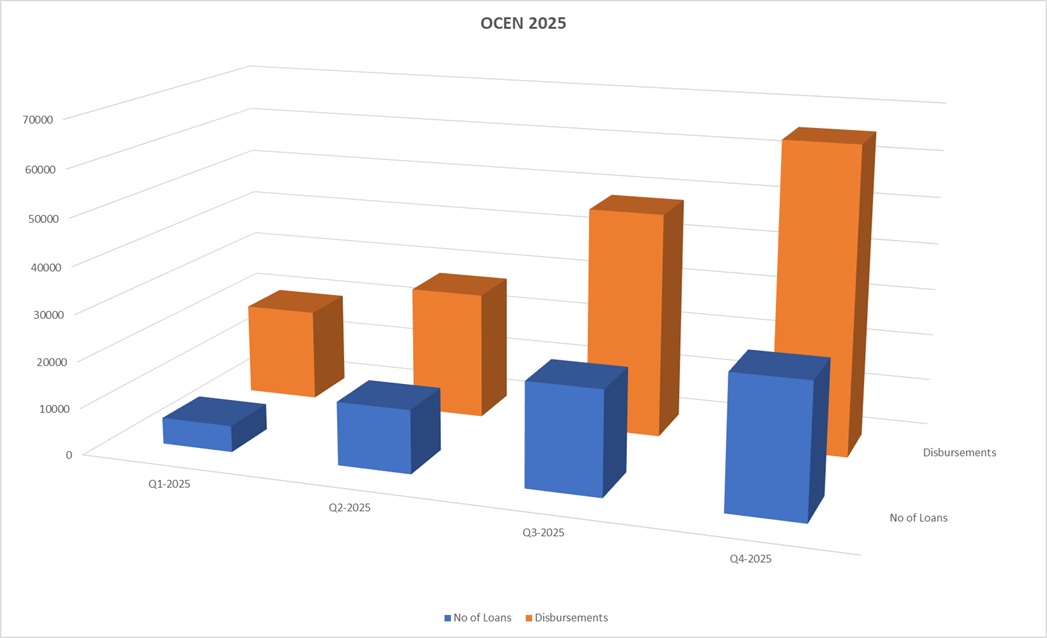

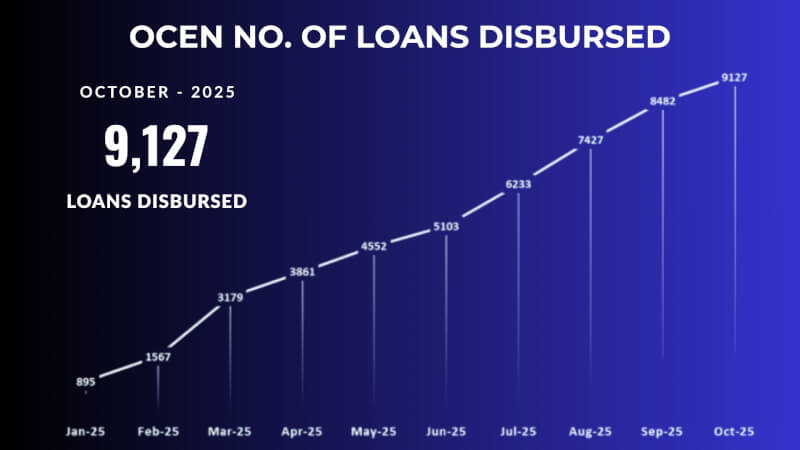

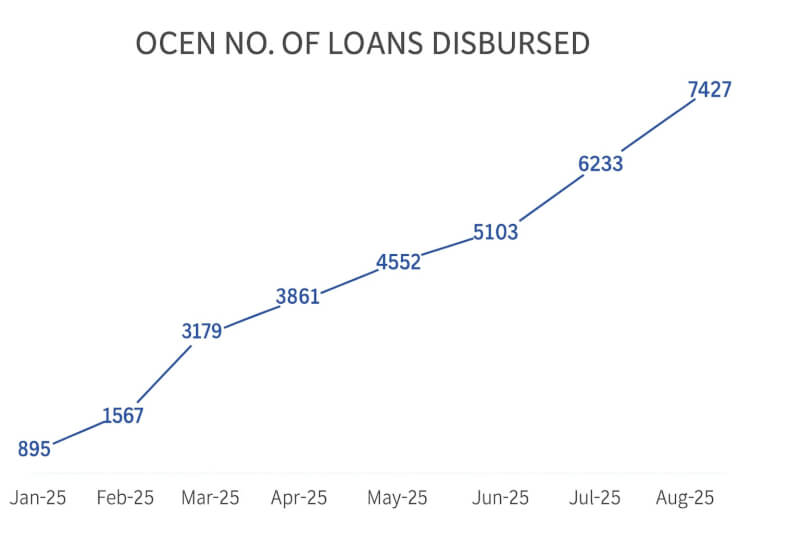

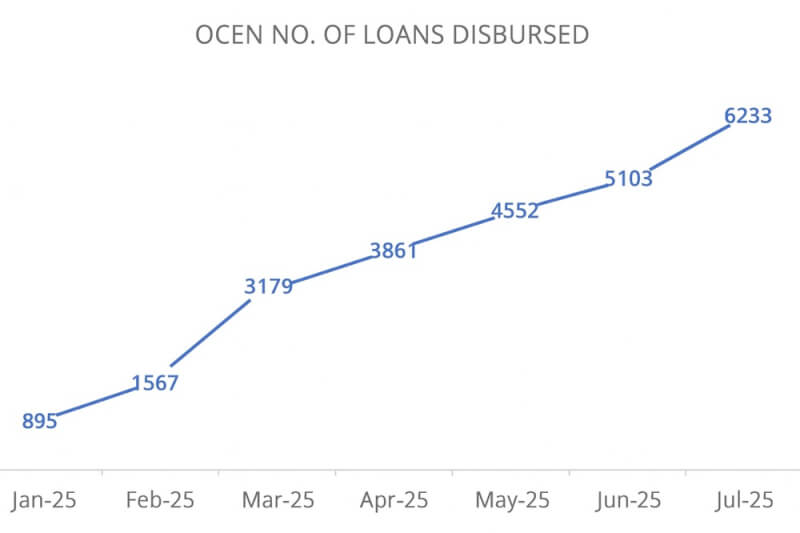

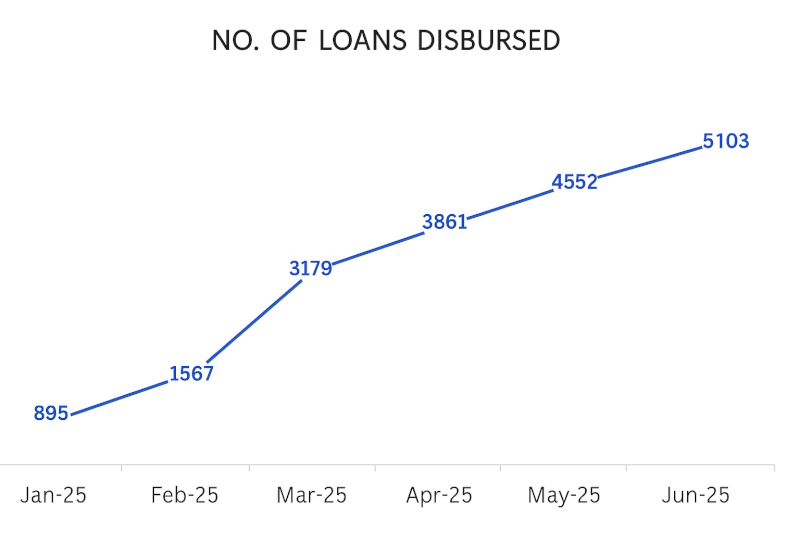

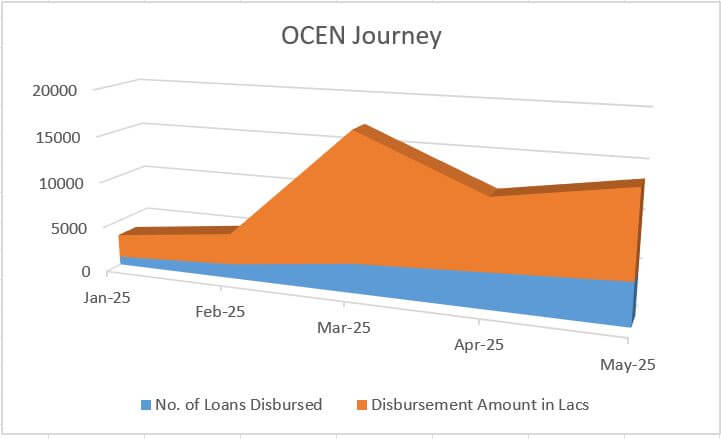

Linking TreDS with the GeM portal is a welcome step towards unlocking true Digital potential in Ease of Doing Business for MSMEs. “This can further create a grid approach by connecting to the Open Credit Enablement Network (OCEN) and trade finances for SME exporters,” said Tanuvi Thakur, volunteer at iSPIRT Foundation. This will further aid EoDB through quicker and cheaper access to credit by MSMEs.

The other major welcome step in this regard has been the in-principle movement from penalty and prosecution to fees. This has also been our core decriminalisation aim for achieving EoDB.

Overall, it’s a subdued Budget despite the challenging geopolitical environment rather than a bold Budget that speaks on both “strategic autonomy” and “reforms”.

About iSPIRT Foundation – We are a non-profit think-and-do tank that builds public goods for Indian product startups to thrive and grow. iSPIRT aims to do what DARPA or Stanford University did in Silicon Valley for startups. iSPIRT builds four types of public goods – technology building blocks (aka India Stack), startup-friendly policies, market access programs like M&A Connect, and Playbooks that codify scarce tacit knowledge for product entrepreneurs of India. For more, visit www.ispirt.in.

For further queries, please reach out via email: [email protected], [email protected]

Please note: The blog post is authored by our volunteers, Sudhir Singh, Tanuvi Thakur and Amit Agrahari