Background

There two precursor blogs recently published to this new article on taxation of digital economy, which are helpful in understanding the context for Software product industry in general and especially for SaaS.

- ‘SaaS’ – the product advantage and need

- ‘SaaS’ – indirect tax issues in India

Here is a brief overview.

The first blog, made a case for SaaS industry to be a formidable part of the Indian Software product industry (iSPI).

The second blog, explored the problems of double and confused indirect taxation, GST and its implications, applying a product definition as different from service and need for a clear distinction between a ‘product’ and ‘service’ or ‘digital goods’ and ‘digital service’.

This third blog is based on excerpt from representations and notes pursued with the Ministry of finance in last few months, as a solution to the problems in a larger sphere i.e. the emerging “Digital Economy”.

The Tax system if fragmented

The taxation on ‘intangible’ goods and services has been marred with double taxation, confusion, and litigations. The biggest cause of this broken tax system is that tax authorities have been giving piecemeal approach to the taxation in this sector.

Until December 2006, there was no indirect tax by central Govt. on Software. In 2006, excise duty was levied on Software and until 2008, there was only excise duty + VAT (even VAT was exempted till such date in many states) payable on Software. In 2008, Software came under the purview of service tax and for a long time until February 2010, a large number of Software product companies paid both excise duty and service tax, plus the VAT in states. This continued until the pronouncement of notification No. 2/10 No. 17/2010-Service Tax Dt. 27th February 2010, which exempted Software product companies from payment of service tax, if the excise duty or customs duty was already paid on same.

An example problem (on Service tax +VAT) of this fragmented tax system, for Software product industry, has been illustrated in previous blog, ‘SaaS’ – indirect tax issues in India.

Similarly on direct tax front, the finance act 2012 subjected income from sale of Software as “Royalty Income”, and therefore subject to TDS of 10% on every sale. A book is traded as a product (a tangible good), whereas the contents are copyrighted. So a buyer buys the book and not the copyright. Similarly in the case of a software product, the buyer buys the product and not the copyright. However, the tax treatment is as if the buyer has purchased the copyright.

In a period between 2006 to 2012, the Software product industry has been subjected to many such bottlenecks. The tax authorities acted in a piecemeal basis, to first apply a tax to increase the tax net and then had to make course correction through several patchwork notifications in multiple steps, resulting in to a fragmented tax system.

The cause of this piecemeal approach has been that Software product (being ‘intangible’ product) is not recognized and treated at par with other products. We have proposed that defining ‘digital goods’ and ‘digital services’ clearly may solve the problem.

Let us understand, why there is a focus needed on ‘digital’ and why the ‘goods’ parlance is needed.

Digital economy is about digital goods and digital services

India has rightly embarked on a path for “Digital India” in line with world economies in transforming to a “Digital Economy”. The move, in 2015 budget towards a ‘near cashless’ has been boosted with UPI launch, which will further significantly contribute to the transformation in to digital economy.

The ‘digital economy’ will be overwhelmed with ‘Intangibles’ i.e. ‘digital goods’ and ‘digital services’. Software, may not just be standalone computer program. It may work with either data, audio or video products. Similarly the audio, video, data and document products may have a software product running them. Hence Software product, sounds, images, data, and documents or combinations of them may exist as a ‘digital product/goods’.

Recognizing the tradability in ‘digital goods’ is one the most important need of a ‘digital economy’. The volume of such trade will be huge in future as the digital economy is unleashed. Anderson said, “Software is eating the world”. IoT is a reality now.

All this pointing to, a ‘digital economy’, that will be overwhelmed with trade of not only ‘digital goods’ and ‘digital services’, but also the trade of ‘right to use’ or ‘transfer of right to use’ just as there is ‘deemed sales’ or ‘transfer of right to use’ of tangible goods.

All these reflect the pervasiveness of digital in future economies, as well as inseparable pervasiveness of Software products in the digital world. The buzz word is now ‘digital’, end-to-end.

Why Digital?

Since a digital economy will be about a converged digital world where Software products will also be inseparably pervasive, taxation issues of Software product industry should be dealt in a unified ‘digital economy’ domain, where ‘digital goods’ and ‘digital services’ will be the produced and supplied.

If tax authorities just focus on Software, it will again create another patchwork and will not provide long term solution, for the evolution that is happening with greater velocity now. Focusing on ‘digital’ will provide strategic solution to the problem at policy formulation level. And hence, the issues of the Software product industry can be dealt with by clearly defining “Digital Goods” and “Digital Services” in the tax system.

Digital goods and service definition

It has been already illustrated in ‘SaaS’ – indirect tax issues in India the COG-TRIP test can be used to identify a Software products as different from Software service. However, in order to align with existing Indian legal system and the evolving international practices, following definitions (based Digital Goods and services Tax Fairness Act[1], a bill pending in USA) at structural level has been proposed.

These proposed definitions are just the guiding factors that can be used as a starting point by the Government of Indian in this direction.

DIGITAL GOOD – The term “digital good” means any software or other good that is delivered or transferred electronically, including sounds, images, data, facts, or combinations thereof, stored and maintained in digital format, where such good is the true object of the transaction, rather than the activity or service performed to create such good.

DIGITAL SERVICE – The term “digital service” means any service that is provided electronically, including the provision of remote access to or use of a digital good.

For purpose of above definitions, the term

(i) “Digital Goods” means “Goods” as defined in 366(12) of the Constitution

(ii) “Digital service” means a “service” and that which is not a “Digital Good”

(iii) “Delivered or transferred electronically” means the delivery or transfer by means other than tangible storage media, and

(iv) “Provided electronically” means the provision remotely via electronic means

(v) “Software” is a representation of instructions, data, sound or image, including source code and object code, recorded in a machine readable form, and capable of being manipulated or providing interactivity to a user, by means of a computer or an automatic data processing machine or any other device or equipment. And, “Software Product” is a standardised set of such software bundled together as a single program or a Module that directs computer’s processor to perform specific operations, exhibiting the properties of an intangible good that can be traded.

Explanatory Note:

In legal parlance, the ‘goods’ exhibit the following properties:

iSPIRT has proposed a COG-TRIP test[2] for identifying it as Software products. The same definition overlaps with the following legally tenable definition and explanation on detailed attributes.

- Durability (perpetual or time bound)

- Countability – traded commodity can be counted as number of pieces, number of licenses used, number of users etc.

- Identifiability – identified as a standardised product

- Movability and storage. Can be delivered and stored and accounted as an inventory

- Ownership of the right to use

- Produced/Reproduced through a process

- Marketable/Tradable or can be marketed and sold using standard marked price (except when volume discounts, bid pricing and market promotion offers are applicable).

‘Goods’ as distinguished from services that are consumed either instantly or within very short period of time or continually coinciding with the activity of provision of service.

‘Digital goods’ exhibit all these properties plus the property of being stored and maintained digitally.

This definition of ‘digital goods’ will also imply, that their sales and purchase will be governed by same laws as for “Goods” in the constitution and various acts thereof. Hence just as ‘Goods’ are subject of ‘sales’ under article 366(29A) so will be ‘digital goods’. It is important in the context of ‘ease of doing business’ in trade of ‘digital goods’ and removing the present confusion on taxation in trade of ‘digital goods’.

The ‘right to use’ as a deemed sales of digital goods to be used or consumed at future instance(s) can also be delivered or transferred digitally. It can be a PIN or a Password or a combination of biometric and password to allow access to digital goods.

In digital economies, many a times ‘digital goods’ are stored on a remote server or maintained digitally on a remote location by a producer or its agents/dealers/distributors for use or access by clients and users.

An act of use or remote access of ‘digital goods’ by using the access PIN or password acquired in advance through a trade or commerce transaction in ‘right to use’ of such ‘digital goods’ shall be an act of trade or commerce in ‘digital goods’ and not of ‘digital service’.

Recommendations made

Following recommendations were made:

- Definition be introduced through a bill/finance act in future.

- Also a clarity be inserted that, ‘digital goods’ will mean “goods” for all purpose, including ‘tax on the sale or purchase of goods’ as defined in Article 366(29A) which also includes the ‘transfer of right to use digital goods’.

- Both indirect tax (in future) GST and Income tax Act, should to refer to the same definition for purpose of ‘digital goods’ and ‘digital service’.

- Need for a Tariff code (HS Code) for ‘digital goods’.

The future lies with recognition of ‘digital goods’ as an international standard and WTO involvement in the accepting these principles.

In the interim, India can adopt a workable solution.

At present, all that is not covered under HS Code classification as given below (mostly software/digital goods downloaded online or SaaS Software) is treated as a service, despite the fact that packaged software and SaaS is the same whether traded on a media or online as a medium.

| HS Code |

Item Description |

| 4907 00 30 |

Documents of title conveying the right to use Information Technology software |

| 4911 99 10 |

Hard copy (printed) of computer software (PUK Card) |

| 8523 80 20 |

Information technology software on Media |

Source: DGFT HS Code Database and CBEC

A HS code classification for following categories can be issued using the last 2 digits (first 6 Digits being defined under international system) Or Until a global harmonious classification emerges a codes may be defined under chapter 98/99.

Following category of definition will solve the issues of Digital Goods

(i) Pre-packaged software (Software Product) downloads

(ii) Software Product supplied as S-a-a-S model

(iii) Sale of ‘right to use’ digital goods

(iv) Digital Goods other than Pre-packaged Software

Some countries have created a HS code under 98/99 for Downloaded Software e.g. China has a code under 980300 for Computer software, not including software hardware or integrated in products. Similarly some countries are using 9916 as a code for pre-packaged software.

Conclusion

The above proposal of definition and the measures in recommendations can solve the issues faced by the industry, help in ‘ease of doing business’, lubricate trade, ensure neutrality and fair practices as well as provide the much needed level playing field.

The proposal does not create any loop holes in system as it does not recommend the change in the tax regime. It merely recommends the changes desired to accommodate the rise of digital economy.

The Software product industry can be the biggest beneficiary of this and members in Software product industry should take up this concept with Govt. of India with full force to help in rise of India as a Product Nation.

References

[1] Digital Goods and services Tax Fairness Act, USA, https://www.congress.gov/bill/113th-congress/senate-bill/1364/text

[2] A framework developed by iSPIRT, under leadership of Shri. Bharat Goenka of Tally Solutions

The follow-on session, by Shekhar Kirani, presented how INDIA is becoming a major player in the GLOBAL Software Product Industry and how Startups from INDIA are disrupting some major players. Subsequently Unbxd, ShieldSquare and Hotellogix discussed their own journeys and added depth to this discussion..

The follow-on session, by Shekhar Kirani, presented how INDIA is becoming a major player in the GLOBAL Software Product Industry and how Startups from INDIA are disrupting some major players. Subsequently Unbxd, ShieldSquare and Hotellogix discussed their own journeys and added depth to this discussion.. Insights and Advise from Mr. Ramesh Abhishek

Insights and Advise from Mr. Ramesh Abhishek Conclusion

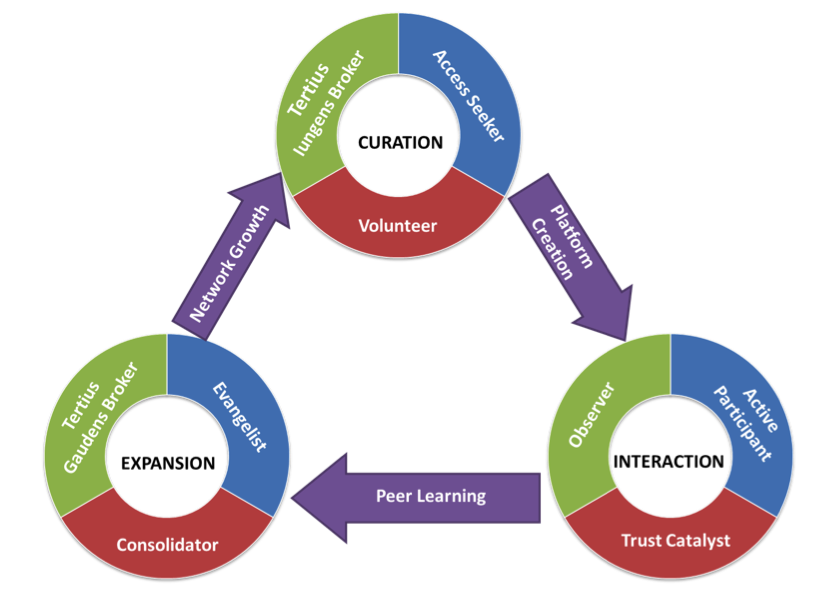

Conclusion The insights from this study provide clear guidance on how to systematically create experiential knowledge networks in emerging ecosystems. It also highlights the important role played by entrepreneurial connectors such as iSPIRT in nurturing these networks.

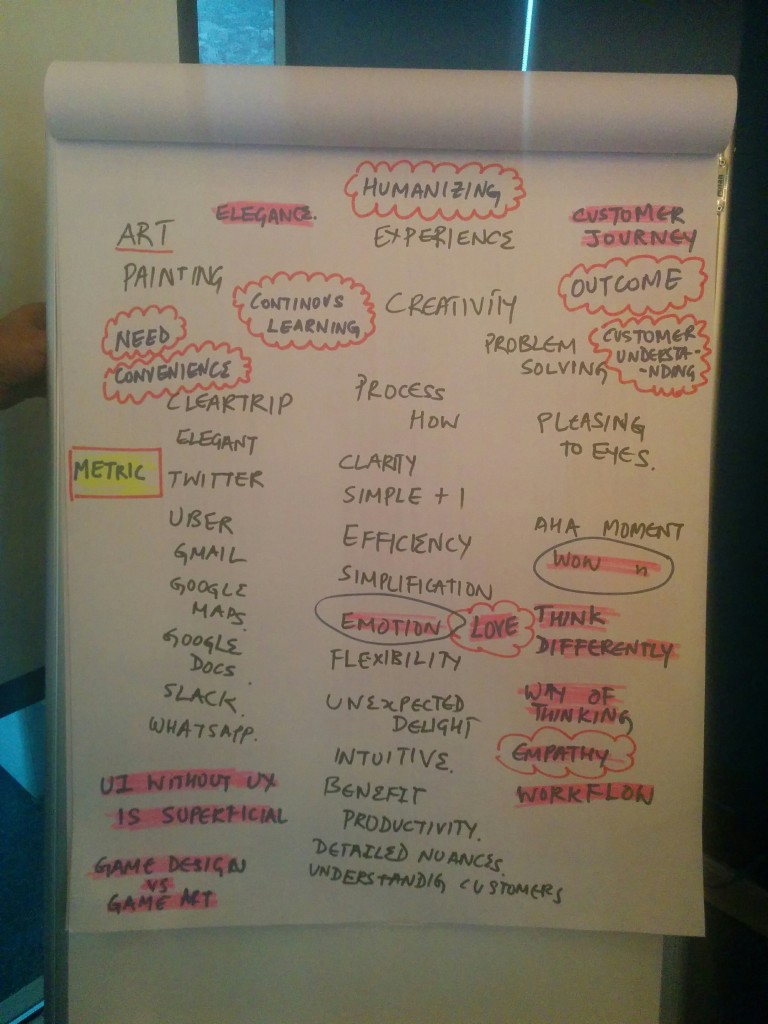

The insights from this study provide clear guidance on how to systematically create experiential knowledge networks in emerging ecosystems. It also highlights the important role played by entrepreneurial connectors such as iSPIRT in nurturing these networks. Throughout the session we had one white board on which we wrote what design means to us. We wrote apps we love and products which we consider as good examples and inspiration of good design. The participants initially thought design had a lot to do with ‘Art’, ‘Painting’ or ‘Creativity’. As we went further, our understanding evolved and ‘Emotion’, ‘Customer Journey’, ‘Elegance’ were the new keywords on the whiteboard.

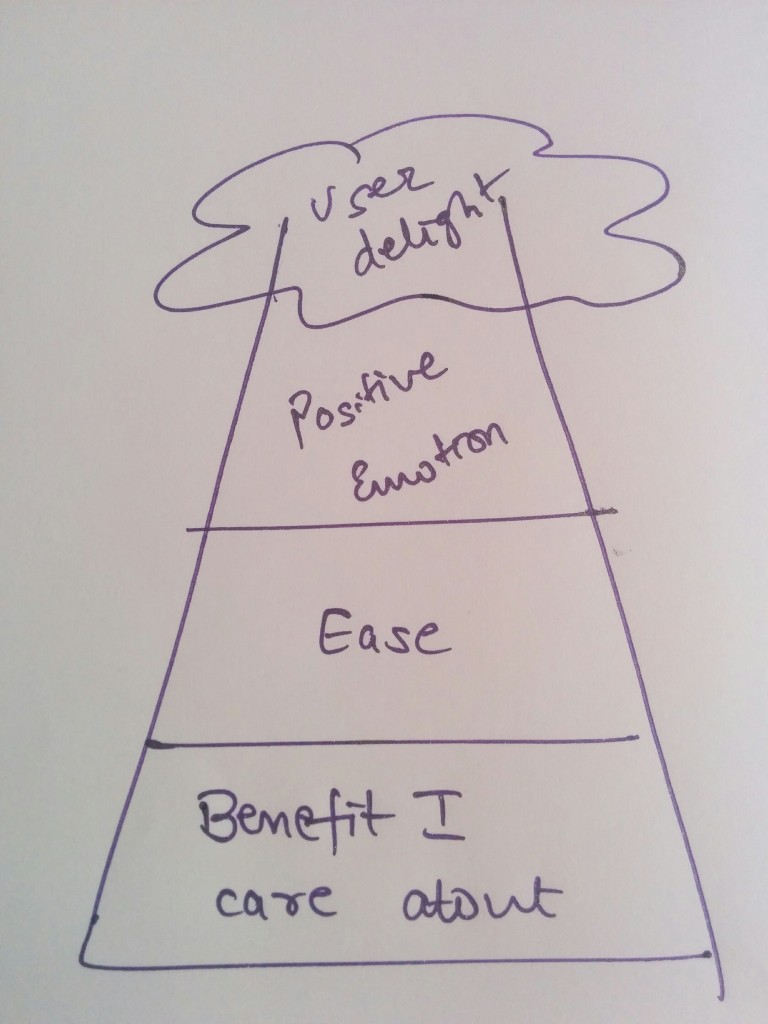

Throughout the session we had one white board on which we wrote what design means to us. We wrote apps we love and products which we consider as good examples and inspiration of good design. The participants initially thought design had a lot to do with ‘Art’, ‘Painting’ or ‘Creativity’. As we went further, our understanding evolved and ‘Emotion’, ‘Customer Journey’, ‘Elegance’ were the new keywords on the whiteboard. There is this simple pyramid which is quite self-explanatory for product making. Bottom to Top it reads,

There is this simple pyramid which is quite self-explanatory for product making. Bottom to Top it reads,