By investing in the product marketplace, India will do the same leapfrog as it did with the mobile revolution.

Recently I had the opportunity to witness the silent revolution that is taking off in India – a revolution that has been overshadowed (and somewhat suppressed) by the media-popular IT giants!

For a long time I have wondered why the IT giants with so much intellectual capital and knowledge had not invested in building products. Most of these giants had smart folks who worked on endemic problems and were focused on solving them through service contracts. My queries to senior executives in IT giants were always met with one of the following answers:

- not part of their niche,

- not easily understood by analysts who closely watched their quarters,

- they did not want their customers to feel that they were capitalizing on knowledge gained through services to address the problems differently, and

- did not have the rich domain experience.

My personal perception was that the reality was different. They could guarantee (not just generate) a positive ROI with an incoming professional in six months. Investment in products required long term thought process and needed a completely different kind of entrepreneurial thinking. More importantly it needed leadership that had an entrepreneurial mindset based on conviction and risk-taking.

In November of 2012 I had the opportunity to attend the Product Conclave of NASSCOM in Bangalore and it opened my eyes to a different India! I got to see a level of passion that I had never seen before. I got to see the edge folks – folks who had worked in the domain in large companies and realized the drudgery of some of the maintenance work that they were doing. While the vast majority were comfortable carrying on there were some folks in there who had the mind-set of “change-agents”. They were not satisfied with simply doing the work – they wanted to get to the root issue and solve/eliminate the need for the problem. They conceived thoughts and ideas on how they could solve the domain issue in a better way. They aspired to replace the increasing labor costs with much better ways of doing things. They were ready to eliminate their jobs completely but that did not fit the revenue model of large IT service companies.

These folks then did the next thing that “change-agents” do – shock everyone around them by giving up titles, safe corporate jobs and took the plunge. They started working towards creating products that would satisfy a market need.

As per latest statistics, the total revenue of the product companies from India is currently over U.S.$2.0 Billion, from approximately 3,400 companies in the software and electronics/semiconductor industry. When I dug into the demographics, the number of companies shocked me first, I had no idea about the same. The revenue seemed fairly small as it works out to an average of $600K per company. Also there seemed to be a concentration issue with 51% of the companies located in the NCR and Bangalore region.

In my personal opinion, by investing in the product marketplace, India will do the same leapfrog as it did with the mobile revolution. It will truly democratize the software industry very quickly and let people shape their own destiny versus becoming part of the eco-system where you have to spend years to display shoulder badges of experience. The biggest barrier is currently created by large behemoths to protect their territory. They have service portfolios to do work, using labor at hourly charge out rates versus the paradigm shift of product folks that will either eliminate or dramatically reduce the need for the same. Product evangelists are creating a different world that is moving away from “status quo” and coming up with new and different ways of doing things. They are the “game-changers”.

Since the Product Conclave in November, I have seen the establishment of iSPIRT, a trade organization that is supported and focused on product portfolio companies. It allows the product companies to build the eco-system that is required to support and enrich their environment with necessary supporting infrastructure. Along with my colleague Greg Toebbe, I have also attended a session in February, 2013 on product start-ups wherein we were introduced to some innovative and creative technologies that had relevance to our requirements.

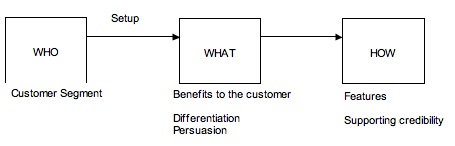

In this fast-paced, globally networked business environment, businesses are continuing to seek disruptive technologies that give them the competitive edge. They are not just looking for smarter and more effective ways to do existing work but different and innovative business models that support their continued evolution in the marketplace. They are not just looking to sell products but to engage customers in the experience – they are not looking for a sale, but a well understood and strong relationship with the customer. Entrepreneurs need to ensure that their solutions are not constrained by the paradigm of “always have done it this way” but are “tectonic shifts” to the way of doing business. They need to address not silo issues, but address them from a customer centric model. They do not need to focus on big-data, mobility, social, etc., as buzz-words, but to provide solutions that provide the customer an engaging experience. They should not get enamored by technology trends and their personal technology biases, but focus on the experience and convenience being desired by the millennial workforce participant. By 2020, half the global workforce will be millennial and the new business models are not expected to come from the current large companies.

In the new world, businesses realize that the days of buying everything from the perceived “safe” companies is no longer the decision that will sustain them – they will buy best-of-breed from the smarter solution companies that treat the world as flat. The power will not be in individual solutions, but the network of best-of-breed solutions. Large companies with multi-year implementation timelines and businesses that seek to automate existing processes will not be the winners of the new world. Solutions will have to nimble with the cycle from pilot to deployment being short followed by continued innovation. Sales cycle will have to be supportive of the same and a long-term annuity of fixed maintenance will not be the driver; ease of use, usage metrics, continued innovation and overall satisfaction will be the new factors that will play into maintenance annuity.

So for all the product folks – my hats off to you! My only advice would be to not be discouraged by the challenges that come along the way. Do not care when people say “I told you so”, do not worry if you do not have all the skills to make it happen, do not worry if it takes a little longer that what you thought. You are the “change-agent” for the revolution that needs to take place and if India has 50 percent of the world’s IT workforce, then it is time that they produce world class products!