When I was a kid, the only goal that I had in my mind was to become a cricketer and play for India. But never did I get an opportunity to play beyond the gully cricket and few matches as part of the school cricket team and my cricket was just restrained to the park level.

My dreams of scoring a century have now finally been full-filled. Playbook RT, something that started in the early days of iSPIRT, turns 100. This is my first century, the gully cricket ones not withstanding.

As crisp as that sounds, it took us around 15 Round Tables to distill this elevator pitch, and truly understand our own product-market fit.

This is the story of how it all began, and of the amazing journey, the lessons, the people who made it all possible. For those of you who love visuals more or are pressed for time, there is a photo-story at the end of this post — please feel free to scroll to the end of this post for that.

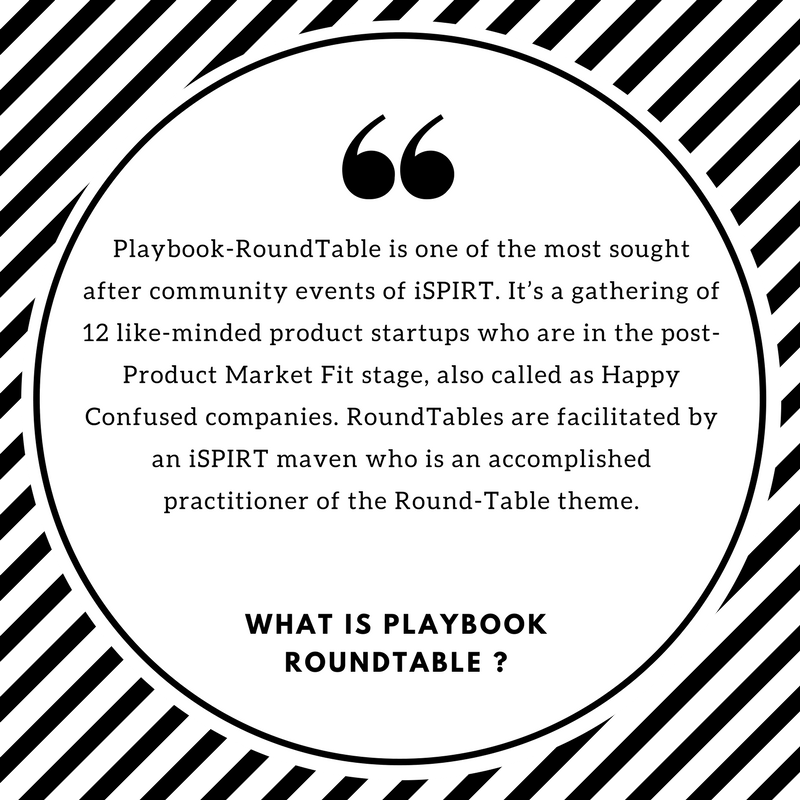

Inthe early days of iSPIRT, Sharad(iSPIRT) initiated the process of the mentoring program with Ashish Gupta(HelionVC), Aneesh Reddy(Capillary), Vivek Subramaniam(iCreate/Fintellix) in order to put together a mentorship program for product companies. We iterated over 10–12 calls about the format, audience, focus and how things will be run. Once everything was nailed down, Ashish took the lead of curating the first playbook and the facilitator was Shankar Maruwada(EkStep).

You can see the level of planning which went behind the scenes of the first playbook.

Pallav Nadhani(FusionCharts) & Ambarish Gupta(Knowlarity) were part of the first playbook and added lot of valuable insights and others benefitted from this learnings.

Ashish was a splendid host for the first playbook. I still remember the yummy samosas and kachoris that we got during the break and I still remember Ashish helping his office boy in serving tea to all the participants. I was blown away by the simplicity and the humbleness of Ashish. Thanks to Nikhil Kulkarni(Flipkart) for capturing all learnings in a subtle way.

The next goal was to conduct Playbooks around Product Management & Sales in different cities. I remember Amit Ranjan(then Slideshare) & Amit Somani(then MakeMyTrip) helping us with the Product Management Roundtable in Delhi and Aneesh Reddy(Capillary) helped in curating the Playbook. Ankur Singla(then Akoksha) then did a wonderful piece on Notes on Product Management — insights from Slideshare / MMT / ex-Google PM.

Ashish Gupta also helped in connecting with Samir Palnitkar(ShopSocially)who kicked off the PlaybookRT in Pune. Sandeep Todi(then Emportant)helped with the blog on Challenges in Building a Global Product Software company from India. It was a little challenge initially to get the right audience, but we just got few good people like Mohit Garg(MindTickle) help in inviting few founders for this playbook.

I got to read a wonderful blog post by Sridhar Ranganathan on Products and I did reach out to him to see if he could help us with the Playbooks. He liked the idea and Aneesh did the selling to him. Sridhar travelled to different cities and did the first playbook for us in Chennai & Hyderabad.

The attendance for the Hyderabad playbook was thin, but the session was very interactive and the 7–8 folks who attended, had a lot to take away from the discussion. Here is what was captured by one of the attendees Don’t try to solve every customer problem by a line of code.

I learnt a lot from Sridhar’s playbook on product management. Vijay Sharma(then Exotel) captured the learnings of the playbook here Product RoundTable Bangalore @ Vizury Office

We did a late beginning for Mumbai and thanks to Avlesh(WebEngage) for helping us in starting the movement with Sandeep’s support. Avlesh disappeared in the middle of the playbook and he had lots of documents to sign as it was a saturday… But I remember Sandeep holding the fort till Avlesh came back and shared his learnings of building WebEngage.

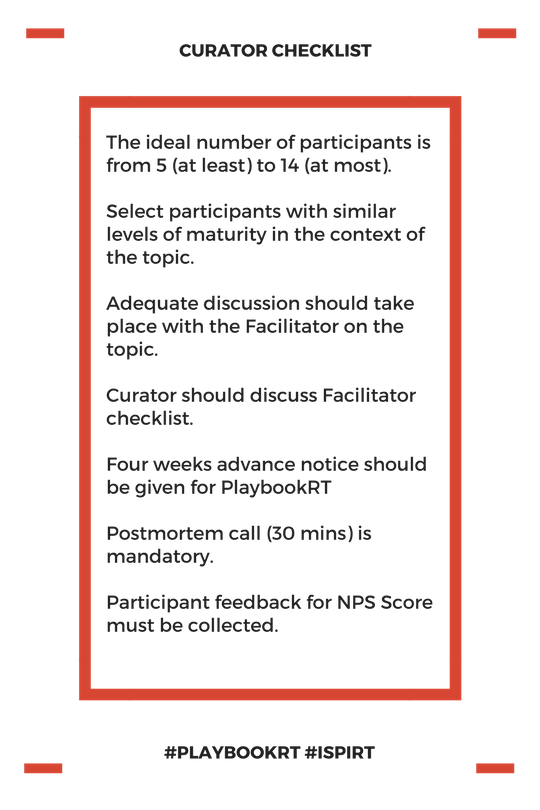

Organizing and hosting a playbook is no small feat. It has taken us a lot of time to put together the following checklist. Feel free to use it if you would like to put together something similar for your community. We have built new initiatives like Cohorts, etc using the same principles.

Curator Checklist

- There cannot be more than 12–14 participants. The sweet spot is 10–12 participants. Minimum number is 5.

- We must select participants with similar levels of maturity in the context of the topic. (Over time we should develop a predicted coherence score and see if that prediction is valid based on post-RT data collection.)

- Adequate discussion should take place with the Facilitator on the topic. It should be sufficiently narrow. It should not be about batting as a whole but about how to play leg-spinners. There would be a Plan B by the Facilitator if the topic ends up being too narrow. It is wiser to err on the side of being too narrow, rather than being too broad.

- It is mandatory to for a first-time Facilitator to attend a PlaybookRT for at least one hour.

- Curator should discuss Facilitator checklist. This discussion should happen before selection of the topic.

- Four weeks advance notice should be given for PlaybookRT if it is not tapping into a pre-curated participant list (e.g. BEX or InTech50). This is to ensure cross-city participation.

- Postmortem call (30 mins) is mandatory. Participant feedback and other learning should be discussed in this call. At the end of the call Curator should assign an overall rating (on a scale of 5) to the PlaybookRT.

- Participant feedback for NPS Score must be collected.

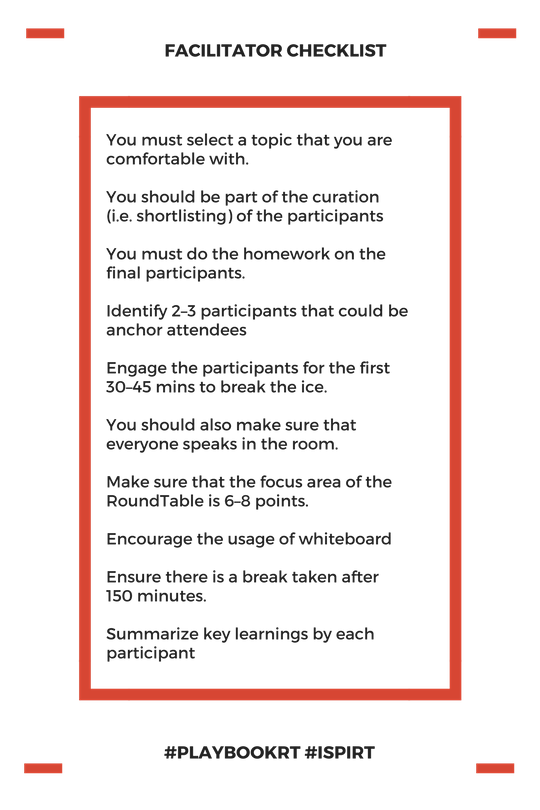

Facilitator Checklist

- You must select a topic that you are comfortable with. You must have expert practitioner knowledge about this topic.

- You should reach out to startups to scope out the specific topic areas you’ll cover.

- You should be part of the curation (i.e. shortlisting) of the participants… you must try and get participants at the same level.

- You must do the homework on the final participants. You must learn about the startups by visiting their website. You must also understand the challenges faced and expectations from the PlaybookRT (this information is in the form filled by the participant).

- Identify 2–3 participants that could be anchor attendees — folks who will trigger conversations and also add value to the conversations.

- Engage the participants for the first 30–45 mins to break the ice. You should go beyond introductions — Something on the lines of: We are struggling to do xyz. The goal is to create an atmosphere of trust so that they spell out more details.

- Participants are continuously requested to chime in with their views. You should also make sure that everyone speaks in the room. For instance, Shankar Maruwada asks very specific questions to participants along the way. He is able to do this because he has done homework on each participant beforehand.

- Seating should be such that people can see each other.

- Make sure that the focus area of the RoundTable is 6–8 points. It is difficult for participants to retain more than.

- Encourage the usage of whiteboard with participants. This allows people to change position and brings energy in the room. Peer learning is vitally important. Don’t be a sage on stage.

- Share list of books/videos/tools that participants should use after the RT.

- Ensure there is a break taken after 150 minutes.

- At the end, summarise key learnings by each participant. Everyone speaks for at least 2–3 mins.

My job has been very simple, just keep hunting for the Curators & Facilitators and allow them to make the magic happen 🙂

- 0–100 customers! How fast can your SaaS startup accelerate? By Ankit Oberoi

- Setting up Inside Sales to sell SaaS into US — Learning’s from iSPIRT #PlaybookRT by Suresh Sambandam

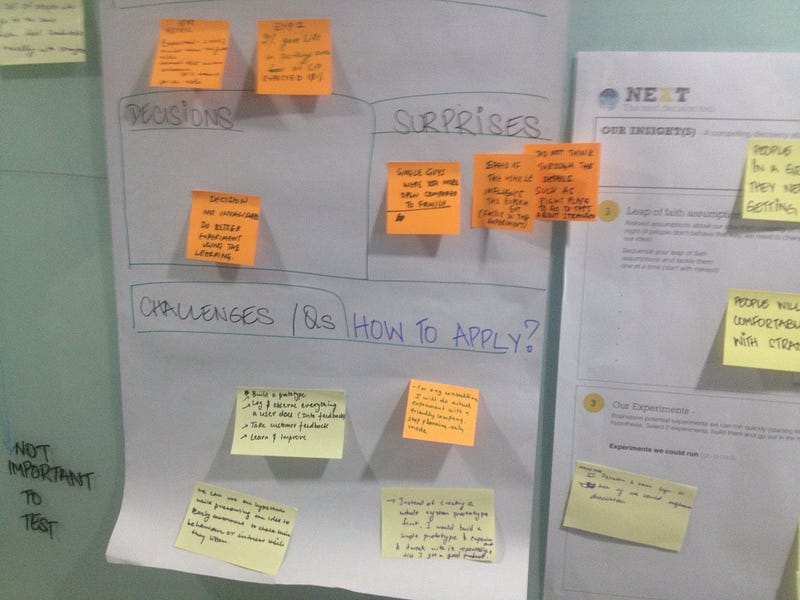

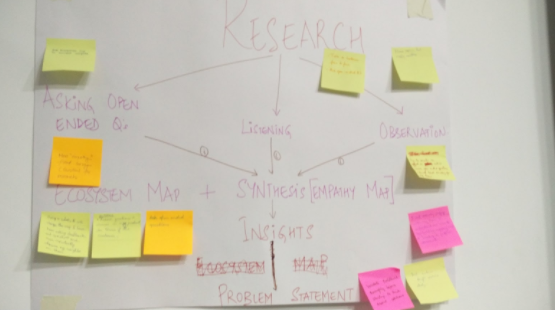

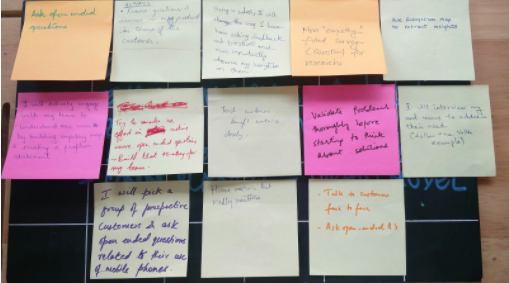

- Design thinking Playbook Roundtable by Deepa Bachu

- Mobile Product & Growth Hacking RoundTable #playbookRT by @amitsomani & @VishalAnand

- The best things are simple. Is your messaging there yet? : from #PlaybookRT by Shankar Maruwada

- How to Structure Sales and Marketing in a SaaS Business by Girish Mathrubootham

- Nuts & Bolts of Marketing & Selling in US for First Timers: A crash course playbook!! By Suresh Sambandam

- 40th #PlayBookRT in NCR on “Break the Barriers of Selling” by Deepak Prakash

- Understanding Software Sales from the Tally Experience

- Rediscovering America — The SaaS way ! by Samir Palnitkar

- Product Management Roundtable For Startups by iSPIRT In Pune. #PlaybookRT by Amit Somani & Rahul Kulkarni

- 22nd #PlaybookRT — Solving a customer’s problem in a way your competitor is not doing, is the most memorable thing for your customer or partner by Pallav Nadhani.

- 21st #PlaybookRT — 13 Sales Mantras for Product Selling in India — Part 1 by Aneesh Reddy

- India as a Product Nation is in good hands — Insights from the Lean Sales Roundtable by Pallav Nadhani, Paras Chopra, Varun Shoor

- Don’t Build Something Unless Someone Is Willing To Pay For It & Asks For It Twice! By Sridhar Ranganathan

- Product Management for Startups and Understanding Growth #Playbookrt52 by Amit Ranjan

Access the complete list of PlaybookRoundtables here. Some learnings from the Playbook Roundtables have been captured here by my friend Rajan(then Intuit). 90% of the Playbooks did get a NPS Score of 80+. Special thanks to Rajan who kept pushing for this 🙂

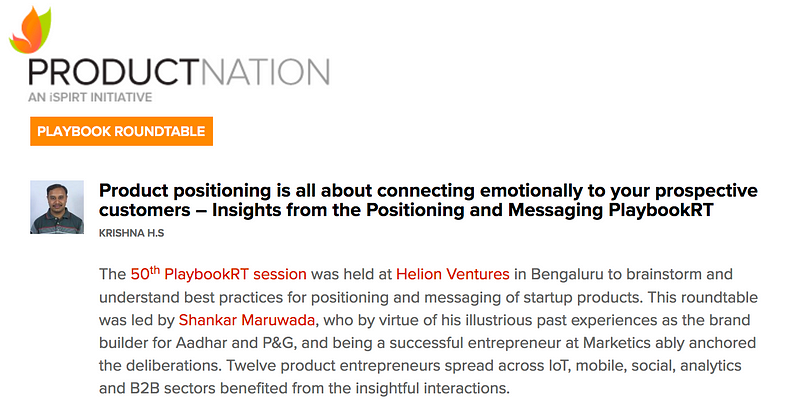

From the 50th PlaybookRT

Shankar helped in putting together the 50th Playbook and it was good to get some folks who had attended the first playbook joining this one.

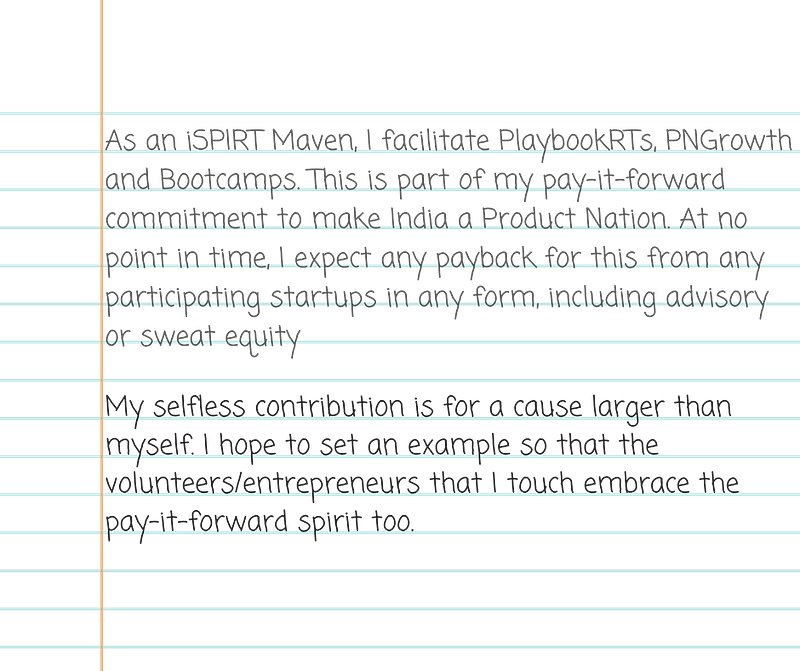

Mavens are trusted experts who pass knowledge to other founders in a pay-forward model in small intimate learning sessions.

Some of our Mavens are

Aneesh Reddy, Pallav Nadhani, Amit Somani, Amit Ranjan, Avlesh Singh, Deepa Bachu, Deepak Prakash, Girish Mathrubootham, Niraj Ranjan, Jay Pullur, Paras Chopra, Pravin Jadhav, Rushabh Mehta, Samir Palnitkar, Sanjay Shah, Shankar Maruwada, Suresh Sambandam.

Some of them who are not mavens but have helped us with few roundtables are:

Vivek Subramanyam, Sudheer Koneru, Ambarish Gupta, Phanindra Sama, Abhishek Sinha, Ashwin Ramesh, Shashank ND, Shivakumar Ganesan(Shivku), Krish Subramaniam, Ankit Oberoi, Arpit Rai, Varun Shoor, Dhruv Shenoy, Manav Garg, Naveen Gupta, Rajiv Srivatsa, Sampad Swain, Kailash Katkar.

A big shout-out to Suresh Sambandam for doing the maximum number of playbooks 🙂

Special thanks to Niraj Ranjan Rout(Hiver) & Rushabh Mehta(ERPnext) for introducing the new format i.e the Tear Down sessions and helping early stage(pre-product market fit) companies on helping them find their product market fit.

All the Maven’s have signed the below code of ethics:

Our team of Dedicated & Committed Volunteers who made this happen in each city

Thanks to you who make time in your incredibly busy lives to make these sessions happen.

- Rajat Harlalka in Delhi

- Sandeep Todi & Sudarshan Ravi in Mumbai

- Siddharth Deshmukh, Abhijeet Mhetre, Aditya Bhelande in Pune

- Nikhil Kulkarni, Titash Neogi, Natwar Maheshwari, Gokul Bose, Thiyagarajan M(Rajan), Amarpreet Kalkat in Bangalore

- Chaitanya C, Laxman Papineni in Hyderabad

- Ashwin Ramaswamy, Kingston David in Chennai

- Ankit Dudhewala in Ahmedabad.

Companies who hosted the Playbook Roundtables and also hosted some awesome snacks/lunch/dinner 🙂

- Delhi-NCR — Eko, Investopad, Posist, Wingify, AdPushup, Kayako, Knowlarity.

- Bangalore — Exotel, Vizury, iCreate(Fintellix), Capillary, Instamojo, Hotelogix, Helion, Accel, DeckApp, SignEasy, Belong, HiverHq, Practo, RazorPay, Synup, UrbanLadder, 24/7 Customer, Elitmus, Srishti Software.

- Ahmedabad — IIM

- Pune — QuickHeal, HelpShift, Pubmatic, Sokrati, TouchMagix, K-Point.

- Mumbai — WebEngage, FreeCharge, WishBerry, LightBox, BrowserStack.

- Chennai — OrangeScape, Freshdesk, Chargebee, Zarget.

- Hyderabad — Ozonetel, Pramati, Zenoti.

Many volunteers who have helped in writing blogs for and about the sessions and also help in editing some of my blogs… especially Sairam Krishnan & Kingston David.

I am terribly sorry if I have missed out someone here! I know you will be modest but please do let me know so that I can add your name here. In highlighting your efforts, we motivate others in our quest to make India, a ProductNation…

ProductNation Founders Tribe

There are around 1000+ Founders who have leveraged the playbooks and the list can be accessed here.

Iam really glad that I will participating at the 100th Playbook Roundtable in Chennai on “Inbound Marketing — Workshop for DIY Global SaaS Startups”. This would be led by Krish of ChargeBee & Suresh of KiSSFlow.

This marks an incredible milestone since our journey began in 2013, and demonstrates the increasing demand for our playbooks every year.

Circling back to my cricket story at the start of this write-up, we all start with an outrageous dream. It is definitely good to dream big but when there is a bigger calling, we should yield to it!

I am so very proud that we’ve reached this milestone. Thank you for your support, and I look forward to celebrating more milestones together in the future.

Thanks to Kingston David for editing this & Titash Neogi for making this look good 🙂

There are hundreds of big and small moments that have made up this journey so far — it is impossible to capture them all here, but I am sharing some of these moments via this photo story — I hope to give you a flavour of the energy and spirit of what made us reach 100!

See more photographs on the FlickR album and few photos here

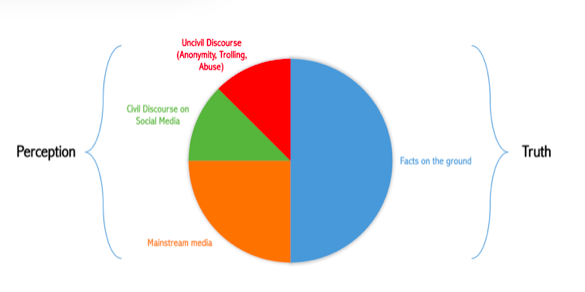

Content is still King, so let’s lead with it.

Content is still King, so let’s lead with it. Disclosure : I am

Disclosure : I am