When reality changes, it’s important for the firms to acknowledge and adjust to the new situation. This is the time to remember the mantra ‘Revenue is Vanity, Profit is Sanity, Cash is Reality’.

The Covid-19 crisis is much written about, debated and analyzed. If there is one thing everyone can agree about on the future, it is that there is no spoiler out there for this suspense. The fact is that no one knows the eventual shape of the business environment after the pandemic ends.

When revenue momentum slows down or even hits a wall as it is happening in the current scenario, costs take centre stage even as every dollar of revenue becomes even more valuable for the firms. So, enterprises need an arsenal of strategic weapons to operate and survive, maybe even thrive, in this period of dramatic uncertainty. The same old-same old, push-push methods will not move the needle of performance.

As an entrepreneur and CEO, I have always found the theory of Marginal Costing (MC) to be practically powerful over the years. Let me tell you why.

At the best of times, MC is a useful tool for strategic and transactional decision making. In a downturn or a crisis, it is vital for entrepreneurs and business leaders to look at their businesses through the MC filter to uncover actionable insights.

Using MC-based pricing, the firm can retain valuable clients, win new deals against the competition, increase market share in a shrinking market and enhance goodwill by demonstrating dynamism in downmarket.

As the firm continues to price its products based on MC, the idea is to continually attempt to increase the price to cover the fixed costs and get above the Break-Even Point (BEP) to profitability. However, this happens opportunistically and with an improving environment.

Pricing for outcomes is more critical during these times and playing around with your costing models can go a long way in determining the most optimal outcome-based pricing approaches.

Steps to Get the Best Out of MC:

1. Determine bare minimum Operating level

Estimate the bare minimum operating level or fixed costs you will need to bear to stay afloat and capitalize on revenue opportunities. This is the BEP of the business. This estimate can include:

- Facilities, machines, materials, people and overheads.

- All R&D expenses required to support product development

- Necessary support staff for deployment and maintenance of products/services.

2. Ascertain the variable costs

Identify the incremental costs involved in delivering your business solutions to fulfil contractual and reputational expectations to both existing and new customers. These costs are the variable costs in your business model. Try to maximize capacity to flexibly hire, partner or rent variable costs as needed, based on incremental revenues.

3. Distinguish between fixed costs and transactional variable costs.

Take your fixed costs at your operating level as costs for a full P&L period. Let’s say, the fiscal year. Take your variable costs as what it takes to fulfil the Revenues that you can book. Make sure you only take the direct, variable costs. Note that if Revenues less Variable costs to fulfil the revenues is zero, then you are operating at MC.

4. Sweat the IP already created.

For every rupee or dollar you earn over and above the MC, you are now contributing to absorbing the fixed costs. Do bear in mind that all historical costs of building the IP are ‘sunk’, typically to be amortized over a reasonable period. Hence, it doesn’t figure in the current level of fixed costs. The idea now is to ‘sweat’ the IP already created.

5. Peg the base price at marginal cost.

Start at the level of marginal cost, not fully absorbed costs. Then, try and increase the price to absorb more and more of the fixed costs. The goal is to get to BEP and beyond during the full P&L period. At the deal level, be wary of pricing based on the fully-loaded costs (variable and fixed costs, direct and indirect).

6. Close the deal to maximize cash flows

Price your product at marginal cost + whatever the client or market will bear to get the maximum possible advance or time-linked payments. This is a simple exchange of cash for margins wherever possible and an effective way to maximize the cash flows. Many clients, especially the larger ones, worry more about budgets than cash flow.

Let’s look at a high-level illustration.

Assume a software product company providing a learning and development platform to the enterprise marketplace. Let’s call this company Elldee.

Elldee has a SaaS business model that works well in terms of annuity revenues, steady cash flows and scale. Clients prefer the pay-as-you-model representing OpEx rather than CapEx. Investors love the SaaS space and have funded the company based on the future expectations of rapid scale and profitability.

However, given the ongoing crisis condition, Elldee needs to take a good re-look at the licensing model. By applying MC filters, it may make more market and financial sense to maximize upfront cash by doing a longer-term `licensing’ deal for the software-as-a-service at even a deep discount, with back-ended increments in price. The variable costs of on-boarding a client are similar to a SaaS deal yet the revenue converts to contribution to absorb fixed costs quickly to help survival and longer runway for future growth. So the client pays lesser than what they would have for a three year SaaS deal but Elldee is able to sweat its IP while maximizing cash flows.

Elldee can even move its existing SaaS clients to this model to capture more revenues upfront by being aware of MC and figuring out the right pricing models to get to the BEP of the business or product. Outcome-based pricing can also be designed to deliver margins beyond the MC, contributing to the absorption of fixed costs more aggressively.

Elldee is now in a position to address different types of markets, clients and alliances. It can calibrate higher and higher margins as the environment improves and client relationships deepen. Over the next two years, Elldee would come out stronger with a more loyal client base, higher market share and a growth trajectory aligned with its pre-Covid19 business plans.

Yes, this is a simplified example but many variations to the theme can be crafted, based on a firm’s unique context.

Remember that a strong tide lifts all boats but a downturn separates the men from the boys. Marginal costing techniques, when customized for sector-specific operating models, delivers a competitive edge at a time from which will emerge stronger winners and weaker losers. Be a winner.

About the contributor: Sam Iyengar is a PE investor, mentor and advisor focused on Innovation and Impact. He can be reached at [email protected].

Skill oriented education: Now while the rural revolution looks interesting, how will the software talent that is usually US bound, join such remote places. Sridhar’s answer to this is Zoho University. Zoho University is a unique education, follow a gurukul Indian approach, where students are pulled from government schools, and trained into important technical skills, English and Maths, Design skills, as well as business skills.I had some great discussions with Anand Ramachandran, who heads Zoho University in Tenkasi. Zoho University now contributes to more than 20% of the 8,000+ employees in Zoho, and it’s heartening to see students from villages, Tamil medium government schools very effectively groomed to build world-class products. The analogy I have for this kind of education is chartered accountancy, which combines knowledge and hands-on skills together. But this takes it to the next level.

Skill oriented education: Now while the rural revolution looks interesting, how will the software talent that is usually US bound, join such remote places. Sridhar’s answer to this is Zoho University. Zoho University is a unique education, follow a gurukul Indian approach, where students are pulled from government schools, and trained into important technical skills, English and Maths, Design skills, as well as business skills.I had some great discussions with Anand Ramachandran, who heads Zoho University in Tenkasi. Zoho University now contributes to more than 20% of the 8,000+ employees in Zoho, and it’s heartening to see students from villages, Tamil medium government schools very effectively groomed to build world-class products. The analogy I have for this kind of education is chartered accountancy, which combines knowledge and hands-on skills together. But this takes it to the next level.

While the SaaS industry began over 2 decades ago, many say it is only now entering the teenage years. Similar to the surge of hormones which recently brought my teenage daughter face-to-face with her first pimple. And she is facing a completely new almost losing battle with creams and home remedies. In the same vein, convergence of

While the SaaS industry began over 2 decades ago, many say it is only now entering the teenage years. Similar to the surge of hormones which recently brought my teenage daughter face-to-face with her first pimple. And she is facing a completely new almost losing battle with creams and home remedies. In the same vein, convergence of

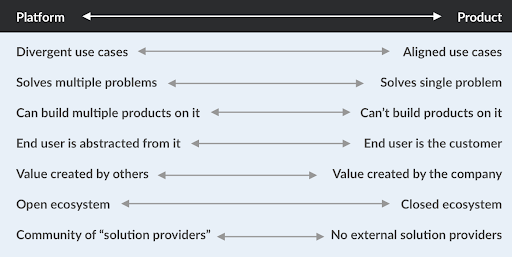

As market needs change, the product needs a transform. As new target segments get added different/new product assumptions come into play. In both these scenarios existing products begin to age rapidly and it becomes important for startups to re-invent their product offerings. To deal with such changes startups must experiment and iterate with agility. They require support from a base “internal” platform to allow them to transform from a single product success strategy to scaling with multiple products strategy.

As market needs change, the product needs a transform. As new target segments get added different/new product assumptions come into play. In both these scenarios existing products begin to age rapidly and it becomes important for startups to re-invent their product offerings. To deal with such changes startups must experiment and iterate with agility. They require support from a base “internal” platform to allow them to transform from a single product success strategy to scaling with multiple products strategy. A strategic partner offers 2 benefits for startups. First is the obvious ability to supercharge the startup’s GTM strategy with effective distribution & scale. How does one make a strategic partnership? Pitching to a strategic partner is very different from pitching to a customer or investor. PSPs look for something that is working and where they can insert themselves and make the unit economics even better.

A strategic partner offers 2 benefits for startups. First is the obvious ability to supercharge the startup’s GTM strategy with effective distribution & scale. How does one make a strategic partnership? Pitching to a strategic partner is very different from pitching to a customer or investor. PSPs look for something that is working and where they can insert themselves and make the unit economics even better.