As the new year approaches, its customary to review the year that has passed. Here is my take on where we stand on innovation at the end of 2013.

Positive Highlights of the Indian Innovation scenario in 2013

Innovation in the public/strategic sectors took two important strides. The first was the successful launch of the mission to Mars (Mangalyaan) which demonstrated India’s ability to undertake complex scientific and technological projects at low cost. The second was the initial operational clearance for the Tejas Light Combat Aircraft by the Indian Air Force.

The emergence of a new generation of Indian technology companies like Vigyanlabs, winner of the Nasscom Innovation Award in the Technological Innovation category for 2013 was another positive development. Vigyanlabs solves an important problem (high consumption of power by data centres) with a system solution that is backed by a US patent.

Some of the most important innovations took place in the political sphere. Two new entities demonstrated the potential for such innovation. The success of a young political party, the Aam Aadmi party, in the Delhi elections demonstrated the value of a grassroots approach to politics backed by creative use of the social media. In Bangalore, the Bangalore Political Action Committee B.PAC seeks to be a catalyst for “good politics” by supporting candidates with a clean record. B.PAC also trains aspiring politicians.

Some of the most important innovations took place in the political sphere. Two new entities demonstrated the potential for such innovation. The success of a young political party, the Aam Aadmi party, in the Delhi elections demonstrated the value of a grassroots approach to politics backed by creative use of the social media. In Bangalore, the Bangalore Political Action Committee B.PAC seeks to be a catalyst for “good politics” by supporting candidates with a clean record. B.PAC also trains aspiring politicians.

Another timely organizational innovation was the launch of the Indian Software Product Industry Round Table (iSPIRT), a think tank devoted to the promotion of India as a power in the software product industry. Two initiatives of iSPIRT – one to connect Indian product companies with the requirements of India’s large small and medium enterprise (SME) sector, and the other to create a vibrant market for acquisition of software product companies (“M&A Connect”) have shown the potential of efforts to close the gaps that hinder the emergence of a vibrant product ecosystem [Disclosure: I am associated with iSPIRT as a member of its Founders’ Circle.]

Market-driven innovation efforts by large multinational companies such as Renault (with the Duster) and Gillette (with the Guard) showed that some MNCs are coming to grips with what it takes to innovate for the Indian market. Yet, the overall MNC innovation scenario in India was mixed with some companies scaling down their efforts to use India as a base for emerging market innovation.

Market-driven innovation efforts by large multinational companies such as Renault (with the Duster) and Gillette (with the Guard) showed that some MNCs are coming to grips with what it takes to innovate for the Indian market. Yet, the overall MNC innovation scenario in India was mixed with some companies scaling down their efforts to use India as a base for emerging market innovation.

The Indian Industrial Innovation Scenario

2013 was a decidedly mixed year for industrial innovation in India. One of the mainstays of Indian industrial innovation, the transportation sector, had a poor year. Despite several efforts, Tata Motors was unable to revive the fortunes of the Nano, and sales remained muted. Mahindra’s earlier success in the SUV market with products like the Scorpio and XUV 500 was eclipsed by determined efforts by MNC automotive companies (Renault with the Duster, and Ford with Ecosport). By all reports, the initial results of Mahindra’s acquisition of Reva (India’s pioneering electric vehicle company) have not been great either with their first post-acquisition product, the E20 seeing only moderate success. Neither Tata nor Mahindra had successful launches during the year. In contrast, MNCs had several successful launches including Honda’s Amaze and the SUVs mentioned above.

Zydus Cadila successfully completed trials for what may become India’s first new chemical entity to reach the market. But the Indian pharmaceutical industry faced several setbacks as prominent companies came under the scanner of American and European regulators, and big names including Ranbaxy and Wockhardt faced regulatory action. Since, their ongoing operations in the bulk drugs (APIs) and generics space provide the cash to fund their innovation efforts, any setback to these businesses could have a long-term negative impact on the Indian pharmaceutical industry.

Traditional Indian business groups have begun to realize the importance of a more structured approach to innovation, but are struggling to evolve appropriate processes to do so. My co-author, Vinay Dabholkar and I received enquiries from such companies in different sectors, but few of them translated into specific assignments.

The Innovation Ecosystem

Reflecting India’s overall struggles with enhancing innovation output, India slipped two positions on the Insead/WIPO Global Innovation Index in 2013. India’s biggest weaknesses are in the institutional environment, and in higher education and R&D.

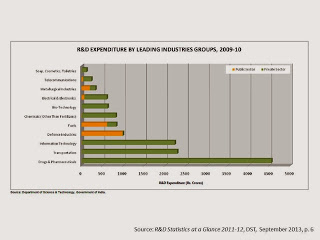

The latest available R&D statistics (pertaining to 2009-10, released on September 2013) show that India’s R&D expenditure as a proportion of GDP is static at around 0.88% since 2005-06. But, there are two important changes to note. The sectors accounting for the largest proportion of industrial R&D spending – pharma and transportation – continue to be the largest, but their share has come down to 27.7% and 14% respectively from 45% and 17% respectively earlier. This is a positive development as it shows other sectors increasing their R&D spend faster. The other interesting development is that private sector industry now accounts for 28.9% of all R&D expenditure and the entire industrial sector (private + public sector) for more than 34%.

The latest available R&D statistics (pertaining to 2009-10, released on September 2013) show that India’s R&D expenditure as a proportion of GDP is static at around 0.88% since 2005-06. But, there are two important changes to note. The sectors accounting for the largest proportion of industrial R&D spending – pharma and transportation – continue to be the largest, but their share has come down to 27.7% and 14% respectively from 45% and 17% respectively earlier. This is a positive development as it shows other sectors increasing their R&D spend faster. The other interesting development is that private sector industry now accounts for 28.9% of all R&D expenditure and the entire industrial sector (private + public sector) for more than 34%.

One piece of good news is that the proposed Inclusive Innovation Fund has taken a step forward with an in-principle approval of the first tranche of funding. But the operational details still seem some distance away. It looks unlikely that the Fund will be put in place before the next general elections, and it remains to be seen whether the next government will see it through to fruition.

One piece of good news is that the proposed Inclusive Innovation Fund has taken a step forward with an in-principle approval of the first tranche of funding. But the operational details still seem some distance away. It looks unlikely that the Fund will be put in place before the next general elections, and it remains to be seen whether the next government will see it through to fruition.

During the year, the Department of Scientific & Industrial Research re-jigged its schemes for supporting R&D by industry. New schemes include “Patent Acquisition and Collaborative Research and Technology Development” (PACE) and “Promoting Innovation in Individuals, Start-ups and MSMEs” (PRISM). As far as I can make out, the PRISM scheme is not too different from the TePP programme that was quite popular earlier. The PACE programme provides loans for companies to acquire patented technologies and then work on them further. In the past, the common problems of government support schemes included processing time, centralization in Delhi and inadequate scale. Let’s hope the government is able to address such issues this time.

Another useful development is the incorporation of innovation into the Results Framework with which the Performance Management Division of the Government of India measures the performance of government ministries and departments. This will hopefully result in a greater focus on innovation in the government.

Conclusion

2013 wasn’t a great year for innovation in India. Industrial innovation, in particular, seems to be at the crossroads. I hope that a focus on innovation will return once we have a new government in place later this year.