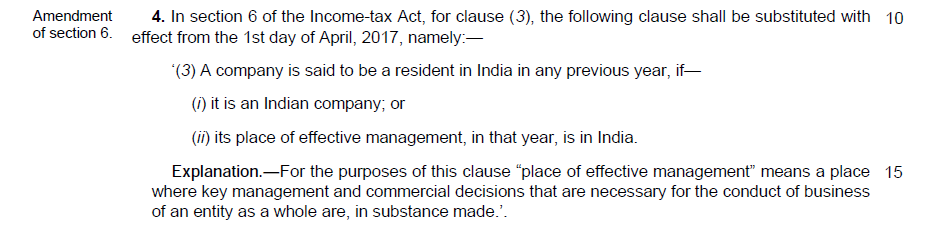

Finance minister had announced during budget 2016 that place of effective management (POEM) will determine if a company is resident in India or not. Accordingly, this was notified in Finance ACT 2016 as under.

The details of what will determine the place of business rules was not decided in the Finance Act 2016. The POEM provisions was supposed to become effective from April 2017. The detailed guidelines of what rules and conditions will determine the POEM has been issued by CBDT on 24 January 2017.

Ever since the announcement in 2016 there were many apprehensions on POEM, especially in SaaS companies.

In order to clear this apprehension a PolicyHacks session of iSPIRT was conducted.

The video discussion on POEM attended by Girish Rowjee, Founder CEO of Greytrip; Mrigank, Mrigank Tripathi, Founder CEO of Qustn Technologies; Sanjay Khan Nagra, of Khaitan and Co.; Avinash Raghava and Sudhir Singh, iSPIRT is given below.

What does the above POEM ruling incorporate in finance bill imply?

In simple terms the place of effective management in above act means a place where key management or commercial decisions that are necessary for the conduct of the business of an entity are made, in substance. This implies Indian resident status on a company will apply even when the entity is incorporated outside India, if the place of effective management is proven to be in India.

The guidelines issued on 24th January 2017 by CBDT will be used to determine if a business of non-Indian entity or a subsidiary of Indian entity will fall under the place of business rules or not. The Guide lines can be accessed here.

POEM is an internationally recognised test for determination of residence of a company incorporated in a foreign jurisdiction.

Why this regulation has been brought in?

POEM require Indian firms with overseas subsidiaries or foreign companies in India to pay local taxes based on where the business is effectively controlled.

The main intention of this regulation is to capture the income in shell companies incorporated outside India that are held by resident Indians with a basic intention of retaining the income outside India.

The regulation is not intended to discourage valid Indian businesses to setup an entity outside India or operate in global markets.

Does it impact Software sector?

It is very common for the India Software companies to open an office in foreign geography, many times as a subsidiary of Indian company and sometimes a new entity with mixed local and Indian management. Hence, the POEM has been worrying entrepreneurs in this sector. For SaaS segment, it is very normal to have a foreign entity, either for reasons of funding or market penetration.

As mentioned above, for a valid global business the POEM will not be a hurdle. Businesses, having global operation but not retaining income in foreign companies (i.e repatriating profits to Indian company) through authorised route and after complying with other regulations, POEM will not be a a worrying factor.

There may be a very few Software Companies, who may need to be concerned, to pass the test of POEM. Any determination of the POEM will depend upon the facts and circumstances of a given case. The POEM concept is one of substance over form. If POEM is established to be in India for businesses operating outside India, they will be taxed in India.

It is not possible to generalize the impact of POEM on Software sector or illustrate few used cases. Whether a business operating outside India will get classified as POEM can only be ascertained after detailed examination.

Exemption for turnover less than 50 Crore

There is good news for startups as per the Press release accessible here, it has been decided that the POEM guidelines shall not apply to companies having turnover or gross receipts of Rs. 50 crore or less in a financial year.

This was not clear before video discussion and doubts were expressed during discussion, as this rule has not been described in the guideline circular of CBDT but has been mentioned in the press release of same date from CBDT.

Hence, we can expect that the rule of less than 50 crore income shall be embedded in income tax rules to be notified later.

Other salient features

- The provision would be effective from 1st April 2017 and will apply to Assessment Year 2017-18 and subsequent assessment years.

- The Assessing Officer (AO) shall, before initiating any proceedings for holding a company incorporated outside India, on the basis of its POEM, as being resident in India, seek prior approval of the Principal Commissioner or the Commissioner, as the case may be.

- Further, in case the AO proposes to hold a company incorporated outside India, on the basis of its POEM, as being resident in India then any such finding shall be given by the AO after seeking prior approval of the collegium of three members consisting of the Principal Commissioners or the Commissioners, as the case may be, to be constituted by the Principal Chief Commissioner of the region concerned, in this regard. The collegium so constituted shall provide an opportunity of being heard to the company before issuing any directions in the matter.

The point 2 and 3 mentioned above will ascertain that there is no arbitrary discretion exercised by Assessing officers on ground.

The Guidelines issued can be accessed here, also provides examples that explains when an active business outside India will be treated as Indian business based on POEM. These examples do not explain each and every case.

Also the exemption of 50 Crore is neither given in Finance Act or in the Guidelines but mentioned in press release.

CBDT may therefore issue further circulars to clarify these positions.