The DigiSahamati Foundation, the non-profit Self Regulatory Organization responsible for evangelizing the nascent Account Aggregator (AA) ecosystem, is organizing a hackathon featuring lots of masterclasses for the public to attend and learn from.

As a refresher, an AA is a new kind of legal entity defined in this RBI circular. The basic idea is that the average Indian today generates lots of financial data. Each credit card payment, sale of a mutual fund, repayment of a loan, and filing of an invoice generates some new data about users, be they individuals or businesses.

This data trail is actually very valuable – understanding a person’s financial activity can tell you a lot about that individual’s behaviour, preferences, and profile as a consumer. Today, banks use this data about customers to sell them various kinds of products (insurance, loans, savings products), and they also sell the customer’s data to marketers and advertisers. This is not necessarily a bad thing, as long as it happens in a secure way, with the customer’s consent and in such a way that the customer gets some value out of it too.

This is where the AA comes in. In today’s world, the customer doesn’t have any say nor cut of revenue when the bank shares their data with marketers. It is also difficult to extract the valuable financial data outside of a bank’s database to share with a third party provider such as a lender, insurer, or wealth manager. Until now, the only ways customers could get their data out of the bank today is through physical passbooks, downloaded PDF statements, or by giving access to their SMS/emails/netbanking account.

These methods are painful and unsafe, and they don’t help a customer get the best deals. If the customer could easily and cheaply move their data to third parties, then maybe they would get better interest rates and prices, and their existing bank would also have to offer more competitive products and pricing.

Fortunately, the banks and RBI have figured out that in order for India’s financial sector to really grow, individuals and companies need a more safe and efficient way to maximize the value of their ever growing data. This will not only benefit consumers, it will also result in a richer and more innovative banking landscape with a larger customer base. The AA is the entity which helps users give their consent to move data outside their bank account to a third party in a safe and easy manner. The customer gets to choose exactly what data to share, with who, for how long, and under what conditions. This consent is granularly programmable and revocable. Detailed information about this new system can be found on the Sahamati blog.

The AA framework is about to go live in the next months with some of the country’s largest financial institutions including SBI, HDFC, ICICI, IndusInd, Axis, IDFC First, Bajaj Finance, and others. Given this timing, Sahamati decided to organize a hackathon in order to spread awareness of this powerful new infrastructure.

The response so far has been excellent for them. More than 600 hackers were accepted to take part in this four-week long virtual hackathon. During these four weeks, participants in the hackathon will learn about all the different facets of this new technology, from UI/UX to security to product innovations in fields like lending, insurance, personal finance management, and more.

All of these masterclasses, as well as the final presentations by hackathon participants, are open to the public. The list of masterclass presents can be found here.

The hackathon officially kicked off last Saturday. It was inaugurated by Mr. Nandan Nilekani, non-executive Chairman and Co-Founder, Infosys. There were also a number of presentations last week, including a deep dive into the technical architecture of the AA framework and a masterclass on successful use cases for financial data in the EU.

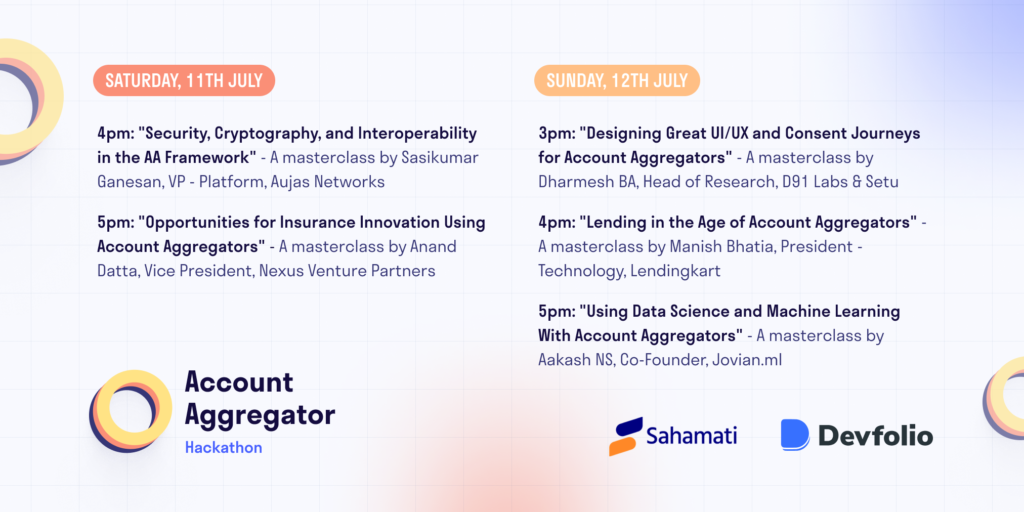

Here is the schedule for this weekend, perhaps some of you reading will be interested in attending some of these masterclasses!

Saturday, 11th July:

- 4 pm: Security, Cryptography, and Interoperability in the AA World by Sasikumar Ganesan, VP – Platform, Aujas Networks

- 5 pm: Insurance Technology Opportunities in the AA Landscape by Anand Datta, Nexus Venture Partners

Sunday, 12th July:

- 3 pm: Account Aggregators and the UI/UX of Consent by Dharmesh BA, Head of Research, D91 Labs & Setu

- 4 pm: Lending in the Age of Account Aggregators by Manish Bhatia, President – Technology, Lendingkart

- 5 pm: Using Data Science and Machine Learning with Account Aggregators by Aakash NS, Co-Founder, of Jovian.ml

The entire schedule for the hackathon, along with all public links, can be found here!

We hope some of you attend this event and see the power of this transformational new infrastructure for yourselves!