“The ‘Landline to Mobile’ leapfrog for MSME credit is here.”

On Friday evening we hosted the first open house discussion on the new Open Credit Enablement Network (OCEN). It is the next chapter of the ‘India Stack’ story, one that has provided the building blocks for public digital infrastructure in our country.

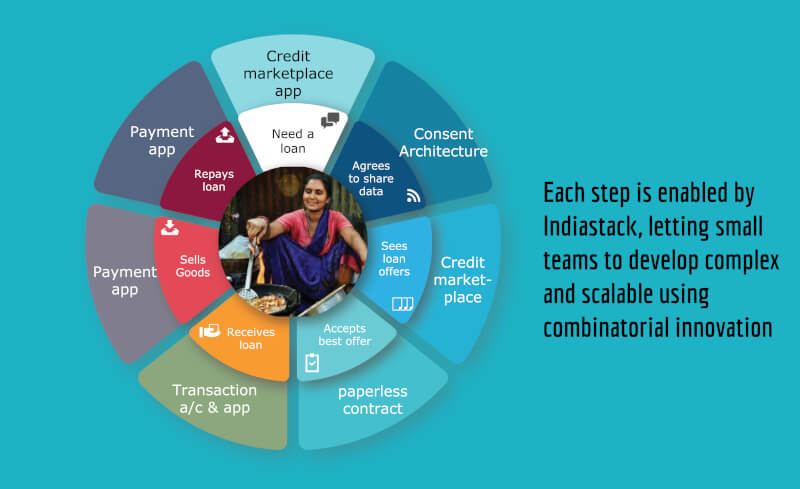

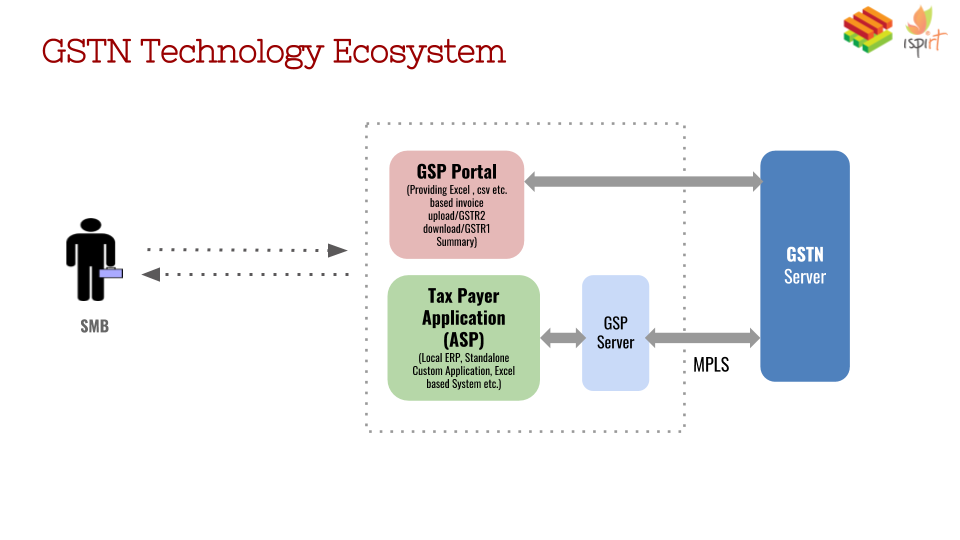

The past decade has seen us widen the net for financial inclusion in India on the back of open infrastructure for digital identity (Aadhaar, eKYC, eSign) and payments (UPI, AEPS). This year will also see the launch of the Account Aggregator framework, ushering in a new era for data governance in India. Similarly, OCEN is a new paradigm for credit that seeks to provide a common language for lenders and marketplaces to build innovative, financial credit products at scale.

The first session on OCEN covered the following topics broadly

- By Sharad Sharma

- An introduction to iSPIRT and our values

- An overview of India Stack and where OCEN fits in

- By Siddharth Shetty

- A product demo of Sahay, the reference app for OCEN

- By Ankit Singh

- The reason for the credit gap in India

- The challenges for lenders and prospective credit marketplaces

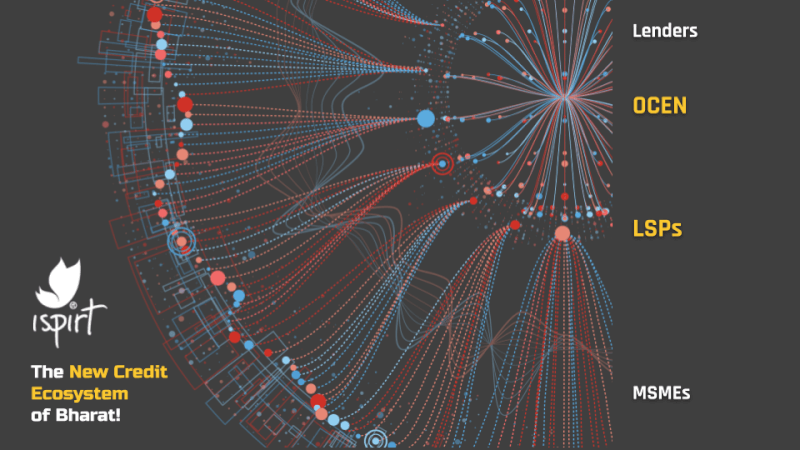

- A reimagined credit ecosystem with OCEN and Loan Service Providers (LSPs)

- The roles of LSPs

- A new cash flow-based lending paradigm

- The opportunity for market participants with OCEN

- Release of OCEN APIs, Check them on Github: https://github.com/iSPIRT/lsp-lender-protocol-specification

- Brief Q/A – Nipun Kohli

Why do we need this?

Access to credit is a crucial part of any flourishing economy. It is safe to say that India’s economic engine has not yet gotten out of second gear because of our inability to guide formal credit into the hands of the people and businesses that need it most. The unit economics of our current lending set-up are broken, and don’t suit the needs of either borrowers or lenders. The challenges range from high costs of customer discovery to lack of trustworthy data for underwriting, and an overall mismatch in ticket size, tenure and interest rates of loans. This has resulted in a whopping MSME credit gap of over $330 bn.

OCEN is an effort to recognise that the touchpoints for delivering financial products to individuals and MSMEs extends beyond traditional lenders. In order to democratize access to credit in India, OCEN reimagines an ecosystem where every service provider can become a Fintech-enabled credit marketplace.

This means that whether you’re an aggregator, a payment gateway, a software provider or any other company that interfaces with consumers, you can now fill in a crucial role in India’s lending value chain. OCEN will allow you to effectively ‘plug in’ lending capabilities into your existing product or service offerings, enabling you to play the role of a Loan Service Provider (LSP) in this framework.

At one end this will simplify and reduce the cost of acquiring and analysing new customers. Working in tandem with the Account Aggregator framework it will also allow applicants to leverage different data sources so that lending can become a Cash flow based operation instead of the existing balance sheet focus. Overall these open standards will enable lenders to accelerate the disbursal of formal credit while allowing LSPs to holistically serve their existing customers.

India’s new credit rails are ready to be laid out, and we look forward to working with our spirited fintech ecosystem participants over the coming months.

We will be hosting weekly open house sessions to keep diving deeper into OCEN. The next session will focus on Open Credit Enablement Network (OCEN) APIs at 5 pm IST on 31st July 2020.

Readers who wish to learn more about OCEN are encouraged to share this blog post and sign up again for the session here: https://bit.ly/LSPOpenHouse (same embedded below)

As always, in order to successfully create a new credit ecosystem for Bharat it will take the collaborative effort of participants from every corner of our fintech ecosystem.

If you’re interested in participating as a:

- Loan Service Provider

- Lender

- Technology Service Provider

please drop us an email at [email protected]

Readers may also submit any questions about OCEN on the google form: https://bit.ly/LSPQA. We shall do our best to answer these questions during next Friday’s open house discussion.

About the Author: The post is authored by our volunteer Rahul Sanghi.

Recommended Reading

Chapter 7 and 8 in RBI UK Sinha MSME committee report: https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=924

Introduction to India Stack’s fourth layer – Data Empowerment & Protection Architecture: https://www.youtube.com/watch?v=mW__azI8_ow