ESOP another Stay-in-India checklist item gets MCA nod

Ministry of corporate affairs (MCA) has recently relaxed sweat equity issuance norms for startups. These new relaxations are for limited to Startups recognized by Department of Industrial Policy and Promotion (DIPP). The announcement will immensely help startups. For startups not recognized under DIPP, there is not change.

The new announcement is – Companies (Share Capital and Debentures) Third Amendment Rules, 2016 (Amendment Rules). It amends the Rule 8 governing sweat equity shares issuance and Rule 12 of Rules 2014 that pertains to issue of shares under ESOP. The other rules to draw out an ESOP plans remains same.

This blog explains the new announcement and some basic concepts for those who may not be aware of terms like ESOPS and Sweat Equity and how they benefit the startups.

Mr. Sanjay Khan Nagra, iSPIRT volunteer explains the new announcements in below the embedded video.

There is lot of material on internet on examples and ESOPS plans and how they benefit the entrepreneur and the employee both. The objective of this blog is to set a background and describe new announcement.

An ESOP plan effects the basic capital structure of the company. It also has long term legal or tax implications. A good ESOP plan can maximizing the benefits from the existing and new provisions. Hence, we suggest startups interested in drawing up an Employee Stock Option Plan (ESOP) should seek a professional advice.

What is an ESOP?

An Employee Stock Option Plan (ESOP) is a benefit plan for employees which makes them owners of stocks in the company. ESOPs have several features which make them unique compared to other employee benefit plans. Most companies, both at home and abroad, are utilising this scheme as an essential tool to reward and retain their employees. Currently, this form of restructuring is most prevalent in IT companies where manpower is the main asset. (Definition Source: The Economic Times).

How ESOPS benefit Startups

ESOPs are a proven tool for startups to succeed and grow. There are many ways that ESOPS can be beneficial for startups.

Some of the ways this helps are as given below:

- Promoters or founders who can’t contribute capital but bring knowledge and dedication to startup can be have access to equity.

- Startups can attract experience and talent with sweat equity

- Startups can use ESOPs as a reward to motivate employees

- It gives sense of ownership to employees and hence act as an employee retainer ship tool

Change made for Startups

MCA has announced two changes. One, that will increas the base of sweat equity that a startup can issue. Two, that will expand the horizon of sweat equity to promoters and director. Both the changes have are described below.

Increase in limit of Sweat equity shares issued by start-ups

The Rule 8(4) of Rules, 2014 restricted companies from issuing sweat equity shares in excess of 25% of the paid up capital at any time. The rule also limits the issuance of sweat equity shares per year to 15% of the paid up capital or issue value of Rs.5 crores whichever is higher.

The amendment in new announcement expressly permits Start-ups to issue sweat equity shares not exceeding 50% of its paid up capital up to 5 years from the date of its incorporation or registration.

The limits of 15% of paid up per year or capital or Rs.5 crores whichever is higher will still need compliance.

Stock options to promoters and shareholder/directors of startups

The new announcement allows Startups to issue the sweat equity under ESOP to their promoters and to directors who hold more than 10% for the first 5 years from the date of their incorporation. The restriction on issuing stock options to promoters and such directors continues for all other companies

In order to provide this benefit MCA has used notification to exempt the startups from application of Clause (i) and (ii) under Explanation C of Section 62 (1)(b) of Act, 2013 that defines the term ‘Employee’. The Explanation in Section 62(1)(b) reads as below.

Explanation:

For the purposes of clause (b) of sub-section (1) of section 62 and this rule ”Employee” means-

(a) a permanent employee of the company who has been working in India or outside India; or

(b) a director of the company, whether a whole time director or not but excluding an independent director; or

(c) an employee as defined in clauses (a) or (b) of a subsidiary, in India or outside India, or of a holding company of the company but does not include-

(i). an employee who is a promoter or a person belonging to the promoter group; or

(ii). a director who either himself or through his relative or through any body corporate, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company.

[The clauses (i) and (ii) given in blue does not apply on DIPP registered startups for 5 years]

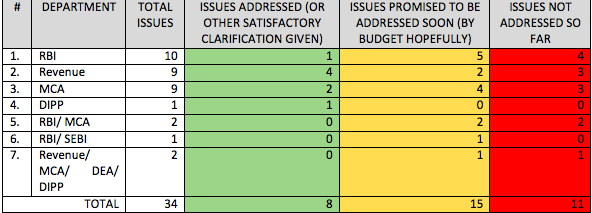

The policy changes announced by RBI are as follows:

The policy changes announced by RBI are as follows: Lastly, while the RBI has positively stated that it will notify certain changes soon, all of MCA issues and a majority of RBI issues are still at a ‘discussion/recommendation stage’ (and have been merely acknowledged by the authorities as issues that need to be resolved). Hopefully, the authorities will not stop here, and will implement all these changes soon. Needless to add, iSPIRT will keep interacting with, and assisting, the authorities in achieving a quick closure to these items, as well as the remaining issues which have not yet been touched by the authorities.

Lastly, while the RBI has positively stated that it will notify certain changes soon, all of MCA issues and a majority of RBI issues are still at a ‘discussion/recommendation stage’ (and have been merely acknowledged by the authorities as issues that need to be resolved). Hopefully, the authorities will not stop here, and will implement all these changes soon. Needless to add, iSPIRT will keep interacting with, and assisting, the authorities in achieving a quick closure to these items, as well as the remaining issues which have not yet been touched by the authorities.