A week or so before #SaaSx4, I woke up with an early morning call from Prasanna (SaaSx Volunteer) to tell me that they have nominated Omnify for the Product Teardown. Honestly, I jumped out of bed and my first reaction was like Ohh sh*t.. Not the Teardown!!

But then he said that they will select three companies out of the few nominated. So I agreed for a Hangout call hoping that we will not be selected.

So, Why did we do it?

I think, as a startup it’s good to go through “Make & Break” cycles which helps building a stronger product. Incidentally, that week we were sort of doing an internal teardown of our product and our conversion funnel. After the first hangout call with Avlesh, Shekhar and Bharath, I realised that it is indeed a great opportunity to get external feedback as we will be making a lot of effort this year on Product Design and Marketing.

Also, best part about the SaaSx community is the positive environment where no one is judging others and it’s all about learning from each others mistakes. Guys like Girish, Avlesh and Sudhir openly talk about the mistakes and learnings so others can benefit.

So, in the same SaaSx spirit we decided to participate in the Teardown for the benefit of us and anyone who can learn from our mistakes.

About Omnify (to give some context)

Omnify helps small businesses to Sell and Schedule their services online through One, Simple Platform. We have built comprehensive scheduling for Group Classes, Appointments, Events, Camps, etc. which can be easily sold as Packages and Subscriptions through Omnify.

Goal of the Teardown

I had multiple calls with Avlesh, Shekhar and Bharath before the teardown. The purpose of the calls were to have better understanding about Omnify and see how they can help.

After some discussion, we decided to find gaps in our conversion funnel; right from discovery, signup, onboarding to setup.

Discovery

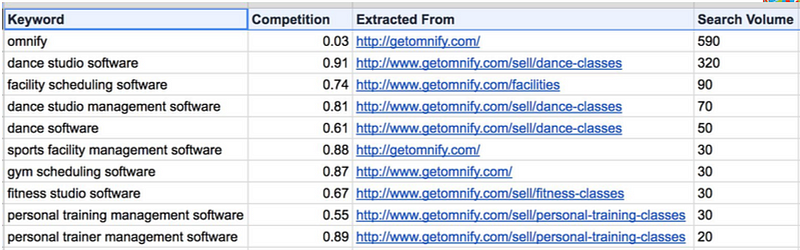

Our major channel for getting customers is Search. Hence this part was focussed on our SEO. Interestingly, we got a thumbs up for this part as we have already put some work into our SEO. There is so much more to do and scaling our Top of the funnel is currently our Top Priority as pointed out by both Shekhar & Avlesh.

The best part about Search is that it shows “Intent” which has a direct impact on your conversion. For SaaS startups (especially at early stages and targeting global market) this should be the most important channel for customer acquisition. Hence, my advice for anyone who has not yet worked on their SEO is to atleast get the basic On-Page optimisation, Major Keywords and URL structuring right. It is a time consuming project but it will be worth your time and effort.

Here is an old, but a simple post on this by Moz.

In case you have no clue where to start, just hire an SEO expert from UpWork for a $100 project to do an SEO Audit of your website.

Action Plan: We are now spending a lot of time on Keyword optimization, Improving on page optimization and figuring out ways to churn good quality content at scale. Will share our learnings with some data once we can.

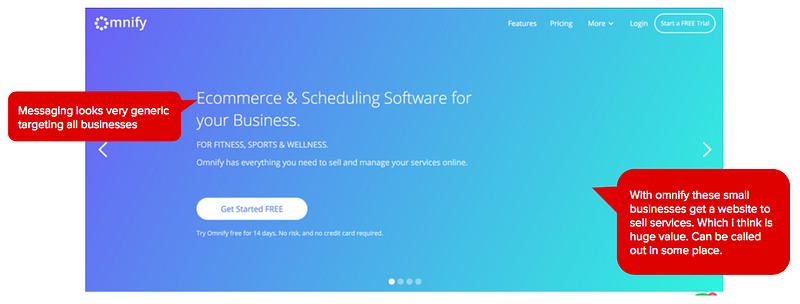

Website

Next target for the Teardown was our Website (https://www.getomnify.com/)

Bharath did a great job pointing out few key issues in our website that may be affecting our conversion and also did a comparative analysis with our competitor’s website who has probably spent millions of $$ to optimise it for the target audience.

Although we had spent quite a lot of effort on our website as it the most important part of our company and our doorway to customers across the world.

Although, there is a lot of room for improvement but here are a few things that we already worked on.

Trust

- Good Design breeds trust.

- Simple things like SSL certificate (https) improves trust in your website.

- Transparency — About us page with photos and social profiles of the team.

Mobile Responsive

A big chunk of the website visitors are probably coming through mobile, so it’s super important that the website looks and works great on any mobile device.

Speed

Today, everyone has very little patience. So if it takes more than a few seconds to load a page we might lose potential customers. Simple things like image compression, lazy loading, etc can be very effective to improve speed drastically.

Visual Content

People scroll through the pages in seconds, it’s super important to have enough visual content like images and videos to grab their attention.

Key Takeaways:

- Our messaging on the landing page should be more targeted and simple to understand.

- Improve Trust on our website through customer review, case studies, etc.

- Learn from our competitors on targeting.

- Content language should be optimised for the biggest market (US in our case).

- We should have country specific landing pages for at least our major markets.

Action Plan: We are doing a sprint soon to optimize our landing pages with more targeted content and adding customer reviews + case studies.

We are also going to try Zarget (https://zarget.com) to experiment and improve our website conversions. Thanks for the dinner Arvind! 🍺

Customer Onboarding

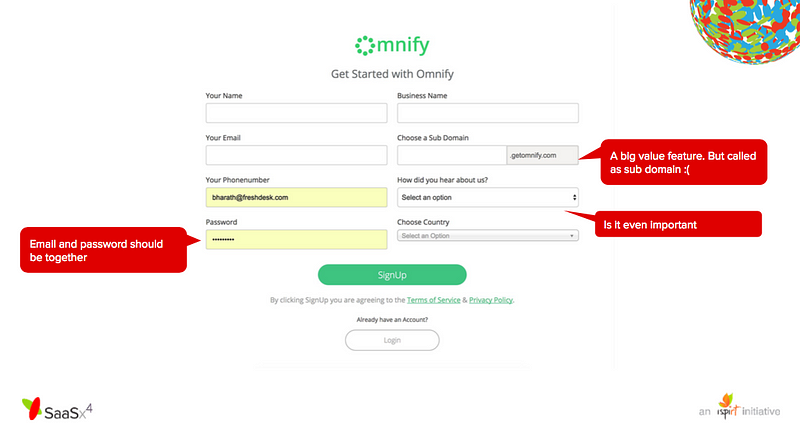

This is where we already knew our funnel is broken and although we have already been working on it, we got good critical feedback and suggestions from Bharath.

Signup

Interestingly, this is one of the most ignored pages for most startups (including us).

Even small things here can increase drop-off or conversion.

In our case, I think we got away with small ux issues as Omnify is a business product and the value of a Free trial outweighs the effort of the signup. But, needless to say we are making it simpler.

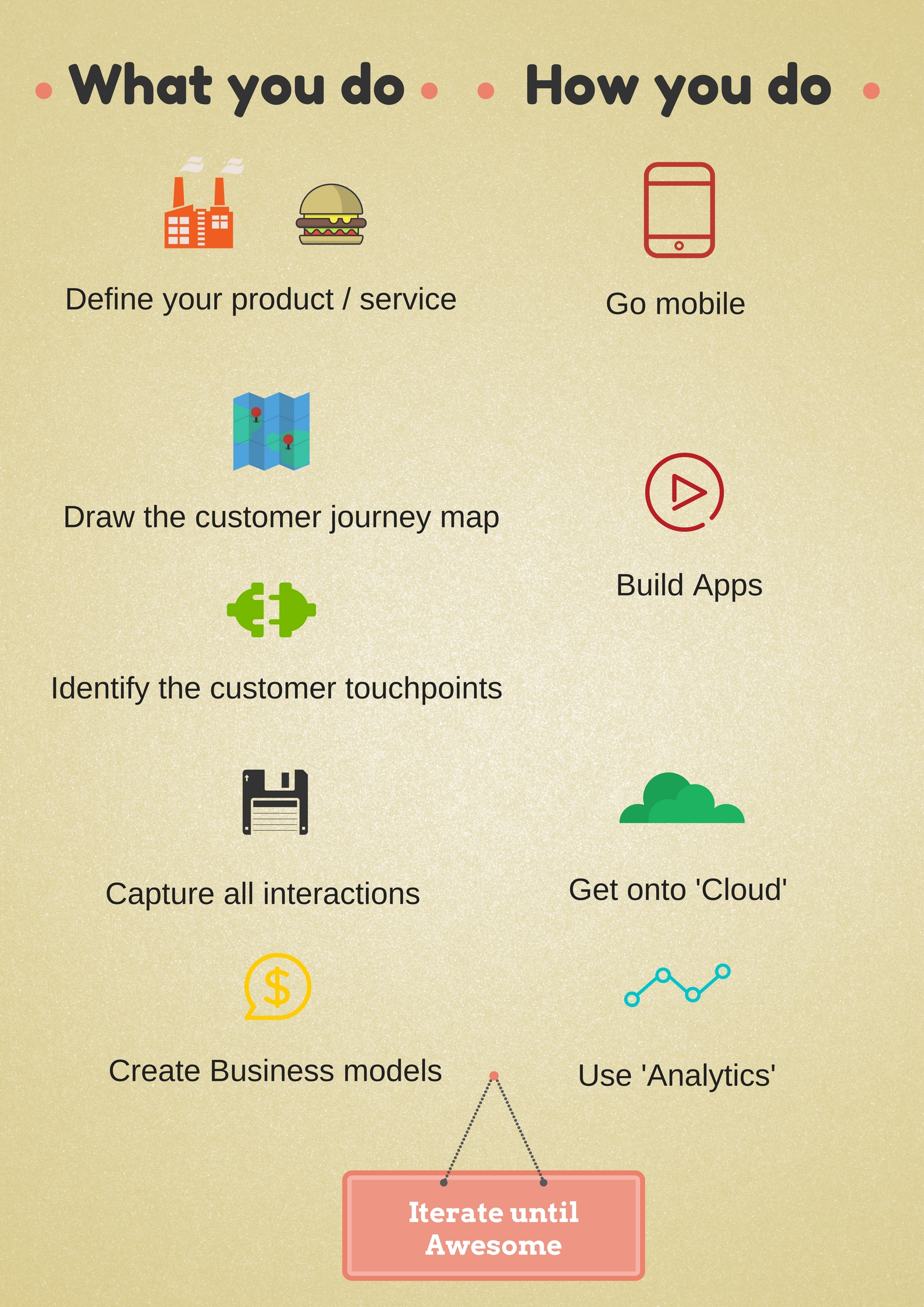

Onboarding & Setup

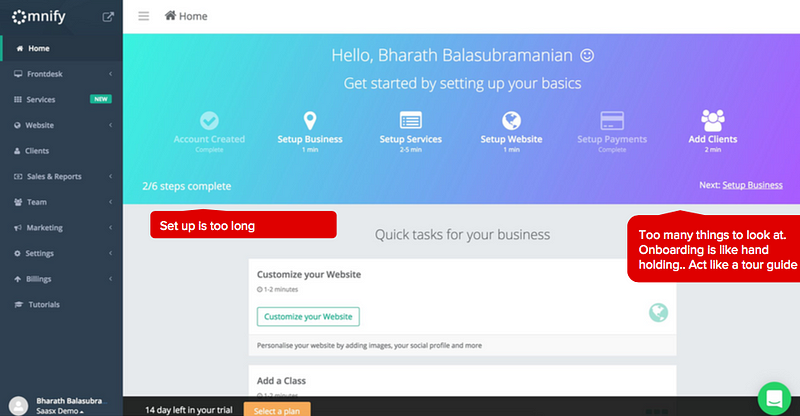

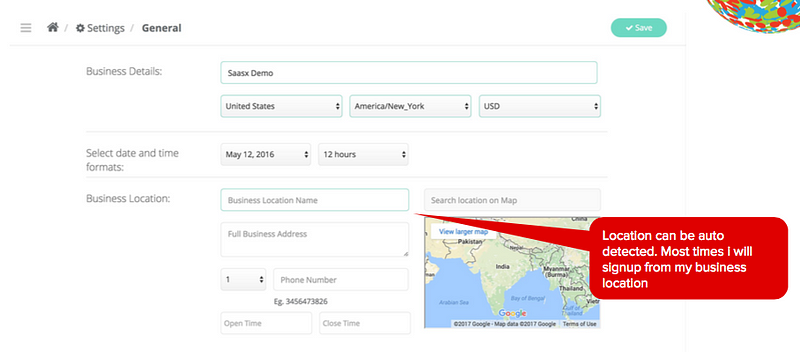

To give more context, our current onboarding process is a wizard that appears on Home page of the Dashboard for new users and stays there until completed. One major issue with this is that once you navigate away from Home there is very little hand-holding.

This is how it works currently:

- Setup Business: Basic information and contact details.

- Setup Services: Comprehensive and a little time consuming.

- Website: Auto-created but valuable only after a few services are setup.

- Attach Payment Gateway: Connect Stripe or Paypal.

- Add/Import Clients

Design Suggestions

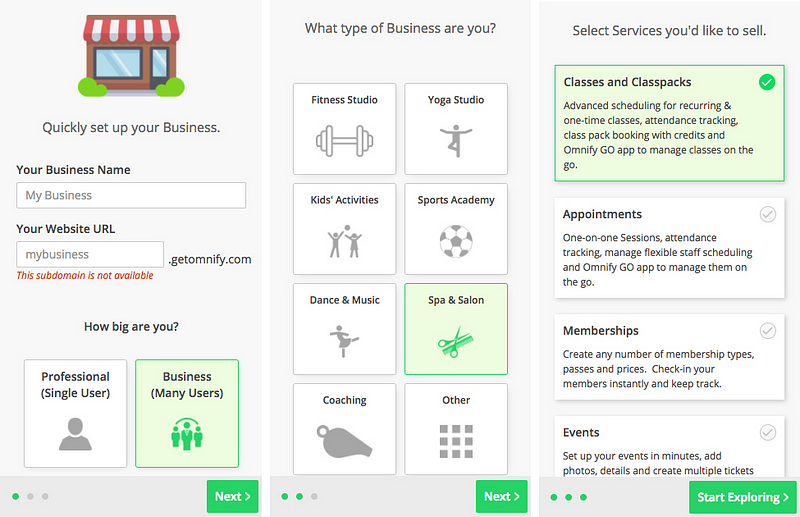

Bharath suggested a simple 2 step onboarding process for Omnify.

Key Takeaways:

- Our Onboarding needs more customer hand holding.

- Setup needs to be simpler or create Website with Sample Services for Instant Gratification.

- Auto-fill wherever we can.

Action Plan:

We believe in fast iteration and are already redesigning our onboarding and setup. I will share a detailed post on our Onboarding redesign later but for now, here is a Sneak peak on what we are upto (Still iterating):

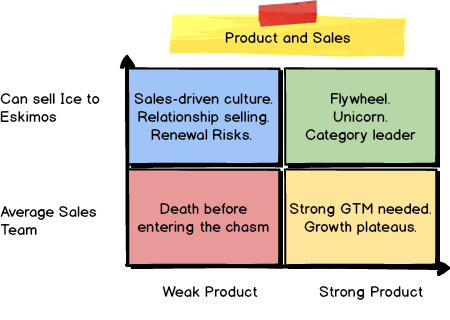

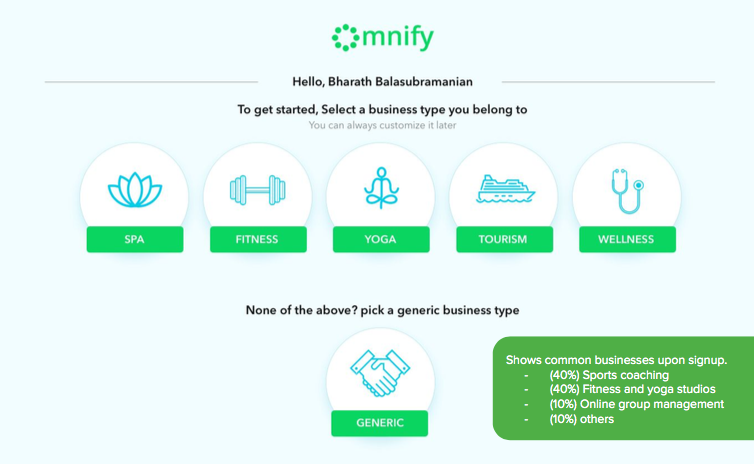

Market and Positioning

Last part of the Teardown was about understanding the target market and our positioning.

There were 3 points that were discussed.

Understanding our Target Customer

Omnify can be used by anyone who provide services and scheduling is an important part of their business. Most prominent segments are fitness, wellness, sports, kids activities and recreation.

Horizontal or Vertical SaaS

This was one of the hot topics at SaaSx and I am hoping for more content on this from the community.

In case of Omnify, we started as a vertical SaaS product but went through a customer discovery process thanks to Inbound Marketing and pivoted to Horizontal SaaS.

Since we didn’t have control over who was signing up, we thought we might as well turn it into an experiment to understand demand and gaps in the market. After working with hundreds of customers across different categories and 50+ countries, we learnt that we are solving a core problem for a wide set of customers who behave very similarly.

Hence, our view of the market changed to horizontal.

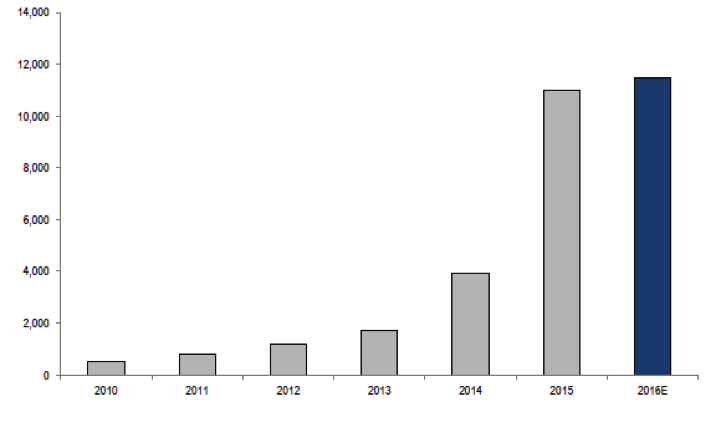

Target Geography

While it’s extremely important to choose the right geography if outbound is the core channel for customer acquisition, businesses like ours who run on Inbound Marketing have an advantage of understanding different geographys at due to lower cost. Saying that, we are currently picking up few key geographies with better volume and conversion rates to put our efforts on.

Key Take-away:

Leveraging existing market segments is easier than creating new segments.

Last words..

Overall, product teardown was a great experience and we would recommend other startups to do both, internal and external teardown of your products regularly. It’s a great tool to find gaps in the product so we can iterate fast and grow faster.

Big shout to Avinash, Avlesh, Bharath, and Shekhar for putting so much effort into the Product Teardown.. taking calls at 8am on a Sunday, spending time going through our product demos, etc. Thanks guys, it was super helpful.

Also, it is truly a pleasure being part of such an amazing community of Entrepreneurs and I would like to thank everyone who worked hard for making SaaSx possible. Already looking forward to the next one.

Keep Hustling..

Manik Mehta

Founder & CEO, Omnify Inc.

Say hi @manik_me

P.S. It was the first SaaSx for my Co-founder, Kabandi and she can’t stop talking about it 🙂