Indix is a SaaS + Big Data product intelligence platform that allows businesses to organize, analyze, visualize and act on the world’s product information in real-time. Indix uses big data analytics and visualization to deliver actionable insights. Indix also offers APIs for developers to build product rich applications. It was founded by former Microsoft VP, Sanjay Parthasarathy, who previously led billion dollar divisions at Microsoft. Other co-founders include Sridhar Venkatesh, Rajesh Muppalla, Satya Kaliki and Jonah Stephen Jeremiah. Indix is backed by prominent angel investors as well as Avalon Ventures and Nexus Ventures.

Introduction

Indix is a platform that intends to be the single complete repository of information about the world’s products that are currently spread all over the Internet.

Consider this scenario: if you are responsible for analyzing price trends of a brand that you manage (say a fast-selling mobile phone) to ensure the market is healthy, you will do one of these two things:

- Search for the product, filter the results that indicate price, and go through the pages, doing this every few days (or hours)

- Identify a few top sites that sell the item and monitor prices on these site, every few days (or hours)

As you can imagine, this can be a very time consuming and inaccurate exercise, and may not leave you with enough time to act on the information you gain, (e.g. Why is Flipkart dropping its price every few days while Tradus does not?).

Using the Indix App for retailers and brands, that is built on top of the Indix product intelligence platform, you can get all these numbers from across the Internet at your fingertips, and get access to insights like price drops, new sellers, etc. This allows you to consume this real-time data and get on to your real job: analyzing price trends across various slices and dices of data.

It is very important to be clear on one point, a point which Sanjay (founder and CEO) emphasized in our interview: Indix is building a platform that provides access to the world’s product information, with all product attributes, in a structured form; the possible ways of using this data are limitless. This Indix App for retailers and brands is just one of the possible uses. A developer ecosystem around the Indix platform will create extremely innovative applications on this platform soon.

The Company

The company was founded to address three problems:

- Offer a good view of the products out there to product managers by providing a comprehensive and structured product repository. Today, searching for products using existing search engines yields unstructured and error-prone results, whereas Indix intends to offer structured information about products of the world to everyone.

- Today, product managers spend most of their time collecting data. Indix aims to reduce this time to next to nothing. This will allow product managers to do the work that is valued most – analyze data and generate insights for their business.

- Enable product awareness of applications, to the point of letting users complete the purchase cycle everywhere a product is mentioned. For example, on whichever page a product is mentioned (say a blog that refers to the recent ad of a deodorant), there can be automatic workflow created by an app (which uses the Indix platform to access details of the product) so that the reader can interact with the product information, get more details and insights, and buy the product from a merchant he likes.

Indix is headquartered in Seattle and has a total team size of 42, with six people based in the Seattle office focused on business development and marketing, and 36 people based in the Chennai office focused on the product development.

It is a startup with a deep engineering focus and great culture. Here are a few things they do to foster a good workspace environment:

- They have an internal app that assigns every engineer a Super Hero status and tracks their attendance at their daily standup.

- They have treasure hunts / bounty hunts that involve the engineering teams taking on coding challenges.

- They have a monitor that screams when a build breaks and in the future, it will have a missile launcher, which will send a missile in the direction of the engineer who broke the build!

The Indix Platform

Indix is a SaaS + Big Data product intelligence platform that gathers product data from Internet, processes it, and makes it available in a structured form. Comparing two products listed on two different websites and figuring out whether these are the same products or not is a very hard problem, and Indix does a great job in product comparison by doing deeper searches and using multiple attributes to compare. They have a few hundred million products (along with rich attributes) collected so far and their target is to have a billion products on their platform.

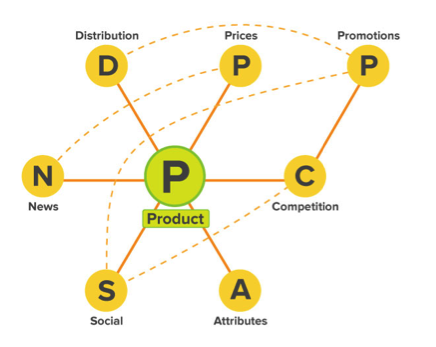

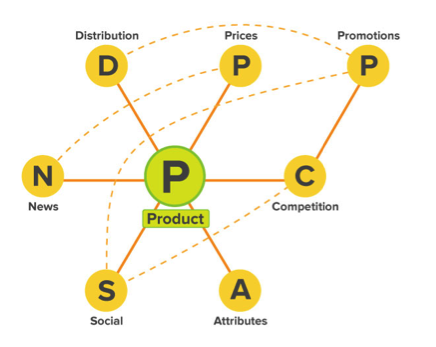

The platform offers access to developers for its data who are then able to build various applications on top of this valuable stream of data. While price is the most important attribute of a product, there are many other attributes which can be interesting to app developers and their users.

Currently, Indix offers two products:

- Indix App for brands and retailers for better and faster market and product analysis.

- Developer API set to access their platform data and build rich applications.

Indix app is priced per user per month, and Developer API access is per company per month.

Indix App

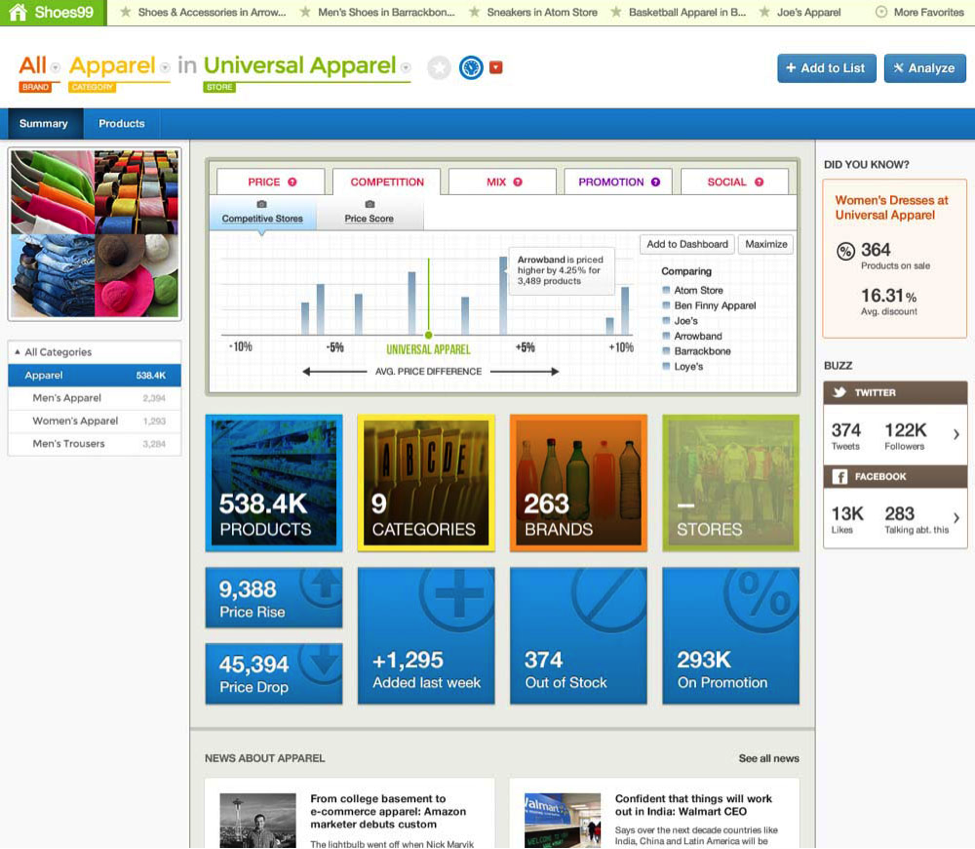

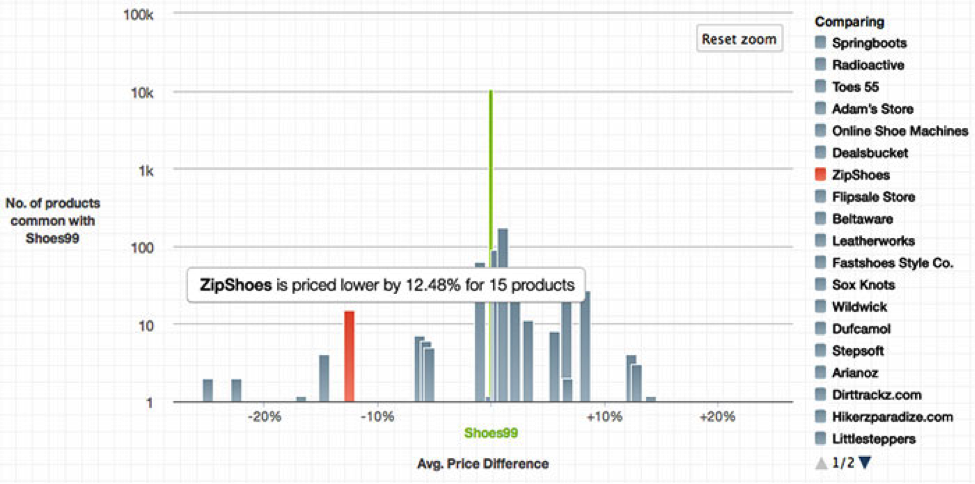

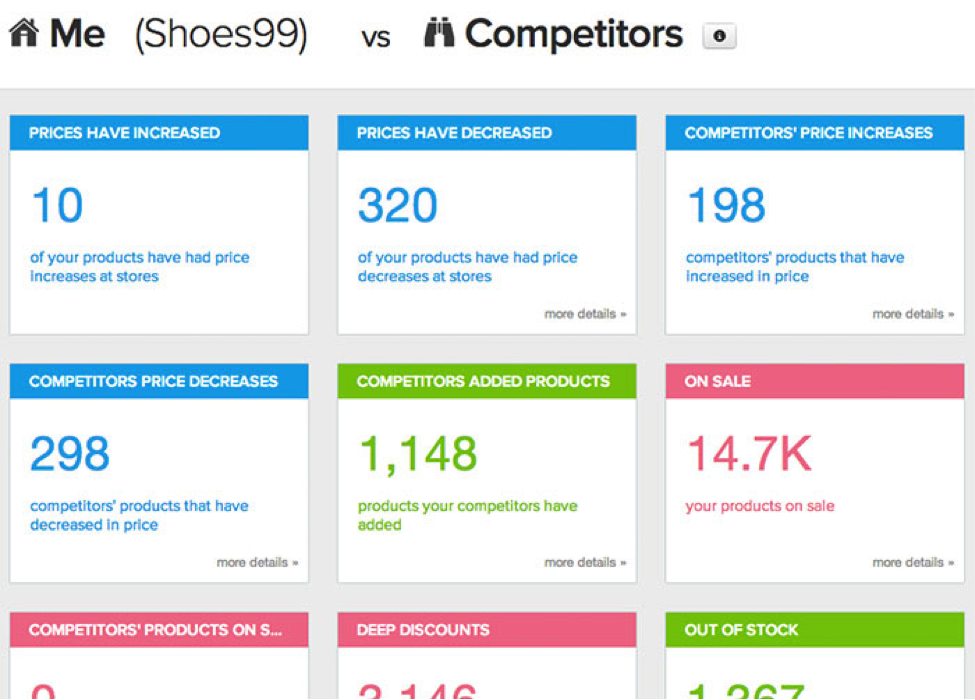

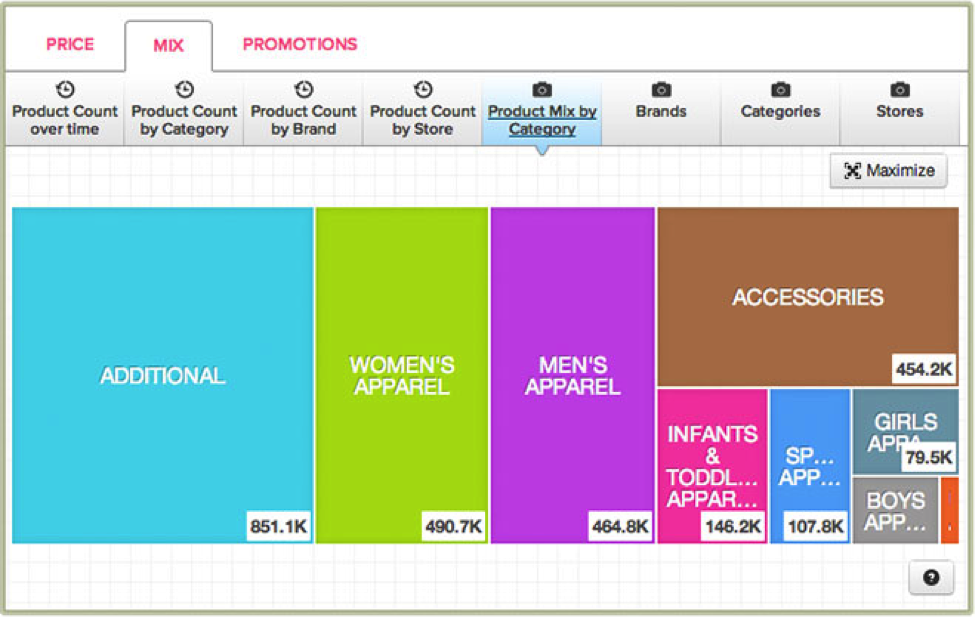

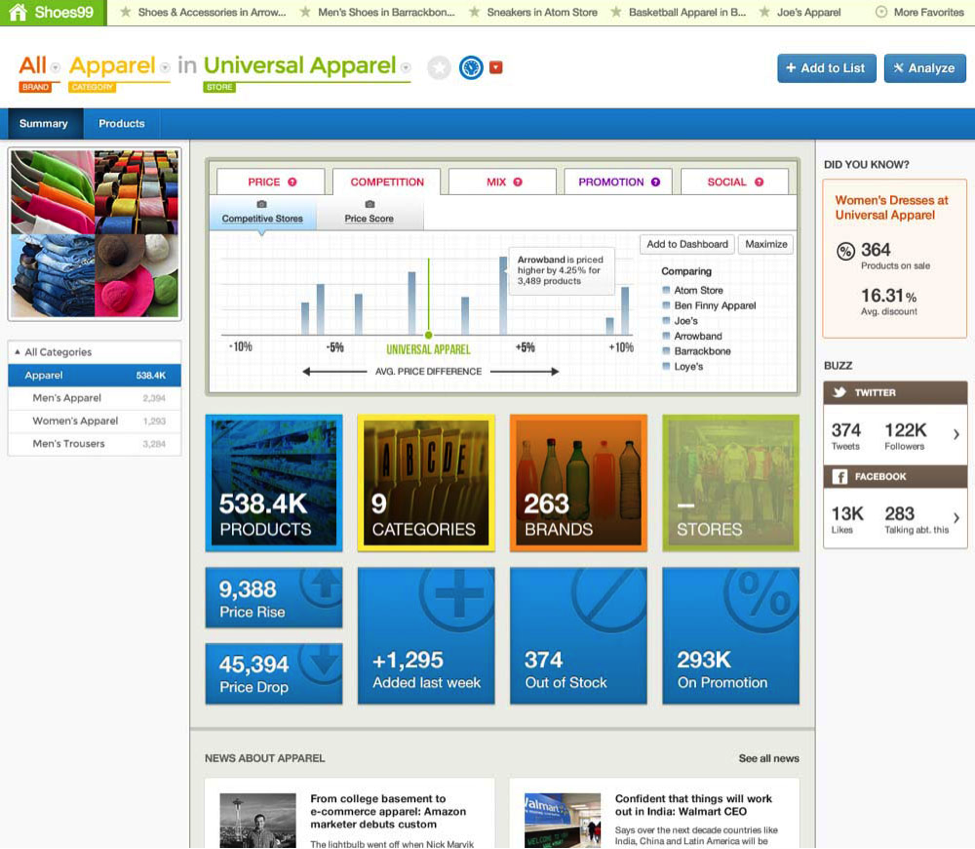

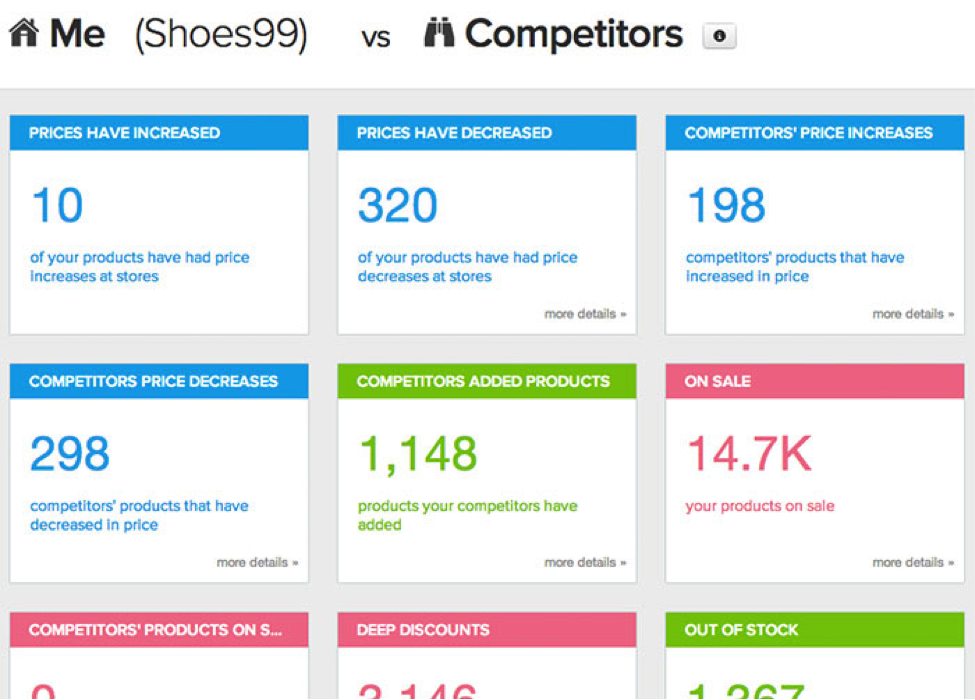

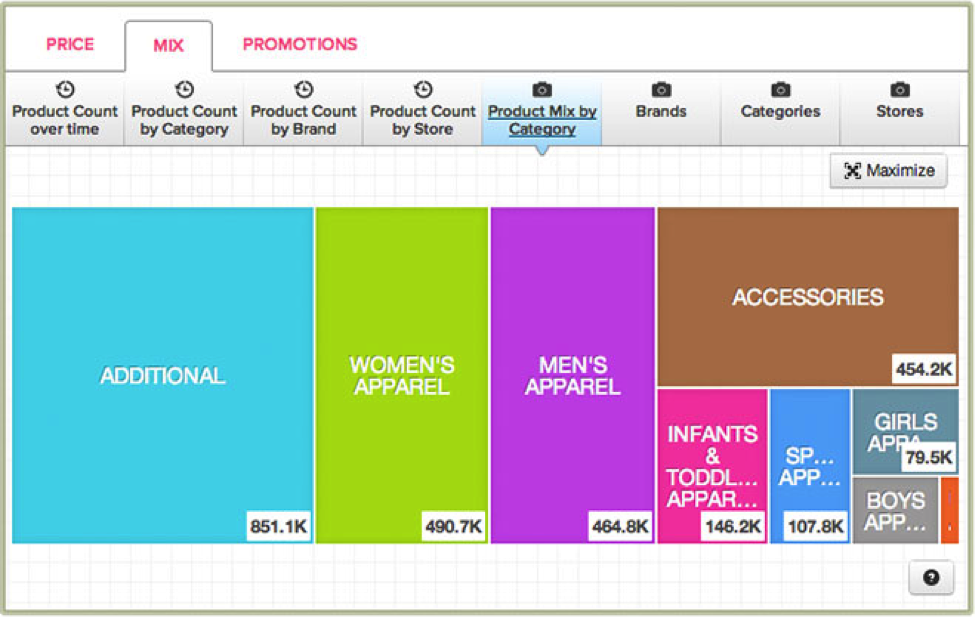

Indix app allows brand managers to explore unlimited product, competitors, and categories; monitor various channels through which the product is being sold; and gain insights on pricing, assortment, and Minimum Advertised Price (MAP), etc.

The way it works is as follows:

- The brand manager logs into the app and selects a few products and categories that (s)he is interested in tracking.

- The brand manager can also select one or more competitors to track.

- Once these are set up, the brand manager can view the dashboard to analyze trends on assortment, prices, promotions, availability, competition, and social news, etc. within selected categories of the products.

- Insights can be obtained through the analysis center. These could be analyses done by the brand manager as well as pre-defined insights thrown in by the app (see screenshots below)

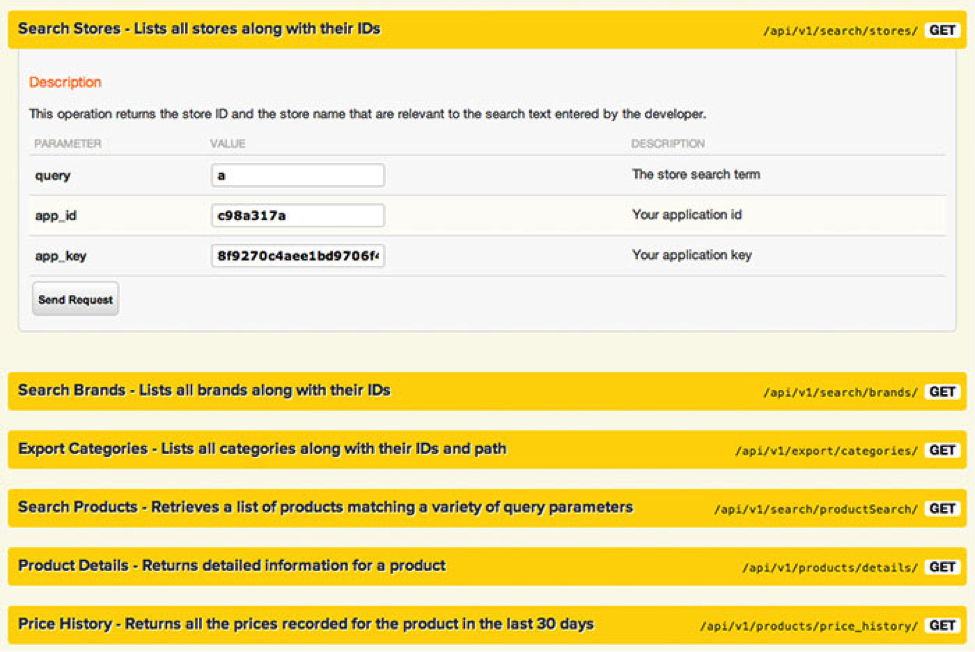

Developer API

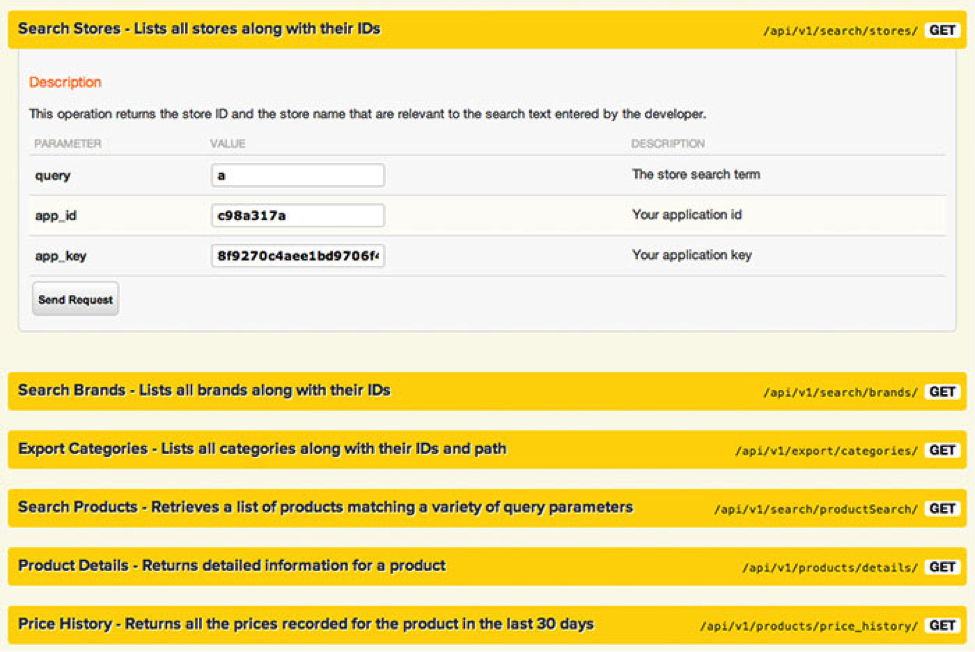

Since Indix is primarily a platform, its value will be best leveraged when outside developers use the data to build rich applications for users and businesses. Developers get access to the large repository of product information, which is easily accessible via RESTFul API that the Indix platform exposes.

Since Indix is primarily a platform, its value will be best leveraged when outside developers use the data to build rich applications for users and businesses. Developers get access to the large repository of product information, which is easily accessible via RESTFul API that the Indix platform exposes.

Differentiators

Differentiators

Here are a few USPs of Indix that are worth noting:

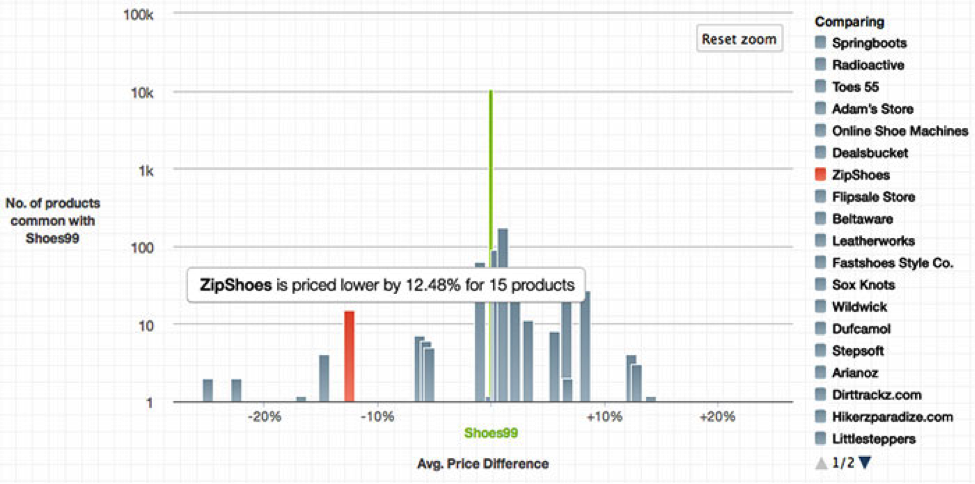

- Intuitive and visual interface – The Indix app is very user-friendly and designed to be intuitive, with customer use-cases in mind. It provides insights on pricing, assortment, markdown, availability, categories, and competition in real-time in a highly visual fashion; making it easier and faster for product managers to make data-driven decisions.

- Scale – They have tens of millions products and billions of price points and other product related information. There is no limit on the number of categories, prices, or competitor’s products you can track.

- Data quality – Their data is highly robust and accurate, thanks to their deep expertise in big data and analytics. They continue to improve their matching algorithm to do deeper comparisons (compare multiple attributes before declaring products the same).

- Customer Service – They have integrated help and feedback systems within their product and are very focused on providing an outstanding customer support service. If their testimonials are anything to go by, they have many happy customers.

Market and Roadmap

This is a big market that Indix is operating in. Currently, their product is targeted at pricing analysts, brand managers, category/merchandising managers, and others involved with product information at brands and retailers, broadly referred to as product managers. There are millions of product managers in the US alone.

This is a hard problem to solve, and there aren’t many companies building product intelligence platform at this scale. Some companies have worked in category-specific or attribute-specific (like price) product data space, but not in a category-agnostic way Indix is doing it – Black Locus (acquired by Home Depot), decide.com (acquired by eBay), and Kosmix (acquired by Wal-Mart). So this is an interesting space for them to be in.

Over the next 6-12 months, their priority is to sign-up additional customers, incorporate their feedback, invest in marketing, and achieve an even bigger scale for product data in their platform. There are more than 1 billion products and services on the Internet. Today, the Indix platform has tens of millions of products, billions of price points, and other product related information, and they continue to add new products. They mentioned that the next 6-12 months are crucial towards realizing their vision of organizing, analyzing, and visualizing the world’s product information and making it accessible and actionable in real time.

They also continue to work on refining and improving their API set based on feedback.

The Road Ahead

As Sanjay writes in their launch post,

“In the future, all applications will be product-aware, just as applications today are people and location aware. The same way Facebook connects you with people and Foursquare connects you with places, Indix can help connect you with products.”

It is a very powerful vision that Indix is running with. They are enabling this by

“..[doing] the hard work of finding, understanding, categorizing, normalizing, matching and, in general, structuring the vast amount of product-related information on the Internet. Our ultimate goal is to provide a view of the Internet through the product lens”.

This is a tough and inspiring challenge for the company, to organize the world’s product information. However, the impact this can have is equally inspiring and this is what is driving the company forward.

Sanjay ran billion dollar businesses at Microsoft, and this one surely is headed in that direction.

Sanjay’s Advice to Startups

- To get a billion dollar idea, you need to work on very hard, almost impossible problems. What we are working on at Indix is very hard, and it is inspiring.

- Build a strong culture and pour your soul into it. Everyone has a personality, whether writing code, doing design, managing HR – their work should reflect their personality.

- Hire great people whom you can trust.

- Create a healthy balance between what you think is right (vision and mission) and what customers want; don’t go overboard on one side or the other. We talked to 100 people (not only customers) before we built a line of code, to learn from them. Started coding in Jan 2012, did 7 versions, threw away the first 6. We built for about 6 months (3-4 prototypes), and only then started talking to customers, as guidelines and not as requirements. Only when the product was fleshed out in some detail (alpha release) did we start looking at what customers wanted, and after beta, started taking feature requests.

- I don’t believe in Minimum Viable Product (MVP) – critical mass of product is more important, at least in the enterprise space. I had the luxury to do so since I had funding, but it is an important point to think about.

- If you build for the US, one of the cofounders must have had significant experience living in the US, or one of the co-founders should move.

The criteria for the first phase of shortlisting were as follows:

The criteria for the first phase of shortlisting were as follows: