Product pricing is a touchy feely subject, hence the following disclaimers for I get into it…

- There is NO one-size-fit-all solution to your pricing problem.

- Don’t look for a one time silver bullet for product pricing.

- Pricing varies drastically between verticals, products, company stage, etc.

- This article is meant to give thought frame work around pricing and not a meant to be a perfect solution to your product-pricing problem

- Hence read this article and make it your own for addressing your product-pricing needs…

Getting the product price right is one of those ever elusive goals that almost all product companies are after. Companies undertake product-pricing activity for many different reasons, for example:

- New product introduction

- Updates to existing product

- Changes to sales / revenue targets

- Changes to product costing

- Changes to competitive landscape

Just like other product related activities such as product management, product development, support, etc., product-pricing activity should also be given its due time, resources and priority. Without thorough data driven process companies will find themselves not convinced about product pricing and end up going to square one again.

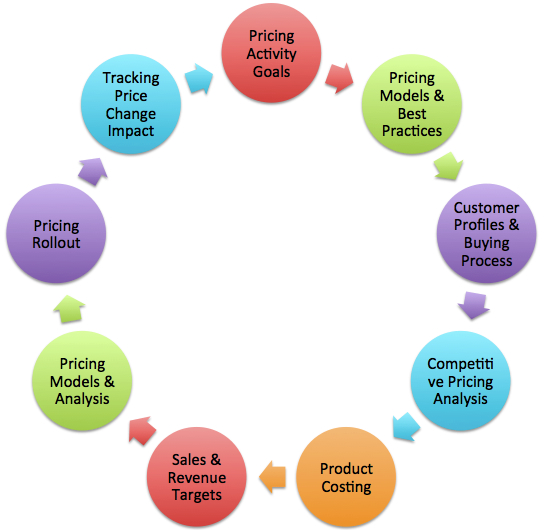

Hence before beginning on the product-pricing endeavor, here are some of the steps that companies should think about.

Again, a word of caution before I delve into various aspects of the framework given below… this is a simple framework, and companies should pick up the pieces that are applicable to them, as opposed to strictly following the process. I’m not a believer in blindly following any framework and neither do I promote it. I encourage companies to study various frameworks and then pick the one that they believe will benefit the most for their specific situation and then look into the application of it. I recommend that companies should not look for silver bullet or ‘one size fits all’ approach cause there is none!

Having said that, the first step in product-pricing exercise is to really nail down the reason for undertaking the exercise. Instead of CEO, Business head, Sales head initiating the conversation, it’s recommended that once a quarter there should be a pricing check point. There are a couple of benefits of doing that:

- Sales head can provide you with the market pulse on the manner in which competitors are positioning pricing and customer input on pricing

- Product Marketing Manager can share insights on changes in competitive pricing.

- As a team, companies can determine the circumstances under which pricing needs to be looked into on emergency basis. For example recently airlines suddenly started cutting their ticket prices, telecom operators slashed priced of Internet usage, etc.

- Identify any data collection tools that need to put in place or updated so that right data is collected on ongoing basis so that it can be used for objective decision making.

The discipline of having these conversations periodically helps companies keep an eye out for any ecosystem changes that might force them to think about changes to product pricing. In case the company has multiple products or product lines that are related to each other, then it becomes even more imperative to have these periodic checks. Through these meetings companies should be able to nail down if product-pricing changes are required and if, yes, what are the reasons for those.

It always helps to keep track of various industry best practices around pricing. This is an ongoing exercise. It helps you in understanding the following:

- Industry rules and regulations specific to the industry vertical that company operates in. For example recently SpiceJet was pulled aside by government for selling tickets for Rs. 1

- Accepted pricing norms in the industry.

- Who pays for what?

- Acceptable price range

- Things that can be included or excluded from pricing perspective

- Pricing transparency norms, etc.

- Pricing models that customer / consumers are familiar with and can relate to.

The idea here is to get pulse of the eco system and understand what’s working and what’s not.

Know thy Customers! Understanding your customers purchase psyche is extremely crucial. You should know atleast the following things about your customers:

- Customer’s perception about value of the product category

- Is it a must have or a nice to have?

- Buying process: The end-to-end process that Customers go through as part of product purchase.

- How are budgets approved?

- Who is the buyer?

- Who is the approver or approvers?

- How do customers compare products?

- How do they use the product?

- Which features matter to them the most?

- How long is the buying process?

- How far in advance do customers plan the purchase?

- Payment recovery once the product is sold

- Objections raised by Customers in the buying process

- Customer segmentation: All Customers are not born equal. Broadly customers can be grouped into various categories. This categorization or segmentation can help in creating pricing models based on Customer’s ability to pay for and use the product. For example:

- Volume (High / Medium / Low)

- Global (Users from multiple geos using product)

- Number of users (High / Medium / Low)

- Bargain hunters

- Smart cookies

Each of these segments should be studied in-depth so that product offering and pricing can be tailored to them.

- Data capture: Customer segmentation can be done successfully only if data is related to customers is captured by Sales, Support, Marketing and product teams. Without this data, Companies may be flying blind and not know what’s working for them and what’s not. Typically, the longer time window data companies have to work with the better it is. In case, the of new product release, this may not be possible, but then put the systems in place from day one so that the data is captured from the get go. Companies can use CRM systems, home grown systems, etc., but they must use some system. Otherwise the data is lost in emails and permanently lost when folks move on from organization.

Then comes the Competition, the ever changing and ever present force that impacts various aspects of your business, including pricing. In order to consider competitive impact, Companies’ should first know the following:

- Who is the core competition?

- Competitions’ geo presence

- Who is the secondary competition and beyond that?

- What pricing models do they have?

- How big is their product adoption?

- Feature comparison

- How long have they been around?

- Pricing model presentation

- How often does the competition shows up sales scenarios?

The key here is to really use the competitive information to figure out the real threat that the competition poses in Company’s grown strategy.

Companies should really have handle on the product costing. Many companies in the B2C space create product and put it out there based on the way their competition is pricing the product. They assume that the pricing is such that they will be profitable anyways after a while. But this approach is suicidal! Because companies then one day suddenly realize that despite of high product sales volume, they don’t have a lot of margin and to be really profitable, they would drastically need to change the pricing or increase sales or cut costs. A number of books have been written on product costing and it’s recommended that Companies should work with certified cost accountant for getting a handle on their product costing.

Product pricing is also a function on Sales and revenue targets. This is part of the top down approach of product pricing. A company can decide that they have to reach a certain revenue goal and work backwards from there to come up with an approximate price of the product. At this point they may realize that they have to price the product much higher that what the market is ready for or the other way round. In either case, the Sales team needs to be always involved in the pricing conversation, so that they can bring their market knowledge to the table. At the same time it’s necessary to note that they don’t use pricing as the reason for not being able to reach their sales target.

Pricing Models and Analysis is the most fun part of the product pricing exercise. This is where all the data that has been gathered internally as well as from external market is used for determine product pricing. Here are some steps that should be taking as companies try to come up with pricing model:

- Identifying the key-pricing drivers:

- By users (Customer Types)

- By organization

- By product units

- By transactions

- By functionality

There can be many more. Ensure that pricing is in line with the value the Customer is getting out of it.

- Impact analysis: Every time changes to pricing / pricing model are suggested, impact on the following should be taken into consideration before rolling out pricing:

- Existing customers (to grandfather or not)

- Sales and support process

- Revenue and Sales target

- Profitability

- Product buying experience

- Acquisition of new customers

- Product Management

- Product Marketing

- Product Engineering

- Billing related changes

- Pricing models: When coming up with product-pricing models, ensure the following:

- Easy to understand

- Easy to explain

- Easy to pay (annual payment option)

- Relates price to value (value driven)

- Room for Sales to provide discounts (introductory offer, seasonal discount, regular client discount, one time annual payment discount, etc.)

- Enables differentiation (charging for unique value as opposed to commodity)

- Has low barrier to entry of first time users (freemium)

- Has options for attracting large prospects (future customers)

Note: Void the word ‘unlimited’ in the pricing model wherever possible. Incase ‘unlimited’ word is being used, then should be explained in the terms and conditions.

- Scenarios modeling are very critical to really understand the impact of pricing and pricing models. To do this, take existing customers and future customers and find out before and after impact. For example with current pricing Customer was paying X with new pricing customer will pay Y. Create real looking pricing page, rate sheets to understand the visual impact. Perform this activity for every customer segment and analyze the impact. Be especially sensitive about the impact on the customer segment from which the company is making large revenues. If this segment is adversely getting impacted then, the new pricing might have over all negative impact on the revenue.

Pricing roll out is equally, if not more as, crucial as the pricing model itself. A lot of internal and external training needs to happen before new pricing can be rolled out. Consider the following as part of new pricing roll out preparedness:

- Overall roll out plan with departmental ownership. Timing of rolling out of pricing changes is critical. Make sure that it’s not in or just before the time when you get the most orders (busy season, if there’s one for Company’s business). There is enough time to explain changes as necessary to the high value customers.

- Marketing:

- Website

- FAQ

- Pricing collateral

- Checkout process (if there is one used for online purchase)

- Video (why is the change being made and how it impacts you – the customer)

- A-B testing readiness

- Product:

- Incase there are features that need to be added to ensure correct pricing

- Sales and Support:

- Updating sales and support process

- Training sales and support team

- FAQ (internal and external)

- Special process for High Value customers

- Process for breaking the news

- Phone

- In-person

5. Setting benchmarks: It is essential to capture benchmarks before rolling out new pricing, so that impact of pricing can be checked objectively. Here are some of the benchmarks to that can be captured:

- Lead Generation benchmark

-

- Number of leads / week / geo

- Average deal size by vertical

- Type of leads (lead mix)

- Lead sources

6. Sales and Support Cycle benchmark

- Time to close deals

- Competitive references during price negotiations

- Number of price discussions when closing deals

- Feature usage by customers

- Number and type of support queries

7. Revenue and process benchmarks

- Revenue by Geo and by Vertical

- Revenue by Customer segment

- Changes to customer segment mix

Once the pricing is rolled out, either to pilot group, or to everyone, the impact of pricing must be tracked. There are a number of ways to track impact:

- Collect the KPIs and compare them against the benchmark

- Get on call / emails with customers to get their reaction

- Use the data from A-B testing to track change in customer behavior

- Take corrective measure as necessary

- Keep track of macro-economic changes as well, which may coincide with pricing rollout.

So before you take on the pricing exercise, ensure you the have time and resources to do justice to it…

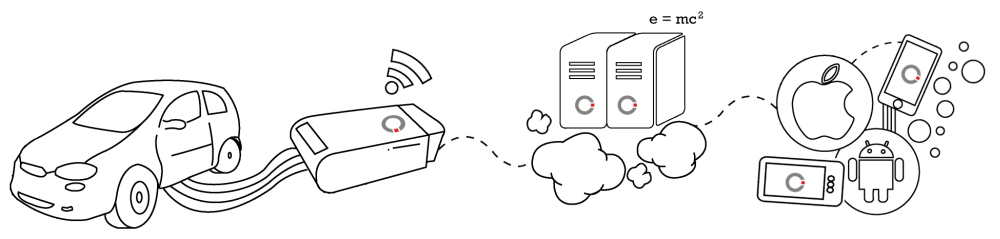

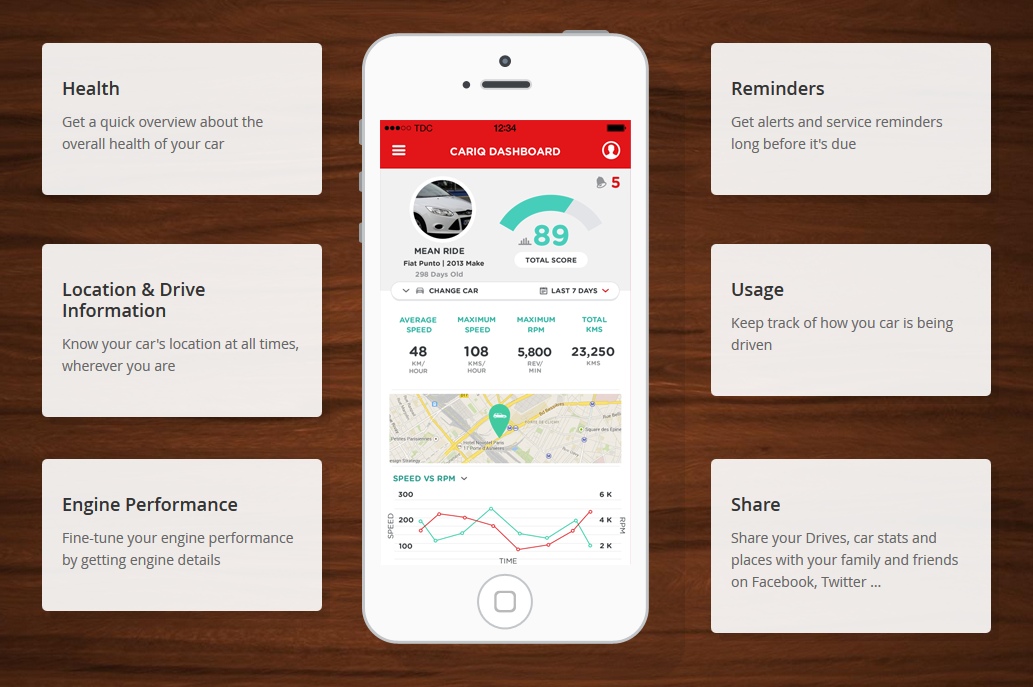

It was the experience of my purchase of Hyundai i20 a few years ago, which made me aware of an acute problem. When I made the purchase, I knew what car, make, and model I wanted to buy. I knew what mileage to expect, I read reviews, and before I went to the dealer, the decision was already made. There was so much information available to help me buy. But I was not ready for what happened after the purchase. I had to set manual service reminders, I was not aware whether my car was performing as expected. I was apprehensive when I left my new ride parked for hours at open parking places. I just wished, – what if my car was a smart car and managed this for me? Wouldn’t it be cool, if my car could detect problems, remind me of service alerts, or tell me its location even if I was not in the car. That lead me to first investigate mechanical add-on to get this data until I realised that cars have computers, and those computers can talk. I can get data on performance, condition, and even potential unseen problems. That was it. I knew I had to harness this data to convert into meaningful insights.

It was the experience of my purchase of Hyundai i20 a few years ago, which made me aware of an acute problem. When I made the purchase, I knew what car, make, and model I wanted to buy. I knew what mileage to expect, I read reviews, and before I went to the dealer, the decision was already made. There was so much information available to help me buy. But I was not ready for what happened after the purchase. I had to set manual service reminders, I was not aware whether my car was performing as expected. I was apprehensive when I left my new ride parked for hours at open parking places. I just wished, – what if my car was a smart car and managed this for me? Wouldn’t it be cool, if my car could detect problems, remind me of service alerts, or tell me its location even if I was not in the car. That lead me to first investigate mechanical add-on to get this data until I realised that cars have computers, and those computers can talk. I can get data on performance, condition, and even potential unseen problems. That was it. I knew I had to harness this data to convert into meaningful insights.