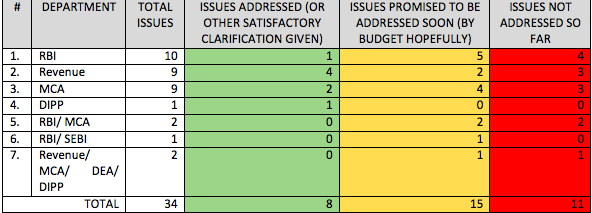

Over the past few months, we have witnessed a number of policy changes focused on creating a conducive environment for startups and entrepreneurship in India. Some changes go beyond the startup ecosystem and attempt to resolve the issues faced by companies/investors in general. A common feature in most such changes is iSPIRT’s Stay-in-India Checklist (SIIC). The SIIC comprises 34 issues, which were extracted from a larger list of 120+ issues, put together by the iSPIRT team after extensive consultation with various stakeholders.

With the 29th June notification of the MCA amending the Deposit Rules, a total of 29 SIIC issues have been addresses/acknowledged by various government departments. Some of the key changes that have taken place pursuant to SIIC are as follows:

- Angel tax: Monies received by a company from certain resident investors (including angel investors) which are in excess of the fair market value of shares issued against such monies, are taxed as income in the hands of such company. This leads to significant hurdles in domestic angel investments (other popular modes of investments are exempted from this tax). Now, startups that are approved by the inter-ministerial board formed by DIPP (“Approved Startups”) have been exempted from this requirement.

- Harmonisation of tax policy for listed and unlisted equity instruments: There is unnecessary disparity between holding periods for listed and unlisted shares for claiming long term capital gains benefit in relation to them. While the holding period for listed shares is only 12 months, for unlisted shares, it was 36 months. This, despite the fact that investment in unlisted shares, such as those of startups, carry higher risk. Now, this period has been reduced to 24 months. This relaxation is available to all companies, irrespective of them being startups.

- Favourable tax regime for IPR: In the past several years, India has experienced that the ownership of IPR created in India does not reside in India, as tax regime for IPR in other jurisdictions is more favourable. Now, income by way of royalty in respect of a patent developed and registered in India will be taxed at 10%. This relaxation is available to all companies, irrespective of them being startups.

- Convertible notes: One of the most popular instruments abroad for startups to raise early stage funds, convertible note, is not expressly recognised in India, and could be considered to be a form of ‘deposit’ which can be taken by a company only from its existing shareholders/ directors. Now, convertible notes of up to INR 25 lakhs per person have been permitted for startups that have registered on the StartupIndia portal (“Registered Startups”).

- Indemnity escrows and deferred consideration: In FDI transactions, use of escrow mechanisms for indemnity arrangements and payment of deferred consideration required prior approval of the RBI. This created significant hurdles in acquisition of Indian companies by non-residents (since these terms are standard in acquisition transactions globally, and all acquires expected them in Indian acquisitions as well). Now, these mechanisms have been permitted for a period of up to 18 months and for an amount of up to 25% of the consideration under the automatic route (without the prior approval of the RBI). This relaxation is available to all companies, irrespective of them being startups.

- Transfer from FVCI to non-resident: There is uncertainty around the transfer of shares of an Indian company by an FVCI entity to a non-resident entity. While certain custodians allow such a transfer without an approval of the RBI, other custodians require prior approval of the RBI before proceeding with such transfer. Although there is no specific regulation that requires FVCI entities to obtain prior approval of the RBI for such transfers, given the aforesaid difference of opinion among custodian (which results in delays in M&A transactions), there was a need for the RBI to clarify this issue. Now, Registered Startups have been exempted from this requirement.

- Restriction on FVCIs from investing in all sectors: Foreign venture capital investors (FVCIs) are permitted to invest in only certain specified sectors. This is largely owing to the list of permitted sectors set out in registration certificates issued by authorities to FVCIs. Now, FVCIs are permitted to invest in all Registered Startups, regardless of the sectors they have been engaged in.

In addition to the above, the following issues have also been recognised by various government departments. The changes to resolve these issues have either been notified, or have been announced to be notified in due course:

- Collection of foreign monies by residents in India on behalf of non-residents

- Online filing of forms for cross border transactions

- Simplification of incorporation process

- Share swaps in FDI transactions

- Venture debt not be categorised as deposits

- Acquisition of overseas company with an existing subsidiary in India

- Foreign subsidiaries of Indian companies investing back into India

- Relaxation of external commercial borrowing guidelines for startups

- Simplifying process of conversion of LLP into a company

- Exclusion of private companies from the term ‘listed company’

- Grant of ESOPs to promoters and independent directors

- Single window agency for closure of failed startups

- Permitting outbound mergers

- Simplifying the process of private placement

- Applicability of provisions relating to insider trading on private companies

As one would note, a significant number of material issues have either been addressed or are in advanced stage of being addressed. iSPIRT continues to interact with the government to get further relaxations on these issues, as some relaxations are restricted only to Approved Startups or Recognised Startup, or are simply limited in scope. iSPIRT also continues to push for resolution of other issues which have either not been addressed so far or are new and have not been covered in SIIC.

The policy changes announced by RBI are as follows:

The policy changes announced by RBI are as follows: Lastly, while the RBI has positively stated that it will notify certain changes soon, all of MCA issues and a majority of RBI issues are still at a ‘discussion/recommendation stage’ (and have been merely acknowledged by the authorities as issues that need to be resolved). Hopefully, the authorities will not stop here, and will implement all these changes soon. Needless to add, iSPIRT will keep interacting with, and assisting, the authorities in achieving a quick closure to these items, as well as the remaining issues which have not yet been touched by the authorities.

Lastly, while the RBI has positively stated that it will notify certain changes soon, all of MCA issues and a majority of RBI issues are still at a ‘discussion/recommendation stage’ (and have been merely acknowledged by the authorities as issues that need to be resolved). Hopefully, the authorities will not stop here, and will implement all these changes soon. Needless to add, iSPIRT will keep interacting with, and assisting, the authorities in achieving a quick closure to these items, as well as the remaining issues which have not yet been touched by the authorities.

What are some of the learning’s from this effort?

What are some of the learning’s from this effort?