When a capsule is launched into space, the initial rocket gets it off the ground. However, that rocket can only get it so high. Eventually it runs out of fuel and the structure needs to drop off. At that time, a second rocket booster ignites and continues to propel the capsule into space.

In the world of startups, getting your company into orbit usually takes a few power boosters to get there. Your initial boost may get you off the ground, but it’s not enough to get into space. Even if you are at a later stage, if you don’t have the right final rocket, you can still crash to the ground before you reach orbit.

iSPIRT offers several activities to help SaaS founders and companies right when they need it. Each of these sessions acts like a multiple-stage power booster to give your company the lift exactly when you need it.

Most SaaS companies need these three rocket boosters to achieve orbit:

- Stage 1: Product Tear Down

- Stage 2: Getting to $100K MRR (i.e. approx $1M ARR )

- Stage 3: Hyper Growth – Firing all cylinders

In the product tear down session, founders get critical feedback. This is not for the weak hearted.😜

Stage 1: Product Tear Down

In this session, we help validate

- The core problem you are addressing

- Your differentiated solution to that problem

- How customers might discover you

- The consistency of your website and overall offering (audience, problem, position, price, credibility, etc.)

- Freemium vs free trial, simplicity to signup, signup friction

- The ‘shortest path to WOW’ that is appropriate for your product

The product tear down session is run by Shekhar Kirani, Venture Partner from Accel Partners, Suresh Sambandam, CEO of KiSSFLOW, and Bharath Balasubramanian, UX Architect from FreshDesk.

Here’s a bit about each of these sessions. While the principles will apply to any business, it applies much more aptly to SaaS software companies

Here’s a bit about each of these sessions. While the principles will apply to any business, it applies much more aptly to SaaS software companies

Stage 2: Getting to $100K MRR

Your Stage 1 rocket should be enough to get you off the ground and achieve a good height with your initial set of customers. Now you have a working hypothesis that puts you in pursuit of the right product-market fit.

Your Stage 2 session kicks in when you’ve found the product-market fit to systematically grow the business. For companies at this stage, we moderate Playbook Roundtable sessions. This slide deck should give you a broad idea of what we discuss with the playbook participants.

Your Stage 2 session kicks in when you’ve found the product-market fit to systematically grow the business. For companies at this stage, we moderate Playbook Roundtable sessions. This slide deck should give you a broad idea of what we discuss with the playbook participants.

Stage 3: Hyper Growth – Firing All Cylinders

Companies that have crossed $1M ARR are selected to attend this session. A typical SaaS company doesn’t have enough resources to pursue a lot of initiatives. Often there is a big disconnect between what founders want to pursue in S&M viz-a-viz what they should focus on to get to the first $1M as quick as possible. Therefore, Stage 2 centers around a focused set of must-do initiatives, rather than spray-and-pray on many initiatives. You might notice that many topics in Sales & Marketing are missing or discouraged in the slide deck. That is by design.

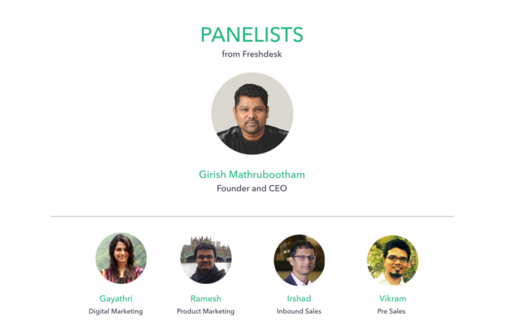

Stage 3 is extremely important because even though you’ve cleared thousands of miles, you still aren’t in orbit yet and need the final power booster to get there. For Stage 3, we bring you none other than the SaaS Superstar, Girish, Founder & CEO of FreshDesk, to share how to take your $1M SaaS company into a $5m enterprise.

Stage 3 is extremely important because even though you’ve cleared thousands of miles, you still aren’t in orbit yet and need the final power booster to get there. For Stage 3, we bring you none other than the SaaS Superstar, Girish, Founder & CEO of FreshDesk, to share how to take your $1M SaaS company into a $5m enterprise.

If your SaaS startup is sitting on the ground or about to make a nose dive, don’t miss out in getting these booster shots to launch yourself into a grand orbit.

Oh, we also do a big gala event called SaaSx once in 6 months in Chennai, where we bring together all the SaaS founders in one place. The last three editions (SaaSx1, SaaSx2, and SaaSx3) have been blockbuster hits. And if you are in Bangalore, you can join the big crowd attending the SaaSx sessions on ‘SaaSy Bus’.

If you are a member of a SaaS founding team, you should definitely join the SaaS Insider Group and be up to date with SaaS news in the country and across the globe. Last but not the least, Avinash Raghava, Fellow at iSPIRT is the common thread among all these orchestrated activities for SaaS from iSPIRT. He is passionate about helping SaaS founders and none of this would be possible without him.

If you are a member of a SaaS founding team, you should definitely join the SaaS Insider Group and be up to date with SaaS news in the country and across the globe. Last but not the least, Avinash Raghava, Fellow at iSPIRT is the common thread among all these orchestrated activities for SaaS from iSPIRT. He is passionate about helping SaaS founders and none of this would be possible without him.

P.S. iSPIRT harnessed the collective knowledge of SaaS founders into a structured document called the Jump Start Guide for Desk Marketing and Selling. Check this out without fail.

To understand the challenges mentioned above and gain insight into the current SaaS landscape,

To understand the challenges mentioned above and gain insight into the current SaaS landscape,