Vivek from iCreate facilitated yet another juicy round table with lessons learnt ‘from the trenches’. While this article provides a distilled summary, it cannot do justice to in-person learning. I strongly encourage you to attend the next iSPIRT round table.

Vivek started off by saying that there is no silver bullet. Every product exists in its specific market conditions. Different things work for different products in different domains. Nevertheless, there are certain fundamental themes that are commonly applicable.

The fundamental problem typically during the early days of a startup is lack of clarity of what are we solving and for whom (in other words – “Product-Market fit”). Articulating this clearly is the first thing a startup needs to get right.

Spend some time answering the two questions below and ensure that all of your team is on the same page. Otherwise, it will be like the classic story of six blind men describing an elephant in completely different ways.

WHO AM I?

I am better than ____ (existing way of solving the problem)

For ________ (what problem)

Because _____ (differentiation)

As a result of ____ (your secret sauce)

Answer this for your product. This manifests in your strategy, marketing communications etc.

WHY BUY ME?

Create a sentence with 10-15 words. I am better than X because of Y and solving the problem of Z.

Articulate this clearly and crisply. Otherwise, you are confused and it is also confusing to your customers.

Without clarity, you knock on a lot of doors and have lots of meetings, but with no results. This can be very frustrating.

Domain Knowledge

It is very important that you have a very good understanding of the domain in which you are playing. Depth of problem understanding is a must.

Do you know who the buyer really is? It is not enough to say company C is the customer. Who exactly in the company is your customer? Why should the user spend time to understand your product? Why should the user talk to you? What is his/her role? What are their motivations and fears? What is their procurement process? Are you sure you qualify to pass those gates?

You need to have differentiation in your product with respect to your competition. It can be things like premium domain knowledge, completeness of the solution, cheaper pricing etc. You should be clear about your USP (Unique Selling Proposition) and articulate it to your team and prospective customers. The differentiation should be outcome-based and not based on things like technology stack.

People pay a premium for completeness. Plus it is easier to understand. And we can show the value to the user. E.g. architecturally, well designed modules are all fine, but from the customer point of view, he needs to see a complete use case coverage.

There is a popular Hindi saying “Jo dikha hain, wo bikta hain” (meaning “only what can be seen can be sold”). It is tougher to convince with words. Ensure you can clearly demonstrate the value of your product in action.

Pay close attention to your problem space and understand the dynamics. For example, in banking domain, the customers are married to existing platforms such as SAP, Oracle etc. So when you make technology choices, ensure that they work with the incumbent platforms.

Product Market Fit

Product market fit is critical. Have a plan to get to product market fit as fast as possible. Danger is you might run out of money, so get to product market fit fast. iCreate was providing services and used these revenues to fund their product development. This way they had a longer runway to get to product market fit.

If you need to educate the value of your product, then there is a segmentation mismatch. Better to find a market place where they see the value clearly and it is more about demonstrating your value. If you have to explain why they should use your product, then product market fit is not there.

In your universe of market place, there will be big clients, small clients and medium clients with different attributes. Do not try to solve the problem for everyone. Pick your initial target segment as narrow as possible and play there. Pick a demographic where the user sees the value immediately and get them to start adopting. You can later expand to other segments when you see success.

Qualify your market segment and leads. If they don’t have the problem, don’t spend time with them. You will see a glimmer of hope everywhere, but you are not going anywhere. This will give you a false sense of accomplishment and is a dangerous situation to be in.

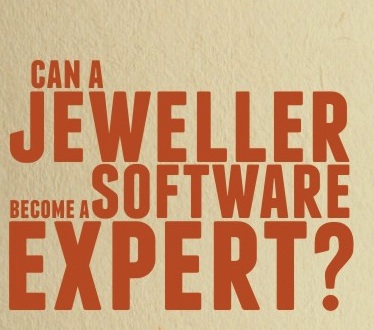

Having a vertical offering works better than a horizontal offering (i.e. applicable to everyone in the world). Having a generic mother of all products means multiple stakeholders need to be convinced and the message also gets diluted. It is better to choose a specific problem and completely solve it. You can sell faster and also sell for more and get customers faster. For example, iCreate had a generic solution which took 9-12 months to close the deal. With a single point solution, the time reduced to 3-4 months.

As a startup, you want to do several different things, but you don’t have resources. You need to make the hard call and pick the 1 or 2 things you want to pursue. Platform to solve N problems takes 2 or 3 times more time than solving 1 problem. An amorphous offering is more dangerous and takes more time.

Another example that was shared was of a language translation product. They struggled to find market fit for their generic language translation services. Then they verticalized it to retail segment where their product translated customer messages to native language and vice versa. They were able to then go and penetrate this market segment.

As a startup, it is challenging to verticalize a horizontal offering due to resource constraints and the temptation to have a large market size, but this needs to be done.

Finding the first customer willing to use the product is a big challenge. Be prepared for a long grind, and it can be a very frustrating experience. Sometimes it can take a long time to get the product market fit (several months). However, you should keep an eye on whether you are making progress or the product is not viable as a business. You need to introspect if you are getting product-mismatch feedback. Set clear goals and metrics. Don’t go by sentiments. You have to be dispassionate. Come up with some objective metric such as “The way for me to validate X is Y”.

If founders can’t sell, nobody else can sell. Look at the offering instead of finding a sales guy.

Every company needs one or two key inflection events change the trajectory completely. You also need some luck to get your first break. Try to get top marquee client vs. a small client. Marquee client also helps in marketing and validation and others will have lesser resistance to trying your product.

Product Merit is a must. In addition, try to show up where your customers hang out e.g. have stalls in conferences.

The next big challenge is getting the first paid customer. Then, you need to get your first referencable customer.

You need to inculcate champions among your existing customers. They will also tell their peers. This is critical during early days. Investors and prospective customers want to talk to existing customers.

Creating a Sales Team

Look for partners or non-founding sales ONLY after getting product market fit and messaging right. Till then, the founders should be the sales team. In iCreate, pre-investor stage sales team was zero.

Initial sales guys that you hire should be comfortable with the ambiguity of startups.

Hire folks who can put ‘skin in the game’, aligning with wealth creation (e.g. ESOP) or a percentage of revenue. Incentives also work – for example, “If you get $X revenue in Y months, you will get a car”. Make the incentives outcome based and not effort based

In India, typically R&D budget is much more than the sales budget, but as you get traction investment in sales should increase. One rule of thumb is to have 60:40 (engineering to sales) during growth stage. In US, mature companies have R&D costs around 15% of revenue and 50% of revenue is invested in Sales.

If the sales team is sub-optimal, firing early is better. You might make mistakes, but it is liberating when you fire a misfit as you can focus on important things better.

Without raising money, growth can be slower. If you raise money, growth is much faster. Raising money for growing is a very good idea.

Partnerships (Distribution and SI)

First, have a story to sell. You put in initial effort to get initial customers in your target geographies. Then attract partners using these success stories.

We discussed two kinds of partnerships.

- Distributor – who just resells your product.

- System Integrator (SI) – who resells your product along with implementation or other services.

In every market, nuances are different e.g. private vs. public banks, different geographies etc. You need to figure out which kind of partnership is suitable to your product.

In mature markets like US or Hong Kong, you can sell direct and may not partners. US is a great place to do business, as you get quick and clear feedback – positive or negative. If they see value, they will buy. However, the sales cost in US is expensive.

In emerging markets, people want in person meetings and they do not say yes or no immediately. This can lead to mixed signals and longer sales cycle.

In geographies like Africa you might have to work with local partners. Your direct sales may not work. In general, East Africa and West Africa need distribution partner to set up meetings. Then your sales guy has to do the work. Look at sector focused players e.g. computer warehouse in Nigeria, Simba in Kenya.

Middle East and Africa are brand conscious – they don’t want to go with small startups.

In mature organizations, SI plays a major role and has a lot of influence on decisions. Evangelize both with SI and clients. Once SI sees a win for your product, they will want to replicate that in similar contexts.

Be generous with commissions to your partners. Once they see the money, they’ll show more seriousness. See if your partner can make commitments to gauge their seriousness. The commitment is not necessarily in money terms only. For example, ask if the partner is willing to send their employee for training on your product to your location.

Be generous with commissions to your partners. Once they see the money, they’ll show more seriousness. See if your partner can make commitments to gauge their seriousness. The commitment is not necessarily in money terms only. For example, ask if the partner is willing to send their employee for training on your product to your location.

It was observed that strategic discussions with SIs not as fruitful as tactical ones. If there is an immediate opportunity, SI and you can have a meaningful tactical discussion. Strategic level discussions might give you a good feeling, but not much might come out of it.

Channel partners need to see a clear way of how and how much money they can make. Find a channel partner who already has a user base of stakeholders of your interest. To find out, look at other players in your space and which partners they are using.

Remember that your product is just an additional product for your channel partner.

Partners want to look at value addition, not just cost or feature arbitrage. Partners compare your deal with existing big names to see if they get to benefit more by pitching your product.

Partners need to be given all intelligence on a platter. They don’t want to spend on learning or figuring out. They don’t want you to experiment at their cost.

Some participants were worried that brands from India might have to first fight the battle of perception of being an India based company. But feedback was that it might be an issue in the beginning, but once you get traction and the product has merit, this problem is not insurmountable.

Government tenders is a complicated process. You need to be proactive about positioning your product even before tender process.

Product Positioning

There are different stakeholders in a B2B context – could be the CEO, IT Manager, or VP of a business unit. All of them are looking at different parts of the problem (one might be looking at cost savings, one might be looking at value delivered by the product and another might be looking at maintenance costs). Create your message for each stakeholder.

For your product positioning, consider the following:

- For the points of your differentiation, reinforce in your messaging.

- For points of parity with competition, highlight them.

- And for points of despair, mitigate or downplay them.

From your client’s point of view (particularly in large enterprise context) “he will never get fired for hiring a well-known brand. It will be risky for him to try a startup’s product”. Reduce the risk for your client and also demonstrate differentiated value of your product.

Proof of Concept

Instead of free proof-of-concept (POC), ask for conditional order. This shows commitment and also the buying process will start early. In B2B context, the process can be quite long. If the POC is not successful, the order can be cancelled. If you can get a paid POC, that is the best. Free POC can be a waste of time if the person driving the pilot does not have buying authority.

Advisors

It is good to have an advisory committee of domain experts. This is good for validation. You can never be an expert in every area, so have advisers. Typically, you meet them once a month or once a quarter.

There are three common models for compensating advisers:

- Free. They like your passion and are willing to give you advice from their experience. But this can be good only for some time. Otherwise, you will start feel guilty about taking their time for free.

- Stock options. This is better as they will benefit when you benefit.

- Payment for their time. This is the standard consulting by the hour model.

Conclusion

While there is no silver bullet that works in every scenario, there are certain fundamental aspects that are common.

Unfortunately, a lot of learning is experiential. And it will take time. You’ll do wrong things but when you navigate, you can course correct earlier by having the knowledge from those who have tread this path before you.

Please share your thoughts in the comments section below.

Tweetable tweets

The first problem a startup must solve is product-market fit. Everything else comes later. Tweet this.

It is very important that you have a very good understanding of the domain in which you are playing. Tweet this.

People pay a premium for completeness. Better to solve one problem completely than N problems partially.Tweet this.

Jo dikha hain, wo bikta hain (“only what can be seen can be sold”). Tweet this.

If you need to educate the value of your product, then there is a segmentation mismatch. Better to find a market place where they see the value clearly. Tweet this.

If founders can’t sell, nobody else can sell. Look at the offering instead of finding a sales guy. Tweet this.

Tactical discussions with System Integrators are more fruitful than strategic ones. Tweet this.