What is Stay-in-India Checklist?

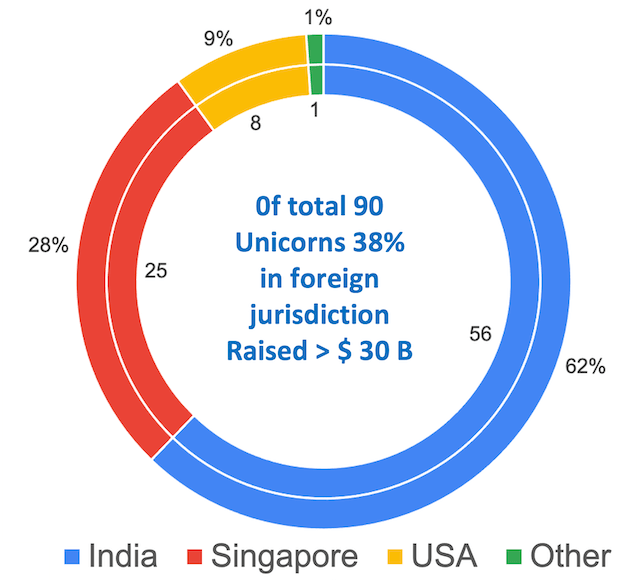

The Stay-in-India checklist is a list of regulatory hurdles that makes it attractive for Indian startups to Domicile in foreign jurisdictions like Singapore and USA.

The checklist was prepared by iSPIRT to present the most important issues where respective Government departments or regulators could being in reform to help stop this exodus of start-ups from India.

The checklist is important to achieve the vision and mission objectives of National Policy on Software Products. In turn, it will boost the innovation-driven economy, Ease of Doing Business (EOB) in India, retain and multiply the economic value thereby contributing to the 5 trillion dollar economy goals by 2025.

The issues pertaining to various regulations on making funding of start-ups complex and unattractive, difficult or redundant compliance, ambiguity or unclear notifications etc.

iSPIRT has taken up a list of 36 issues since 2015/16. Until now out of 36 issues, some have been addressed. Some issues were resolved fully, some partially and about 17 or more issues from the original list are still unresolved.

Note: This blog is a progressive blog to maintain the evolution of the Stay-in-India Checklist and its progression as the issues get resolved by the Govt. of India.

Index of issues solved and remaining

The objective of this blog post is to provide readers in the Start-up community to keep track of issues in this checklist.

We covered many of the resolved issues on www.pn.ispirt.in and www.policyhacks.in . Ready links given below.

- https://pn.ispirt.in/ispirts-stay-in-india-checklist-gains-further-traction-rbi-and-mca-follow-the-startup-india-action-plan/

- https://pn.ispirt.in/stay-in-india-checklist-successes-so-far-and-the-path-forward/

- https://pn.ispirt.in/list-of-startup-issues-resolved-stay-in-india-checklist/

- https://pn.ispirt.in/rbi-allows-convertible-notes-for-startups-from-foreign-sources/

- https://pn.ispirt.in/external-commercial-borrowing-norms-for-startup-ecb/

- https://pn.ispirt.in/notice-on-angel-tax/

A list of issues pending to be solved is are given below.

1. Digital Goods and Services Confusion

Authority: MoF and MOC

Status/Explanation:

The digital economy is about “Digital Goods” and “Digital Services”. Even the physical goods are traded through “Digital services” platforms and means. Hence, it is important to get “Digital goods” defined in our legal systems as distinct from “Digital Services”.

National Policy on Software Products (NPSP) was announced in February 2019 promoting Software products with a vision to make India a Software product nation.

Software products possess all properties of “Goods” except that they are intangible. Recognition of Software products as distinct from Software services is paramount to the success of the NPSP and promotion of the Software product industry. In larger shape, this requires a clear treatment and definition of Digital (intangible) “Goods” and “Services”.

Recommendation/Suggestion:

The National Policy on Software Product (NPSP) was announced in Feb 2019 to promote the Software products. The Policy implementation has huge friction owing to the non-acceptance of Software products as separate from Services. To leverage NPSP for the success of the Software product Industry “instituting” this clarity is important.

2. Abrogate Softex forms for SW products

Authority: MoF and MOC

Status/Explanation:

Softex form is required to be filed for export of software. After the GSTN system came into existence, all exporters filed Export invoices and regular exporters filed a letter (LUT) with the Government of India. The GSTN system can be used to track remittances received against each invoice.

Software products are traded based on MRP/list price mechanism in both On-premises and SaaS models and hence does not require any valuation.

Recommendation/Suggestion:

Softex forms is a Redundant process to ascertain Foreign remittances arrivals after the GSTN system is in place. RBI systems should digitally connect EDPMS to GSTN for a homogenous tracking of export proceeds remittances just like Income tax and other systems have done it. This will give way to a homogeneous system across all goods and services.

At the least Softex forms for Software products can be abrogated to ease the business of Software product companies where there is no need of valuation and those listed on the Indian Software Product Registry (ISPR) maintained by MeitY.

3. Remove TDS on sale of Software products

Authority: MoF

Status/Explanation:

A business can buy a hardware product without a TDS but not a Software, as the purchase of a Software product from Software companies are subject to TDS at 10% of all receipts under Section 194J.

The refund of this amount only happens after filing their IT Returns in September of each year, with this delay causing hardship in terms of working capital.

In the case of SMEs and Start-ups, it is hard to receive working capital loans from banks or NBFCs. For SaaS business the transactions are online and it is not possible to map TAN numbers at the time of online transactions and tracking of TDS on all transactions.

Since all profitable businesses with more than 40 lakh turnover are filing GSTN invoices, the tracking can easily be done through the GSTN system of each invoice amount and mapped to the income tax return filed at year-end.

Recommendation/Suggestion:

No product is subject to TDS when sold by producer to channel partners or end consumer. Software Products are subject to this sale. CBDT mixes this TDS with other TDS issues hence is reluctant to remove it. Income from Software products should not be classified as Royalty income and “Software Products” should be treated as “Goods” as defined in constitutions. This again requires recognition of “software products” and a Solution to this problem.

4. Setup HSN Code for Software Products

Authority: MoF

Status/Explanation:

Software products are intangible goods and keeping and treating them with Services in SAC list will not be able to help in creating a “Software product Industry”. They have to be classified as “products”.

Presently Software is classified in HSN code based on the medium on which it is physically supplied. The intangible Software is not defined in HSN and for domestic purposes, the Software product companies use Service Accounting Code Services Accounting Code (SAC) list which is not internationally harmonized. Hence, the trade of Software products can’t be homogeneously measured.

Recommendation/Suggestion:

HSN code mechanism is only used for Physical goods. However, in order to promote “Software products,” some countries are giving treatment to “Software products” and “Digital goods” under chapter 98, 99. India should also create a provision for “software products” HSN code until a harmonious global system is developed for “Digital goods” (including Software Products).

5. Level playing in B2C Sales of SW products

Authority: MoF

Status/Explanation:

Although there are mechanisms laid to report sales in India for foreign companies (non-resident taxable person), yet a lot of business of Software products especially in apps business happen in B2C area from not so popular brands. As a result, the Indian “Software product” companies have a non-level playing field as they have to comply with the GST regime of 18%.

Recommendation/Suggestion:

Provisions should be made to relieve the B2C sales of Indian “Software products” from heavy 18% GST for the advancement of “Digital India” and especially new post-pandemic digital and Gig worker economy.

6. Favourable Tax Regime for IPR

Authority: MoF

Status/Explanation:

In the past several years, India has experienced increased capabilities of innovative, creative and capable young professionals for creation of significant and valuable IPR. At the same time, India has also seen that the ownership of such IPR usually does not reside with Indian companies or in India.

Whilst there are several ‘non-tax’ reasons for this loss of ownership in favour of other jurisdictions, tax remains one of the major reasons. As a result of the huge negative tax impact, Indian companies constantly look to hold their IPRs for worldwide use in a jurisdiction which is more favorable from a tax perspective. Some of such notable jurisdictions are: Ireland, The Netherlands, Switzerland, and Singapore.

Further, governments of certain jurisdictions are aggressively targeting Indian companies to house their IPR there. For instance, a majority of Indian software product companies prefer to set up base in Singapore given the incentives offered by the Singapore government and the aggressive marketing by the Singapore government.

It is noteworthy that in the case of technology companies, IPR is one of the most (if not the most) important assets. Accordingly, technology companies usually follow their IPRs and establish base in jurisdictions that are most favourable for IPR. Lacking this, India has seen most of its technology companies shifting base to jurisdictions such as Singapore.

Creating a favourable tax regime for intellectual property is, therefore, extremely important for retaining technology companies in India.

This is partially covered in the Budget announcement, which provides that income by way of royalty in respect of a patent developed and registered in India will be taxed at 10%.

Recommendation/Suggestion:

Further action also needs to be permitted-

- Such companies should not be subject to minimum alternate tax. However, such companies should be subject to dividend distribution tax as may be applicable to all other companies;

- Transfer of IPR so developed and owned, or acquired and owned should result only in capital gains and be taxable as capital gains. Such IPR should be characterised as a long term asset if held for more than 3 years as is the case for other assets;

- For self-generated IPR, the holding period should start from the date an application is made under the IPR laws for its exclusive ownership, viz, copyright, trademark or patent registration.

7. Informal Guidance Mechanism & appellate authority at RBI

Authority: RBI

Status/Explanation:

This needs to be pursued. The RBI helpline announced recently does not resolve this issue, as it does not contemplate making RBI approvals/rejections public or appeal process for parties aggrieved by an RBI decision.

While public notification of RBI decisions has been announced for compounding orders, it is yet to be done for cases of approvals/rejections of applications under FEMA (on a no-names basis).

Recommendation/Suggestion:

In our discussion with authorities, it was suggested that instead of codifying laws on aspects like round tripping, it is better to have an informal guidance and appeal procedure at RBI, similar to SEBI. This needs to be pursued.

8. Filing of Form FC-TRS – post-transfer requirement

Authority: RBI

Status/Explanation:

In terms of the FDI policy, a transfer of shares of an Indian company between non-residents and residents can be taken on record by the company subject to it receiving endorsed form FC-TRS. While the filing of this form has been made online, it still takes a few days’ time for the AD banks to review and approve the form.

Thus, the transfer of shares cannot be recorded by the company (despite the purchaser remitting monies to the seller and completing all other formalities) until form FC-TRS is endorsed/approved by the AD bank. At times, this process takes months (there are substantial delays even after the filing process has been made online).

Recommendation/Suggestion:

Since FC-TRS filing is online now, there should not be an issue in making it a post-transfer requirement.

9. Collection of monies by a resident on behalf of a non-resident to be permitted

Authority: RBI

Status/Explanation:

The Foreign Exchange Management Act, 1999 (FEMA) prohibits any person to make any payment to or for the credit of any person resident outside India in any manner. As the nature of commerce has undergone major change and many services and goods are being delivered through aggregators using online or mobile media, there is a need to re-look at this provision. Essentially, in all aggregator arrangements, the aggregator acts ‘on behalf of’ the seller to collect payments and provide selling and/or ancillary services.

Recommendation/Suggestion:

Presently, only start-ups have been permitted to collect monies in India on behalf of their foreign subsidiaries. This needs to be permitted for all companies, and also on behalf of any other entity (regardless of such entity being a subsidiary).

10. Acquisition by residents of overseas companies with an existing subsidiary(ies) in India to be permitted

Authority: RBI

Status/Explanation:

Presently, there is uncertainty on the meaning of “round-tripping” in relation to such transactions.

Recommendation/Suggestion:

“Round tripping” is usually invoked when an Indian company acquires a foreign company, with an existing subsidiary in India.

It needs to be clarified whether the transfer of shares between an overseas subsidiary of an Indian company and a third party falls under any compliance/approval process under FEMA.

Also, there is a limitation on foreign investment by resident individuals in association with the ‘Indian Party’ in only operating entities. This may be done away with.

The RBI policy announcements contain only the following generic statement: “Streamlining of overseas investment operations for the start-up enterprises”. The aforesaid specific actions need to be performed.

11. ODI JVs/WOS investing back into India to be permitted where it is a genuine business requirement and bona-fide investment

Authority: RBI

Status/Explanation:

There is uncertainty with regard to “round-tripping” in such transactions.

Recommendation/Suggestion:

Such investments should be permitted (under the approval route, if need be) on commercial justification.

The following transaction may be specifically permitted:

- Bona-fide acquisition of existing structures having a leg in India; or

- Where the Indian investment is made for bonafide commercial reasons out of funds earned/raised overseas without Indian guarantee and is in 100% FDI automatic route sector (e.g. infrastructure).

Further, setting up an overseas structure under the ODI route to raise equity capital for investing back into India should be specified/clarified to be a bonafide and permitted overseas investment.

Since there is no bar under the extant regulations, entities which have overseas JVs / WOS which have downstream investments in India should not be subject to punitive action.

Individuals should be allowed to hold shares in foreign entities with step-down subsidiaries, subject to the investment in the foreign entity being a specific fraction (and not the whole of) of foreign funding received by step-down subsidiaries.

To permit Investments up to a specified limit (eg USD 10 million) by companies (regardless of their net worth) in overseas entities.

Again, the RBI policy announcements contain only the following generic statement: “Streamlining of overseas investment operations for the start-up enterprises”. The aforesaid specific actions need to be performed.

12. Late filing to be allowed for subsidiary formations by start-up founders

Authority: RBI

Status/Explanation:

Currently, this is not permissible.

Recommendation/Suggestion:

Lot of founders who set-up subsidiaries abroad and have not compiled with RBI, should be allowed an automatic route through late fees.

13. Restriction on FVCIs to invest in all sectors to be removed and brought in line with FDI policy

Authority: RBI

Status/Explanation:

Presently, FVCIs are permitted to invest in only certain sectors.

Recommendation/Suggestion:

In terms of RBI/2016-17/89/ A.P. (DIR Series) Circular No. 7 of 20 October 2016, FVCIs are permitted to invest only on ten sectors (viz., Biotechnology, IT related to hardware and software development, Nanotechnology, Seed research and development, Research and development of new chemical entities in pharmaceutical sector, Dairy industry, Poultry industry, Production of biofuels, Hotel-cum-convention centres with seating capacity of more than three thousand, and Infrastructure sector).

While RBI (under the above circular) has exempted start-ups from this restriction, other companies also need to be exempted from this.

14. Limit on acceptance of deposits from shareholders to be removed for private companies

Authority: MCA

Status/Explanation:

Under Section 73 of the Companies Act, private companies are allowed to accept deposits from their shareholders up to 100% of their share capital and free reserves. However, since most start-ups require constant funding during initial years, and do not have free reserves, such limits may be removed for them.

Recommendation/Suggestion:

The Companies Law Committee Report recommends removal of this limit for all start-ups. However, fine print is awaited.

15. Grant of ESOPs to promoters and independent directors for all private companies

Authority: MCA

Status/Explanation:

The provisions of the Companies Act do not permit companies to grant ESOPs to promoters or members of the promoter group or independent directors. There is no rationale for this restriction as the promoters essentially function as employees of the company. Further, through multiple rounds of fundraising, the stake held by the Promoters would have significantly diluted. Also, to get good professionals to join as independent directors, it is important to issue them ESOPs as payment in cash for compensating them is a burden on the company’s resources.

Recommendation/Suggestion:

Provisions of the Companies Act need to be amended to permit issuing of ESOPs to promoters and members of the promoter group and independent directors. Management ESOP should be permitted for unlisted companies to keep the Promoters incentivized and motivated. Likewise, the role of advisors is critical for the success of the ventures. Equity seems to be the only logical form of incentive, given the lack of liquidity.

While the MCA has permitted the issuance of ESOPs to promoters for start-ups, this needs to be permitted for other companies as well. Also, the issuance of ESOPs to independent directors needs to be permitted as well.

16. Taxation of gains from sale of ESOPs as salary or prerequisite (leading to very high tax at present)

Authority: MCA

Status/Explanation:

The ESOP regime in India is geared more towards listed entities, which have a liquid market, as opposed to start-ups. Section 17, IT Act 1961 and Rule 3, IT Rules 1962 deal with the taxation of ESOPs. First, the employee is subject to tax at the time of exercise of option – i.e. this tax is payable immediately even if the employee has not sold the share in that tax period. The magnitude of the tax is calculated on the notional gain between the acquisition price of the share (option strike price) and the fair market value (FMV) at the time of exercise. Secondly, the nature of such gains is considered as salary or perquisite. This means that the employee may be payable for ordinary income tax – 30% (excluding surcharge and education cess), calculated as per the marginal income tax rate) for the notional gains calculated above. This causes an economic outflow in the hands of the employee upon exercise, which is funded by debt or is at times even declined due to this reason. This is especially acute since the shares they hold don’t have the same rights as those offered to Investors.

Recommendation/Suggestion:

Amend Rule 3(8)(iii) of the Income Tax Rules, 1962 and as follows (insertion in bold) “In a case where, on the date of exercising of the option, the share in the company is not listed on a recognised stock exchange, the fair market value shall be such value of the share in the company as determined by a merchant banker or accountant on the specified date as per Rule 11UA(1)(c)(b), provided such fair market value shall not be less than the exercise price ”

OR

Tax incidence should arise in the year of the sale of shares (not the year of exercise of the option). Profit made on sale of shares should be treated as capital gains (vs. the treatment as a portion of the gains as salary or perquisite).

17. Dividends from overseas subsidiaries taxed again in India

Authority: MoF

Status/Explanation:

Dividend received from overseas subsidiaries is taxed once again in India as income in the hands of the company. Also, while the rate of tax on such dividends for certain companies is 15% (as against 30%), the same exemption is not provided to limited-liability partnerships and individuals.

Recommendation/Suggestion:

Thus, tax levied on dividends from overseas subsidiaries should be discontinued, for parent companies incorporated by resident Indians in India.

18. Fair market value tax

Authority: MoF

Status/Explanation:

Any investment above the ‘fair market value’ (as may be determined by the Income Tax Authority at a future date) is treated as income for the company and is subject to income tax. This impacts angel investments at high valuation, as there is a risk of the Income Tax Authority determining such investment as above fair market value and requiring the company to pay tax on the differential.

Recommendation/Suggestion:

Start-ups have been exempted from this tax. However, the certification process to be recognized as a start-up is cumbersome and needs to be relaxed.

19. Harmonisation of tax policy for listed and unlisted equity instruments

Authority: MoF

Status/Explanation:

Listed Securities have a holding Period of 12 months for LTCG whereas for Unlisted it is 24 months Unlisted securities have a tax rate that is twice the rate of their listed counterparts, and the surcharge applies on the sale of unlisted securities while it is exempt for listed securities.

Recommendation/Suggestion:

Globally, the differentiation in tax treatment on listed and unlisted securities is not prevalent. Unlisted securities are more illiquid and riskier as compared to listed securities. They should have the same tenure of holding and the same tax rate on the same. There is a disparity in the tax rates applicable for capital gains on the sale of listed securities (12 months) vis-à-vis sale of unlisted securities (24 months). Dematted Unlisted securities of start-ups or companies that were registered as start-ups can also be subject to STT (or the new Stamp Duty regime announced in February 2019) in order to harmonise the tax treatment of both listed and unlisted securities.

Disclaimer: The discussion and ideas expressed here should not be construed as legal advice. The discussion is conducted with Industry practitioners and experts for purpose of benefiting the Industry members in the Software product, Start-up ecosystem and other related industry sectors