First of all, huge thanks to Vizury for sponsoring great food and the premises to hold the round table. Many thanks to Aneesh, NRK Raman and Srirang for leading the session and providing valuable inputs. And of course, to all the participants for the energetic discussions and knowledge sharing.

Here are the key takeaways from my notes. Please note that there are several nuggets of practical advice based on the experiences of the session leaders and the participants, and not just standard text book stuff. It was a great learning experience for me and I hope I can pass on some of it to you.

While we touched upon a lot of topics, we spent considerable time on startup sales, channel partners and selling to geographies outside India, and lead generation and qualification.

While we touched upon a lot of topics, we spent considerable time on startup sales, channel partners and selling to geographies outside India, and lead generation and qualification.

Read on to know more.

Startup Sales and Hiring Salespeople

Best guys to sell during early stages of the startup are the co-founders themselves, even if they don’t have sales background. Initially, you will stumble, but you will learn and figure out what works for you. If founders cannot sell the product in the first 1 or 2 years, then you must seriously evaluate the viability of the business

Once you’ve made the initial sales yourselves, then you put in a structure. External sales guys need to have conviction in the product to sell it. That will be lacking during the early stages of the company – but founders have that conviction. Hence founders can sell better during the early stages. One participant mentioned that for the first 3 years, he and his co-founder were selling and only later they looked at a professional sales person.

Getting the first reference customer is always the toughest part. One you have a reference customer, momentum will build.

Hiring an external sales guy is not a good idea at the beginning. Identify folks from engineering and customer facing teams who have the aptitude or inclination to do sales and ask them to lead Sales.

Culture fit is very important in a sales person. Also, check if the person has spent 4+ years in a single company – that shows that he has been delivering results. Sales people should also be pushing back to you. This shows that they are getting feedback from the field and are informing you about market situation.

Culture fit is very important in a sales person. Also, check if the person has spent 4+ years in a single company – that shows that he has been delivering results. Sales people should also be pushing back to you. This shows that they are getting feedback from the field and are informing you about market situation.

It is a good idea to raise investor money to scale up business development. Investors are willing to invest in this once the product has been validated and you have a few customers.

You need to experiment to figure out what works for you. For example, for a company that made trading software, an ex-trader worked great as a salesperson instead of a seasoned sales guy, because the ex-trader was able to relate to the customer.

The sales person should have hunger and also have a good history of past successes. Consider the age of the sales person too – in some industries, an older person might work better as the customers expect to see maturity.

Like pair programming, “pair selling” is also a useful thing to try. This helps in DNA match, culture fitness. Some companies have paired an account manager or a product manager with the sales guy.

In complex sales where there are multiple stakeholders from the customer’s side, ensure that you sell individually to all the influencers.

In complex sales where there are multiple stakeholders from the customer’s side, ensure that you sell individually to all the influencers.

You need to pay close attention to how the customer buys. Branding and marketing engine is also very important in “creating a desire in the customer to buy”.

Channel Partners (local and global)

When creating partnerships (in the context of channel partners and resellers) globally, be careful what works and what does not in that culture.

In general, partnerships work well outside your headquarters and you can have multiple non-exclusive partnerships. People like to do business with a local person.

Look at the credibility of the partner. Is the partner knowledgeable and up to date in your domain? For one company, partnerships worked well in Brazil, but did work very well in Europe.

When you set up an office in other countries, you need to be aware of the labour laws regarding how easy/difficult it is to fire non-performing employees, taxation, accommodation etc. Going with a partner alleviates all of this to a great extent. However, you need to have someone from your team who is responsible for managing partnerships.

Remember that the main motivation for the channel partner is money. So make sure there is enough for them so you have their mind share. Even if that means that the channel partner makes more money than you. Initially, you need to be very involved so the partner tastes success. For example, you need to generate leads to the partner, go along with him to complete the sale and let him make the money from your efforts, initially. This will get them excited.

Similarly, if you want to have sales offices or channel partners in other locations, encourage well performing sales folks from headquarters to move to that location, stay there for a few years to set up processes, signup channel partners, hire local people and train them.

You can start by signing an MOU first and have some targets. Then after 6 months of so, you can sign a formal partnership agreement.

One company also pays 20% of the salary of an employee of the channel partner. Then you can have a joint business plan with your partner to set goals, metrics tracking etc.

You should look at your customer acquisition cost and consider pay a huge chunk (say 80%) of that cost to the channel partner.

While making sure that you do not have exclusive agreement with a single partner, be sensitive that having multiple partners in the same geography can lead to partner conflicts which in turn could be bad for your business.

Also, look at companies that sell complementary products. Maybe you can partner with them too so they make money by cross selling your product.

Channel partners are not really a must. If you can make your product easy to setup and use, then you can focus more on marketing, google adwords etc (e.g. SAAS models). Also, in these models, you need to ensure that partners have good incentives as typically the ticket sizes are smaller and they don’t have opportunities to make money from “implementations”, training etc. One company took an approach to let the partner decide the pricing in a particular geography with the agreement that a percentage of the revenue goes to the partner.

However, if the product is not easy and you need people on the field to educate the customers, you should definitely consider channel partners.

Sales Engine is similar to Engineering Engine

Sales Engine is similar to Engineering Engine

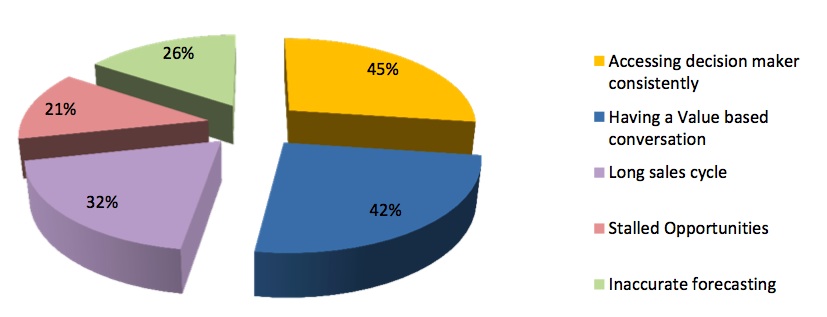

One of the biggest challenges faced by Indian product companies is that the founders do not have a sales background. Our ecosystem has evolved to a point where we can build great products, but lack the sales acumen. There was consensus among the participants that sales is much harder than engineering. Engineering, while no doubt hard, is still manageable. We know the inputs, outputs, risks and mitigations with a high degree of certainty. Sales is a different beast with lots of uncertainties.

Srirang guided us to treat the sales engine also similar to the engineering engine.

The three pillars for the Sales Engine are (a) People, (b) Processes and (c) Technology.

People: Competencies, Incentives, Org Structure. As in engineering, there can be a magnitude of difference between an average sales person and a good salesperson. So hiring the right candidate is very important. And you have to set up the correct incentive program and org structure to ensure motivation and excitement in the sales team.

Processes: Strategy, Execution, Metrics. Again, as in engineering, you need to define the strategy, the execution plan (who does what) and what metrics you are going to use to measure execution.

Technology: Enablement, Communication, Monitoring. Sales team needs to be enabled. For example, ensure flawless demonstrations and training to the sales people so their selling experience is smooth and they focus on the customer. Use the right tools (e.g. Excel, CRM, SalesForce) to track and monitor their activities.

At different stages of the company, you need different kinds of pillars – which means you need different kinds of sales people, different processes and different technologies.

Lead Generation and Qualification

The classic sales process consists of five stages:

- Lead Generation.

- Lead Qualification

- Relationship building

- Solution design

- Negotiation and Closure

Depending on the kind of product, some of the later steps might not be relevant, but lead generation and lead qualification are of primary importance.

Focused lead generation is better than generic lead generation.

Some companies have used databases of leads to generate leads and have found it useful for mass email campaigns.

LinkedIn is a good source to connect with prospects (with premium account, you can send InMail too). After connecting, you can then try to have a call/skype to show your value proposition, if there is interest.

Someone mentioned that LinkedIn Ads worked for them. On Google adwords, there were mixed reactions. Some say it is costly, but it helps to put the word about the product. Google adwords can generate a lot of leads, but people also noted that there was a lot of churn from these leads (in the context of SAAS based business).

If you have a horizontal product, make a vertical offering. Your campaigns have to industry specific and you should talk their language. Customers are looking for a reference customer they can relate to. This produces better results than targeting all verticals with a horizontal positioning.

Metrics is very important in the sales engine. You must be measuring and tracking customer acquisition costs. And track them at various stages of the sales funnel. For example, let’s say you generate 1000 leads, out of which 600 are then qualified, 400 of them get to proposal stage, 200 get to negotiation, 150 closed and then 130 retained for renewal. At each stage, you must count the man hours spent and put a cost for that. This will help you improve your sales processes – particularly in the area of lead qualification as you can see what kind of leads are working and you can pursue folks who are likely to buy.

The first step is to establish Qualification Criteria. Then evaluate each lead and assign score to lead based on the qualification criteria. Based on the score, put the lead in one of three action buckets – pursue, drop or nurture (i.e. keep warm).

Also, ensure you pay attention to negative attributes to qualify leads based on your experience and judgment – e.g. if a company has greater than 2000 employees, then they might not be suitable to your business.

Don’t take up a wrong customer at startup stage. It can be a drain on your resources.

There are three main aspects of lead generation.

- Publish

- Blogs

- Website

- Industry Magazines

- Whitepapers

- Promote

- Speaker in conferences

- Advertisements

- SEO

- Connect

- Email

- Cold call

- Road shows

- Referrals

- Social Media

Conclusion

The discussions “raised awareness” and provided lots of data from practitioners.

The discussions “raised awareness” and provided lots of data from practitioners.

The key thing to remember is that there is no silver bullet and what worked for someone else may not work for you. Kishore Mandyam went one step further and said that what worked for them six months ago might not work for them now! While there is no magic wand, you can look at general guidelines and best practices from the experiences of 20 odd practitioners.

If you have any more tips or best practices, please do write them in the comments section.

Tweetable Takeaways

Best guys to sell during early stages are the co-founders, even if they don’t have sales background. Tweet This.

Getting the first reference customer is the toughest part. One you have that customer, momentum will build. Tweet This.

Channel partners should make enough money off you. It is OK for them to make more money than you. Tweet This.

Invest in channel partners so they invest in your product. Tweet This.

Sales Engine is similar to the Engineering Engine. Tweet This.

If you have a horizontal product, make vertical offerings. Industry specific campaigns work better. Tweet This.