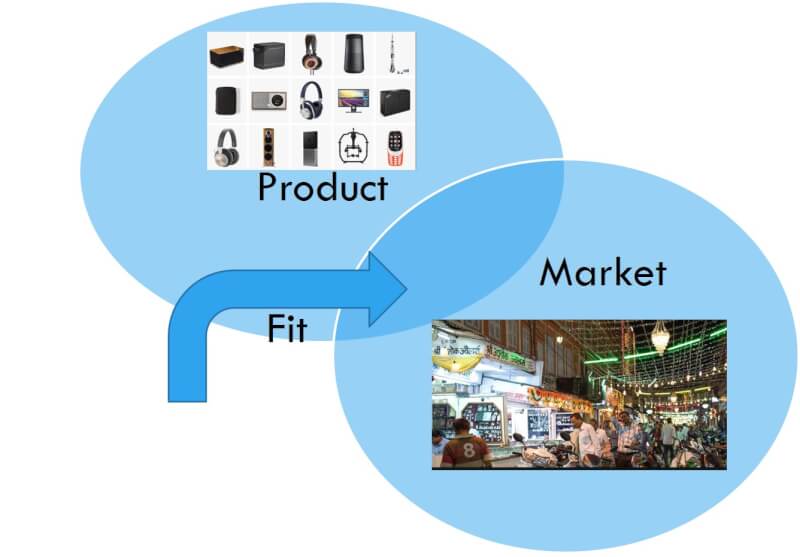

I wanted to write a post on how timing is important for a product-market fit – but with the covid19 times, this has become even more important as the leading indicators change superfast. Usually, such events create massive opportunities for certain products, and if you have that product, you are bound to win.

Marc Anderssen needs to be quoted whenever we talk about Product Market Fit, as I certainly view him the father of this concept, especially for the software products. Marc says that no product idea is bad, but the timing of the product is the most important factor.

In this post, I will just pick on 5 examples to explain why timing is so important and then go into some factors that makes the timing so important.

To explain the significance of timing Paytm is a great example. Paytm was making good traction in the digital payment space. But they were still being only used by the digitally savvy. In came 8 Nov 2016, when the Indian government announced demonetization and slowly tried to promote digital payments. This really made for a great opportunity for Paytm, and it went into an amazing growth trajectory. Of course, since the product and the platform was already scalable, it could really fulfil the huge demand, and it doubled its user base in just a year.

Microsoft office took super advantage of the spike in the PC revolution, they had individual products that were created for different purposes e.g. Excel – spreadsheets, Powerpoint – presentations and Word – documents. The evolution of these individual products were timed very well, constantly innovated but the timing of combining them and offering them together turned out to be a blockbuster.

Priced attractively or bundled with windows, it took the market both consumers as well as business market by a storm. The timing of this was so profound that, the market it had created or the potential it leveraged is still unmatched. While the products were well-engineered and simple to use, I feel the market traction was because of the timing, when the users and businesses were ready to consume and pay for such productivity software.

Who would have imagined that such a simple use case of handling your small accounts or ledger for shops would become such a big hit? I feel the real reason for this is timing. Khatabook came about to solve a real problem that exists with Kirana stores and small businesses in India. But its timing was so good, that this was the time when Jio got launched, and you all know how Jio has penetrated the mobile data usage or how these small business owners could afford a smartphone. Khatabook came out big at the same time and it was perfect use of a smartphone you owned to solve a painful problem of udhaar and khata (loan and books).

Dr E. F. Codd published the paper, “A Relational Model of Data for Large Shared Data Banks”, in June 1970 in the Association of Computer Machinery (ACM) journal. This was the inspiration to build out a relational database management system (RDBMS) and SQL by Oracle founder Larry Ellison and a couple of his colleagues. While the initial versions was developed in 1977, it became more prevalent later in the mid 80s to 90s. Client-server technologies became very popular in 80s and 90s. This is the time, many needed a more sophisticated database to run on these client-server technologies. Especially companies and businesses looked to leverage technologies and build robust business applications. The timing of Oracle’s database was perfect, and hence the ideal product-market fit.

This is something of a no brainer in the current covid19 situation. Who would have imagined that the whole world gets locked up in a room and most of the business works through zoom. Can’t be a better example to explain the timing effect of such a product that matches the needs of the market. You could say it all luck, but remember the product was designed to scale to a significant level, a reason it could stand the test of times.

Hope the above examples were easy to understand how timing is so important for you to reach product-market fit.

I would like to summarize my post with 5 factors that make timing so important

Market – there is going to be market for every solution at a point in time. But you need to really identify that problem you are solving and whether there is going to be people who are willing to pay for solving that problem. The market always exists, but when does the market mature to become sizeable is all based on timing.

Event – always contributes significantly to certain products. It could be great foresight for some, could be mere luck for others, could be of different types such as current covid19, government actions e.g. GST/Demonetization, competitive action etc.

How long before – In all the examples above, you see that products don’t hit product-market fit instantly, it takes time, perseverance and understanding problem statement deeply. Ideally the products should be built at least a few years before it becomes mainstream, and built to scale. Also, it’s not important to be first in there to become big, often many of the products have done better in catch up and been able to lead

Pivot and survive – while the examples are all success stories, there are many more that have not been able to make there as lack of hitting that timing. If you time your product very late, there are others who have solved the problem, or the problem has gone beyond its useful time. A good example would be that of building a webcam and waiting for the timing to happen on that, while the world has moved on having a webcam in all laptops. In these situations, it’s better to pivot and survive.

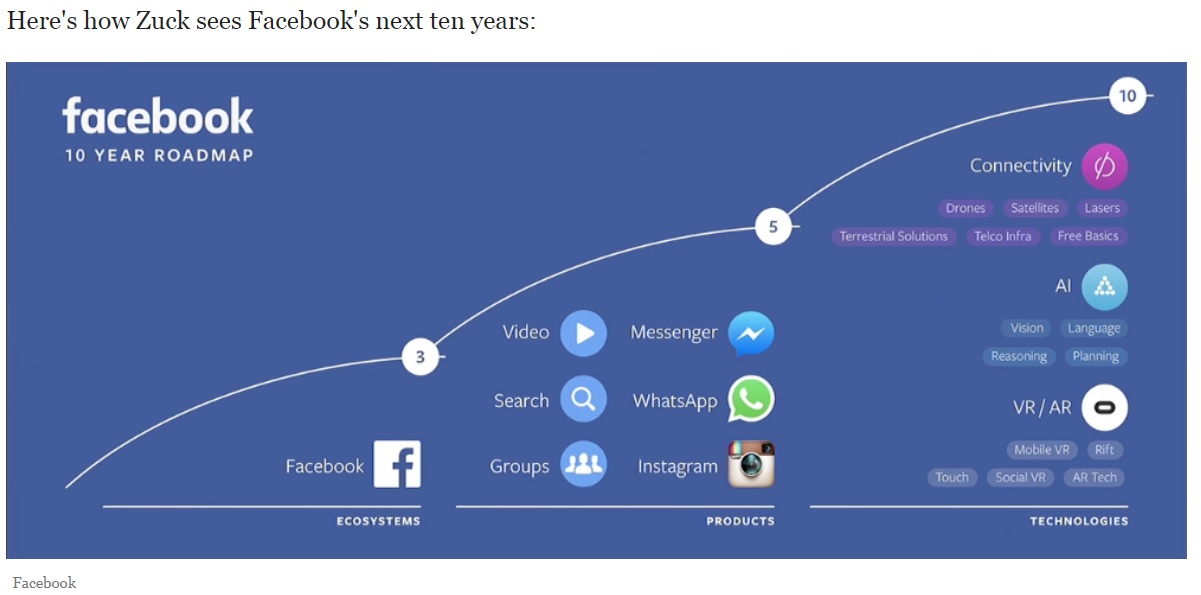

Technology and Innovation – finally the kind of technology and innovations that are coming through is fast, and its important to time your usecases based on the innovations that are forthcoming. Sometimes it could be luck, sometimes you saw that coming, sometimes it didn’t make that mark. Remember AI has been in news for the last 25 years, probably it’s just hitting the potential for a product-market fit.

Hope this post helped you understand this critical factor for product market fit – Timing!

Stay Safe.

Skill oriented education: Now while the rural revolution looks interesting, how will the software talent that is usually US bound, join such remote places. Sridhar’s answer to this is Zoho University. Zoho University is a unique education, follow a gurukul Indian approach, where students are pulled from government schools, and trained into important technical skills, English and Maths, Design skills, as well as business skills.I had some great discussions with Anand Ramachandran, who heads Zoho University in Tenkasi. Zoho University now contributes to more than 20% of the 8,000+ employees in Zoho, and it’s heartening to see students from villages, Tamil medium government schools very effectively groomed to build world-class products. The analogy I have for this kind of education is chartered accountancy, which combines knowledge and hands-on skills together. But this takes it to the next level.

Skill oriented education: Now while the rural revolution looks interesting, how will the software talent that is usually US bound, join such remote places. Sridhar’s answer to this is Zoho University. Zoho University is a unique education, follow a gurukul Indian approach, where students are pulled from government schools, and trained into important technical skills, English and Maths, Design skills, as well as business skills.I had some great discussions with Anand Ramachandran, who heads Zoho University in Tenkasi. Zoho University now contributes to more than 20% of the 8,000+ employees in Zoho, and it’s heartening to see students from villages, Tamil medium government schools very effectively groomed to build world-class products. The analogy I have for this kind of education is chartered accountancy, which combines knowledge and hands-on skills together. But this takes it to the next level.

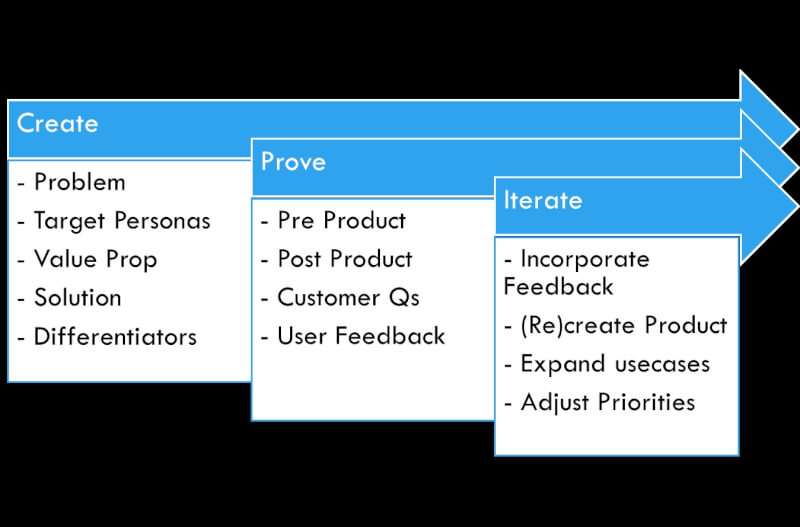

This can be called creating the functionality.

This can be called creating the functionality.