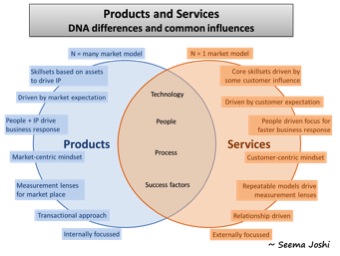

For mobile apps, there are three dominant pricing strategies: Premium, Subscription and Freemium.

According to a report by app-store analytics company, Distimo, freemium now accounts for 71% of Apple AppStore revenues in the US, up from somewhere around 50% last year, and rising. In Asia, freemium is 90% of App Store revenues.

Is freemium always the most optimal? What factors should you consider when choosing a pricing strategy?

Firstly, here is what these different pricing models mean, as applied to mobile apps:

Premium apps (or Paid apps) have an upfront price before they can even be downloaded. Similar to licensed software, except that the App Store makes all future upgrades to the premium app free once purchased.

Contrast this with freemium (a portmanteau of “free” and “premium”), where the app is free to download and use. However, some features inside the app are unavailable until you pay for them. App stores make it dead simple for developers to charge small amounts of money inside the app.

Subscriptions are a regular fixed fee the user is charged automatically via the App Store for using the app. Magazines in the iOS Newsstand are usually subscription-based. Subscriptions can actually overlap with either premium or freemium models. For example, Spotify requires you to have a subscription to even use the app (premium), while Pandora is closer to freemium where you can pay a subscription to get ad-free and unlimited hours of music.

How do you decide which to choose?

Premium has very limited use today

Perception is a large factor in how high a price is acceptable, and going premium helps create that perception. With premium, every user pays upfront, but the amount each user pays is fixed, regardless of how much utility each gets. Also, users have come to expect apps in the $2 – $5 range (a few niche apps can charge $10-$20) and there is no way to get higher ARPU.

In general, premium works in the following situations:

1. There is a strong demand for your app – niche areas are good candidates here.

2. You have a strong brand already and can establish trust with users where they are willing to pay before they download the app.

3. There is not a lot of competition that will almost certainly drive the price down.

4. You don’t care much about reach – which will be much smaller because of the “pay gate” into your app.

5. There are no ongoing feature or content costs that can drive up the average cost of of supporting a user to levels higher than what the user paid for the app.

Freemium helped create those million-dollars-per-day games

Freemium was popularized by casual games in Japan and Korea and has quickly become the winning model in mobile apps. It works really well in the following situations:

1. There is enough competition that users invariably have other cheaper or free options (low barrier to entry). This has been partly the reason for most mobile apps today moving to freemium.

2. When reach is important. You need large amount of users quickly to create network effects. For example, to drive virality or gather significant data.

3. When there are a small % of power users willing to pay significantly more than the other light users. The pay-as-you-go model facilitates this. Hard core users can drive as much as 100 – 1000 times more revenue than the other users. This is why some free-to-play games are reaching a $1MM per day revenue runrate.

More users in freemium, but a small percentage of them drive astronomical amounts of revenue.

The mobile app economy has progressed to a point today where all of the above usually hold true. Freemium does require some operational effort in managing your free and paying users, converting the former to the latter, and driving repeat purchases. However, this helps create a sustainable business rather than a one-time hit.

Subscriptions: the Holy Grail?

A subscription provides a guarantee of repeat transactions and hence, businesses with subscription revenues tend to be valued far higher. The subscription price is usually smaller than the one-time price to incentivize the user into a longer term commitment. As the seller, you make up for the discount by being guaranteed future transactions.

A single issue of The New Yorker costs $6, but a year’s subscription of 52 issues is $70. That is a 77% discount and is still better, revenue-wise, than selling individual copies. Of course, they make a lot of money through advertising, so a guaranteed customer in the future is far more important to them. This may not be the case in all businesses. Amazon gives you a ~15% discount to “subscribe” to certain household items.

But the subscription model does have a few drawbacks:

1. Like premium, there is a single price for all users, regardless of how much they use. There is a lot of money left on the table because hardcore users willing to pay a lot more cap out at the fixed price. There is some more money left on the table where the subscription price and commitment is too high for a large number of light users who will not sign up.

2. Tiered subscriptions does let you set different prices, but still creates ceilings on both price and consumption. Netflix has a 1 DVD plan for $8, 2 for $12, all the way up to 8 for $44. The lost opportunity? (a) A user can only do 8 DVDs. There may be a few subscribers who want much more. (b) A $44 price tag for DVD rental has a sticker shock. It is easier to charge $5.50 eight times than to charge $44 one time.

So when should you use subscriptions? Whenever you can – subscriptions are considered the holy grail of revenue models, BUT it is important to make sure you are not leaving money on the table just to get a subscription commitment from a customer.

The ideal pricing strategy

Escalators are faster than stairs, even faster if you run up them.

At the risk of over-generalizing, a combination of freemium + subscription would be ideal for most apps.

Not everything being sold lends itself to subscriptions. Impulse purchases typically don’t. For example, a power-up that will help you cross this level in a game, or an Instagram filter that makes this photo of yours look exceptional. In such cases, it is best to start with a freemium model and then offer subscriptions to your regular customers to drive purchases further. Content (magazines, music streaming, movie streaming) has more commonly been a subscription business. For these, it is a good idea to start with the accepted subscription, but remove any ceiling on purchases and consumption by offering more content that can be purchased in-app in addition to the subscription.

The mobile app economy is already large and growing even bigger. Get all the value you can out of it.

Drop in a comment, or shoot us an email if you want to chat about this for your app. We’re happy to help!

Update:

Marco Arment wrote his thoughts about our post:http://www.marco.org/2013/10/02/lattice-labs-freemium. Do read that too – it is an interesting debate and certainly not over yet!

More users in freemium, but a small percentage of them drive astronomical amounts of revenue.

More users in freemium, but a small percentage of them drive astronomical amounts of revenue. Escalators are faster than stairs, even faster if you run up them.

Escalators are faster than stairs, even faster if you run up them.