Who am I writing for? SaaS product managers and founders.

We recently had someone move on from Wingify (the company that owns VWO and Pushcrew). After they were gone, admin was doing a review of our software expenses and found a line-item for Popcorn Metrics with no clear owner. The person who had left was the only one using it, and no one knew why, or what it was used for.

Removing Popcorn is as easy as removing a code snippet, so I reached out to them asking to cancel.

This is the problem when your product hasn’t been adopted widely or deeply. You might have sold the product in that a customer is paying for it, but you haven’t truly sold it until they’re using it extensively.

Width

By width, I mean that multiple hierarchies across departments in a company are using the product. Best examples would be:

- communication platforms (Skype, Gmail)

- HR & performance management software

- document editing and management (Google Docs, Office 365)

If a product solves the basic needs of any workforce, it’s likely to be adopted widely. The more widely a product is used, the more value it’s providing and consequently, it’s difficult to remove.

Depth

By depth, I mean the level of dependence on a product. For me, defining features of deep adoption are:

- the product supports a key process, eg. the company’s sales process runs on a CRM, performance & payroll management is done on an HR software, or technical support delivered through support software

- the product has important data that companies don’t want to lose

- the product enables, or connects with multiple other data silos to make 1 + 1 = 3

- the product is mouldable to support the company’s workflow

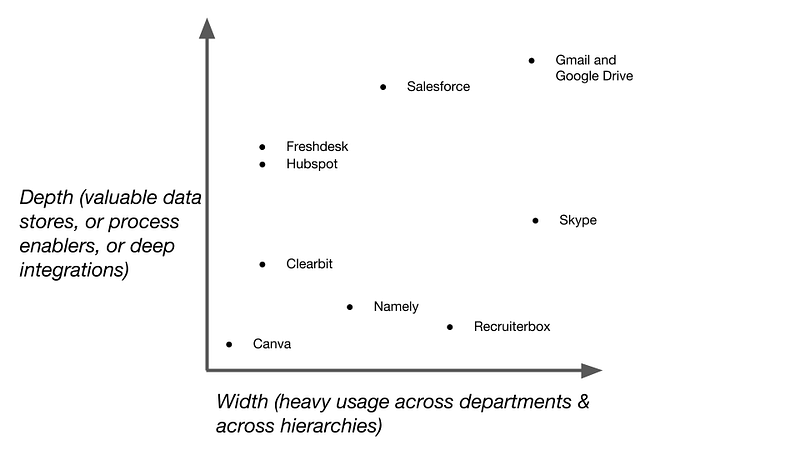

Placing the products we use at VWO on a depth/width graph, here’s what I came up with:

Explaining the graph above:

- Recruiterbox comes in the middle-ish because it’s mostly used by hiring managers and HR. It is used across all departments, but not across enough hierarchies. And the data it contains isn’t as valuable… mostly resumes/profiles of candidates who weren’t a fit.

- Canva, the easy graphic design software for non-designers, which I put to show a product that has minimal width or depth. It mostly comes up when designers aren’t available. Going by Canva’s initial positioning, they might get slightly deeper adoption if they are able to tap into social media marketing teams.

- Clearbit, connected to Salesforce and used for lead enrichment. We hardly ever login to the product, but I suspect we’ll keep using it until the contract renewal date rolls by and they raise prices. That’s when we’ll probably look to BuiltWith or something similar. I’ve included Clearbit to show a product that takes care of a small but important part of a business process, and as long as it does its job and the business process remains the same, it’ll keep being used.

- I’ve put Namely in the middle because even though it is HR and performance management software, at Wingify we haven’t adopted it fully. I notice that everyone uses it, but only for a few days every quarter during appraisal time. It could have deeper adoption if we had big-company kinda HR processes, but since we don’t, maybe Namely is suited to big companies with more sophisticated HR policies and management?

- Salesforce is probably the best example of a product completely owning a process, owning data, deep integrations and being used extensively by executives. I admire them for this, though I will never recommend them to anyone because of the painful experience it is dealing with the company and the product.

More thoughts

Not all products can have wide and deep adoption, but that doesn’t mean all hope is lost. If a product can capture even one important process for a team, the likelihood of churn reduces significantly. For example, Canva could if it targeted teams that need quick, good-looking images without relying on a graphic designer. First thing comes to my mind is social media teams in B2C businesses who are running campaigns all the time. Or take Recruiterbox from above, not widely or deeply adopted in the org but does a damn good job of streamlining the recruiting process.

Products tend to have higher a lifetime if they have some of the following properties:

- Are the “source of truth” in an org for important process/data

- Are in the core departments of finance, HR, sales, manufacturing/production/product and R&D

- Are used by practitioners and executives for different purposes

- Some or all parts of a team’s KPIs are reported by the product

- Are heavily used by senior management

- They are close to the value provided & realized by a company, like product, R&D or revenue/profits

Salespeople are trained to hack the selling process by reaching the highest decision maker as soon as possible. No doubt this still works, but in a world where hierarchies are flattening, practitioners who’re going to be actually using the product are becoming important factors in the buying process. Making a quick sale without adequate follow-up support from customer success managers leaves you at a risk of being upended after the contract period.

The Customer Success function can have a massive impact on increasing lifetime value if they understand that their goal in the first few months is to increase width and depth of adoption of the product, and they’re incentivized towards those goals.

Based off my Canva point, I realize that when you’re creating a product, it’s important to think of the process and data that you’re going to own, and for the teams + hierarchies that you’re going to own them. And this needs product + human effort.

I’m surprised why products don’t integrate more deeply with email. There’s this entire hullabaloo about AI and chatbots right now (early 2017). I’d instead focus energies on much a deeper sync with Gmail and Outlook. After all, that’s where the majority of decision makers spend their time.

Guest Post by Siddharth Deswal, Lead Marketing at VWO. This post originally appeared on http://deswal.org/saas/to-reduce-churn-your-saas-needs-to-be-adopted-widely-and-deeply/

Thank You for sharing, Keep Posting

This statement is well said “And this needs product + human effort.”

Thanks for this post,great blog