What is Financial Inclusion? Financial inclusion is the delivery of financial services & products to sections of disadvantaged and low income segments of society, at an affordable cost in a fair and transparent manner by regulated mainstream institutional players. The term “financial inclusion” has gained importance since the early 2000s, and is a result of findings about financial exclusion and its direct correlation to poverty.

Where are we today?

It is estimated, that about 2.5 billion people or about half of the global population do not have access to any kind of formal banking services. In India, only 55% of the population have deposit accounts. Less than 20% of Indian population has life insurance coverage and only 10% have an access to any other kind of insurance coverage. The number of credit cards has hovered around 20-25 Million mark for last 4 years.

Reserve Bank of India’s vision for 2020 is to open nearly 600 million new customers’ accounts and service them through a variety of channels. Some of the steps taken by RBI to fuel inclusive growth are:

- Setup of business correspondents (BCs):In January 2006, RBI permitted banks to engage business facilitators (BFs) and BCs as intermediaries for providing financial and banking services. The BC model allows banks to provide doorstep delivery of services, especially cash in-cash out transactions, thus addressing the last-mile problem. With effect from September 2010, for-profit companies have also been allowed to be engaged as BCs.

- Adoption of Electronic Benefit Transfer (EBT): Banks have been advised to implement EBT by leveraging Aadhaar & BCs to transfer social benefits electronically to the bank account of the beneficiary and deliver government benefits directly without a middle-man, thus reducing dependence on cash and lowering transaction costs.

- Relaxation on know-your-customer (KYC) norms: KYC requirements for opening bank accounts were relaxed for small accounts in August 2005, thereby simplifying procedures by stipulating that introduction by an account holder who has been subjected to the full KYC drill would suffice for opening such accounts.

- Simplified branch authorization: RBI permitted domestic commercial banks to freely open branches in smaller towns & cities with a population of less than 50,000 with general permission

- Opening of branches in rural areas: To further step up the opening of branches in rural areas banks have been mandated in the recent monetary policy to allocate at least 25% of the total number of branches to be opened during a year in rural areas.

It is worthy to note that Mangalam, a small town in Coimbatore district in Tamil Nadu, with a population of under 10,000 in 2001 became the first village in India where all households were provided banking facilities by the end of 2005.

Challenges

Some of the policy changes to improve financial inclusion were hurriedly executed without setting up appropriate regulatory oversight or consumer education. Aggressive micro credit policies that were introduced to enhance financial inclusion resulted in consumers becoming quickly over-indebted to the point of committing suicide. There were large scale suicide cases reported. We also witnessed repayment rates for Micro-lending organizations collapse after politicians in one of the country’s largest states called on borrowers to stop paying back their loans, threatening the existence of the entire 4 billion a year Indian micro credit industry. Industry is still trying to recover from that setback.

It was also felt after a decade of efforts in this space that financial inclusion isn’t possible without financial education. We have seen even in mature & literate economies like the US, there are several social issues that arise from easy availability of credit. At the hind side this should have been anticipated but wasn’t. RBI launched National Strategy for Financial Education on July 16, 2012 with a vision to build “A financially aware and empowered India” with the following goals:

- Create awareness and educate consumers on access to financial services, availability of various types of products and their features.

- Change attitudes to translate knowledge into behavior.

- Make consumers understand their rights and responsibilities as clients of financial services.

Opportunities

Given the focus government has on improving financial inclusion, this sector offers massive potential to entrepreneurs. Analysts put the initial estimates at over USD 2 Billion or 11,000 crore within the next 3 years alone. Let’s briefly look at the kind of opportunities that exist.

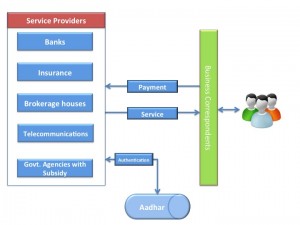

If you look at the graphics above opportunities primarily lie around interaction between various service providers and BCs. Few opportunities that are hot today include:

- Developing Next generation payment systems – Financial inclusivity deals with high volume but small ticket transactions. Existing payment gateways are too expensive and not built grounds-up to deal with the complexity & nature of this business. Therefore there is an acute need for a new payment gateway that is low cost and based on either Aadhaar or biometrics.

- Mobile technology could be leveraged in various ways as there are over 700 Million people in India who have mobile phones. Today mobiles can do almost everything, from biometrics to even IRIS & document scanning. There are limitless applications one can think of.

- Financial Applications – Various financial applications be it in insurance, in capital markets or banking could be developed to be able to reach out to the rural masses. All these applications must be able to support Aadhaar, Biometrics & be able to work thru Business Correspondents.

- Services – Setting up efficient BCs & training them to be able to conduct multiple businesses in another massive area of opportunity.

Very interesting times like these call for innovation & out of the box thinking. Wear your thinking hats, there is never going to be a better time.