iSPIRT – co-hosted the first Platform Roundtable to prime the discussion on Indian platform companies’ game plan for potential business disruption that platform companies bring to a sector. It was held on 12th March at the office of InMobi, Bangalore. The Roundtable was anchored by Dr. Peter Evans, Vice President at CGE and Sangeet Paul Choudary, a CGE Fellow and founder of Platform Thinking Labs.

The theme of this Platform Roundtable was to invite leading platform company in India, to come and participate in an open discussion on the title question with a two-fold focus.

- To drive awareness on global research to platform companies and

- To ask for India platform businesses support in strengthening this industry practice research

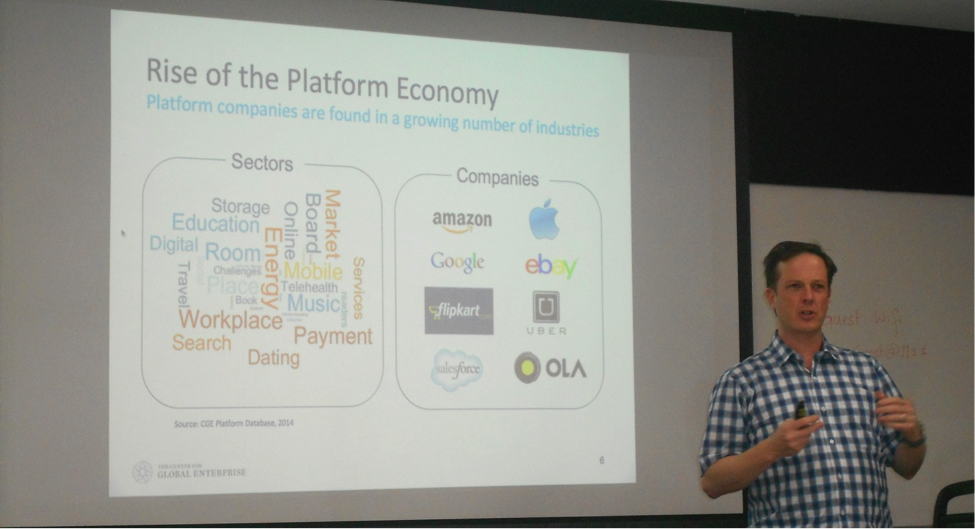

CGE has been tracking the rise of the platform economy as how such are platforms restructuring industries and economies to answer questions like why platforms so disruptive to traditional businesses /industries. To learn about this from first principles CGE has initiated their first global study of platform companies that is analysing platform dynamics in markets around the world. It goes without saying that software is integral to enabling platforms.

Given iSPIRT’s ambition and viewpoints blogged by an anchor that product offerings, especially software platforms, are not for the faint hearted but such businesses have grown substantially in recent years to become a much larger part of the economy globally, naturally, we had some questions of our own to pose for the CGE’s two leading platforms experts to answer.

Given iSPIRT’s ambition and viewpoints blogged by an anchor that product offerings, especially software platforms, are not for the faint hearted but such businesses have grown substantially in recent years to become a much larger part of the economy globally, naturally, we had some questions of our own to pose for the CGE’s two leading platforms experts to answer.

Is India destined to be player in the emerging platform economy, where single and multi-sided business models are rapidly gaining size and scale in local and global markets? As a player in this rapidly changing digital landscape, do platform companies understand the rules of this game well? What game plan do I as a platform company must understand and embrace to score runs in this match?

Is India destined to be player in the emerging platform economy, where single and multi-sided business models are rapidly gaining size and scale in local and global markets? As a player in this rapidly changing digital landscape, do platform companies understand the rules of this game well? What game plan do I as a platform company must understand and embrace to score runs in this match?

In addition to this CGE had certain research outputs and participation inputs that they wanted to share and start a dialogue with Indian platform startups that we wanted to facilitate to improve the overall ecosystem

Benefits that participating Platform Startups were after are

- Learning from CGE’s analysis & insights of the research work on platforms done so far

- Ways to participate and contribute to strengthening this understanding of opportunities and constraints that India platform companies face both domestically and internationally

Attendees of the Roundtable:

| Company Name | Attendee | |

| 99Tests | Praveen Singh | |

| AngelPrime | Amit Somani | |

| Capillary Technologies | Pravanjan Choudhury | |

| CGE | Peter Evans | |

| ContractIQ | Ashwin Ramasamy | |

| FreeCharge | Pravin J | |

| Hano | Thiyagarajan | |

| InMobi | Preetham | |

| Instamojo | Akash Gehani | |

| CrowdFire | Sid Menon | |

| LetsVenture | Sanjay Kumar Jha | |

| Nowfloats | Ram Kumar | |

| Olivo India Pvt Ltd | Satish Garimella | |

| Oyorooms | Ajay Bansal | |

| Platform Thinking Labs | Sangeet Choudary | |

| Urban Ladder | Sudhanva Rao | |

| webmobi | Sachin Anand | |

| Primaseller | Mohammed Ali | |

| Vivek Subramanian | ||

Overview

According to statista, the number of crowdfunding platform, one type of two-sided platform, alone exceeded 450 in 2012 worldwide and majority of them were based in the United States and Europe. This is a small drop in the ocean of number of platform companies that serve many needs, beyond crowdfunding, and as such represent huge opportunity that disruptive companies across different sectors and markets are going after.

Most of the tech entrepreneurs have built interesting products to address various market needs in a platform way – where a platform is built using any base of technologies on which other technologies or processes can be built for a group of external producers and consumers can interact to create value.

Most of the tech entrepreneurs have built interesting products to address various market needs in a platform way – where a platform is built using any base of technologies on which other technologies or processes can be built for a group of external producers and consumers can interact to create value.

Platforms = Scale

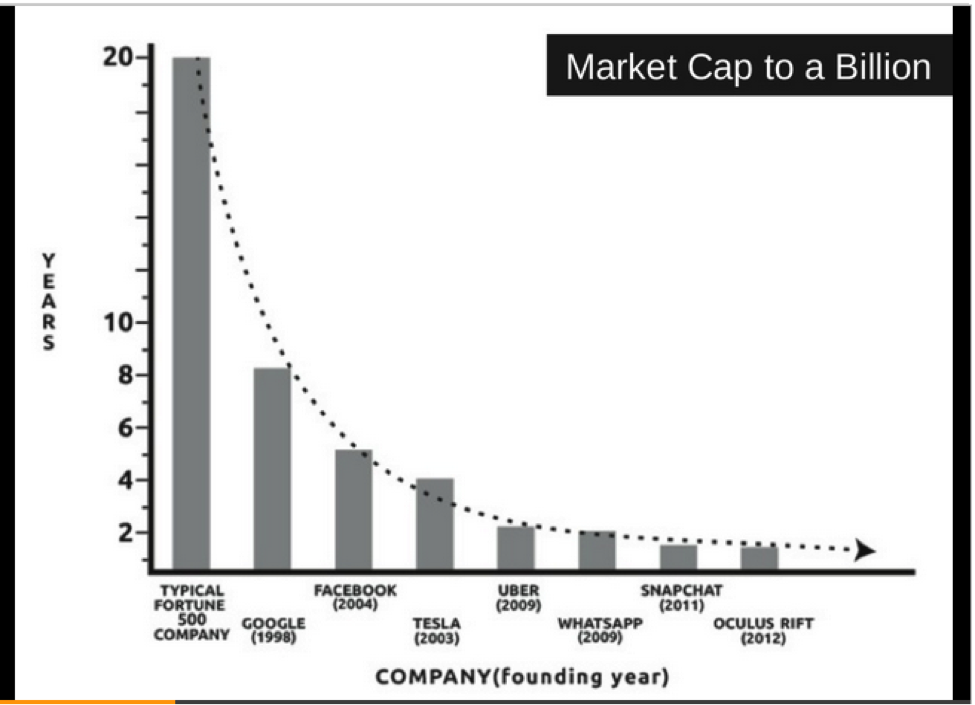

Platform businesses, unlike typical businesses (say fortune 500 company) scale up and out very quickly and this pace is only accelerating in the past decade as can be seen in the chart below

Platform companies reach $Billion+ market cap in couple of years now and this is mainly due to network effect of having more users and creating more value cyclically. Tech entrepreneurs, usually tend to measure user growth of a platform as a yardstick instead of thinking systemically, that platform users play different roles. This approach is incorrect.

Platform companies reach $Billion+ market cap in couple of years now and this is mainly due to network effect of having more users and creating more value cyclically. Tech entrepreneurs, usually tend to measure user growth of a platform as a yardstick instead of thinking systemically, that platform users play different roles. This approach is incorrect.

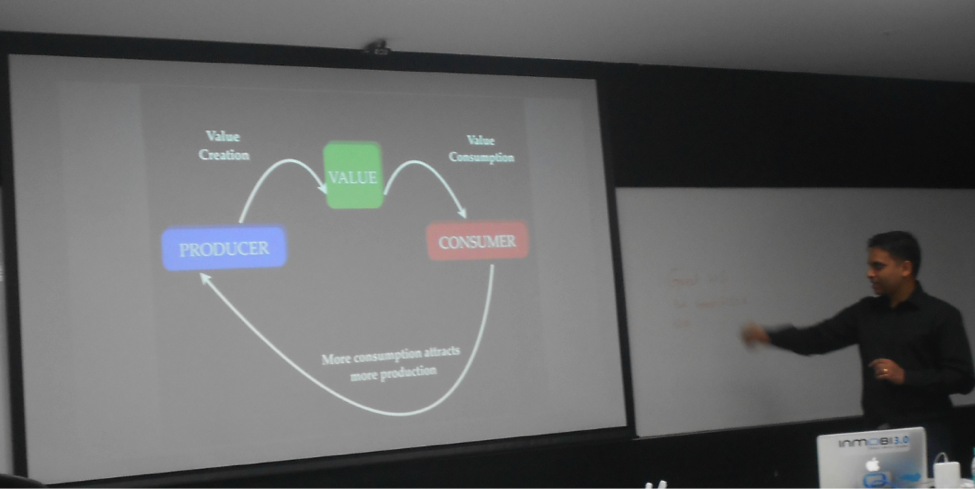

- Users can be classified as producers and consumers in any platform where the value is created by the producers and consumed by the consumers of the platform given both of them are users of the said platform. Platform as a system has the necessary feedback loop that incentivizes the producers as more consumption attracts more production cyclically so value increases over time as network effect dictates. So instead of user growth the right metric to consider is the interaction between producers and consumers in terms of growth and address any interaction failures

- Platforms scale quickly in time both operationally and in terms of monetization – For instance AirBnB operates in 180 countries and 36000 cities – so does Uber operates in 45 countries and 190 cities. So they are essentially a globally integrated enterprise in terms of design almost from the get go as contrasted with multi-national corporations (MNCs). In terms of revenue, Apple has paid out more to iPhone/iPad App developers (> $10B ) in US than the Hollywood box collection

Systems theory and Network effect

In response to a question on how best to understand this business we should look for systems theory, micro-economics and appropriate metrics Sangeet mentioned:

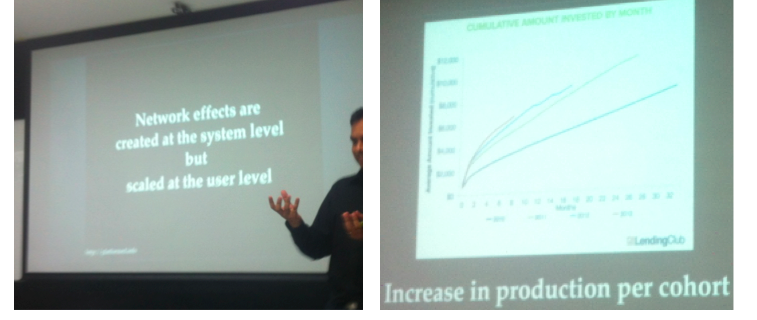

- Instead of user growth, which is at best a vanity metric, increase in production per cohort of users is a better metric of production growth. Similarly, what is “inventory”, and how much time does it take to liquidate it, are there are any consumption request failure (think “ no cars available” message in Uber when you as a consumer go to book a ride) are key interaction numbers for platform companies to dashboard.

- Essentially taking a systemic view, production feedback loop, network feedback loop encouraging producers to produce more and consumers feedback to consume more are platform target measures.

- Cumulative value of the platform comes from collection, reputation, influence and behaviour data -collectively these act as switching cost to producers who are multi-homing across similar platforms. Business (especially product managers) should accordingly consider platform data acquisition, user behaviour design for cumulative value optimization rather than as point feature set of platform to compete or imitate since network effects are created at the system level but scaled at the user level.

- Chicken and Egg problem typical of multi-sided platforms can be addressed by looking at network density of a node and the required levels of production over the amount of production per consumer cohort. For hyper-local or local markets (like Uber in a City X) should be solved as chicken-egg problem for each locality and hence will moderate scale.

Thus platform business have to focus on removing gate keepers to producer-consumer growth, identify new producers to onboard and disaggregate as necessary via tools etc systemically and micro-economists as needed to design/ troubleshoot any supply-demand problems based on the respective platforms model of inventory.

Thus platform business have to focus on removing gate keepers to producer-consumer growth, identify new producers to onboard and disaggregate as necessary via tools etc systemically and micro-economists as needed to design/ troubleshoot any supply-demand problems based on the respective platforms model of inventory.

Business Considerations

Sangeet and Peter also outlined certain business considers that this winner-take-all platform models tend to produce:

- Do not forget the success of a platform business depends on a number of control points that different from the traditional businesses. Starting with producers and consumers who are both external to the platform, the platforms are not like “Pipes” where Supplier to Company to Distributor/Customer model works in this networked environment.

- The target or objective of traditional sales team is to drive sales of products of the company which in platform business is produced by producers. Even though as a marketplace, the platform captures the commercialization of goods and services in the platform, it is not produced by the company employees which impacts productivity, brand, culture of the company to highlight a few. Practical lessons like AirBnB getting the first “Hosts meetup” to build culture and best practices of hosting were discussed to highlight details to which platform companies needs to pay attention.

- Also regulatory agencies are taking a close view at the monopolistic nature of the platforms

The discussion then covered into how in India platforms in Travel succeeded versus platforms in e-commerce and transport are facing tough challenges from global competitors. Everyone one chimed in with interesting thoughts and how such instances played/playing out in China vs India.

Conclusion

It was open session with structured discussion among the participants on about how platform initiatives have unique management challenges and how they need to be managed. Practical aspects of the problem were complemented with research on a macro-, global scale. Participants raised questions on the components of platform business and ways & means to grow them across industries, like health, hospitality, venturing and got validated insights!

The high level of interest and engagement from all participants was evident as the session that planned for couple hours on a mid-weekday saw almost all registered attendances coming in well before start time in peak Bangalore traffic and lots of questions with a request to form a platform group for discussions and suggestion to have macro-economists available for early stage startups to leverage.. We finally concluded our first Platform Roundtable for 2015 with a promise from CGE that they will share more research with iSpirt and there will be two-way ongoing exchange on the platform matters such as research sharing, platform database creation.