Health warning: this post is slightly longer than the regular articles as the subject calls upon a more detailed discussion of the issues, so please be patient and read on!

Our start-up ecosystem has come leaps and bounds over the past few years, the sheer development can be measured by the rising number of early stage investments, the increase in the number accelerators and the number of wannabe student entrepreneurs aspiring to become next Steve Jobs or Mark Zuckerberg. On the face of it all this may sound really promising (which it is!) but many cracks begin to appear as one starts scratching the surface. The current rate of ecosystem development will fall way short of the challenge that currently faces this nation and unless we change gears it will be difficult if not impossible to meet the expectations in the next decade.

When I was kick-starting my journey, I came across a startling fact that reinforced my belief that Indian start-up ecosystem needs more momentum if it is to come anywhere close to meeting the broader socio-economic targets. According to a recent planning commission study, India needs to support nearly 10000 scalable start-ups by 2022 to provide some level of sustainable job creation to the 140 million potential job seekers entering the workforce over the same period but currently around 450 new tech start-ups are launched and overall just 200 start-ups get funded every year by angels / VCs. So what is fundamentally going wrong here? Why can’t a country that prides itself on its intellectual horsepower, huge proportion of adults and a maturing market not able to get its act together?

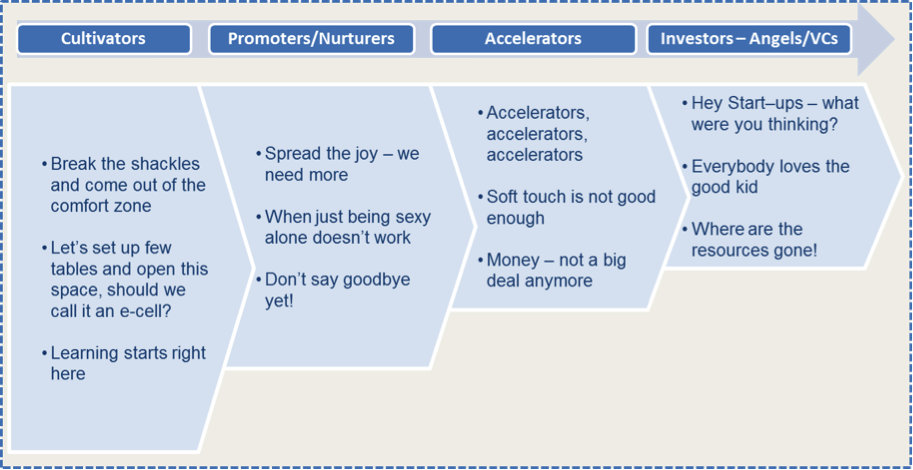

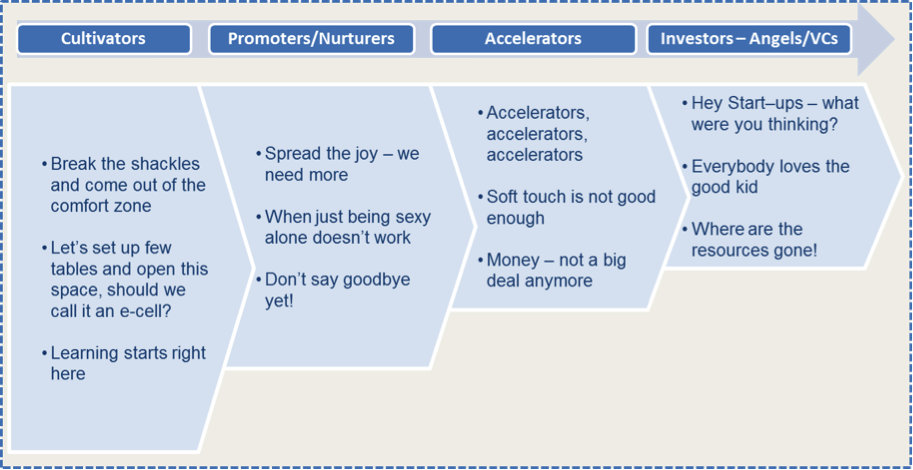

This prompted me to explore some of the underlying root causes within the ecosystem (i.e. non market or policy related) that are impeding the ecosystem growth. A deeper look into the ecosystem value chain reveals fundamental gaps along the start-up journey starting from entrepreneurial desire through to building sustainable businesses and obtaining early stage funding.

Cultivators

Cultivators are the first level institutions that provide exposure to the budding entrepreneurs and help them find their starting point. These institutions play a key role in igniting the dormant fire and giving birth to entrepreneurs. But let’s face it our social, education and even the corporate culture is not actively embracing the entrepreneurship phenomena. According to a Gallop study, India ranks in the bottom quartile for culture and social capital for entrepreneurship. India’s premier institutes fall way short of global benchmarks on producing entrepreneurs (5% versus 10% in premier global institutions) and the innovation rank is also not something we can boast about (62 out of 125 nations).

Cultivators are the first level institutions that provide exposure to the budding entrepreneurs and help them find their starting point. These institutions play a key role in igniting the dormant fire and giving birth to entrepreneurs. But let’s face it our social, education and even the corporate culture is not actively embracing the entrepreneurship phenomena. According to a Gallop study, India ranks in the bottom quartile for culture and social capital for entrepreneurship. India’s premier institutes fall way short of global benchmarks on producing entrepreneurs (5% versus 10% in premier global institutions) and the innovation rank is also not something we can boast about (62 out of 125 nations).

Break the shackles and come out of the comfort zone: Indian culture broadly lacks that entrepreneurial spirit and does not encourage risk taking – the fear of failure is the single biggest challenge we need to overcome. Institutions promote careerism over entrepreneurship and traditionally our family culture dominates our career decisions. This has changed recently but we need more of this to drive faster change. We need more leaders and risk takers!

Let’s set up few tables and open this space, should we call it an e-cell?: There are E-cells in pretty much every college campus these days but the quality of support provided is an issue up for debate. Majority of the incubators see their role as limited to providing physical space and hosting few business plan events. The institutions usually do not have relevant entrepreneurship driven structured programs and courses that can encourage students to get a real taste of this exciting pursuit.

Learning starts right here: Those brave ones who dare to opt for entrepreneurship as a career option lack an understanding of what a sustainable, global and truly innovative business means – their aspirations are not BIG enough. The education and corporate system struggles to explain these notions as a result of which the quality of entrepreneurs / ideas is generally weak.

Promoters & Nurturers

These enabling institutions (usually run by volunteers as non-profit ventures) provide the necessary glue in the value chain and ensure a supportive environment is created that encourages entrepreneurism. The institutions are doing an excellent job in encouraging entrepreneurs by providing a platform to connect likeminded individuals in a short, intense and fun product building format but fall way short of following this through and nurturing them into a start-up mould. According to an estimate from one of the founders of such initiatives, only 20-30% participants consider launching a start-up out of which a mere 5-10% can hope to find a place in a structured program like an accelerator.

These enabling institutions (usually run by volunteers as non-profit ventures) provide the necessary glue in the value chain and ensure a supportive environment is created that encourages entrepreneurism. The institutions are doing an excellent job in encouraging entrepreneurs by providing a platform to connect likeminded individuals in a short, intense and fun product building format but fall way short of following this through and nurturing them into a start-up mould. According to an estimate from one of the founders of such initiatives, only 20-30% participants consider launching a start-up out of which a mere 5-10% can hope to find a place in a structured program like an accelerator.

Spread the joy – we need more: It is believed that the cumulative attendance at these events stands at less than 20000 entrepreneurs per year which is only a fraction of the potential entrepreneur base cultivated upstream. These institutions have done a fantastic job at glamorising the entrepreneurship phenomenon but the potential reach of such initiatives has so far been limited due to domain and geography focus.

When just being sexy alone doesn’t work: Majority of these 1-2 days format programs / events are successful in creating a buzz in the community but fail to instil a deeper and broader desire among the participants to take the plunge and do something more intently with their ideas and teams. As suggested above, usually around 20-30% participants think of taking the next step and starting the venture.

Don’t say goodbye yet!: Some institutions provide a level of structured support to the entrepreneurs interested in starting up post such events but the ecosystem in general lacks the infrastructure / will to sustain their momentum until they are ready to be passed on to the downstream institutions such as accelerators. On average less than 8% applicants are acceleration ready when they approach the program suggesting the underlying weakness in the pre acceleration support system.

Accelerators

Accelerators help build the fundamental blocks of the start-up business i.e. finalising the product, launching and gaining initial traction, building a clear business strategy etc. Most accelerators barring a few have popped up in the last year or so and are still devising an optimal model for the Indian start-up ecosystem. The accelerator success metrics are yet to be defined / standardised but if we take the typical business performance indicators, start-ups going beyond a critical mass (revenue, customers, funding etc.) post acceleration program are exceptionally rare – funding for less than 20% of portfolio companies compared to more than 80% for top performing accelerators in US. This is quite alarming.

Accelerators help build the fundamental blocks of the start-up business i.e. finalising the product, launching and gaining initial traction, building a clear business strategy etc. Most accelerators barring a few have popped up in the last year or so and are still devising an optimal model for the Indian start-up ecosystem. The accelerator success metrics are yet to be defined / standardised but if we take the typical business performance indicators, start-ups going beyond a critical mass (revenue, customers, funding etc.) post acceleration program are exceptionally rare – funding for less than 20% of portfolio companies compared to more than 80% for top performing accelerators in US. This is quite alarming.

Accelerators, accelerators, accelerators: A lot has been debated about the recent growth in the number of accelerators. But the reality is India currently has close to 25 accelerators that provide money and/or mentoring to approximately 150 start-ups annually whereas in US top 3 accelerators alone are able to accelerate as many start-ups. We will need many more “quality” accelerators with both tech and non tech focus to give promising start-ups a fair chance to learn the tricks of the trade and provide them a strong launching platform.

Soft touch is not good enough: From my personal experience, I find a huge expectation mismatch among start-ups and accelerators. Where the later believes that following a similar sort of model to Y Combinator is all that we need but the reality is we must understand that the mindset of western entrepreneurs is very different from that of an Indian. Having lived and worked abroad for quite some time, I can certainly say the air of capitalism is very thick in the western culture whereas we don’t get a similar level of exposure from our educational / professional backgrounds which can enable us to become commercial in our thinking. Therefore a complete hands off and short duration engagement model underpinned by too much “gyaan” has had limited success so far. There is a need to do some hand holding during the program to get the start-ups proficient in various aspects of their business. Mentoring alone won’t do it, we need commercial partners who are engaged with the start-ups throughout the program.

Money – not a big deal anymore: Let’s face it, in today’s world raising few lakh rupees is not an insurmountable challenge for start-ups, most wannabe entrepreneurs are capable of scratching theirs’ or their folks’ wallets to gather the initial seed amount to build their MVPs. With money not being a huge issue the start-ups are not willing to give away a substantial amount of equity to accelerators in return of limited perceived value. The value proposition doesn’t appear to be compelling enough to attract good quality start-ups who could otherwise benefit from the acceleration process and proceed efficiently to the next level.

Investors – Angels/ VCs

Investors are the big daddies of the start-up world and arguably play an instrumental role in making or breaking the dreams of the entrepreneurs who want to leave their mark on this world. They provide the impetus necessary both financially and operationally to scale the business to the next level. So what are the reasons why only 1-2% of the start-ups that approach them are successful in raising funds whereas in US this is close to 15-20%.

Investors are the big daddies of the start-up world and arguably play an instrumental role in making or breaking the dreams of the entrepreneurs who want to leave their mark on this world. They provide the impetus necessary both financially and operationally to scale the business to the next level. So what are the reasons why only 1-2% of the start-ups that approach them are successful in raising funds whereas in US this is close to 15-20%.

Hey Start–ups – what were you thinking?: One of the main reasons cited by VCs is that most start-ups are not ready for the next big leap – they have not showed much traction or demonstrated enough maturity to justify a heavy cheque. To some extent I can also substantiate this as most of the ideas I have seen going through to the VCs or angels are not ready for funding – there is no clear validation, few (if any) early adopters, little revenue and limited clarity on the business direction. But why is the quality of the start-ups not good enough at this stage? The answer lies in the journey of the start-up up to this point!

Everybody loves the good kid: Although many early stage funds and angels claim to be open to all start-up types but sub consciously there is a strong bias towards best performing tech or web enabled companies (65% of total investments in 2012) where the business models appear more scalable and capital efficient. There is nothing wrong with this investment philosophy but we also need players who are willing to make some riskier bets on a decent team / idea still in early stages and support more non tech focused businesses as well where potential returns could be comparable.

Where are the resources gone!: I have also observed that in some cases although investors like the idea and team but feel restricted in terms of financial and/or human resources. This is less than ideal as the last thing we need is to let the great start-ups die because of lack of resources. More than money lack of quality advisors who can actively work with the portfolio companies is critical.

These issues among others that have not been covered here aim to illustrate some of the potential gaps that exist in the ecosystem. However I must reiterate that where we are at today is a great position to be in and has given us an excellent launching pad. I am very optimistic about the future and I hope by addressing these challenges we can further improve our ecosystem and come closer to meeting our targets and building a sustainable start-up nation!

Please stay tuned for the next post in the series that will look at the potential solutions to these challenges…The start-up – ecosystem nexus – “as-is” vs. “to-be”