Welcome to the Third edition of the India SaaS Survey by DCS Advisory, India’s largest software investment banking advisory practice, in partnership with iSPIRT Foundation.

What is the survey about?

The survey aims to anonymously benchmark Indian SaaS companies to better understand the unique challenges they face and the unique advantages they leverage, creating a single reference point updated annually.

What’s New?

In-line with our goal of constantly improving the quality of our survey we have added two new sections this year, one covering Inside Sales and the other looking at Product Market Fit. Our interactions with SaaS founders and various other stakeholders in the ecosystem clearly identified these topics as the most valuable for the founders of our young ecosystem. We have also added new analyses to previous sections which we hope will further enrich the survey.

Decoding the Results

This year, we have received responses from 59 respondents with an aggregate ARR of ~$175Mn, including some of the most prominent SaaS companies operating in India. We sincerely thank all participants for their time and effort in completing this survey and look forward to ever-increasing participation every edition going forward.

Some key takeaways from the survey are:

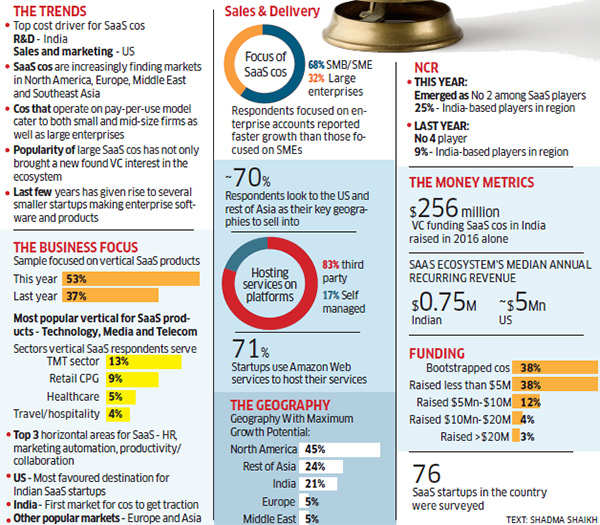

- Our typical (median) respondent this year is at $0.75M in ARR, likely to be Bangalore or Chennai headquartered (58%) and was founded in 2014 or later

- Whereas last year we noted a ‘paucity of machine focused SaaS’, this year infrastructure SaaS made it into the top 3 amongst horizontal focus areas (and took in >50% of horizontal funding)

- Overall our respondents grew faster than last year and continue to be bullish on the future, looking towards North America for growth

- Inside sales is now the most popular sales channel in our ecosystem but, based on our data, does not yet conclusively outperform the more established FoS channel. In the years to come, particularly for startups selling overseas, we expect this to change

- ~50% of our respondents that focus on Inside sales boast a conversion rate of 10-25%. We look forward to tracking this metric in future editions of this survey

- 92% of our respondents believe they have achieved product market fit, further indicating that it takes a period of 12-24 months with about 3 product releases to get there (see commentary below).

- Across the board our respondents typically earn gross margins in the range of 60-70%, with R&D being the largest expense post gross margins

- Our typical respondent reported ~10% annual churn (which may be under reported). We believe the customer lifetime is likely somewhere in between at 5-6 years

- Over a third of our sample has never raised external capital. Those that have, have raised $1-5Mn (median) at 7.5-10.0x of ARR (median).

Commentary on PMF

Additional correlations which cannot be derived conclusively from the collected data but I still believe to be relevant so highlighting here as a commentary:

- Quicker product-market fit seems like a major factor in reaching >$1M ARR .

- Startups who reached product-market fit in <1 year are more likely to hit > $1M ARR in < 2 years.

- Approximately 50% of startups who took longer to reach PMF have not yet reached $1M ARR.

- While Sales & Marketing was clearly listed as the top challenge on the journey to $1M, PMF was more of a challenge for startups who took longer to reach market-fit.

As before, we remain committed to refreshing the survey results on an annual basis. As the India SaaS ecosystem continues to grow, we fully expect to increase overall survey participation, as well as the insights and bench marking data provided. You can also read the results of the previous 2016 SaaS survey and the 2015 Survey results.

Note: Feature image original source – Nick Youngson