In the rapidly evolving landscape of the AI economy, the choices made today will reverberate for generations. As custodians of India’s future, we must recognize the urgency of embracing AI as a lynchpin of economic growth. The time to act is now!

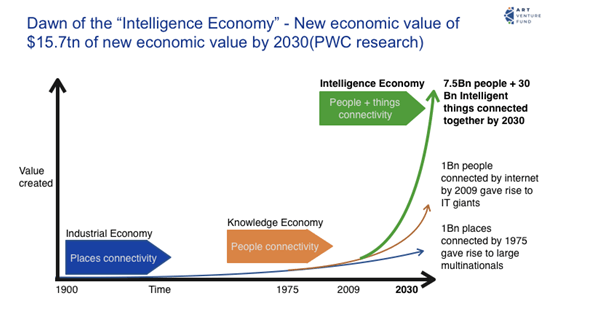

In an era characterized by relentless technological advancement, a nation’s economic growth trajectory hinges on its ability to harness the power of artificial intelligence (AI). Goldman Sachs reported that generative AI could raise global GDP by 7%. By 2030, this AI driven Intelligence Economy might add $15.7tn of new economic value as per PWC research.

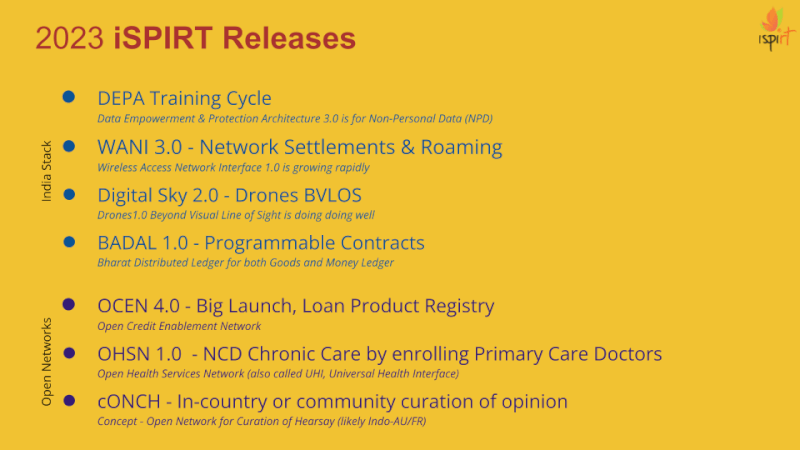

With its burgeoning tech industry, diverse and large data pool and remarkable human capital, India stands at the precipice of an economic transformation that could either propel it to global leadership or condemn it to follow in the wake of other trailblazers. As political decision-makers, the imperative to recognize and seize this opportunity cannot be overstated in view of India’s bid to become one of the top 3 economies of the world. The availability of the DEPA Training Cycle and the DPDP Bill passage through the Parliament open the door to immediate and strategic action via the creation of a large AI economy.

I. The AI Imperative for Global Competitiveness:

India’s demographic dividend of 900mn+ people is no secret but must be coupled with technological prowess to ensure a multiplier effect for sustained growth. As global economies increasingly pivot towards AI-driven industries, overlooking this shift risks consigning India to a secondary role on the global stage. To maintain competitiveness, India must embrace AI not merely as a tool but as the very foundation of its economic strategy going forward. It must ensure that it is not just a consumer of AI but a critical creator of AI. In fact, it must aim to emerge as one of the 3 AI superpowers in the world.

II. Safe AI Leadership Depends on Data

India’s DEPA Training makes privacy-preserving collaboration between Training Dataset Providers and Modelers (called Training Dataset Consumers) possible at a large scale, which is a critical element in AI journey. The DEPA system does not rely on hard-to-implement enforcement of legal covenants around Anonymized Datasets, as is the case in countries like the US, where AI companies are fighting constant litigation. Instead, it depends on computational privacy guarantees in the use of aggregated datasets. This is core to enabling safe AI systems, built with reliable and traceable access to datasets. Then, it can be deployed quickly with human alignment that India can provide with its billion plus users. As India begins to unlock continental-scale datasets using this system, it will give rise to a vibrant ecosystem of AI Modelers. This dataset advantage in AI is not to be underestimated. By focusing on early Safe AI adoption, India can secure a foothold in these sectors, attracting global investment and cementing its position as an innovation hub whose AI innovations would be adopted by societies around the world.

III. Addressing Socioeconomic Disparities: Remote AI driven workflows & 5G

Harnessing AI’s potential can also serve as a powerful tool to address India’s socioeconomic disparities. AI-driven solutions can optimize resource allocation, improve public service delivery, reduce cost of access and create job opportunities across urban and rural areas. With massive 5G rollout, the possibility of digital global work aided by AI is here. It can dramatically bring income opportunity to rural and smaller cities, if we can bring in Indic language AI tools, which lower the bar for participating in the global workflows. By proactively leveraging AI to bridge gaps and enhance productivity, India’s leadership can demonstrate a commitment to inclusive growth and lay the foundation for a more equitable society. All the while reducing strains of growing urbanization, which might be disastrous for its overburdened large cities.

IV. The Gameplan for AI Leadership: Missing piece of compute clusters

DEPA Training will safely and responsibly unlock the collaboration between India Training Dataset Providers and Modelers. We have the talent already and the market scale to do Reinforcement Learning with Humans in the Loop. What we lack is tensor-scale computing enabled for Industry, startups, academia and Govt itself. The Government of India must address this by enabling the creation of many, not one, tensor-scale GPU cloud providers. There are many ways to do this: Challenge Grants, Viability-gap funding for cloud providers, and Matching-grants for Modelers. We favor the Matching Grants method for effectiveness, transparency, and competition. In addition, we must seek to create AI on the edge compute ecosystem for a strategic future.

V. Collaborative Diplomacy and Global Alliances:

AI does not recognize national borders, and collaboration is key to advancing the field. At the same time, we must recognize that Nvidia H100 boards are already on the US Export Control List for China. The US might leverage its muscle further at some time in the future. We must therefore have a strategic perspective in making our aggregate AI capability and datasets available to others based on a principle of reciprocity. We must build careful alliances with a broad set of players in US, EU and Asia that will accelerate India’s AI capabilities but also position the nation as a global AI thought leader.

VI. The Consequences of Inaction:

The consequences of neglecting AI’s potential are dire. India risks becoming a mere consumer of AI technologies, ceding economic leadership to countries that have embraced AI as a strategic priority. China, our neighbor, has famously vowed to be the sole AI superpower by 2030. This passivity could lead to missed opportunities, economic stagnation, and a loss of global influence. It may even result in India failing to breach the top 3 economies, , as we might have to buy both oil and artificial brains, draining our resources for welfare schemes for our large population. That could risk demographic disaster instead of demographic dividend.

Conclusion: We need to act now!

In the rapidly evolving landscape of the AI economy, the choices made today will reverberate for generations. As custodians of India’s future, we must recognize the urgency of embracing AI as a lynchpin of economic growth. The time to act is now! We must catalyze innovation, ensure global competitiveness, and create a prosperous future where India’s leadership is defined not by its past but by its capacity to shape the AI-powered future world decisively.

Sharad Sherma is co-founder of iSPIRT Foundation. Umankant Soni is the Chairman AI foundry, General Partner ART Venture Fund.