“If I had to guess, Social Commerce is the next area to really blow up” – Mark Zuckerberg

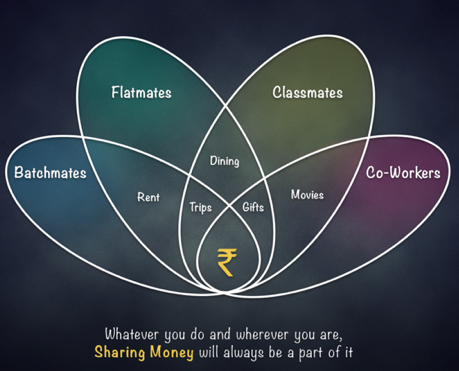

‘Social Commerce’ or more simply ‘Social Payments’ has been a relatively new concept to come up in the last few years. And in most cases, it remained like the early days of big data – easier to toss around but not presenting a clear picture. I believe the vagueness gets accentuated by the fact of the word ‘Social’ being a part of it. This is what leads a whole set of audience out there, to think that just latching on to or simply appending a ‘pay’ option inside a social network makes up for the concept. Nothing could be further from the truth. The true meaning of the word ‘Social’ in ‘Social Commerce’ is actually the full context of your real life use cases where any social activity is involved. For example – a dinner with your friends, an act of planning and sharing cost for a gift, so on & so forth.

In fact, if you actually ponder, you would perceive that the real driver of this phenomenon has been something else entirely. It is the proliferation of ‘shared economy’ lifestyle that makes these social use cases so prominent and common for us. Also your payment instances and touch points intersect across the whole matrix of these use cases. Traditionally, the process has been pretty fragmented with the social & fun experience never coming across in those payments you made with your friends. Until now!

In fact, if you actually ponder, you would perceive that the real driver of this phenomenon has been something else entirely. It is the proliferation of ‘shared economy’ lifestyle that makes these social use cases so prominent and common for us. Also your payment instances and touch points intersect across the whole matrix of these use cases. Traditionally, the process has been pretty fragmented with the social & fun experience never coming across in those payments you made with your friends. Until now!

And the reasons are plentiful. Let’s start from why social commerce has not worked with the incumbents (your digital wallets) –

- The pain of uploading money first from your bank account (because come on, you don’t keep large amounts of money in your mobile wallet)

- The limits of sending money to another wallet (You can’t send more than Rs. 10k at one time as a normal user!)

- The charges and time delays on withdrawing my wallet balance into my bank account (They are charging you for transferring your money back to yourself!)

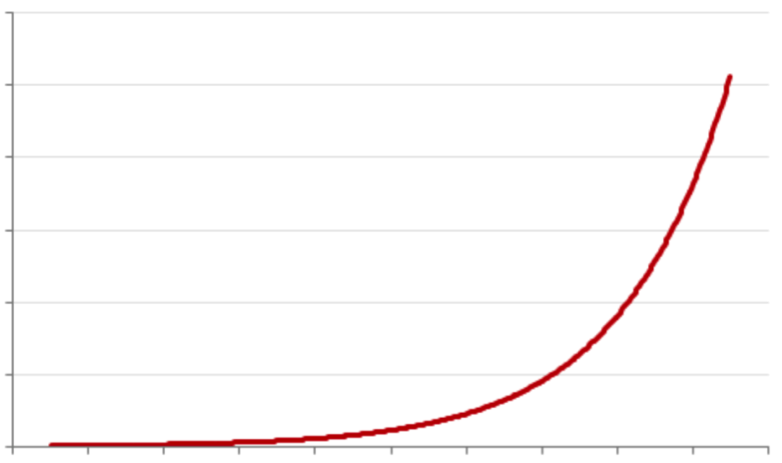

And I am sure you must have realized that the arrival of our own stack – UPI is the one of the key turn arounds (the ‘Paypal moment’) for Indian ecosystem, especially in terms of enabling ‘Social Payments’ as a category to exist independently in a big manner. UPI has brought about 10X the simplicity and 10X the speed which is a core pre-requisite for situations where you need to share money with your friends without any awkwardness. Now imagine adding all your social use cases on top of this beautiful and secure base of UPI. As you may have realized by now, that not only does it create a completely new paradigm but also increases the value by an order of magnitude (because of the network effects).

Once the wheels of motion start on any evolutionary path, it becomes almost impossible to stop them. The natural extension is that this category is bound to grow in India as well both in numbers and value (give the fact that it has already reached to 10s of billions of dollars in the west (US) with Venmo and the east (China) with WePay). The key thing to remember here is that in any new economy, it requires a fresh approach and outlook since the positioning is different from traditional P2P players and hence the product delivery and experience also needs to be different for the user. There have been numerous examples around the world with large social networks trying to add a basic P2P payments functionality and hoping it to take off in a big way. But it has not worked that well numerous examples like Snapcash (P2P payments via Snapchat in US).

This brings us full circle to the two golden philosophies that have stood the test of time again and again –

This brings us full circle to the two golden philosophies that have stood the test of time again and again –

- The products that work on the premise of ‘this thing/activity can be done here too’ never make the cut. For example – ‘You can send money on Paypal too!’ is NOT what a Venmo user is thinking.

- Once a consumer associates a product with a certain repeat and high frequency use case, it becomes nearly impossible to change his habit and perception for that product. For example – Messenger has traditionally been a place for sending messages and that is what a user thinks of when he recalls that app (and not for sending money).

This is where the formidable advantage of having a clean slate comes in –

- Tailoring the product design around your real world habits when it comes to splitting, collecting, managing and tracking all your payments with your close contacts

- Ensuring that the experience is insanely fun so that it takes away all the awkwardness that traditionally accompanies any monetary transaction with your friends

- Ensuring that the product caters to all your use cases to such a minute detail that even you get surprised when it comes to the features!

Needless to say that I am more than excited about how the Indian market is evolving in the fin-tech domain (especially with the Indian government supporting it at an awesome level). Look forward to continued awesomeness and magic along the way.

Cheers, Rohit Taneja, Mypoolin

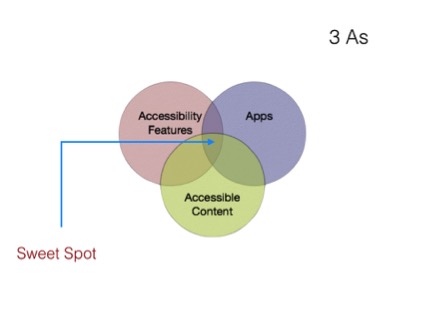

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –

Hence, our principle is simple – “Let people come in for the utility. Present it in the simplest manner. And let them discover the power of a humane touch”.

Hence, our principle is simple – “Let people come in for the utility. Present it in the simplest manner. And let them discover the power of a humane touch”.