India is on the glide path of emerging as one of the economic powerhouses of the world – its economy is ranked sixth in size globally (and slated to climb to second by 2030); it has the fastest growing annual GDP growth rate amongst (major) countries; the country ranked in the world’s top 10 destinations for FDI in 2017-18. With a population of 1.3 billion and a large middle class of ~300 million+, it is one of the most attractive markets globally. Specifically in the digital economy – India has a huge $ 167 billion-sized IT industry; it boasts of a 55% market share in global IT services & outsourcing; 1140 global corporations run their tech R&D centres in India. In the tech startup space, India has attracted Private Equity (PE) & Venture Capital (VC) investments of $33 billion in 2018, and it has over a dozen unicorns (startups with over $1 billion valuations).

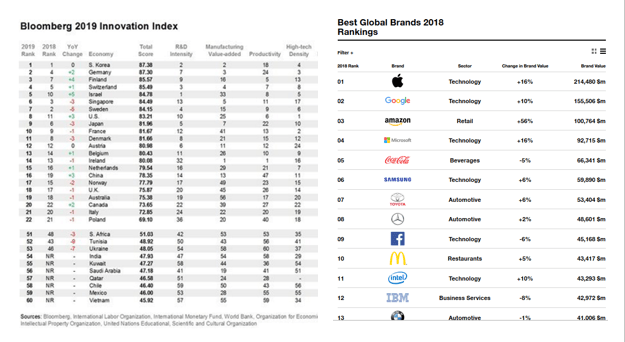

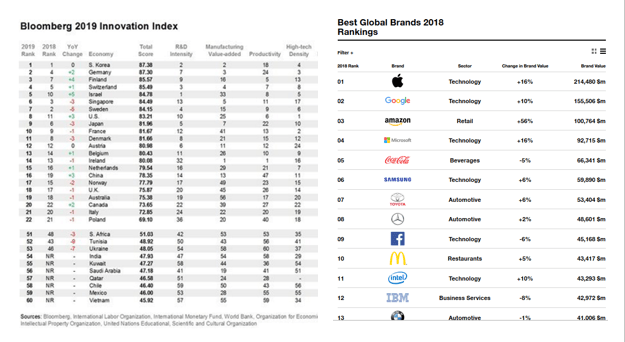

These data-points are truly impressive and would make any country proud, but they belie one of the glaring historical paradoxes of the Indian economic story – the sheer absence of world-beating products from India. Ask Indians to name three truly world class, globally loved Indian products or brands – chances are they’ll struggle to name even one. Check out the Global Innovation Index 2018 from the World Intellectual Property Organization (WIPO) – India doesn’t figure in the top 50 countries. Or the Interbrand 2018 Top 100 Global Brands Ranking – there’s no Indian name on that list. Leave aside brick & mortar industries, the Indian IT & Digital sector doesn’t fare any better on this count. IT services, which forms its lion’s share comprises largely of low end, commoditized services or cost arbitrage based outsourcing contracts. Most of the new age tech unicorns in India are based on ideas and business models that are copied from foreign innovators (with some local tweaks) – their outsized valuations are a result of them being the gatekeepers to the large Indian market, rather than from having created path-breaking products from first principles. So the overall trend is that India has a large domestic market, and it is a big supplier of technical brain power on the world stage, but when it comes to building innovative products, we come to a total cropper. This is best reflected in the Infosys Co-Founder, Narayan Murthy’s candid quote – “There has not been a single invention from India in the last 60 years that became a household name globally, nor any idea that led to the earth-shaking invention to delight global citizens”.

The launch of the National Software Products Policy (#NSPS):

It is in this light that the recently rolled out National Software Products Policy (#NSPS) by the Ministry of Electronics & IT (MeitY), Government of India marks a watershed moment. For the very first time, India has officially recognised the fact that software products (as a category) are distinct from software services and need separate treatment. So dominated was the Indian tech sector by outsourcing & IT services, that “products” never got the attention they deserve – as a result, that industry never blossomed and was relegated to a tertiary role. Remember that quote – “What can’t be measured, can’t be improved; And what can’t be defined, can’t be measured”. The software policy is in many ways a recognition of this gaping chasm and marks the state’s stated intent to correct the same by defining, measuring and improving the product ecosystem. Its rollout is the culmination of a long period of public discussions and deliberations where the government engaged with industry stakeholders, Indian companies, multinationals, startups, trade bodies etc to forge it out.

#NSPS will bring into focus the needs of the software product industry and become a catalyst in the formulation of projects, initiatives, policy measures etc aimed at Indian product companies. One of its starting points is the creation of a national products registry that’s based on a schematic classification system. Other early initiatives that will help in operationalizing the policy – setting up of a Software Products Mission at MeitY, dedicated incubators & accelerators for product startups, development of product-focused industrial clusters, preferential procurement by the government from product companies, programs for upskilling and talent development etc.

The Indian IT / Software Industry Landscape:

To understand the product ecosystem, one needs to explore the $ 167 billion-sized Indian IT / Software sector into its constituent buckets. The broad operative segments that emerge are –

1) IT Services & ITES: This is by far the largest bucket and dominates everything else. Think large, mid & small sized services companies throughout the country servicing both domestic & foreign markets. e.g. TCS, Infosys, Mindtree, IBM, Accenture, GE etc

2) Multinationals / Global Development Centers: These are foreign software companies serving Indian markets and/or using India as a global R&D development centre. e.g. Microsoft, Google, Netapps, McAfee, etc

3) Domestic Product Companies: This is a relatively small segment of Indian software product companies selling in domestic or overseas markets e.g. Quickheal, Tally etc.

4) Startups – E-commerce / Transactional services: This is the large, fast-growing segment of startups into direct (or aggregated) transactional businesses like e-commerce, local commerce, grocery shopping, food delivery, ride sharing, travel etc. e.g. BigBasket, Flipkart, Amazon, Grofers, Milkbasket, Swiggy, Dunzo, Uber, Ola, Yulu, Ixigo, MMT etc. You could also include the payment & fintech companies in this bucket – e.g. Paytm, Mobikwik, PhonePe, PolicyBazaar, Bankbazaar etc. This segment has absorbed the maximum PE & VC investments and is poised to become bigger with time.

5) Product Startups – Enterprise / CoreTech / Hardware: This is comprised of companies like InMobi, Zoho, Wingify, Freshdesk, Chargebee, Capillary, electric vehicle startups, drone startups etc. They could be serving Indian or foreign B2B markets.

6) Product Startups – Consumer Internet: This segment is composed of media/news companies, content companies, social & professional networking, entertainment, gaming etc. e.g. Dailyhunt, Inshorts, Sharechat, Gaana, Spotify, YouTube, video/photo sharing apps, Dream11 etc.

(N.B. Off course, this segmentation schema is not water-tight and there could be other ways to slice and/or label it)

Why India lags behind in Software Products?

The global software products industry has a size of $ 413 billion, and it is dominated by US & European companies. India’s share in that pie is minuscule – it is a net importer of $ 7 billion worth software products (India exports software products worth $ 2.3 billion, while it imports $ 10 billion). “Software is eating the world” – entire industry segments are being re-imagined and transformed using the latest developments in cloud computing, artificial intelligence, big data, machine learning etc. In this scenario, it is worth understanding why India seems to have missed the software products bus. The reasons are multifarious, cutting across cultural, economic, market, behavioural and societal factors –

a) The cultural aversion to Risk, Ambiguity & Failure: Indian society has traditionally valued conformity and prepares people not to fail. Our family and educational environments are geared for teaching us to eschew risk-taking and avoid ambiguity. But building products is all about managing risk and failure. When you take a product to market from scratch, you take on multiple types of risk – market risk, execution risk, product risk. For many people in India, this is in stark contrast to their social/attitudinal skills and expectancies they have built up over a lifetime.

b) “Arbitrage” offers the Path of Least Resistance: If you pour water down a heap of freshly dug mud, it will find the path of least resistance and flow along it. Human behaviour is similar – it is conditioned to look for the path of least resistance. And “arbitrage” offers that least resistance path in the IT industry – be it cost arbitrage, labour arbitrage, geographical arbitrage, concept arbitrage et al. The IT services industry leverages the cost arbitrage model via cheaper labour costs. Many of the transactional e-commerce startups in India have used geographical arbitrage to their advantage – once a successful product or model is created in another market, they bring it to India to capitalize on a local first mover advantage, build a large valuation and become the gatekeeper to the market before the (original) foreign innovators arrive in India many years later! But arbitrage means, that while you are taking on market & execution risk, you are not assuming the product risk. These dynamics played out at scale over the years has meant it is easier for a wannabe entrepreneur in India to go the arbitrage way and quickly build out a business using a readymade template than go down the software products path, which has a much longer gestation & higher risks associated with it.

IMHO, this “arbitrage” factor represents the single biggest reason why India has seen a virtual explosion in e-commerce startups, at the expense of product startups. Look around the startup ecosystem and you’ll see all kinds of transactional businesses involving activities like buying, selling, trading etc. Why… this almost reminds of that famous 17th-century quote by Napolean when he described Britain as a “nation of shopkeepers”

c) Tech isn’t enough – you need design, marketing skills: To build great software products, you not only need strong technical abilities but also good design, marketing & branding skills to carve out a compelling product offering. Ask any startup in India – one of their most common problems is the inability to hire good designers and UX professionals. This puts Indian companies at a comparative disadvantage – even if they have the engineers to build the technology, their inability to translate that technology into an appealing user experience often means the difference between success and failure.

d) Lack of “patient” venture capital: This is a complaint you hear often from Indian product startups – the lack of venture capital that’s willing to be patient over the longer gestation cycles software products demand. While there is some truth to it, the more likely explanation is that software product companies present a “chicken & egg problem” for Indian startup investors. Investors are driven by financial returns – if they see returns from product companies, they’ll bet their monies on them. It just so happens, that Indian investors haven’t yet seen venture sized returns from software product companies. Hopefully, this dynamics will even out as the ecosystem grows.

e) Inadequate Domestic Market Potential: Many software products are monetized via subscription models, where the market’s ability (and propensity) to explicitly pay for the service is critical for success. Sometimes (SAAS/enterprise) companies try their model in India, only to discover there just aren’t enough paying customers. These startups may then be left with no choice but to either target foreign markets, or in extreme cases just move abroad for business continuity. Thus it has become imperative for the Indian domestic market to grow in size and scale to ensure the viability of product startups.

Platform companies from India are a non-starter: One aspect that needs calling out specifically is the sheer absence of any platform companies from India. Platforms are the next evolutionary step for scaled software product companies – if you get to the stage, where other industry stakeholders start building on top of the plumbing you’ve provided (thereby becoming totally dependent on you), that’s an immensely powerful position to be in e.g. AWS, Android, iOS etc. This factor assumes even greater importance given upcoming trends in AI, machine learning, deep learning, automation, robotics – the companies which emerge as platform providers may offer strategic advantages to the country of their origin. As depicted by the graphic below, India is as yet a non-starter on this count. This is deeply worrying – imagine a scenario 10-15 yrs out, when Indian software companies start dominating the domestic markets and also are a force to reckon with globally, but it’s all built on intellectual property (IP) & platforms created & owned by foreign companies!!

Some Suggested Action Areas for the National Software Policy:

MeitY in consultation with industry stakeholders is likely to create an implementation roadmap for #NSPS. Here are some specific action points I’d like to call out for inclusion in that roadmap:

Domestic Market Development: As explained earlier, the Indian domestic market needs curated development to reach a potential that makes product startups viable without having to depend on overseas markets. This calls for a series of steps, such as policy support from sectoral regulators, funding support via special go-to-market focused venture capital funds etc. The government could also help by announcing a preferential procurement policy from domestic software product companies. The Government e Marketplace (GeM) can help in institutionalizing these procurement norms.

Creating Early Awareness (Catch ‘em young): Fed by constant news in media about IT services, ITES, BPOs, outsourcing etc the average person in India is likely to be aware of IT services, but not necessarily software products. Many people may have friends and family members who work at TCS, Infosys, Wipro, IBM etc, but the same can’t be said about product companies. Given this scenario, it is important to create early awareness about products in schools, colleges, universities across metros, Tier 1, Tier 2 & 3 towns. Some of the world’s biggest product innovators like Bill Gates, Steve Jobs started writing software before they had reached high school – so if we can catch people young, we actually get a much longer runway to get them initiated into the product ecosystem. If they learn about products after they’ve started working in the industry, or when planning a mid-career shift from services to products, it might be quite late.

Reducing entry barriers for starting Software Product Companies: As shared earlier, one of the big problems in the Indian software product space is that there just aren’t enough entrepreneurs starting up product businesses. E-commerce & transactional services actually absorb (or suck in) a lot of entrepreneurial talent by virtue of having lower barriers to entry. To make a serious dent in products, you need a much larger number of product companies started off the ground. This can happen only by systematically bringing down the entry barriers – driving awareness, providing funding support, providing market development support etc. Advocacy and evangelism by software product industry role models also can help develop confidence and conviction in people to think products instead of services or e-commerce.

Building domestic Software Product Companies atop public goods: Silicon Valley has shown how you can build successful commercial applications on top of public goods (e.g. Uber built on top of GPS, Google maps & mobiles). In a similar way, public goods in India like IndiaStack, or HealthStack can be the base (or the plumbing) over which commercial applications get built for mass scalability. The good news is this trend has already been kickstarted, though its still early days.