Enterprise as well as Consumer Software is moving fast towards a Software As A Service (SaaS) model. Who would not like paying a per user, per month charge as opposed to doling out huge amounts of money for licenses upfront and paying 16 to 20% Annual Maintenance Charges year after year! But the short history of SaaS companies is already full of companies that grew too quickly, or chose the wrong pricing or customer acquisition strategies, ran out of money and had to go out of business! The same revenue model for a SaaS product business can also become its Achilles Heel if it is not understood and managed properly!

Understanding SaaS Revenue Models in all their glory is key to building a sane, reliable and successful way to build a product company. There are a few venture capital companies that have had lots of practical experience building successful SaaS companies and can share with you a lot more detail. Like Matrix Partners’ David Skok who has written almost a thesis on SaaS economics – here is a sample – The Saas Business Model – Drivers and Metrics. David has partnered with HubSpot and NetSuite for all of this exploration and they must know what they are talking about! Other good references are Doubling SaaS Revenue by Changing the Pricing Model and SaaS Revenue Modeling: Details of the 7 Revenue Streams.

But for a start, here are 5 essentials of SaaS revenue and pricing models a product startup needs to remember for success:

1. Monthly Recurring Revenues Vs. Getting them to pay Annually: Get your customers to pay annually if you could (depending on the nature of your product – enterprise or consumer facing). It’s a hassle for them and you to process these invoices every month and follow up on late payments, etc. It has a clear effect on the cash flow. Plus you may not have to worry about churn that much since they are not making that decision to pay you month after month where they could pause and decide to churn! If Annual billling does not work, try at least a quarter at a time. It may not be worth all the processing time doing it month after month.

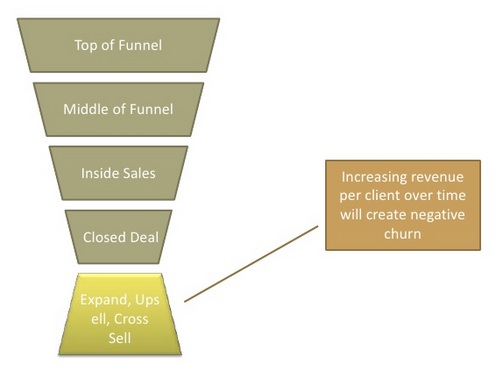

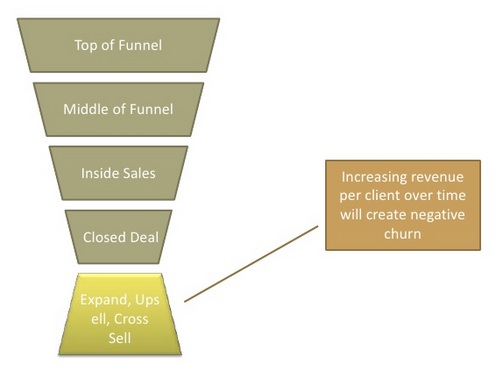

2. Churn and Negative Churn: Churn is the periodic turnover of your customers. Companies mentioned above have found that about 2.5% to 3% churn is OK. You need to be concerned if it goes beyond that. However with Up-selling and Cross-selling, you can actually make it positive churn too! This is when the marketing funnel that becomes narrow from the top becomes broader again with upselling and cross-selling. Which brings us to discussing more of the shape of the Marketing Funnel when it comes to SaaS Vs. non-SaaS product companies!

3. Marketing Funnel Economics:

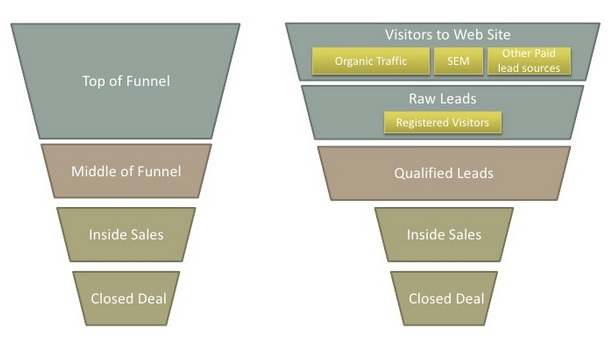

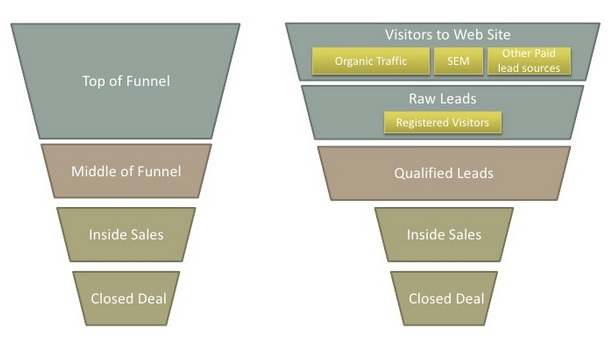

The marketing funnel on the left shows a typical one for non-SaaS product companies. The one on the right shows the one for SaaS product companies. The main difference is the top of the funnel is much wider and uses organic traffic, in-bound marketing, search engine marketing and optimization and prospects from other paid sources.

The relative sizes of the tops of the funnels also show the difference between how wide the top of the funnel needs to be for SaaS product companies!

3. Balancing Customer Acquisition Cost (CAC) vs. Customer Long Term Value (LTV): There are only 8 hours in a day for selling. Traditional licensing models offer an initial large amount in a sale and annual maintenance fees of about 16 to 20% every year after that. SaaS models may offer a smaller initial set up fee and uniform cash flow month after month, year after year after that if you keep the customer. So you need to line up more clients in a SaaS model for reaching the same level of sales as when closing traditional licensing sales deals. So you need to necessarily reduce Customer Acquisition Costs (see the widened top of the marketing funnel in the figure above – that’s what that represents). Some rules of thumb regarding CAC and LTV are that the Long Term Value of the customer needs to be greater than 3 times the Customer Acquisition Cost and the months to recover the Customer Acquisition Cost should be less than 12 months! This also makes a compelling case for designing and developing related products and do some effective cross-selling and up-selling enabling you to realize that Long Term Value even if your CAC is high! Also making sure that you get the Customer Acquisition Cost in less than a year takes care of the problem of churn and if they continue after a year, you have already made your money!

4. Repeatable Sales Model: SaaS product companies rarely can afford the same direct sales model that non-SaaS models do. This is just given the smaller initial sales numbers even though the revenues are recurring rather than an initial large amount and 20% every year after that in maintenance fees in the non-SaaS traditional model. This makes it imperative that the SaaS sales model is easier, quicker and repeatable.

5. Scaling Pricing with Customer Value: Many SaaS product companies shortchange themselves by improving their product so much that they provide much more customer value than they are charging them for. Scaling pricing by clustering value adding features together and packaging them and offering them as upgrade packages is key in ensuring that your pricing keeps up with the value your are providing.

These are only some basics. I highly recommend checking out the references I have earlier in this article. There is a treasure trove of experience and knowledge about how to make it work, all online and free!

In sales, a referral is the key to the door of resistance – Bo Bennett.