Indian insurance market today is primarily dependent on push, tax incentives and mandatory buying for sales. There is very little customer pull, which will come from with increasing savings and disposable income. With the recent increase of FDI limit to 49% from 26% has put more pressure on public insurance companies to maintain their market share.

Public Insurance Systems

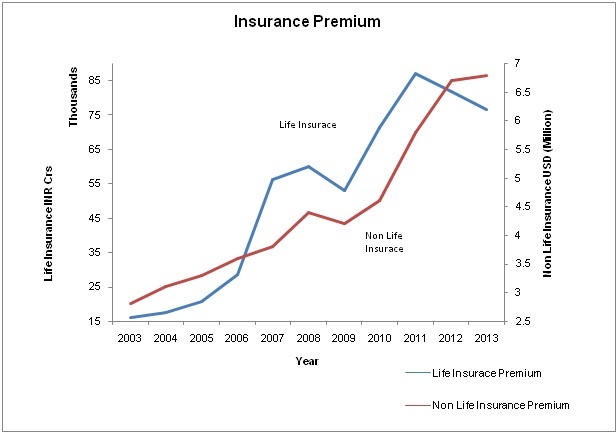

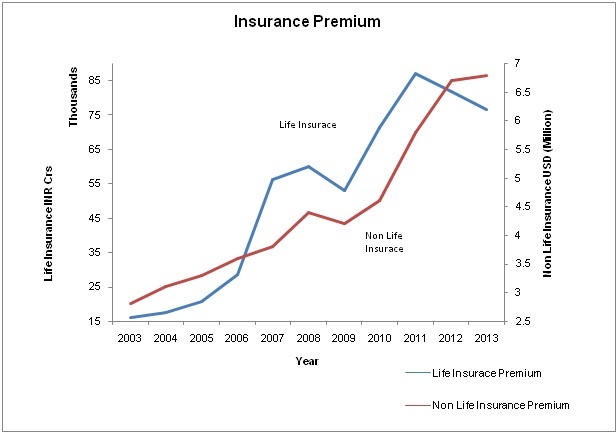

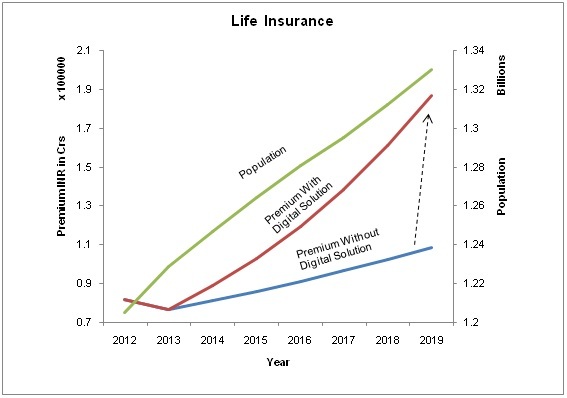

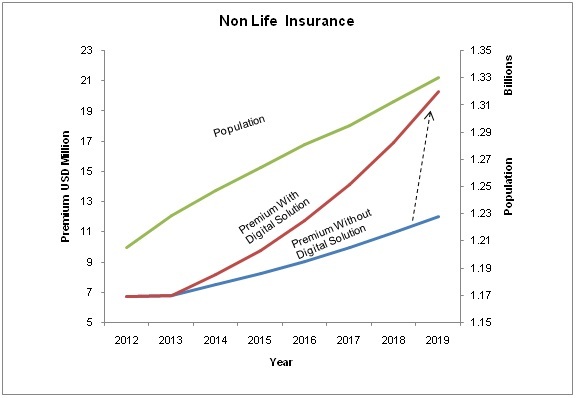

Premiums from Life Insurance is decreasing since 2011 and there is no significant growth in Non-Life Insurance premium from 2012 (growing population, vehicles should increase premiums collected every year). India’s population is 1,22,88,88,667* and only 20% are insured i.e. 98,31,10,933 people are uninsured. Working population is 49,15,55,467** that can afford insurance. With these numbers, India’s insurance adoption rate and the premiums collections are decreasing every year.

*Accurate data was not available, forecasting was done

*Data based on censusindia.gov, 2001

Source – Data from IRDA

Digital Solution

Current projections show that, by 2030, the global middle class could constitute 50% of the world’s population. Today’s low income consumers become tomorrow’s middle class. Insurance companies need to effectively target emerging customers through awareness (marketing), affordability (products) and accessibility (ease of purchasing, servicing and claims handling). A digital solution will build enterprise agility helping public insurance move away from pull strategy and engage people with a push strategy.

Marketing

IRDA is trying to make people aware of the benefits of insurance. They are successful in getting 20% of the total population insured, but the other 80% of the population is not aware or they are not considering insurance important.

Alerts Management – Insurance companies should remind people constantly through SMS, e-mail and IVR, the important of insurance and the benefits they will reap from it.

Campaign management – Definitely public insurance companies are publicizing their schemes and products through media channels but a measurement of every campaign is needed. A digitalized campaign management solution would give public insurance company’s information on which campaign was effective and how many products they sold through that.

Products

Insurance products should be created based on the needs of the customer to attract more customers.

Analytics- Have an analytics solution in place to constantly monitor your customer’s behavior through available external databases to give them products they need the most.

Interactive e-mail- Have a push mechanism email strategy solution, where the solution should mail all relevant products to existing/prospect customers to give them more available options. Customer should be able to view all available products within their mailbox instead of getting redirected to the company web portal.

Purchasing, servicing and claims handling

Make your customer onboarding and other transaction simple to pass on their experience to their friends and family.

Self-care portal – An integrated self-care portal that can be used to browse through products, online purchase, submit claims and take feedback or requests. Centralized application that should integrate with existing processes to create a uniform platform.

Onboard- use digital onbording solution for faster onboarding clients. Research shows that many people change their mind half way through onboarding process. Do not lose a customer with snail onboarding.

Interactive e-mail – Integrate the web portal into a PDF and give greater control to the customer.

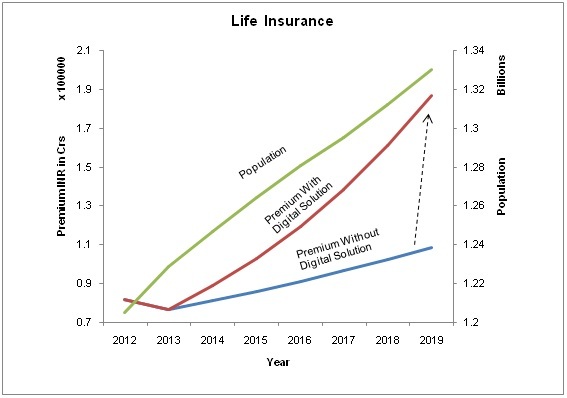

YOY Life Insurance Premium with and without Digital Solution

*Note

• The above calculations are based on historical data

• These approximate statistics are used to show the benefit of a digital solution

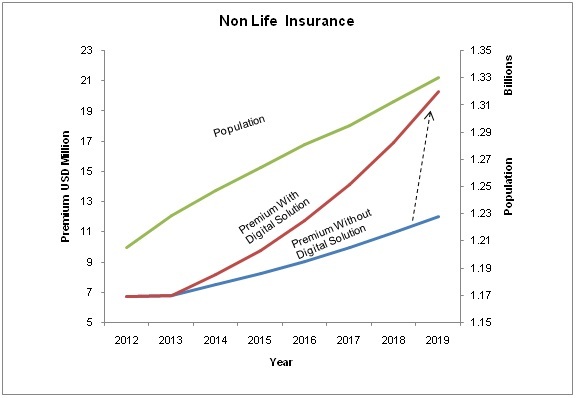

YOY Non Life Insurance Premium with and without Digital Solution

*Note

• The above calculations are based on historical data

• These approximate statistics are used to show the benefit of a digital solution

Benefits with Enterprise Agility

- Increase insurance penetration in India (SMS alerts in rural areas).

- Increase in premium with alerts about insurance to everyone.

- Faster time to market new insurance products.

- Relevant offers are sent to customers for generating revenue.

- Centralized application can be accessed by clients and business users.

- Enhance customer experience and reduce client acquisition.

- Provide specific, focused and timely marketable messages

- Revenue realization by upto 35-40% per customer segment

- Ability to analyze transaction information and make payment though the interactive PDF provides useful insights and greater convenience to the customers

- Targeted and personalized promotional offers and interactive hyperlinks that lead to more information about the offers enables customer to be better informed