Starting up is hard, make no mistake about it, while media romanticizes startups and mostly talks about the glorious success stories, what goes behind is months and years of toil, frustration, fighting all kinds of odds. Cliched as it might sound but overnight success is the culmination of years of hard work.

Bootstrapping a startup is even tougher, apart from challenges of building right product, right team, right marketing plans and dealing with daily operational chaos, you additionally need to worry about money and cash flows and hence constantly innovate to compete, there are no easy paths, what you need is undivided focus and continued perseverance.

Now with all these challenges last thing a bootstrapping entrepreneur needs are fresh challenges on personal finance front. It can be distracting to least and can even have a debilitating impact on your business, when all your energy and time should be focused on getting your business to move to the next orbit, unforeseen issues on personal finance side can sap your precious energy.

While we cannot mitigate all risks in business, but with a better financial planner you can reduce distractions and also some legitimate business risks, here are few tips that can help you manage your personal finances better.

1. Keep your personal fixed expenses low

As you bootstrap, start with a review of your personal expenses see if you can lower your expenses especially the fixed ones, there are always expenses which can be cut, like a costly dish TV subscription with all the channels you never watch or suboptimal phone bill plans when you can get a better offer or the weekly outings where you splurge or non-healthy junk food, or the gym membership where you never go, maybe a jog in nearby park can be better. Cut expenses wherever you can and migrate to a leaner personal expense structure.

2. Track your expenses and do active budgeting

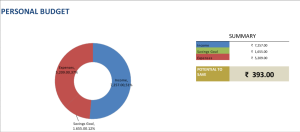

Last thing you want when you are running a startup is surprises every month on your expenses which can be due to faulty planning. Plan your expenses to the last tee, do active budgeting. If required, use budgeting software. If not, pick up a simple excel sheet. There are a lot of pre-formatted excel workbooks available which can help you plan your budget.

You can use the following sheet for expense planning.

3. Before you bootstrap plan for the worst

Create multiple cash flow scenarios. A lot of assumptions go bad when you are starting up as there are too many unknowns in a startup environment. Slipping product timelines, fundraising plans going awry, growth not taking off as you expected there are simply too many moving parts. So for any plan you create do a thorough analysis. Hope for the best but always have a plan ready for the worst.

4. Get a good health Insurance for you and your family

One of the major unplanned expense that can hit you is unforeseen health. Cost of health in general has skyrocketed in India. So before you bootstrap, ensure that you have a good health insurance cover for you and your family, the cover should be adequate and should reflect your lifestyle.

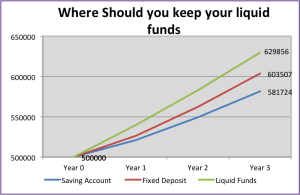

5. Do not park money in savings account, Invest in liquid funds

Your day to day money requirements should be parked in instruments which give higher returns. Every additional rupee matters. Therefore, do not keep your money in savings account but invest in short-term liquid funds. They provide 2-3 % higher returns than saving accounts and are almost as liquid as savings account, so you can use your money anytime and also earn higher from your savings.

Let’s say you maintain 5 lakhs rupees balance in your liquid account, this is an account for your emergency funds. Below chart explains what will be your account balance at the end of 3 years, if you see liquid funds will give you 4.3 % and 8.3 % higher return vis-à-vis Fixed deposits and savings accounts respectively.

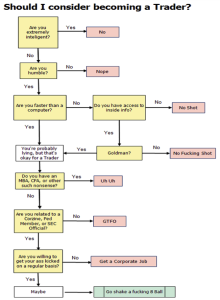

6. Avoid speculative investments like daily stock trading

As an entrepreneur, you are already grappling with ambiguities and surprises. The last thing you would want is surprises on your personal finance front. So start avoiding any risky investment you are making and stay away from stuff like daily stock trading or other speculative investments in the stock market or otherwise.

The below infographic explains why day trading is not a good idea 🙂

(Source: Zerohedge)

7. Create a personal financial plan

You must have created a proper business plan for your startup but what is also equally important is that you create a financial plan for yourself. Look at how your cash flows are going to be like what are your projected expense, both recurring and non-recurring, sources of income, how much savings you have, short term and long term liabilities. Finance planning helps you create a detailed view of what to expect on money front in next few years, here is a simple step by step guide to create a financial plan

8. Ensure your loan liabilities are taken care off.

Having large loan (personal or home loan ) commitments is not a good idea if you are planning to bootstrap. If you have such commitments relook at them and figure out a way to manage risks arising out of these liabilities. Set up a viable payment plan for all of these liabilities.

Article Credit : Sarabdeep Singh, co-founder of Bodhik.