Sanjay Jain, Pramod Varma, Ranga Raj

With a lot of momentum being built around Digital India and Smart Cities, we offer a contrarian view of how government agencies and stakeholders should approach this complex problem. While there are many facets towards the journey of Smart Cities – some that are non-technology related – political, bureaucratic, architectural, social, cultural etc., and others that are technology driven. We will focus on technology led aspects and approaches to Smart Cities in this blog.

Internet of Cities – Platform for innovation

The impact of Internet and networked societies have led to India Stack – the foundation of Digital India. The learnings of development of these public goods along with others are used as case studies of how smart cities ought to be approached. Tradition within the government, public sector and large entities have been RFP/Tender procurement process. This inherently has some significant limitations:

You cannot tender for Innovation!

You need to conceive and define in great detail what is required in an RFP – Change requests and evolutions prove to be costly mechanisms to incorporate

Restricts solutions to be provided by selected parties and you and other stakeholders live/die by their performance

Constrains participation (Criteria to meet bidding and selection process)

Smart Cities are a journey and not a well-defined destination, so needs to be sustainable. To believe that anyone if capable of anticipating and predicting the needs/technology/standards evolution over a 50-100 year time frame is impossible. Hence traditional procurement process need to be replaced by a different mindset.

Best principles from India Stack – Design for India Smart Cities Platform

Traditional vertically integrated approaches – pipelines are being replaced now with Platforms (documented in a popular book – Platform Revolution). So thoughts need to shift towards Government as a service or Government as a Platform. The approach adopted by the team in Aadhar were (in no particular order of priority):

Don’t outsource “Thinking” – Build a cross functional team with strong leadership (eg. As Nandan did for Aadhar)

Build internal capacity

The government could not possibly do it all by themselves internally – so the thought process of what was to be done by the government and what was to be done by ecosystem players was outlined

Debate on the ideas of the offering by engaging with thought leaders and stakeholders and subject matter experts that bring in different perspectives

Once the core idea and value proposition(s) are determined – float expression of interest to various parties

Based on feedback repeat the exercise if necessary

Post the outline of the “solution”, strip out the core elements that need to be done by the government and those that can be performed by the ecosystem players

Design core functionality Internally – focus on security, scalability, maximize use of open source and ensuring that the design does not lock oneself to a particular technology or a vendor

Keep it simple and minimalistic – Aadhar focused on a few parameters of storage as compared to other countries attempting to store 50+ parameters that had to be got from multiple sources leading to bureaucratic tangles

Open this core functionality via APIs

Create a strong policy/governance structure and operations management team for the core and how a level playing field can be provided to ecosystem providers

Incentivize ecosystem players (preferably on an outcome based model) to participate in the success of the platform for a win-win model (eg. Ecosystem players invested in technology infrastructure for Aadhar enrolment and were paid post a successful issue of an Aadhar number, which led to ecosystem partners being the marketers of success of Aadhar)

Aadhar did not invest in field infrastructure but just the strong secure scalable back end exposed via APIs and ecosystem partners invested and participated in the fastest growth of a Billion users worldwide!

Smart Cities Platform – Shared Public Goods

Smart Cities are complex, long term initiatives and should not lead to big RFPs, but take an approach similar to what Aadhar and the India Stack took. Design of Smart City platforms need to be capable of sustaining over long period of time as back end systems, front end systems, APIs/Interfaces etc., evolve over time. The figure it for yourself or DIY approach is not economically viable model as well as this will lead to at least a 100+ cities learning and reinventing the wheel and is certainly not an efficient mechanism of using tax money. Governance of municipalities or cities around the county are broadly similar, but have different priorities. A shared economy model of public goods that could be shared/reused and learning and best practices of one applied to another is a healthy approach that the country needs. The EU for example has a governance structure that creates shared public goods that can be leveraged and customized to local environments. Examples of shared economy in transport, accommodation etc have become very popular around the world. Smart Cities should not be funded and built entirely by the government but rather done in a public/private partnership model of a plug and play. An example is private green/alternate energy sources of generation owned by private parties can plug and play into the grid in a win-win model where everyone stands to gain – the utilities body, the private generation entity and the consumers/citizens as a whole. Similar approaches should be adopted by governments with the vertically integrated invest it all/own it all/ operate it all approach should be abandoned in favour of a shared economy model.

Government as a market maker – spurring innovation (Open APIs, Open Data, Always on RTI)

Some elements of how services are delivered by only trusted parties that belong to the system have to be thrown out of the window. IRTC was available through reservation counters in stations and their website. The experience was not optimum, but when they opened up APIs, numerous ecosystem players offered railway reservations in many forms and that provided choice to consumers. Everyone benefited in the end – Railways, ecosystem players and commuters. Numerous services of governments are offered through only selected offices and a website/portal that often do not work. Government and agencies are not best suited to build and deliver services to customers – ecosystem players are and may the best person win. So governments need to think of themselves as “market maker” – this leads to innovative solutions from startups to well established players including government agencies to provide choice of delivery of these services to public and market forces then take over. Regulation and governance framework to ensure level playing field and not stifle innovation is essential. All of this will lead to greater creation of public goods as the India Stack has demonstrated.

Unique Identity beyond people + Digital Locker + Consent Layer + Payment – Citizen services

Aadhar and India Stack has been leveraged for various schemes such Direct benefit transfer (LPG subsidy, NREGS/PDS..), attendance systems etc. We now explore a few other examples of how India Stack could be leveraged by state agencies for re-thinking how services could be delivered to citizens.

Identity of four sovereign elements that need to be registered are essential

Individuals – Aadhar

Companies/Establishments – PAN/GSTN (Professionals such as directors/doctors/architects/lawyers etc are also distributed in silos but need to be networked and accessible )

Land – Records and Titles – again very distributed and siloed but essential to unlock the value of this asset type as the ability to verify, buy/sell/mortgage/rent could significantly contribute to the GDP of the country. Integrating this with the real estate bill would be a welcome step.

Things (eg. Vehicles) – Agencies such as the Vahan is an attempt to this, but adopts the traditional approach. Ownership/Buy/sell/insurance/permits/taxes/fitness/loan/mortgage/enforcement records when merged provide transparency to transactions.

Voting – Aadhar provides identity which could be used for cleaning up voter registration records for duplication and fraud entries. But with additional layers of entitlement and anonymity, plus digital lockers for documentation proof of residency (ward), remote presence-less digital voting for armed forces and others to exercise their right to vote without physically being present at the ward

Healthcare – Identity + health records + Consent + Insurance (RSBY or private/government players) + Payment/Claims processing/Renewal could make healthcare for all more affordable (lowering costs of transactions) and accessible without the frustration currently associated with it

People Verification – Passports/background checks/Employment/Certification of skills/degrees/Crime/Legal records – police/courts. Today a lot of this data needs to be digitized by distributed in thanas or court jurisdictions. An integrated record system across the country is essential for ensuring people movement and the ability to establish trust or be verified is essential for the employer/issuer/employee. India Stack could significantly contribute to enabling this national grid of information exchange based on consent.

There are numerous other examples in various vertical and horizontal segments that can benefit significantly with the India Stack and many public and private sector players are constantly innovating in this space

Citizens – It is our problem to solve

As we mentioned Smart Cities is a complex difficult journey that can be tackled with a big band approach. Take small problems solve them using these guidelines mentioned above and the use of open data combined with hackathons (bringing in key stakeholders – RWAs, NGOs, Citizens bodies that are deeply interested in the betterment of a city) to allow the ecosystem to innovate solutions to your problems. Seeing is believing and these small initiatives will then recruit more interested parties and a viral effect will take place. As a call to action it means a new thought process and approach by the government to bring in expertise from the outside (as done with Aadhar) and for core committed citizens to rise to the occasion and take up this challenge in a collective manner. It is our city, our government, but by paying taxes and electing a government, we no longer can throw the problem to the other side. The crowd sourced model, the shared economy model, the platform way of thinking are new mindsets that need to creep in to replace the tender raj.

Vinay Nathan of Altizon talks about application of effectuation in his company and how it made him do more with less.

Vinay Nathan of Altizon talks about application of effectuation in his company and how it made him do more with less. PNCamp in pune is your grand opportunity to get candid feedback on your product and its marketing. If you are a startup with a prototype or product at an early stage with few users/customers but struggling to get further traction, then PNCamp is a great place where you could get an opportunity to showcase your product and seek feedback, inputs and suggestions on specific to your product. At PNCamp, experts will take product teardown sessions on following aspects.

PNCamp in pune is your grand opportunity to get candid feedback on your product and its marketing. If you are a startup with a prototype or product at an early stage with few users/customers but struggling to get further traction, then PNCamp is a great place where you could get an opportunity to showcase your product and seek feedback, inputs and suggestions on specific to your product. At PNCamp, experts will take product teardown sessions on following aspects.

The other that perhaps will have equal transformational impact is its peer in the world of digital payments, the Unified Payment Interface (UPI). As soon as I had my first experience with UPI, I realized that its impact has barely been appreciated by most, including me.

The other that perhaps will have equal transformational impact is its peer in the world of digital payments, the Unified Payment Interface (UPI). As soon as I had my first experience with UPI, I realized that its impact has barely been appreciated by most, including me.

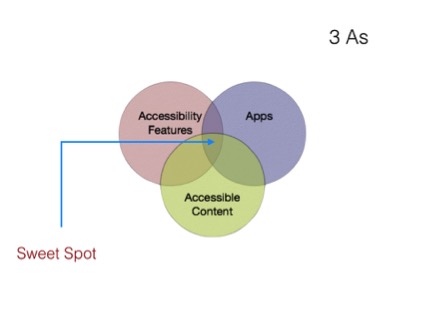

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –

Getting back to the phrases we discussed earlier, let us combine the vertical sections of the app market into 1 and perceive the awesomeness that we get –