This is a Guest post by Krupesh Bhat (LegalDesk) and Ujjwal Trivedi (Artoo).

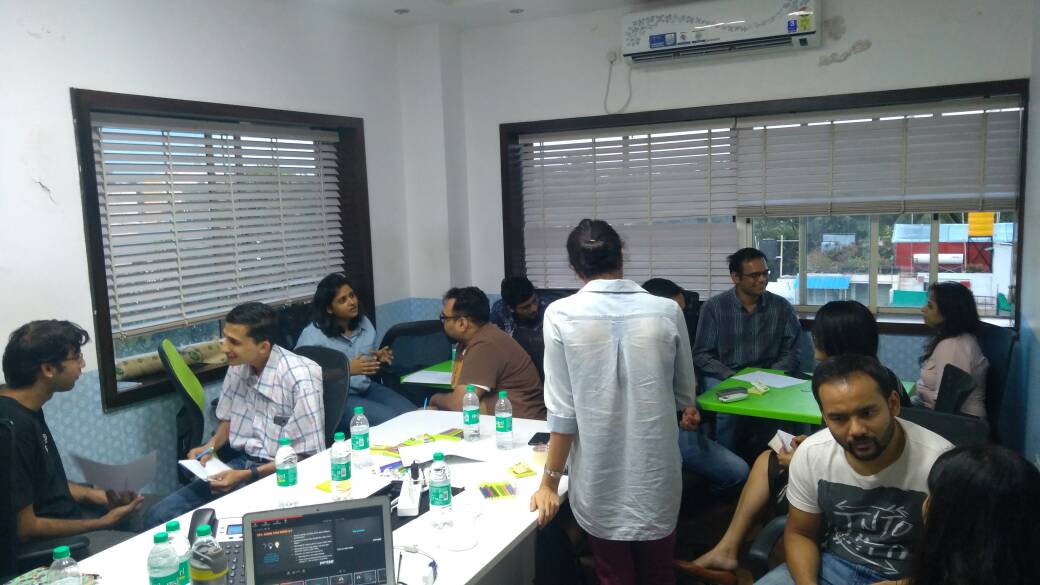

AI is seen as the new electricity that will power the future. How do we make the best of the opportunity that advancements in AI technology brings about? With this thought in mind iSPIRT conducted a symposium roundtable at the Accel Partners premises in Bengaluru on March 10th. Accel’s Sattva room was a comfortable space for 20+ participants from 11 startups. There were deep discussions and a lot of learning happened through subject matter experts as well as peers discussion. Here’s a quick collection of some pearls, that some of us could pick, from the ocean of the deep discussions that happened there.

Products that do not use AI will die soon. Products that use AI without natural intelligence (read common sense) will die sooner.

– Manish Singhal, Pi Ventures

Starting with that pretext, it isn’t hard to gather that AI is not just a promising technology, it is going to be an integral part of our lives in near future. So, what does it mean for existing products? Should everyone start focusing on how they can use AI? Are you an AI-first company? If not, do you need to be one? After all, it does not make sense to build the tech just because it appears to be the next cool thing to do. If you are building AI, can you tell your value proposition without mentioning the word AI or ML? have you figured out your data strategy? Is the need driven by the market or the product?

Before we seek answers we must clarify that there are two types of products/startups in the AI world:

First, an AI-first startup – a startup which cannot exist without AI. Their solution and business model is completely dependent on use of Artificial intelligence (or Machine Learning at least). Some examples of such startups in local ecosystem are Artifacia and Locus.sh.

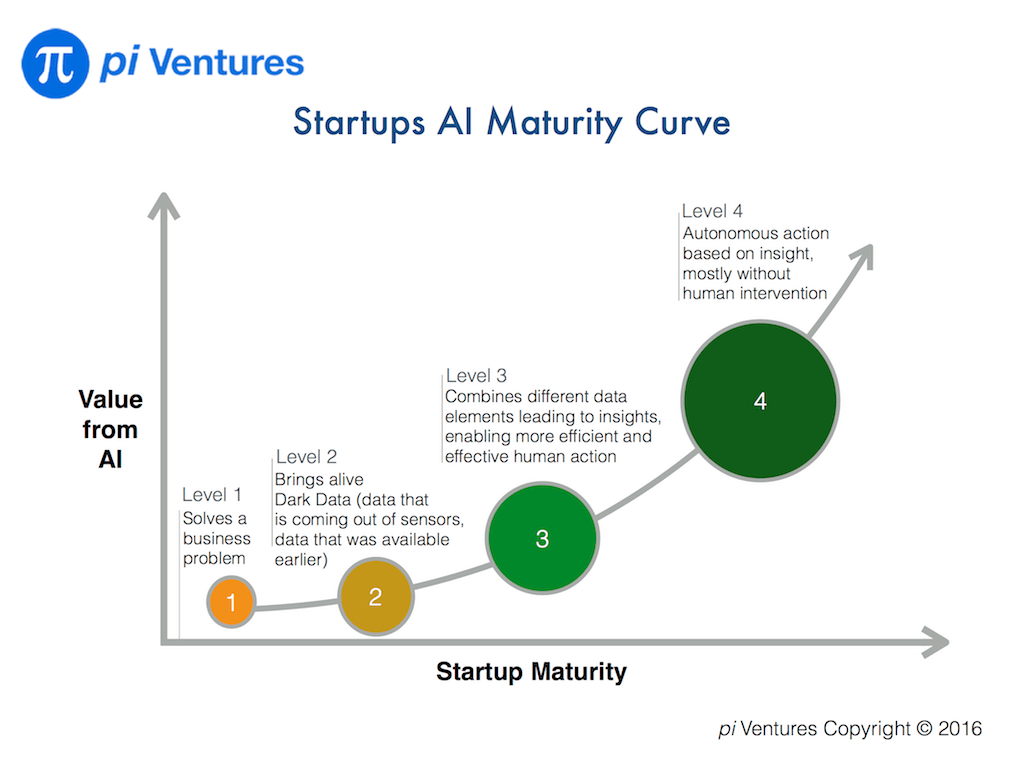

Second, AI-enabled startup – startups with existing products or new products which can leverage AI to enhance their offering by a significant amount (5x/10x anyone?). Manish has a very nifty way of showing the AI maturity of such companies.

The session was facilitated by several AI experts including Manish Singhal of pi Ventures, Nishith Rastogi of Locus.sh, Shrikanth Jagannathan of PipeCandy, Deepak Vincchi of Julia Computing.

Maturity Levels of AI Startups

After a brief introduction by Chintan to set the direction and general agenda for the afternoon, Manish took over and talked about the various stages of AI based companies. Based on his interactions with many startups in the space, he said there are roughly four growth stages where different companies fall into:

Level 1 – No Data, No AI: An entity that solves a business problem and is yet to collect sufficient data to build a sustainable AI business. The AI idea will die down if the company fails to move to state 2 quickly. Business may be capturing data but not storing it.

Level 2 – Dark data, No AI: The company holds data but is yet to build solid AI/ML capabilities to become an AI company. There is a huge upside for such companies but the data strategy needs to be developed and AI capabilities are not mature enough to be considered as an AI/ML company.

Level 3 – Higher automation driven by data and AI: These are the companies that have built AI to make sense out of data and provide valuable insights into the data using AI/ML, possibly with some kind of human assistance.

Level 4 – Fully autonomous AI companies: These are the companies at the matured stage where they possess AI products that can run autonomously with no human intervention.

Manish also noted that most companies they meet as a VC are in level 1 and 2, while the ideal level would be 3 and 4. He noted that AI comprises of three important components: Data, Algorithm & the Rest of the System that includes UI, API & other software to support the entire system. While it is important to work on all three components, oftentimes, the data part doesn’t get enough importance.

|

|

|

Do You Really Need Artificial Intelligence?

A whole bunch of solutions are smart because they are able to provide additional value based on past data. These are not AI solutions. They are merely rule based insights. Nishith from Locus added that there is nothing really wrong with rule based systems and in a lot of cases AI is actually an overkill. However, there are two cases where it seems apt for startups to look at AI for their predicament:

- Data is incomplete: An example of this is Locus who gets limited mapping for gps coordinates and addresses.

- Data is changing constantly: A typical case was of ShieldSquare where bots are continuously evolving and improving and the system deployed to identify them also needs to learn new patterns and evolve with them.

It is important to have clarity on your AI model especially when you communicate with your internal teams. Figure out what is the core component of your product – AI, ML, Deep Learning or Computer Vision.

What’s Driving Your AI Approach?

There are two major driving forces that can help one in deciding whether to AI or not to AI.

- PUSH: The internal force when decision can largely be taken if your business is sitting on a lot of useful data, may be as a side effect of your key proposition.

- PULL: The external market driven force where clients expect or ask for it e.g chatbots. We are already observing that AI can be a great pricing mechanism.

However, take great caution when using Customer data or Derived data, it depends on legal agreement with clients and can get you into legal troubles if it violates any terms.

Is Your Data Acquisition Strategy in Place?

Anyone interested in AI should have a data acquisition strategy in place. Here are a few points that can help you get one in place:

-

- What data do you collect, How do you validate it, Clean it and store it for further analysis?

- Surveys and chatbots can provide a steady stream of data if built correctly

- Think of data as a separate entity (has its own lifecycle), it may help to think of it as a currency and plan how you would earn, store and utilise it

- Capturing location, user interaction data can be insightful. This may include the interactions user has committed and the ones they have not committed (deleted/skipped/hidden)

- It makes sense to invest time, resources and people to gather data properly

- Have a unified warehouse (can start with economical options like Google Analytics and AWS)

It is also important to give some thoughts on how you are using aggregate data across the platform. In case, if your AI model uses a combination of customer specific data and the sanitised aggregate data available in the platform (“Derived Work”), then you should make sure that you have the permission to use such data. Without such clarity, you may run into legal issues.

|

Deepak Vincchi explained how Julia Computing is emerging as the programming language of choice for data scientists. The platform can process 1.3 million threads in parallel and is used by large organizations to crunch data problems. |

In all this was an extremely engaging 3 hours without break. Guiding the session with real examples by Nishith, Shrikanth and also shared learnings from Navneet and others really helped bring to life Why AI and How AI. This symposium is part of an AI playbooks track was aimed at kickstarting cohorts of startups ready to jump with AI and help them get traction with AI, more will emerge on this shortly.

—

10 startups attended this mini-roundtable session – Acebot, Artifacia, Artoo, FusionCharts, InstaSafe, Klove, LegalDesk, Rocketium, Rubique, ShieldSquare.

Thanks to volunteers Rinka Singh and Adam Walker for their notes from the session and Ankit Singh (Mypoolin/Wibmo) for helping coordinate the blog post & note

* All iSPIRT playbooks are pro-bono, closed room, founder-level, invite-only sessions. The only thing we require is a strong commitment to attend all sessions completely, to come prepared, to be open to learning & unlearning, and to share your context within a trusted environment. All key learnings are public goods & the sessions are governed by the Chatham House Rule.

Featured photo by Matan Segev from Pexels https://www.pexels.com/photo/action-android-device-electronics-595804/

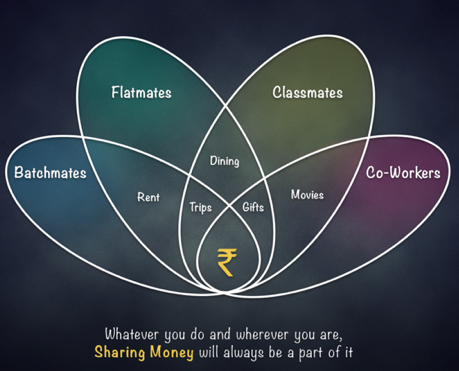

In fact, if you actually ponder, you would perceive that the real driver of this phenomenon has been something else entirely. It is the proliferation of ‘shared economy’ lifestyle that makes these social use cases so prominent and common for us.

In fact, if you actually ponder, you would perceive that the real driver of this phenomenon has been something else entirely. It is the proliferation of ‘shared economy’ lifestyle that makes these social use cases so prominent and common for us. This brings us full circle to the two golden philosophies that have stood the test of time again and again –

This brings us full circle to the two golden philosophies that have stood the test of time again and again –