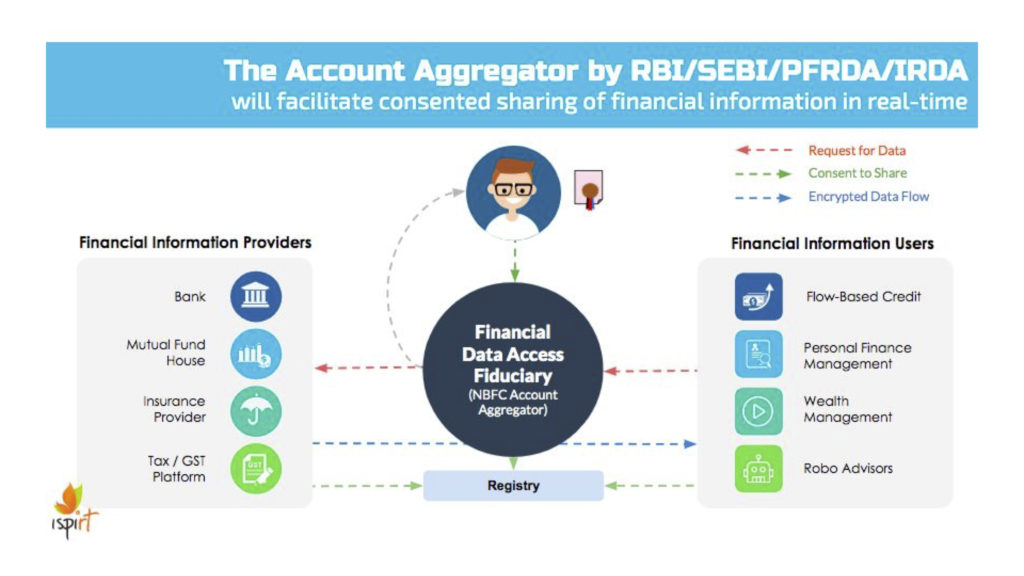

The Account Aggregator (AA) construct defined in this RBI circular, this technical specification, and this article is imminently coming to life. Individuals and businesses in India will be able to link their bank and financial accounts with an AA application and begin leveraging their own data in order to avail of cheaper, faster, and more customized products and services. This document lays out some of the use cases and opportunities open to entrepreneurs and companies to build on top of this infrastructure.

iSPIRT will be hosting a meetup in Bangalore to dive deeper into these opportunities for any companies or entrepreneurs interested in learning more. Details about the meetup will be shared after the following description of the various opportunity areas borne of the AA ecosystem.

Basic potential use cases leveraging AA applications:

- A user can link his HDFC Securities, SBI, and ICICI accounts and use an AA app to share his last 12 months bank statements and demat statement in programmatic form with a fintech. The user is able to see his latest account balances across all his banks and asset managers in one place. The fintech is able to visualize all user transactions according to category, spend amount, date, and payment instrument across all the user’s bank accounts. This use case could happen on a fintech’s mobile app, a bank’s netbanking portal, or any other interface.

- A group of users can share their anonymized stock portfolios with a company which is able to give them investment advice or connect them with a group of like-minded investors for further discussions.

- A user can share her bank statement with a fintech which can analyze her financial behaviour and recommend products to help the user save money eg. “Your bank history shows that you often go into overdraft. You would save 20,000 rupees per year if you switched to XYZ bank which has a more lenient overdraft charge”

Dates for AA framework to go live to all citizens: May 20th, 2020

Current status: Several of the largest financial institutions are in production testing of their AA APIs. Note that the first wave of companies that can consume AA data is limited to companies regulated by RBI, SEBI, PFRDA, and IRDA.

Opportunities in the AA ecosystem: There are 200 banks, 10,000 NBFCs, and thousands of other companies which will need technology to help them adapt to the AA paradigm, There are opportunities to help these companies with:

- Middleware to help them consume and share data in the specified format

- Middleware to help them manage customer consent and customer data (data governance and data security products)

- Middleware to help companies provide good AA UX flows on their apps

- End-user applications such as the personal finance applications mentioned above

In addition to these opportunities around Account Aggregators themselves, there are also several opportunities to build software products and offer services around the fields of Cash Flow Lending, Loan Service Providers, and UPI applications.

Cash Flow Lending (CFL) background:

- Most lenders use traditional credit scores from credit bureaus to understand borrower credit worthiness

- Many individuals and companies in India do not have credit scores (New To Credit – NTC)

- Many individuals and companies in India do not have good credit scores (subprime)

- Getting access to credit for subprime and NTC borrowers is very difficult

- If any bank or lender gives a loan to subprime or NTC lenders, it usually at a high interest rate

- In many other cases, banks only give such subprime loans if the borrower can give some hard tangible assets (such as property) as collateral

- Many borrowers, especially small businesses, cannot give this collateral and therefore cannot get access to credit products that can greatly improve their business health

- The reasons mentioned above are partly responsible for India’s low credit penetration

- There is a new underwriting and lending model emerging called Cash Flow Lending

- In this new model, a business shares its historical business performance with a lender

- This includes historical invoices raised on GSTN, and bank statement records that capture all of a business’ cash inflows and outflows

- Using this data, a lender can understand the likely future performance and creditworthiness of a borrower

- Moreover, the lender can plot the historical cash flow curve of a particular borrower to understand how to best structure and customize a financial product

- This form of lending happens sparingly today because it is expensive for a lender to gain access to a borrower’s verified GST invoices and verified cash flows from a bank in order to reliably plot the cash flow curves of the borrower

- Due to upgraded APIs in the GST system and access to bank statement data from the AA framework, it is now simple and cheap for lenders to understand the verified business performance and cash flows of a borrower

- Due to upgrades in the UPI system, it is also possible for a lender to lock down any future incoming cash flows of a borrower (instead of taking current assets as collateral, a lender can now take future assets – namely cash flows – as collateral)

Current status on Cash Flow Lending: Lenders are free to use whichever underwriting model they see fit. Lenders wishing to begin consuming machine-readable GST invoice data and bank statement data will be able to do so once the AA framework goes live on May 20th.

Opportunities in Cash Flow Lending:

- Underwriting engines to help lenders and insurers analyze data and take decisions based on customer financials and business relationships

- UPI interfaces to help borrowers and lenders exchange e-mandates (the instrument used to lock down future cash flows of a borrower)

- Lending businesses, particularly those serving NTC or subprime borrowers

In order to deepen the penetration of financial services to underserved individuals and borrowers, a new type of financial company has been proposed. This company is known as a Loan Service Provider (LSP).

LSP background:

- Marketplaces such as Uber, Swiggy etc. aggregate high numbers of suppliers (drivers, restaurants)

- Many of these suppliers would benefit from access to credit to improve their lives or businesses

- For the suppliers, getting access to credit is not always straightforward, as in the case of an Uber driver with a subprime credit score

- The marketplaces, by virtue of the data they have about the suppliers (eg. number of rides done in a day, customer ratings, peak operating hours), are in a good position to help the suppliers apply for financial products

- Furthermore, building a financial services layer into their supplier offering would help marketplaces deepen the value proposition of their platform

- The problem is that building this financial services layer involves building bilateral custom relationships with lenders or finserv providers

- If the technical integrations and data pipelines between marketplaces and lenders can be standardized and abstracted, it could be much easier for marketplaces to plug new lenders into their finserv layer and much easier for lenders to plug into different marketplaces

- An LSP is the company which provides the software linking the marketplaces with the lenders

LSP timelines and status: A technical blueprint for an LSP is being developed. Industry participants are welcome to participate in this process or develop and implement their own ideas for an LSP (although having many different LSP standards would defeat the purpose of the exercise, and the likely outcome is that lenders converge on a preferred standard).

LSP Opportunities:

- LSPs can build a bridge between marketplaces and lenders, allowing suppliers on the marketplace to share data with the lenders

- Underwriting engines for different kinds of marketplace suppliers (eg. a Swiggy engine might use the number or orders, seasonality of orders, user ratings, and average delivery time to develop a credit model for restaurants)

Any companies or entrepreneurs wishing to learn more about these opportunities are invited to attend a meetup hosted by iSPIRT on the 13th of March in Bangalore.

You can register on this link to attend the workshop. Please note that the workshop is invite only.

References:

- UK Sinha’s Report of the Expert Committee on MSMEs: Loan Service Providers (LSPs) will be an agent of the borrowers is recommended for consideration by RBI: Announcement, Full Report (Section 8.2.1 on page 108 about LSPs and Section 9.26 on page 126 about Cash Flow-based lending)

- Account Aggregator Resources